georgeclerk

Thesis

Republic Bancorp, Inc. (NASDAQ:RBCAA) is improving its core loan book despite a decline in income from the warehousing line, and as rates continue to rise, we can see an increase in net income over the next 12 months. Furthermore, on a P/B basis, RBCAA is undervalued compared to peers, resulting in around a 15-30% upside in the stock from current prices.

Intro

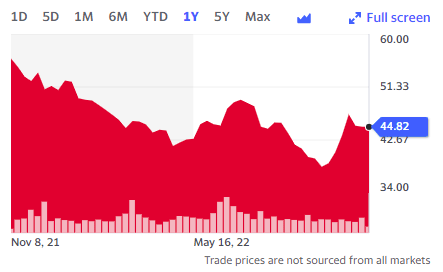

RBCAA is a regional bank based in Louisville, Kentucky, with 42 braces offering traditional banking, warehouse loans, mortgage banking, and refund & credit solutions. The company, despite being a bank and expected to gain from higher interest rates, has had depressed share price performance over the past year, following the bear market of the S&P 500, currently sitting at around $45 USD.

SEC

(Source: Yahoo Finance)

This share price decline does not reflect the outperformance of the company and the positive future outlook.

Financial Analysis

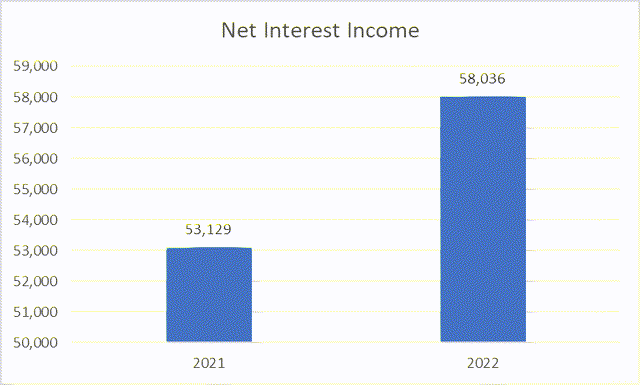

Based on the company’s recent quarterly reports (3 months ending September 2022), the company has gained from higher interest rates compared to the previous year. For example, while the total loan book decreased from $4.3bn to $4.2bn, net interest income has been maintained.

(Source: SEC)

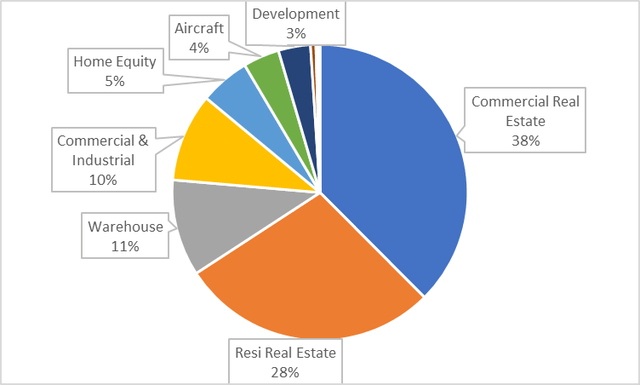

Currently, the loan book (as of September 2022) is well diversified, with the majority of exposure from Commercial Real Estate and Residential Real Estate, followed by Warehouse loans and Commercial/Industrial loans. The majority of the loan book is expected to perform well given that interest rates are on the rise. We can expect interest income to increase for Real Estate loans and Commercial loans. However, the warehouse loans, despite the rate rise, could see a decline in revenues from reduced demand.

In regard to recent performance, overall net interest income for the quarter, net interest income performed well, improving almost 10% to reach $58m.

(Source: SEC)

This was driven by a solid performance from the traditional banking segment, the core portfolio of loans that do not include the warehouse unit or the refund/credit solutions. The segment increased its net interest income by 34% excluding PPP loan-related items and increased the net interest margin to 3.62% for the traditional banking unit.

However, unfortunately, some of these gains were offset by a poor performance from the warehouse book, where there was a decline of 52% driven by a decrease in outstanding balances from reduced mortgage refinancing demand due to the higher interest rates. While an interest rate increase can improve income for this segment, unfortunately, the reduced demand will offset this, so we can expect further poor performance from this segment in the near future while rates continue rising and there is reduced demand for mortgage loans. Luckily warehousing loans are only about 10% of the total loan book.

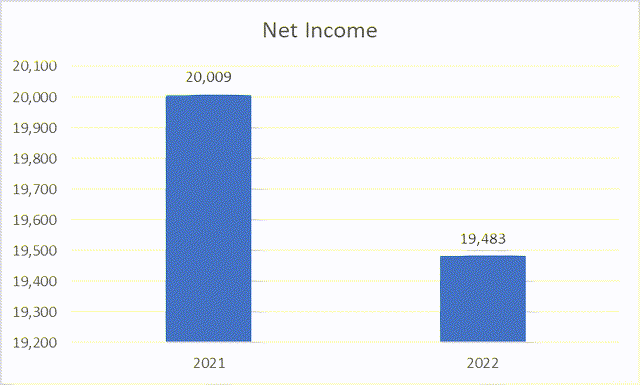

While the largest part of the loan book, from traditional banking, performed well, and improved net interest margin from 3.61% to above 4%, net income for the bank actually decline by just under -3%, from $20m to $19.5m

(Source: SEC)

Which was driven by poor performance from the non-interest income and expenses segment. Non-interest income dropped by -20% and non-interest expense grew 4%, to $46m, a large portion of total costs, amounting to almost 80% of net interest income in the quarter. This expense increase was driven by inflationary pressures on general expense items, such as salaries and overheads. Overall, this has led to a static diluted EPS figure, which remains at $0.99.

Future Outlook

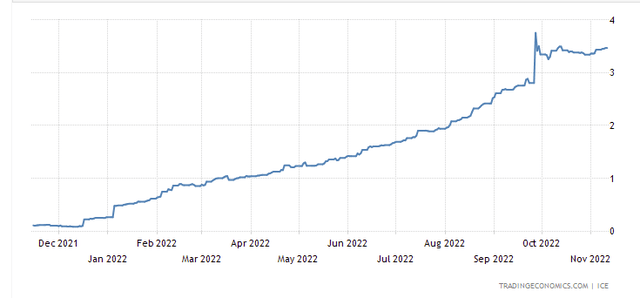

Now, as this is a bank, we can expect interest income to continue rising as interest rates continue to increase, as shown by the 3-month LIBOR illustrated below.

(Source: Trading Economics)

The LIBOR is expected to rise to above 5% next year, so we can see a further improvement in net interest margin to potentially higher than 5% next year if things go smoothly.

However, due to inflationary pressures, we can potentially see non-interest expenses continue rising as well, which may offset partial gains in interest income. However, given the strength of the portfolio, interest income should perform well, and net income should improve from its current level.

Valuation

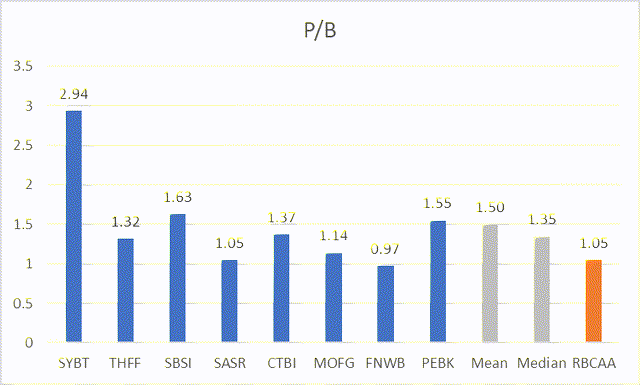

If we look at a set of peer group regional banks as comparable, we can understand if RBCAA is undervalued on a price-to-book valuation

(Source: Yahoo Finance)

We understand that most, if not all, these banks will benefit from macro factors (ignoring micro level factors), and gain in interest income from higher rates (but also expenses will rise from inflationary pressures)

Looking at the P/B comps, we can see that RBCAA is only slightly undervalued compared to peers, giving a +15-30% potential upside. Not a significant amount, but still something and an indication of slight undervaluation.

Risks

- The most obvious risk would be no further rises in interest rates, which would stop the growth in net interest income. There would be further damage if inflation were to keep rising, so costs would offset improvements in income and lead to a further decline in net income, and RBCAA would no longer be undervalued (or may lead to them being overvalued)

- The second risk would be significant rises in non-interest expenses due to further inflationary pressures (such as wage inflation), which would partially or entirely offset gains in interest income. However, this is a low risk.

- If comps were to improve their margins and keep their expenses low compared to RBCAA (e.g. improve revenue per branch), then we could see outperformance of peers compared to RBCAA, as they would no longer be undervalued.

Conclusion

Overall, RBCAA has benefited from the recent rate rises in their core loan book, but their warehouse line has suffered, and their non-interest expenses have risen, leading to a decline in overall net income. Despite this, interest income is expected to continue rising as interest rates continue to increase, which will eventually lead to an improvement in net income and EPS, expected next year. Looking at the comparison on a P/B valuation, RBCAA is undervalued compared to peers, therefore, coupling this with an improvement in net income, RBCAA has the potential of a 15-30% upside from current prices.

Be the first to comment