porcorex/iStock via Getty Images

Fears of an economic slowdown have driven many stocks to high yields that haven’t been seen since 2020. While concerns around a recession are legitimate, it does remind me of the Peter Lynch saying that “more money has been lost preparing for recessions than recessions themselves”. In other words, one could do well by buying into share price weakness before an eventual economic rebound.

This brings me to TriplePoint Venture Growth (NYSE:TPVG), whose share price weakness has driven the dividend yield close to 10%. In this article, I highlight why TPVG may be a good choice for income investors at the current valuation, so let’s get started.

Why TPVG?

TriplePoint Venture Growth is an externally-managed BDC that mainly provides debt financing along with equity investments into high growth, venture capital backed companies. Like its peers Hercules Capital (HTGC) and Horizon Technology Finance (HRZN), TPVG focuses on technology and life science companies, and targets high returns of 10-18% on debt investments from interest and fees.

TPVG’s strategy is to invest in growth companies that are more mature (than early stage companies) and are at the venture growth stage. This market tends to be highly fragmented and underserved, with high barriers to entry given the established reputations and technological know-how of existing players like TPVG with ready access to capital.

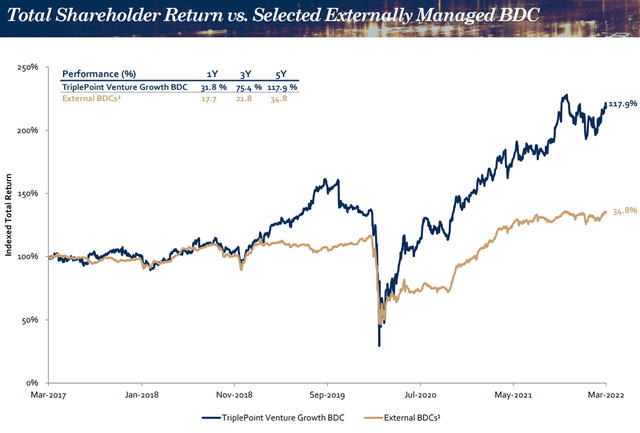

At present, TPVG has an $806 million investment portfolio at fair value, consisting of $696 million of loans to 48 companies, and $110 million of warrants and equity investments across 97 companies. The benefits to investing in warrants and equity is the greater potential for capital appreciation. This has contributed to TPVG’s total return of 194% since IPO. As shown below, TPVG has also produced impressive returns over the recent 5 years, with a 118% total return over this timeframe.

TPVG Total Return (Investor Presentation)

Meanwhile, TPVG continues to execute well, achieving an impressive 15.5% weighted average annualized portfolio yield during the first quarter, sitting well within its targeted range. Moreover, it managed to increase its net asset value per share by $0.18 YoY, to $13.84, and this is on top of the $0.38 YoY per share increase that it saw in the prior year period.

Notably, non-accruals remain low, representing 1.4% of the portfolio fair value, down from 3.8% in the first quarter of 2021, and the $0.36 per share dividend is well-covered at an 82% payout ratio. This is based on Q1 NII per share of $0.44 up $0.02 from the prior year period.

Looking forward, TPVG maintains a healthy balance sheet to fund additional debt financing with a 0.98x debt to equity, sitting well below the 2.0x statutory limit. Risks to TPVG include depressed tech valuations among the overall market weakness, which could delay liquidity events such as an IPO or buyout for one of its portfolio companies.

This could, however, play into TPVG’s favor on its debt investments, as delayed IPOs could mean that portfolio companies would need to extend their borrowings from TPVG without having to do additional dilutive equity funding rounds. This is supported by management’s comments during the recent conference call:

Companies are increasingly evaluating debt financing solutions as a result of these longer timelines for public listings. Following a record year for venture capital activity, many of the companies that raised equity last year at attractive valuations are now looking to add debt. Other companies are seeking additional runway in the form of debt as they plan out their time table in future equity rounds. And still other cases, companies are commencing with drawdowns under their existing lines with us as part of augmenting their financing strategy and capitalization plans in this environment.

Companies are no longer raising equity rounds every six to 12 months necessarily or as quickly as last year and there’s a little more moderation. These are all great trends as many are turning towards debt and layering it in as part of their go forward plans. We believe all this has a positive effect for future business and for our yields. Given the increased demand and increased attention towards debt, we are taking advantage of this opportunistically to increase our rates and expect to increase our yields through the year.

I see value in TPVG at the current price of $14.57 with a price-to-book ratio of just 1.05x. This sits well below the ~1.25x range that it’s traded at over much of the past 12 months. Sell side analysts have a consensus Buy rating on TPVG with an average price target of $17.54. This implies a potential one year 30% total return including dividends.

TPVG Price to Book (Seeking Alpha)

Investor Takeaway

TPVG is a well-run BDC that has produced impressive returns for investors since going public in 2014. It has a solid balance sheet and is positioned to benefit from the current environment as companies seek additional debt financing instead of equity. Meanwhile, the recent price weakness has bumped TPVG’s dividend yield to near 10%, making it an attractive buy for income investors.

Be the first to comment