Joe Raedle/Getty Images News

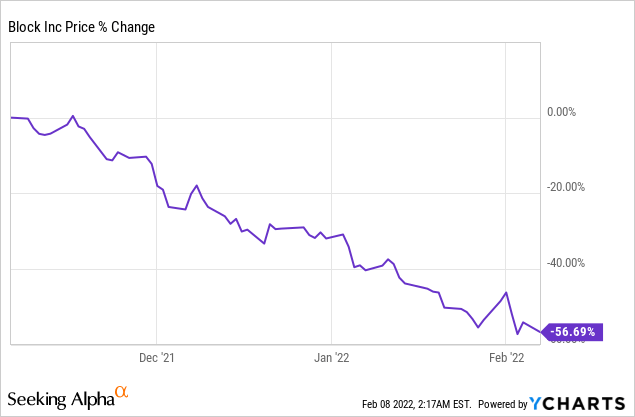

Block, Inc. (SQ) has been absolutely crushed since the NASDAQ reached historic levels in November 2021 and SQ stock has lost 56% of its value.

Block CEO Jack Dorsey stepped down from his dual CEO role at Twitter and will now focus 100% of his attention on Block Inc as he aims to integrate Bitcoin within the company’s core product line.

While I admire his audacity, I think it’s simply too risky to buy SQ stock at these levels since I don’t see any signs of buyers coming into the stock right now.

As Block Inc approaches a key support level of $100, investors could watch their investment value shrink even more if Block dips below support and head towards previous resistance levels of $85.

In this article, I’ll discuss why I’m avoiding Block Inc shares at the moment and provide a balance fundamental and technical analysis of the company.

Block Inc’s Historic Name Change

Block Inc changed its name on December 1st in an effort to rebrand itself and reflect the company’s goal of using Bitcoin as a key driver in future growth moving forward.

However, the name changed hasn’t yielded any positive results so far and Block Inc is down 40% since December 1st, 2021.

It’s interesting to note that Facebook changed its name to Meta at the end of 2021 and experienced the biggest single-day stock market loss in history after reporting lackluster Q4 2021 earnings.

It’s too early to tell if the name change will confuse investors moving forward or pay handsome dividends as Block Inc integrates Bitcoin across its payment app ecosystem.

Block Inc May Suffer From the “PayPal Affect”

Block generated $3.84 billion in revenue during Q3 2021 (Up 27% YoY) with Bitcoin representing $1.81 billion of the company’s quarterly revenue.

Block posted another profitable Q3 2021 with $1.3 billion in gross profit (Up 43% YOY) but generated zero net income in the quarter due to impairments from its investments in DoorDash and Bitcoin.

Square and CashApp, the company’s two major fintech products, continue to experience revenue growth but investors should brace themselves for slower growth if the Fed raises rates through 2022.

Higher interest rates will hurt spending as consumers must pay more to borrow money. PayPal saw its shares drop after releasing Q4 2021 earnings as investors sold off their shares due to weak 2022 guidance.

Block Inc is set to report Q4 2021 earnings on February 24th and I expect SQ stock will fall much further after the news event.

Block Could Drop Below Key Support Levels

From a technical standpoint, Block Inc will likely break down below previous support of $100 and dip to as low as $85 in the short run.

If Block dips below $85 then the next support level is $50 a share, which is nearly 50% lower than its current share price.

I don’t expect SQ stock to drop to $50 but I think you’ll be able to buy it much cheaper after February 24th’s Q4 2021 earnings report.

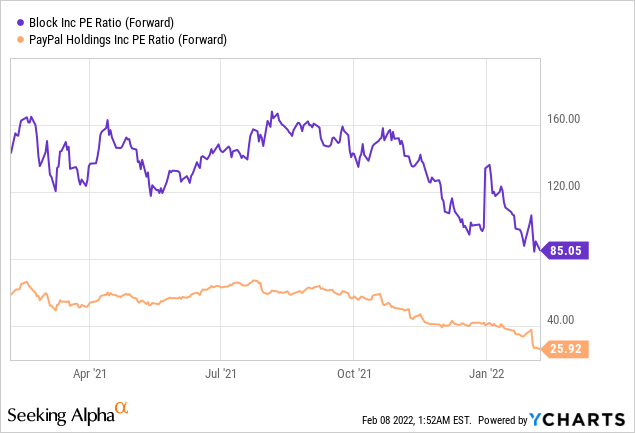

Block shares trade at a Forward P/E of 85 while PayPal trades at Forward P/E of 26.

While 2022 revenue guidance stands at $19 billion, I think a lower EPS estimate of $1.22 in 2022 versus $1.68 in 2021 is a major reason to avoid smashing the buy button right now.

Bitcoin Could Help Revitalize Block’s Share Price

it’s no surprise that Jack Dorsey decided to focus solely on Block Inc and rely on Bitcoin to save the company’s share price.

Global payment volumes will be negatively affected by rising interest rates so Dorsey hopes that Bitcoin mining will help steer the company in the right direction.

Block Inc will start mining Bitcoin and even plans to create its own ASIC miner that could be sold to 3rd parties. I wrote previously about Marathon Digital Holdings and how Bitcoin mining helped the stock price soar from $8 to as high as $80 during the peak of its bull run.

Block will benefit as a Bitcoin miner and bring a lot of new investor interest to the company.

Block holds 8,027 BTC with a current market value of $360 million. The company also has $7.4 billion in cash on its balance sheet, which is plenty of capital to invest in Bitcoin mining technology.

Risk Factors

Higher interest rates will hurt Block’s growth in the near future and I expect weaker guidance from management in 2022.

A Forward P/E of 85 is simply too expensive for this overvalued fintech growth stock and that means lower stock prices for Block as the P/E returns to a more realistic valuation.

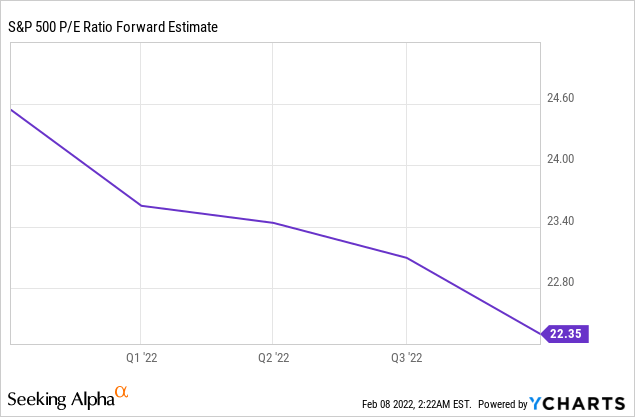

The Mean S/P 500 Forward P/E is 22 so Block looks extremely expensive in comparison.

We don’t know how long it will take Block to start mining Bitcoin, thus it’s hard to price in the new Bitcoin mining aspirations into the current stock price.

The company spent $29 billion to acquire Afterpay in August 2021, which now represents more than 50% of Block’s total market cap. The market didn’t react well to this major acquisition and now SQ stock is in complete freefall from its previous highs.

Conclusion

I like Jack Dorsey and his visions for Block Inc over the next 5 years but SQ stock is too expensive right now.

I will closely monitor the Q4 2021 earnings report on February 24th and start my initial position if Block shareholders panic sell due to weak forward guidance.

Netflix (NFLX) was an excellent dip-buying candidate after lackluster earnings and that will be my strategy for Block moving forward.

Be the first to comment