Daniel Boczarski/Getty Images Entertainment

Introduction

There’s nothing more American than burgers and chicken wings, that’s why you see a fried chicken or burger restaurant on every block. The darling of the industry is now Wingstop (NASDAQ:WING), the largest fast casual chicken wing restaurant in the world. The company has seen great expansion and popular demand over the last five years. Due to this, the stock price has run up to levels I wouldn’t touch.

Wingstop Financial History

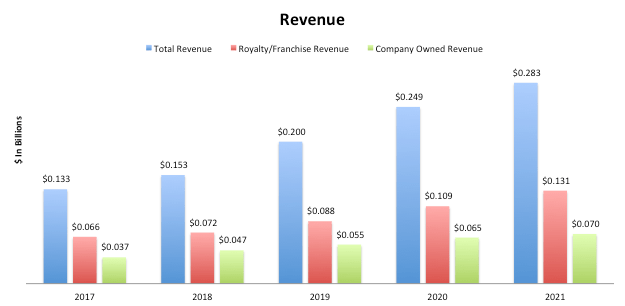

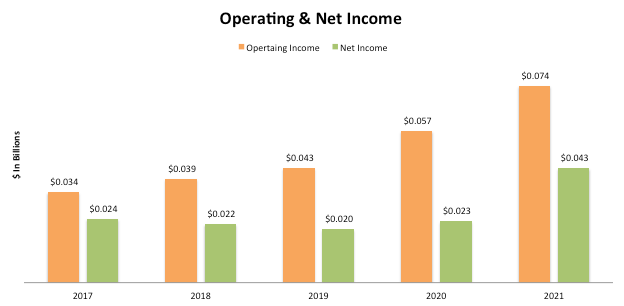

Wingstop Revenue Breakdown (SEC) Wingstop Operating & Net Income (SEC)

As can be seen above, Wingstop has seen great growth over the past five years. Total revenue has grown at a clip of 16.3%, most of which comes from franchising revenue growth of 14.7% per year. While franchising makes up 98% of Wingstop restaurants, the corporate store revenue saw nice growth of 13.6% per year. Of note is that advertising fee revenue make up about 28% of total revenue and has also grown at a rate of 22.92%, but because this revenue doesn’t reflect underlying operations, I won’t pay much attention to it in this article. Overall, this top-line growth has translated into great operating income growth of 16.83% per year. Net income has grown over the five years, but from 2018 to 2020 was bogged down by growing interest expenses. In 2021 it was the first time Wingstop didn’t see interest expense grow since 2017. Thus in 2021, net income saw growth of 87%.

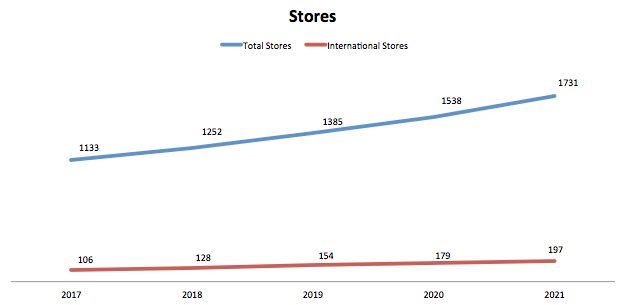

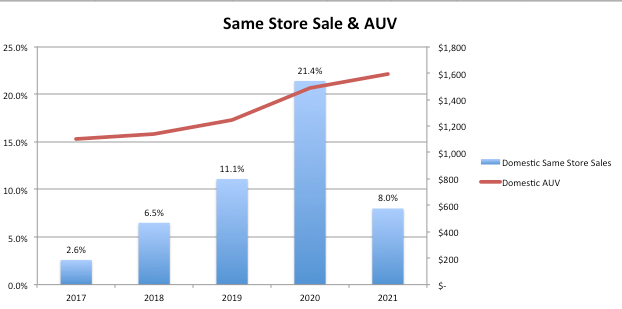

Wingstop Store Count (SEC) Wingstop Same Store Sales & AUV (SEC)

The reason for this growth is attributable to the number of stores opened in the past five years and just how well these stores have performed. Over the past five years, Wingstop has added 598 new restaurants for an increase of 53%. The business has also expanded internationally, with store growth of 86%. Looking at same-store sales shows that these restaurants are well received in the marketplace. Consistent positive same-store sales show the demand for Wingstop is steady, and new stores are providing returns. Also of note is that the average unit volume has increased each year, too. Altogether, Wingstop is seeing high demand in existing and new restaurants. Looking at the company’s stated goals of sustaining long-term same-store sales growth, maintaining returns, and expanding internationally, it seems Wingstop is succeeding in these endeavors.

Wingstop Balance Sheet

Looking at the balance sheet shows the company has nice liquidity but has extended leverage for growth. With a current ratio of 0.97x, Wingstop can pay off almost all current obligations. But the company is all debt, with negative stock equity, showing just how leveraged the above growth is. As mentioned before, the interest expense was increasing every year until 2021, and looking at the times’ interest earned ratio shows the company could be way better off at just 4.92x.

WING Stock Valuation

As of this writing, Wingstop trades at a level around $105 per share. At this price point, the company trades at a P/E of 77.78x. When factoring in the growth of the bottom line over the past 5 years we see a PEG of 6.29X. Altogether, even despite a 21% price decline this year, Wingstop is way overvalued. Is a strong assumption growth like this can be maintained with such great operating metrics over the long term, but also the company has a poor balance sheet and high leverage.

Conclusion

Wingstop has been seeing strong growth over the past few years and paired this growth with great operating metrics to boot. The business is expanding internationally, has consistently positive same-store sales, and is maintaining returns, meeting company goals. But the cost of this has been a high debt load and a stock price run-up. Therefore, while the business is doing well, it has damaged the financial stability of the company and vastly overvalued the business. I wouldn’t buy this company until the price is at least half what it is today.

Be the first to comment