bymuratdeniz

As Apple (NASDAQ:AAPL) faces major supply disruptions for the iPhone 14 Pro during the holidays, the tech giant has run into troubling problems in China. The company can’t simply move production to another location or country due to the massive scale, not to mention the Communist government could retaliate on the sales within China. My investment thesis remains Bearish on the stock due to the predictable weak holiday sales and the ongoing growth issues facing Apple while the stock price is still elevated.

Covid Pains

The ongoing China zero-Covid policy has caused a major disruption with crucial iPhone 14 Pro production. The Zhengzhou facility in China saw a flood of employees leave to avoid more Covid lockdowns leaving Foxconn short an estimated 100K employees to fully staff the facility. Now, the plant doesn’t even have the space to hire new employees and return to full production with 300K employees.

Back on November 6, Apple warned of struggles to meet demand due to lower iPhone 14 Pro shipments due to issues at the facility that have now lasted several weeks:

COVID-19 restrictions have temporarily impacted the primary iPhone 14 Pro and iPhone 14 Pro Max assembly facility located in Zhengzhou, China. The facility is currently operating at significantly reduced capacity. As we have done throughout the COVID-19 pandemic, we are prioritizing the health and safety of the workers in our supply chain.

The company had to even cover for the Chinese government by suggesting the production impacts were due to prioritizing health and safety of workers while the US is fully open for business with no Covid restrictions. Foxconn even announced a move to increase production in India, but the move will take years to replace Chinese production.

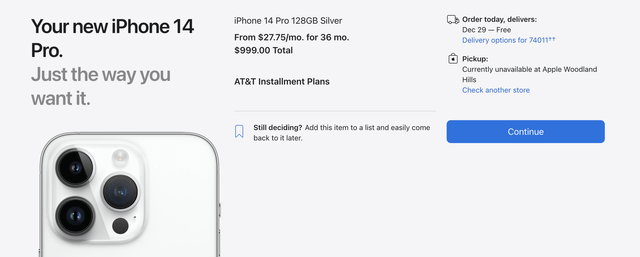

The iPhone 14 Pro and Pro Max wait times on Apple.com have now reached nearly 6 weeks. Anyone ordering here before Thanksgiving can’t even obtain the smartphone prior to Christmas. The timeline will quickly tip into January considering most holiday shoppers probably haven’t even tried to order an iPhone yet.

Source: Apple.com

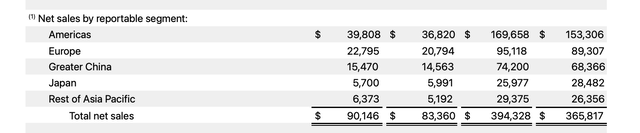

The bigger problem is that Apple obtains nearly $75 billion worth of sales from Greater China, or 19% of all sales in FY22. The Communist country is only slightly behind the $95 billion worth of sales in Europe in level of importance for Apple.

Source: Apple FQ4’22 earnings release

Apple has to walk a tightrope in moving production out of the country once full speed ahead on gaining business from the West. If the company pushes too much production capacity out of China, the country might work towards blocking Apple products in the country. Most tech companies have limited business in China leaving Apple as an outlier.

EPS Cuts Ahead

Analysts only have Apple growing total revenue by $20 to $30 billion annually for the next few years. The tech giant is expected to grow revenues in the 5% annual range, which appears aggressive, but any sales reduction from China would dramatically hit an already slow growth rate.

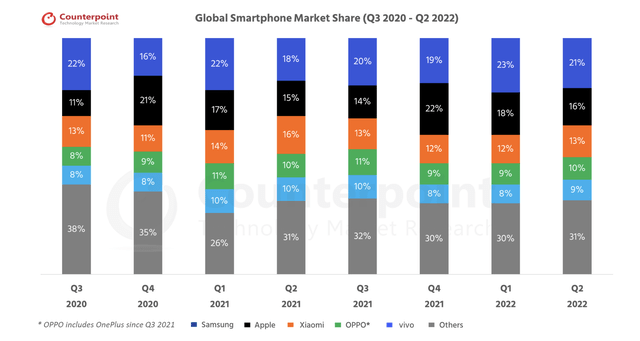

The government really has no reason to support Apple products in the country unless the company keeps massive production levels inside China to provide jobs to Chinese citizens. The country already has some of the largest smartphone manufactures in Xiaomi, OPPO and vivo. The 3 main Chinese smartphones have a combined 32% of the global market while Apple only has a 16% market share.

Source: Counterpoint

Ultimately, China will shift from a zero-Covid policy, but Apple faces significant holiday sales weakness. The stock remains extremely priced at 24x FY23 EPS targets of $6.24.

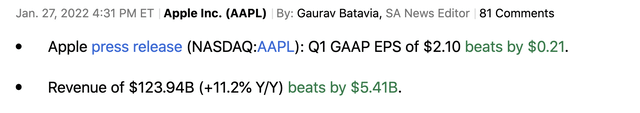

The FY24 EPS target includes a $2.04 target for the December quarter. Last FQ1, Apple produced the following results:

Source: Seeking Alpha

Analyst estimates haven’t fallen much in the last month with just a minor dip from a prior $2.08 consensus estimate. With a massive production facility in China the size of a large city in the US unable to produce anywhere close to maximum levels, Apple is unlikely to top those revenues from FQ1’22 and approach the EPS of $2.10.

Even knowing most of the iPhone sales will just be delayed into a future quarter, the market normally doesn’t handle this scenario very well. iPhone production and sales are the most crucial part of Apple’s business and the market will face a lot of doubts about actual consumer demand.

KeyBanc analysts already noted mixed demand for Apple products. The iPhone 14 base products along with Mac (company warned on weak demand) and iPad demand are weak with only the iPhone 14 Pro models showing strong demand. Those iPhones are the ones facing production issues as Apple was ill prepared for the consumer shift towards the high-end smartphones.

All of these data points suggest Apple won’t come anywhere close to matching the numbers from last year. At $150, the tech giant needs to generate 10%+ EPS growth to come anywhere close to justifying the current valuation. The December quarter will clearly end up significantly below last year’s actual EPS and current estimates.

Takeaway

The key investor takeaway is that Apple faces massive China problems. Not only are China Covid policies impacting production, but the tech giant is trapped leaving a substantial amount of production in the Communist country in order to maintain strong relations to protect the large revenue base inside the country.

The stock provides no upside trading at $150 with a weak holiday quarter unfolding.

Be the first to comment