Hulton Archive

Before answering that question, rest assured that I’m quoting a famous investor, but you probably know the answer to John D. Rockefeller’s quote, as he continues…

“It’s to see my dividends coming in.”

Rockefeller was once the wealthiest man in the world with a $300 billion fortune today, inflation-adjusted (and estimated by Forbes). He built his massive wealth by controlling of 95% of U.S. oil production, via a company he controlled known as Standard Oil.

In 1896, he gave up full control of the day-to-day operations but held on to his shares and the dividends. Since he was the majority owner, he dictated that the company pay out more than 2/3 of its profits as dividends.

Many investors don’t recognize the importance of dividends, that power total returns.

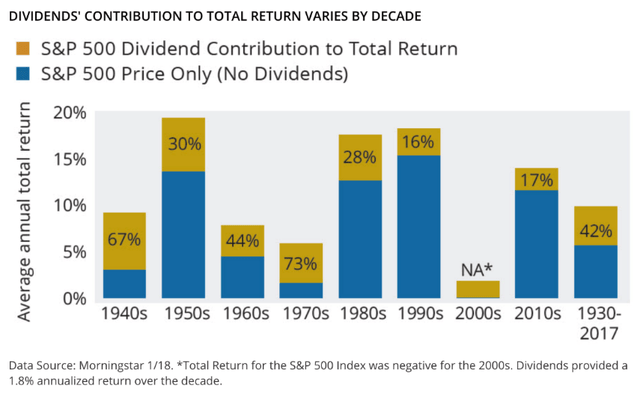

As the chart below illustrates, during eight decades (1930 to 2017) dividends represented the bulk of returns in some periods (1940s, 1970s) while offering modest assistance in other regimes (usually in bull market decades).

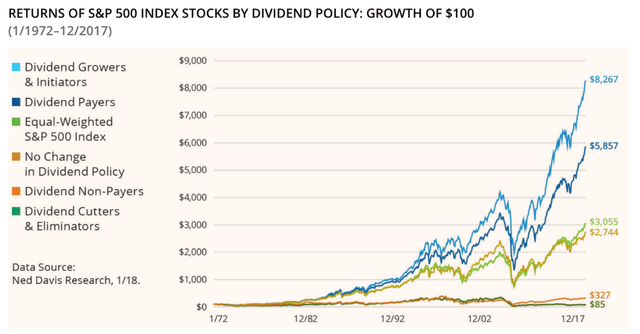

I’ve always considered Rockefeller to be an interesting study, as someone who obviously recognized that dividend-paying stocks consistently outperform non-dividend-paying stocks.

“According to Wharton finance professor Jeremy Siegel, 97% of the total after-inflation return of stocks between 1871 and 2003 came from reinvesting dividends. Only 3% came from capital gains.”

It should be no surprise that the Rockefeller fortune today is invested in a trust, Rockefeller Financial Services, that holds a number of blue-chip stocks including:

- Comcast (CMCSA) – Dividend Yield 3.1%

- JPMorgan (JPM) – Dividend Yield 3.0%

- Visa (V) – Dividend Yield .85%

- Wells Fargo (WFC) – Dividend Yield 2.6%

- CVS (CVS) – Dividend Yield 2.3%.

I don’t see many real estate investment trusts (“REITs”) in the Trust, although I do see a number of energy stocks including BP (BP), ConocoPhillips (COP), Exxon (XOM), Chevron (CVX), and others.

Rockefeller Financial Services has $6.3B in assets under management with just three REITs: American Tower (AMT), Brixmor (BRX), and Iron Mountain (IRM).

Clearly Rockefeller loved dividends, but I wonder whether he would have agreed with my reasoning that,

“The safest dividend is the one that’s just been raised.”

Dividend Growth is the Secret Sauce

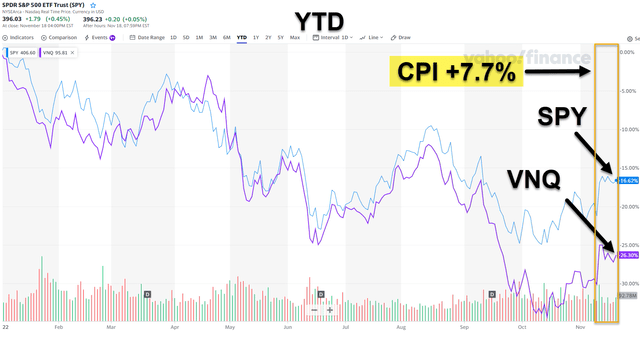

A glimmer of good news on inflation: as price increases eased in October with the CPI showing a 7.7% annual gain (was 8.2% in September), signaling the Fed’s steep interest rate hikes are working. A half-point increase is likely in December.

The key here is not the speed of rate increases, but how high they go. Fed Chairman Powell said this month that interest rates are still going higher, even if the pace slows. Some Fed members are nervous about raising rates too fast.

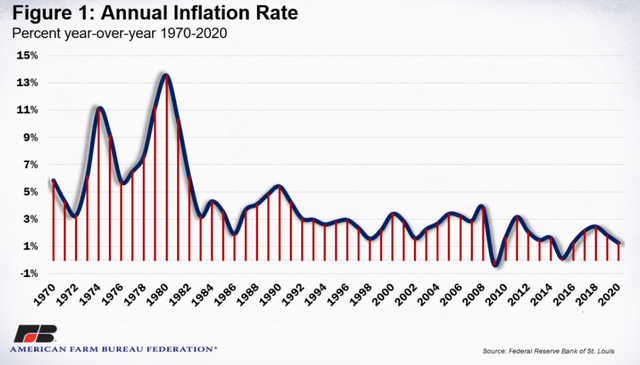

If you scroll back up to the first chart in the article, you can see that dividends represented 73% of total returns in the 1970’s. I find that interesting given the fact that the average inflation in that decade was around 5.3%.

Now, many of my followers know that I’m a big fan of dividend growth stocks, and the chart below demonstrates that dividend growers outperform the other forms of investing, whether they involve dividends or not.

That’s why we love Dividend Aristocrats and Dividend Kings!

And, of course, that’s why I’m recommending these three stalwarts right now!

Realty Income Corporation (O)

Realty Income is a net lease REIT that owns over 11,700 properties in 50 U.S. states, Puerto Rico, Spain and the U.K. This REIT’s scale advantage (1,147 clients) has been a big reason the company has been able to declare 629 consecutive common stock monthly dividends throughout its 53-year operating history and increased the dividend 117 times since listing in 1994.

Another prime-time differentiator for Realty Income is its balance sheet – one of only seven S&P 500 REITs with two A3/A- ratings or better. This highly disciplined capital structure allows Realty Income to generate significant liquidity (over $2.3 billion) and opportunistic growth supported by the capacity to buy in bulk at wholesale prices.

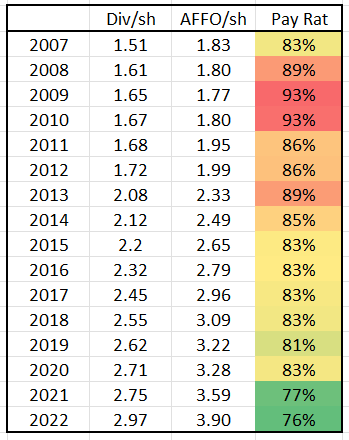

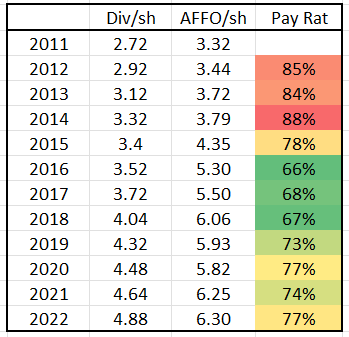

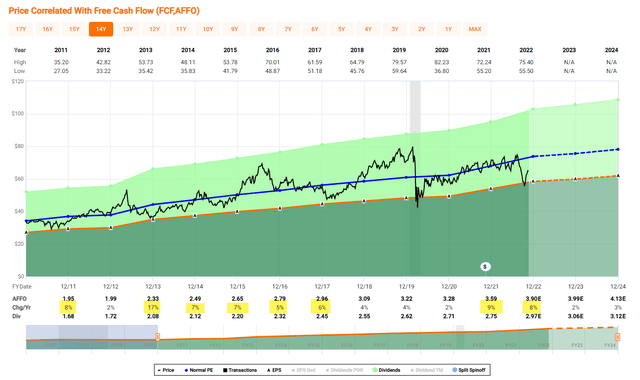

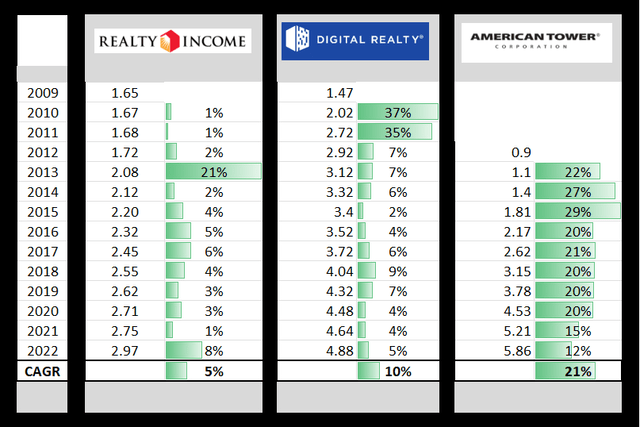

As viewed below, Realty Income has generated positive AFFO per share in every year since 2010 and in many of these years growth was in excess of 5%.

Although growth is likely to slow in 2023, due to rising rates, Realty Income’s existing rental model has built-in bumps that allow the company to generate sustained increases. Importantly, the company’s dividend is safer today than it has ever been in its history, as illustrated by the payout ratio history (below):

iREIT on Alpha

So now that we’ve confirmed Realty Income has a fortress business model, let’s consider the valuation.

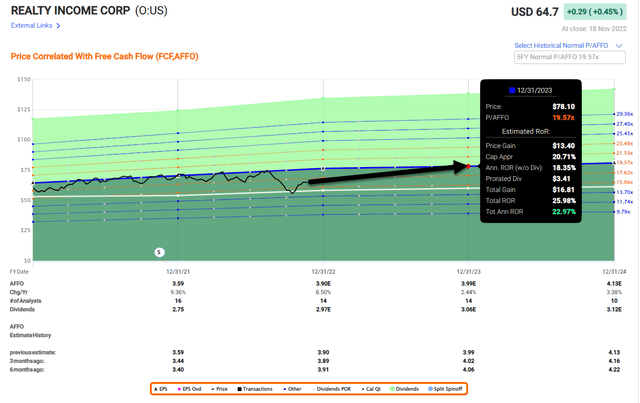

As viewed below, Realty is trading at $64.70 per share with a P/AFFO multiple of 16.8x.

Consider the fact that the company’s normal multiple is 17.8x and the current dividend yield is 4.6%. I find this attractive, recognizing that our $78.00 2023 price target suggests shares could return over 20% annually. I know Rockefeller would be all-in on this trade.

Digital Realty Trust, Inc. (DLR)

Digital Realty is a data center REIT that owns over 300 data centers in 25 countries. The company enjoys one of the largest global platforms of multi-tenant data center capacity featuring 170,000+ cross-connects in critical locations with proximity to industry-leading businesses exchanging data in a community of more than 4,300+ customers.

Digital is also investment-grade rated (BBB), with just 3% secured debt and solid balance sheet metrics – 6.4x net debt / Adjusted EBITDA and 5.7x Adjusted EBITDA / Fixed Charge. As of Q3 2022, the company’s cash and forward equity total over $700 million that increased current liquidity to around $3 billion.

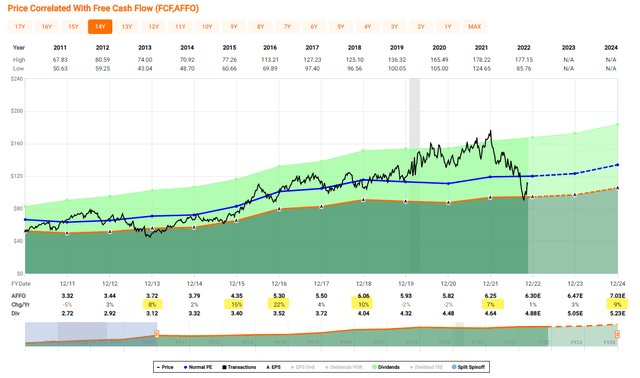

As viewed below, Digital has generated stable growth since 2010, which supports continued dividend growth:

As you can see below, DLR has maintained a sound payout ratio of under 80%, which provides solid support for continued dividend growth. Also, like Realty Income, Digital has a much more diversified business model. International Business Machines (IBM) is the largest customer (with 38 locations) that represents 3.8% of ABR (annualized base rent).

iREIT on Alpha

Digital has increased the dividend for over 17 years in a row, thus the company is well on its way to become a Dividend Aristocrat in 5 more years.

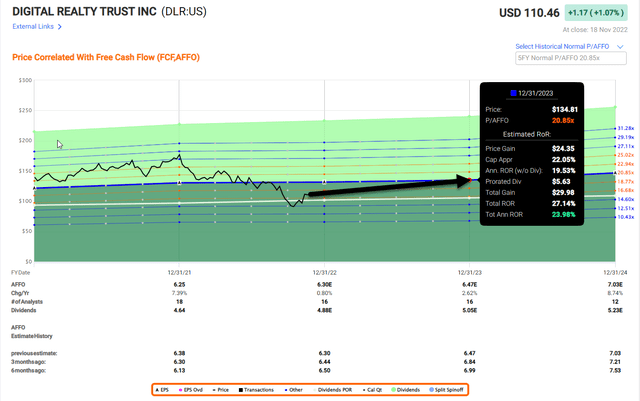

Now, in terms of valuation, I find Digital a really attractive pick. Shares trade at $110.46, with a P/AFFO multiple of 17.6x, versus the normal P/AFFO of over 19.0x. The dividend yield is 4.4% (as I said well-covered) and analysts are forecasting growth of 3% in 2023 and 9% in 2024.

Last week, I visited a Digital data center in San Francisco and a new spec building under construction. I’m as bullish as I have ever been with Digital, and I consider this juggernaut one of my highest conviction picks. I consider Digital Realty to be the modern-day Standard Oil company that boasts dominance in global interconnectivity that hosts critical infrastructure and data sets.

American Tower Corporation (AMT)

American Tower is a cell tower and data center REIT that owns over 223,000 sites (in 25 Countries), including more than 43,000 properties in the U.S. and Canada and approximately 180,000 properties internationally.

Nearly 98% of American Tower’s revenue is generated from leasing properties, as well as fiber, a highly interconnected footprint of U.S. data center facilities and other urban telecommunications.

Since the start of 2019, 5G spectrum auctions, mainly in the mid band, have collectively driven over $155 billion in purchase price proceeds across AMT’s served market.

So far in 2022, AMT has seen carriers leveraging presence in nationwide scale to efficiently and aggressively upgrade equipment on our sites in markets across the company’s international footprint to meet 5G build-out objectives.

American Tower’s investment-grade balance sheet has enabled the company to navigate various economic cycles, as the company has diversified sources of capital (net leverage of 5.5x) coupled with its focus on maintaining robust liquidity of over $7 billion.

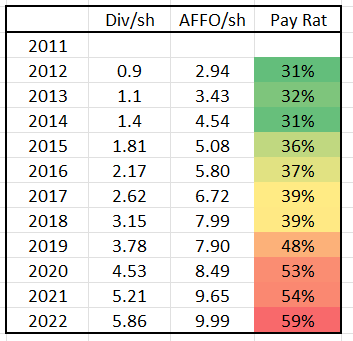

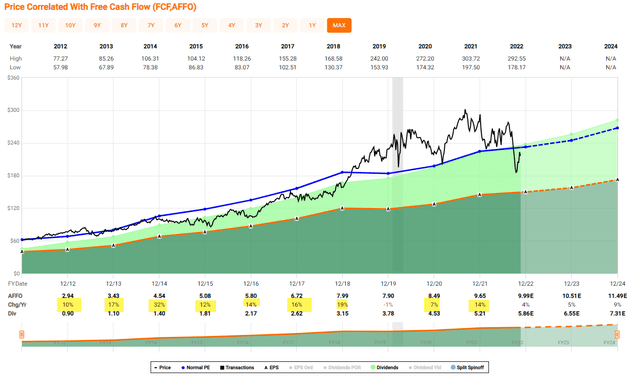

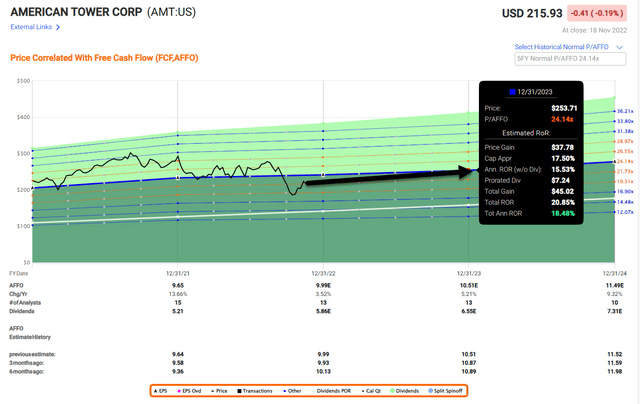

As viewed below, American Tower has a strong record of growing AFFO per share:

On the Q3-22 earnings call, American Tower reiterated its expectations to dedicate approximately $2.7 billion, subject to Board approval towards the 2022 dividend. As you can see below, the company has maintained a conservative payout ratio, now paying out under 60% of AFFO per share.

iREIT on Alpha

Similar to Realty Income and Digital Realty, American Tower is trading at a wide discount: shares trade at $215.93 per share with a P/AFFO multiple of 21.7x. The normal P/AFFO is 23.2x and the current dividend yield is 2.6%.

Once again, like Rockefeller, I like owning monopolistic companies, and AMT fits the bill – iREIT estimates shares could return 15% to 20% over the next 12 months.

What Gives You Pleasure?

Do you see the common thread for these 3 REITs?

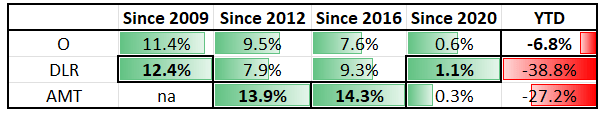

Dividends per Share

As you can see, all three REITs enjoy a reliable dividend growth history, and we anticipate all three increasing the dividend in the future. While shares have underperformed, we have confidence that the dividend growth will drive total returns.

Annualized Total Return

iREIT on Alpha

Bear in mind that Rockefeller understood monopolies extremely well, and much of his wealth was generated based on the fact that he crushed his competition by using scale advantage.

But it was not just scale. Rockefeller recognized that in order to build a competitive advantage, the company had to enjoy a cost of capital advantage, so that it could control costs, and become a dominant player in its respective sector.

Of course, the sum of the parts is what made Rockefeller happy, and of course I’ll end this article with a quote…

Do You Know The Only Thing That Gives Me Pleasure?

Be the first to comment