Birdlkportfolio

Unlike his partner Charlie Munger, who has ignored the political risks that come with investing in Chinese firms such as Alibaba (BABA), it appears that Warren Buffett has a greater sense of geopolitical awareness. The latest decision of Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) to continue to unwind its stake in the Chinese EV firm BYD Company (OTCPK:BYDDF)(OTCPK:BYDDY) signals that Warren Buffett is more than likely to close his position in the company whatsoever and dramatically decrease the direct exposure to China in the foreseeable future.

On top of this divestiture, it also seems that Warren Buffett is preparing Berkshire Hathaway’s portfolio to tackle the upcoming geopolitical challenges since some of his recent picks are well-positioned to benefit from the changing geopolitical landscape. As Sino-American relations worsen while the world is on the brink of a global recession, the latest moves of the Oracle of Omaha could teach a lot of investors how to better prepare their own portfolios for the future in order to decrease their exposure to geopolitical risks.

The Turning Point

Berkshire Hathaway was one of the first major companies to pioneer investing in the EV field long before Tesla (TSLA) came to prominence. Back in 2008, Berkshire Hathaway through its subsidiary bought shares of the Chinese-based battery and electric vehicle maker BYD for $230 million, which became one of the very few direct investments of Warren Buffett into China. Then in 2010, Warren Buffet along with Charlie Munger and Bill Gates made a trip to China, during which they visited BYD’s facility in Shenzhen to show their support to the company and its CEO Wang Chuanfu.

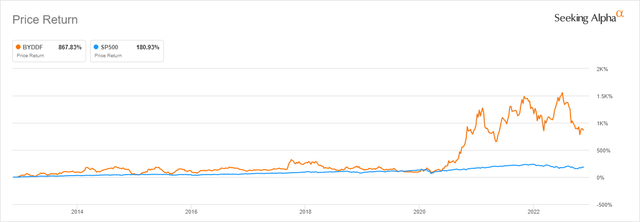

Thanks to his investment discipline, Warren Buffett has been holding BYD’s stock for over a decade now and was finally rewarded for his patience after the start of the pandemic when stocks of the EV businesses skyrocketed and began to outperform the rest of the market.

BYD’s 10-Year Price Return vs. S&P 500 (Seeking Alpha)

As BYD’s shares trade significantly above the price at which Berkshire Hathaway purchased them through its subsidiary more than a decade ago, there’s an indication that Warren Buffett is now looking to fully unwind the position in the company, which was worth ~$9 billion in July.

In August, Berkshire Hathaway began to unwind its BYD holdings by converting them into H-shares on the Hong Kong stock exchange and selling them on an open market, which decreased the overall ownership from 20.04% to 19.92%. After that, a series of block trades have been executed, which decreased Berkshire Hathaway’s ownership of BYD’s outstanding H-shares to 16.6% as of November 8. The continuous selling of BYD’s shares in recent months is a clear indication that Berkshire Hathaway more than likely intends to fully unwind the position. The probable reason why it’s not doing the unwinding faster is mostly due to the lack of liquidity on the Hong Kong stock exchange along with the need to sell shares at more attractive prices without causing a panic selling, which would’ve occurred if the sell order of the entire stake was placed at once.

Considering this, investors might wonder why Berkshire Hathaway is selling its stake in BYD now. After all, BYD continues to be a dominant player within the Chinese EV market, and its latest results show that despite the slowdown of the Chinese economy its business nevertheless continues to grow at a triple-digit rate. On top of that, as the Chinese EV market is about to account for 60% of the global EV sales this year, there’s an indication that BYD would continue to aggressively grow in the foreseeable future, as it already outsells Tesla on the mainland.

While in part, this could be due to the fact that Berkshire Hathaway wants to lock in the profit, it’s unlikely to be the main reason. Let’s not forget that in Q3 Berkshire Hathaway was a net buyer of stocks and has been steadily increasing its stakes in energy businesses, which already trade at historically high prices and could present a minimum upside and a small margin of safety. That’s why the divestiture from BYD could be in large part due to political reasons, which negatively affect China’s economic future.

Unlike the China of 2008, China of 2022 is an entirely different country. I’ve already addressed this in my other article on BYD’s competitor NIO (NIO), in which I’ve highlighted the latest National Congress of the CCP that ended with Xi Jinping concentrating most of the country’s power into his hands. His constant reiteration of the need to redistribute wealth at the same time when the economy is slowing down in light of the property crisis has only accelerated the need to divest from China for different institutions and global conglomerates.

What’s worse is that due to its size as one of the biggest EV businesses not just in China but in the world as well, BYD could easily become a target of the CCP. We already saw how in the last couple of years Beijing has treated its big companies such as Alibaba and DiDi by cracking down on them and interfering in their affairs, which caused panic in the markets and led to a ~$5 trillion rout in Chinese stocks in recent years.

Add to this the fact that there’s a real chance that we could witness a new trade war between China and the West along with Beijing’s potential invasion of Taiwan in this decade, and we could arrive at a conclusion that China is uninvestable whatsoever at this stage. That’s why Berkshire Hathaway is not the only one to divest from China, as we continue to witness a record capital outflow from the mainland, which is unlikely to stop anytime soon due to the reasons described above.

The Elephant In The Room

The problem with Berkshire Hathaway’s portfolio is that as it decreases direct exposure to China, its biggest position Apple (AAPL) is still extremely dependent on the mainland. A few months ago, I wrote an article on the Cupertino-based company, which revealed its weak spots. In addition to having the biggest exposure in terms of sales to China in comparison to its peers, 42% of Apple’s global production was still done in China at the time of that writing. On top of that, Apple was required to compromise with Beijing on where to store data in order to remain in the country, while Tim Cook was publicly praising the CCP so that his company won’t receive the same treatment that Alibaba did due to Jack Ma’s public criticism of the Chinese banking sector in 2020.

Those things show that in case of a serious confrontation between China and the West, Apple could easily become one of the biggest casualties. In addition, overexposure to China also negatively affects Apple’s business, as due to the continuous implementation of the zero-Covid policy, the company’s production has already been disrupted several times in the past, which already caused the management to decrease their shipment expectations for this year.

Nevertheless, the good news is that it seems that Apple’s management understands this and is also actively looking to decrease its exposure to China. In recent months, it has been actively expanding its network of production partners in countries such as Vietnam and India in order to diversify its supplies and no longer rely so much on Beijing and its politics. At the same time, its chip manufacturing partner TSMC (TSM), in which Berkshire Hathaway opened a long position in Q3, is also on track to open new production facilities in Germany, Japan, and the United States in order to decrease its own geopolitical risks. From 2024, TSMC is expected to manufacture Apple’s chips in its factory in Arizona, which would hedge both businesses from the major losses that they could’ve suffered in case of a major confrontation between China and the United States. All of this is a positive development for Berkshire Hathaway’s portfolio.

What’s Next?

Thanks to the diversification efforts of its investment picks, Berkshire Hathaway is poised to significantly decrease its exposure to China directly and indirectly, which would make its portfolio well-positioned to tackle the challenges that come with a changing geopolitical landscape.

At the same time, its latest Q3 earnings results give even more reasons to be optimistic about the future Warren Buffett’s company. Despite the fact that Berkshire Hathaway’s operating earnings were down Q/Q to $7.76 billion mostly due to the decline of the rail profits and due to losses that its insurance portfolio took as a result of the Hurricane Ian, they were still up ~20% Y/Y.

At the same time, its integrated oil and gas picks such as Chevron (CVX) and Occidental Petroleum (OXY), which have been getting more weight in Berkshire’s Hathaway portfolio, are more than likely to continue to generate aggressive returns in the following months. I have already explained in several of my articles on Exxon Mobil (XOM) how the OPEC+ oil supply cut along with the upcoming European embargo on Russia oil that takes effect on December 5 are more than likely to keep the oil supplies tight, making it possible for western oil and gas companies to continue to enrich their shareholders.

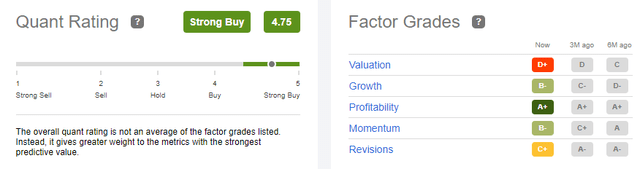

Considering all of this, there’s an indication that the company itself has all the possibilities to continue to deliver exceptional results and even at the current levels represents a decent upside to investors according to the street and to Seeking Alpha’s Quant rating system.

Berkshire Hathaway’s Street Price Target (Seeking Alpha) Berkshire Hathaway’s Quant Rating (Seeking Alpha)

The Bottom Line

Berkshire Hathaway’s indication to divest from China by unwinding its only direct Chinese-based investment in BYD represents a broader trend of capital outflow from the mainland, which could be attributed to the greater increase of geopolitical risks that are associated with investing in Xi Jinping’s China. Add to this the fact that Apple actively begins to diversify its supply chains to decrease its exposure to Beijing’s politics, while TSMC opens production facilities abroad to decrease its downside from a possible invasion of Taiwan in the future, and it becomes obvious that the process of decoupling from China will continue. The good news is that it appears that Berkshire Hathaway’s portfolio is well-positioned to tackle this new reality, which should help the company to tackle the geopolitical risks and create additional shareholder value for years to come.

Be the first to comment