posteriori/E+ via Getty Images

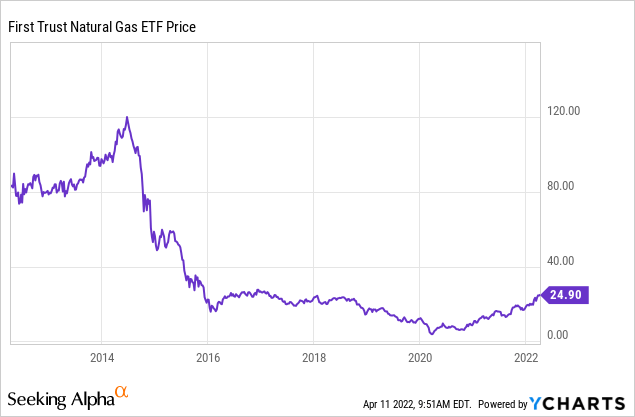

As the photo above infers, natural gas is hot – and so is the First Trust Natural Gas ETF (NYSEARCA:FCG). The fund is up 43% YTD but appears to have more room to the upside. I say that not only because NYMEX gas is currently trading at 8-year highs (see chart below), but because there are multiple positive long-term tailwinds for the sector – including very strong forward strip pricing. Today, I’ll take a closer look at the FCG ETF and let investors decide if the fund deserves an allocation as part of a well-diversified portfolio. My opinion is that the FCG ETF is a BUY.

Investment Thesis

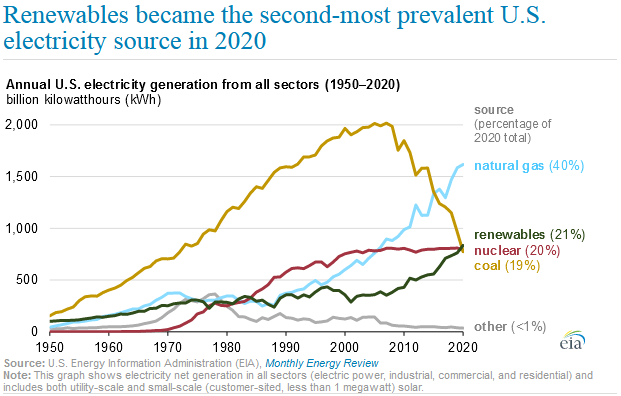

As most of you know, there are currently several strong and very positive catalysts in the natural gas market – both domestically and globally. On the domestic front, the retirement of dozens and dozens of coal plants in the United States over the past decade or so means that cleaner burning natural gas (50% less CO2 emissions than coal, 100% less toxic particulate emissions) is now the #1 source of U.S. electric power generation capacity:

U.S. Power Generation Sources (EIA)

In addition, natural gas power generation has much faster start-up and shut-down times, making it a superior back-up power source for intermittent renewables as compared to coal (or nuclear for that matter).

In addition, you all are aware of the geopolitical energy risks as a result of Putin’s invasion of Ukraine while Russia simultaneously sends vast volumes of natural gas via pipelines to the EU, which desperately wants to cut-off funding for Putin’s war machine.

Meantime, international prices remain significantly higher than the domestic price of gas, and as long as that is the case the prospects for additional U.S. LNG export capacity looks bright for years to come.

So now let’s take a look at the First Trust Natural Gas ETF to see how it has positioned investors to take advantage of the bullish backdrop in the natural gas market.

Top-10 Holdings

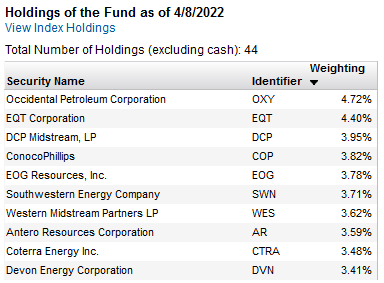

The top-10 holdings in the FCG ETF are shown below and equate to what I consider to be a well-diversified 38.5% of the entire 44 company fund. That is to say, the fund is not overly dependent on the performance of a small number of companies.

FCG ETF Top-10 Holdings (First Trust)

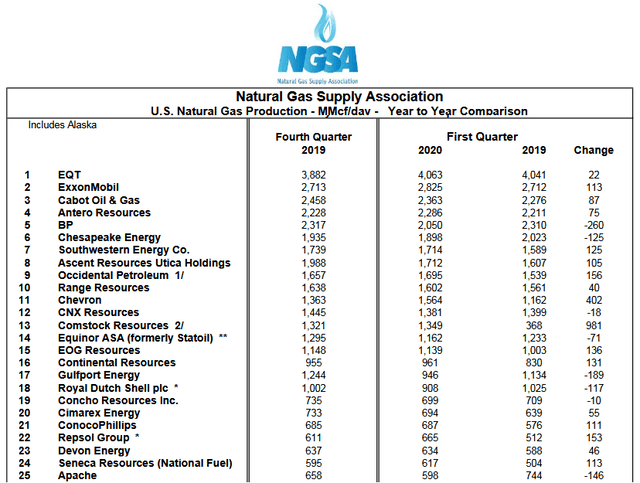

First off, let us compare the companies above with the top-10 natural gas producers in the United States – just to see what the overlap looks like. Before the criticism start flowing, yes, this data is a couple years old. That said, it is the last “Top-40” list that the NGSA has published – likely because there has been significant M&A and asset sales in the sector over the past couple of years and it takes time for those developments to settle out enough to be adequately reported. However, I believe this list is still a good representation of the current major players in the US natural gas production sector:

Top-40 US Gas Producers (NGSA)

EQT (EQT) became the largest natural gas producer when it bought Marcellus producer Rice Energy back in 2017. EQT is the #2 holding in the FCG ETF with a 4.4% stake. The stock is up 75% YTD yet still trades at a relatively low forward P/E of 16x.

DCP Midstream LP (DCP) is one of the largest natural gas gatherers and processors in the United States. DCP is a 50/50 JV between Phillips 66 (PSX) and Enbridge (ENB). The MLP is trading with a forward P/E of only 8.9x, is throwing of a 4.6% yield, and units are up 56% over the past year.

With a 3.8% stake, ConocoPhillips (COP) is the #4 holding in the fund. Over the past couple of years, ConocoPhillips has made two sizeable – and very well-timed – acquisitions in the Permian Basin: Concho Resources and the vast majority of Shell’s acreage in the Permian. COP also has significant LNG production capacity in Australia. COP generated over $13.3 billion in free-cash-flow last year and – due to large increases in yoy prices for oil, natural gas, and LNG – it will likely significantly exceed that amount this year. COP pays both a base and a variable dividend, but has chosen to over-emphasize stock buybacks as compared to more dividend friendly companies like EOG Resources (EOG) – the #5 holding in the ETF – and Pioneer Natural Resources (PXD). See my recent Seeking Alpha article on this subject: PXD Could Pay $20/share In 2020 Dividends. COP has doubled over the past year yet currently trades with a forward P/E of only 9.3x.

Southwestern Energy (SWN) is in the top-10 list of ETF holdings (#6) as well as the top-10 list of US natural gas producers. SWN has also doubled over the past year yet still trades with a forward P/E of only 5.8x.

The #8 holding with a 3.6% weight is Antero Resources (AR) – also a top-10 U.S. natural gas producer. Antero’s Q4 results delivered a massive beat on the top-line (by $1 billion), yet disappointed on a non-GAAP basis. Q4 revenue of $2.4 billion was up 82.4% yoy. AR is up 267% over the past year yet still trades at a forward P/E of only 8x.

As you can see, many of these stocks have had big run-ups over the past year. Is it too late? Are these stocks value traps? I don’t think so – note how many of these companies still trade at relatively low (very low?) forward P/Es.

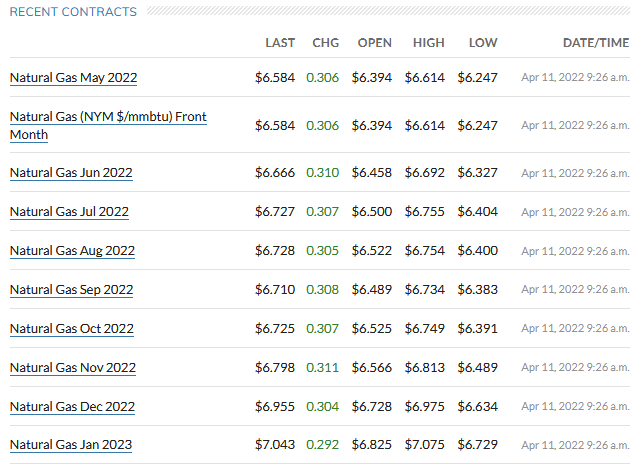

Yet they certainly could be value traps if the bottom were to fall out of the price of natural gas. However, consider the forward strip:

NYMEX Strip Prices (MarketWatch)

As can be seen, the NYMEX strip is very bullish for the remainder of this year. The natural gas producers in the FCG ETF can all generate significant FCF at $4 gas. At a $6+ gas price, they will generate massive FCF. Enough to enable them to easily strengthen their balance sheets (if they need even need to), reward shareholders with increasing dividends, and to make significant share buybacks as well. Indeed, the biggest problems facing the CEOs of these companies is how to best allocate all the FCF they will generate this year.

Risks

Yet I don’t want to minimize the risks either. There is massive geopolitical risks as a result of large-scale Covid lockdowns in China, Putin’s invasion of Ukraine – which could turn into a long-term ordeal of epic proportions, and higher inflation and interest rates. All of these factors could lead to a slowing domestic (and global) economy and perhaps even a severe recession. That would lead to a significant reduction in global natural gas demand, and put pressure on the price of gas.

Meantime, despite all the false energy narratives flying around these days (that I have written about recently on Seeking Alpha), and being generated by energy company CEOs and reflected through many politicians and the media, that there were somehow big limitations in the availability of rigs and/or crews to man them, note the U.S. rig count actually increased by +16 last week. While the majority of those rigs (+9) were deployed to focus on oil production in the Permian, note that oil rigs also produce significant volumes of associated natural gas. As energy investors know all too well, we live in a new “era of energy abundance” and all one has to do to remember that fact is to look at the first graphic in this article to remind themselves that the domestic natural gas market was over-supplied for many years, pushing the price down to very low levels – under $3 for long periods of time. That being the case, were there to be a significant slowdown in LNG export volumes, that would be reflected back into an over-supply of domestic gas – and lower prices.

Summary & Conclusions

While most of the big natural gas producers in the US have already had big run-ups in their stock prices, they arguably still trade at relatively low valuation levels. Also, note that many of the companies in the FCG ETF also produce significant quantities of high-priced oil – Occidental Petroleum (OXY), COP, and EOG Resources – just to name a few. That being the case, the FCG ETF is really an allocation to both oil & gas production and prices, and is very well diversified. While the fund has a relatively high 0.60% expense fee, those investors who want to participate in the sector, but either don’t have expertise or don’t want to spend the time evaluating individual securities, this ETF is one way to get well-diversified exposure to the natural gas sector. FCG is a BUY.

I’ll end with a 10-year chart and point out that during the shale-induced new “era of energy abundance”, this fund has been a miserable performer during the biggest bull-market of our lives. However, as I also pointed out earlier, the current forward strip is very bullish for the companies in the FCG portfolio.

Be the first to comment