NanoStockk/iStock via Getty Images

Investment Thesis

UiPath (NYSE:PATH) is an automation software vendor that helps companies efficiently automate their repetitive business processes.

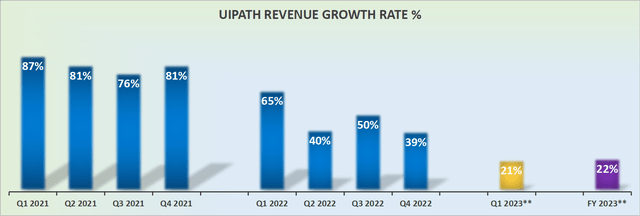

The company put out fiscal 2023 guidance that is nothing short of shocking. The guidance has taken the market by surprise. This high-growth name is now guiding to grow its top-line this year by just over 20% y/y.

We can football this around any way we want, but this is not a high growth CAGR.

I make the case that this now breaks the bull thesis. Here’s why:

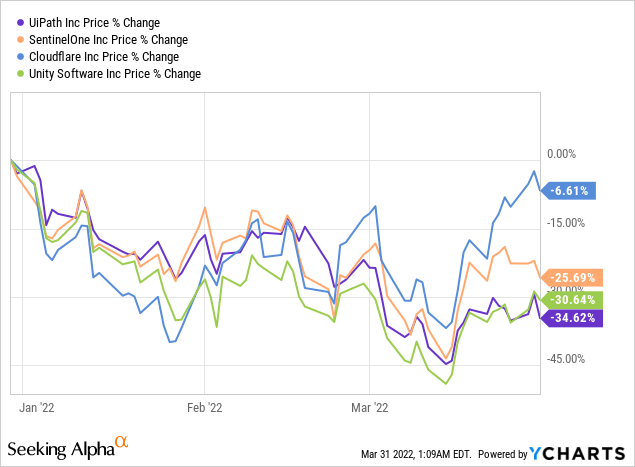

Investor Sentiment Facing High Growth Stocks

Everyone had been clamoring that we had hit the bottom of this bear market sell-off. The thesis was very simple. Buy the dip. Always, whatever you do, buy the dip.

Meanwhile, I was worried that the world is more interconnected than many presuppose. Every high-growth company, was high growth because globalization allowed them to rapidly grow.

It doesn’t take a genius to figure that out. At the same time, it doesn’t take a genius to figure out that Europe on the verge of going into recession is going to have a knock-on effect on the US.

However, the market had been only too keen to shake that off. That had been until these results came out. And that’s what we are going to discuss next.

Revenue Growth Rates Stall

UiPath revenue growth rates

With a graph like the one above, there’s no amount of spin that’s going to save this investment.

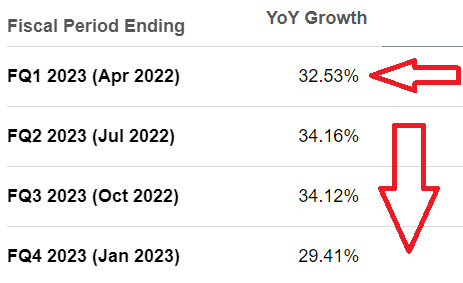

UiPath revenue consensus estimates

You can clearly see a huge discrepancy between what Q1 was expected to come out at and what management is now guiding for.

The Street was expecting to see Q1 2023 be guided for around 33%, and its Q1 guidance is actually around 21%, more than 1000 basis points difference.

What Happened to UiPath?

This is what UiPath’s co-founder and CEO said during the call:

We have a meaningful business in Europe that has been growing well over the last several years. This includes both employees and customers in Ukraine and in Russia, where we have paused business. I can tell you firsthand, this war is having a profound impact on the sense of physical and economic security across the continent and in the UK.

Investors were paying a high premium for this company on the assumption that UiPath had a very strong moat. That it was a secular growth stock that was disrupting the world. But it turns out that UiPath is more prone to macro sensitivities than many realized, myself included.

Profitability Profile Meaningfully Compresses

When it comes to UiPath’s profit margins, there’s good news and bad news. The good news is that UiPath’s non-GAAP operating margins expanded by 300 basis points y/y, from 14% last year to 17% in Q4 2022.

The bad news is that for the year ahead, UiPath’s operating margins are expected to end fiscal 2023 at close to breakeven.

This is very surprising and astonishing that profit margins are going to so meaningfully retrace their solid progress this year.

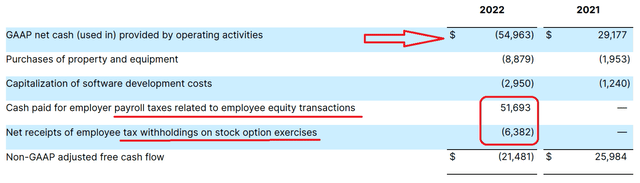

Meanwhile, UiPath notes that its free cash flow is expected to end fiscal 2023 in positive territory. On the surface, that’s great news.

However, now consider what UiPath adds back to make up its free cash flows:

UiPath Q4 2021 results

As you can see above, a meaningful portion of the free cash flow are taxes on management’s stock options. These takes are added back to its free cash flow.

I follow many companies, and this is the first time that I recall taxes on management’s options being added back to a company’s free cash flow profile.

PATH Stock Valuation – Time for Honesty, This Needs a Haircut

After the sell-off after hours, the stock is priced at 13x forward sales. I fail to see how this now affords investors enough margin of safety.

And I’ve been investing long enough to know that when you look at tech stocks, the last thing you mention is a margin of safety! I get that.

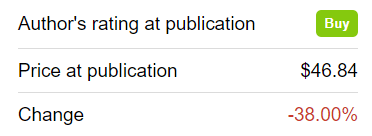

But I also have to be honest enough and say that I was bullish on this stock back in December.

Author coverage of UiPath

And if I had thought a little more about a margin of safety at the time, I would not be staring at a stock that’s down 50% in 4 months.

The problem here is that investors were paying up a fair multiple on the assumption that this was a high-growth stock. They were willing to disregard the questionable path to ”actual” profitability on the basis that this was a high growth name.

But now it’s not a high growth name and it’s not going to be profitable either after management’s compensation package.

The Bottom Line

I love investing. Why? Because it’s one of those places that forces you to change your mind. You have these really strong convictions over something, but when the facts on the ground change, you have to change.

Well, allow me to rephrase. You don’t have to change. In fact, most people look at different facts and build a new narrative that is congruent with their previously held point of view. At all costs, change the narrative, rather than change the hypothesis.

But if you want to do well in the market, you’re going to have to become accustomed to changing your mind when the facts change. And sooner is better than later. That’s exactly why I’ve been pivoting away from this space and deploying my capital elsewhere. Whatever you decide, good luck and happy investing.

Be the first to comment