Adrian Vidal/iStock via Getty Images

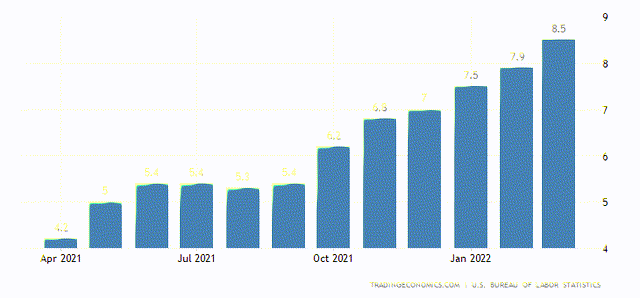

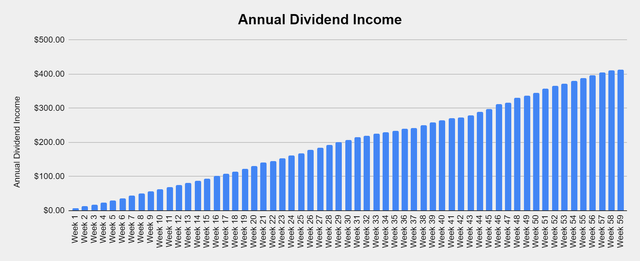

Inflation continues to run rampant as the newest print placed inflation at its highest level since 1981 as the March numbers came in at 8.5%. Over the past year, inflation has doubled, and uncertainty is still circling the markets. The war in Ukraine has no end in sight; we’re living in a rising rate environment; the FED is pegged to raise rates by 50 bps (0.50%) with a possible plan of reducing the balance sheet by $95 billion per month. Permabears continue to circle the declining markets, indicating that a recession is inevitable, while bulls stay the course and buy into weakness. Through all of the external events, I continue to allocate $100 per week to the Dividend Harvesting portfolio, and after 59 weeks, I am in the black by $349.26 (5.59%), and I am generating $412.47 in annual dividends, which is a portfolio yield of 6.6%.

You may notice that the annual dividends didn’t change much as in week 58, I was generating $411.24, and after my allocations for week 59, I am generating $412.47. AT&T (T) finally spun off its WarnerMedia business segment, and the dividend was lowered to $1.11 from $2.08 per share. I wrote a dedicated article on the aftermath of T, which can be read here if you are interested in dedicated analysis. The dividend income that my 10.57 shares of T produced declined by $10.25 due to the new dividend payout. My week 59 purchases offset this, but the normal $4-$7 of weekly dividend growth didn’t occur in week 59 due to this event. I needed to decide what to do with the Warner Bros. Discovery (WBD) shares that were acquired through the merger/spinoff from my investment in T. I received 2 WBD shares in the Dividend Harvesting Portfolio while the fractional share was sold off in the open market. I plan on holding the 2 WBD shares until they reach $50 or $60; then, I will sell them and reinvest the capital into dividend-producing investments.

I can’t believe it’s been 59 weeks of documenting this series. In week 59, the Dividend Harvesting portfolio grew by 2 positions as I added the InfraCap MLP ETF (AMZA) and received the 2 shares of WBD. The track record is looking great as I have closed in the black 98.31% (58/59) of the weeks throughout this process. I follow the 5% – 20% rule where I don’t allow a single position to exceed 5% or a sector to exceed a 20% allocation in the Dividend Harvesting portfolio. This allows me to be diversified and mitigate my downside risk from market selloffs and sector rotations. I am pleased with the Dividend Harvesting portfolio’s performance and feel that its foundational goals are being accomplished. It’s not about the amount of capital invested, as that’s subjective to an individual, but rather creating an investment plan and sticking to it while having positive results.

This series has never been about hitting a target yield, generating a certain amount of profit, or beating the market. I had two specific goals with this series. The first was to create a blueprint for constructing a dividend portfolio by documenting the journey starting from the beginning. The second goal was to illustrate how allocating capital each week toward investing, regardless of the amount, would be beneficial in the long run. Too many people are under the illusion that you need tens of thousands or even hundreds of thousands to benefit from investing. Instead of using my real dividend portfolio as an example, I decided to start a new account, fund it with $100, and add $100 weekly, providing a step-by-step guide to dividend investing. This methodology doesn’t have to be used for dividend investing, and it could be as simple as an S&P index fund or a Total Market fund. Hopefully, this series is inspiring people to invest in their future to attain financial freedom.

The Dividend Harvesting Portfolio Dividend Section

Over the previous 4 weeks (weeks 55-58) my average annual dividend added in any given week was $8 or 2.04%. In week 59, the reduction in T’s dividend caused a brief pause in the momentum. I offset the $10.25 decline by adding $11.67 in dividend income from week 59’s purchases. This canceled the reduction and provided $1.23 (0.30%) in weekly dividend growth. After 59 weeks, the annual dividend income from the Dividend Harvesting portfolio has breached the $400 level and is now generating $412.47. This chart represents exponential dividend growth as the snowball effect is still in its infancy. By making weekly investments in income-producing investments and reinvesting the dividend income, the annual income continues to grow at a rapid pace. Originally, the first week’s allocation of $100 allowed me to generate $7.44 in annual dividend income. Since the start of week 2, I have added 60 positions which have grown my annual dividend income by $405.03 (5,444%). By making these investments, I have created my own source of additional cash flow, which is the real premise of this portfolio.

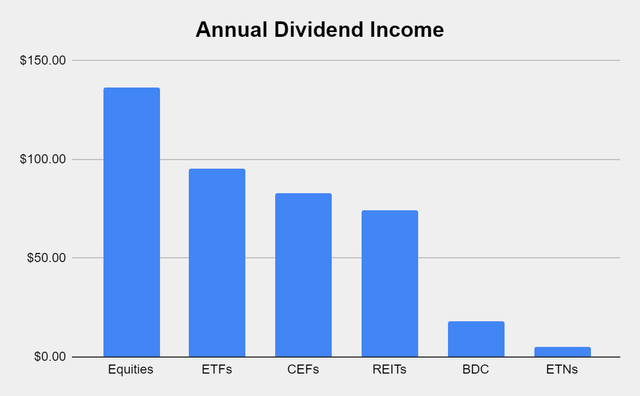

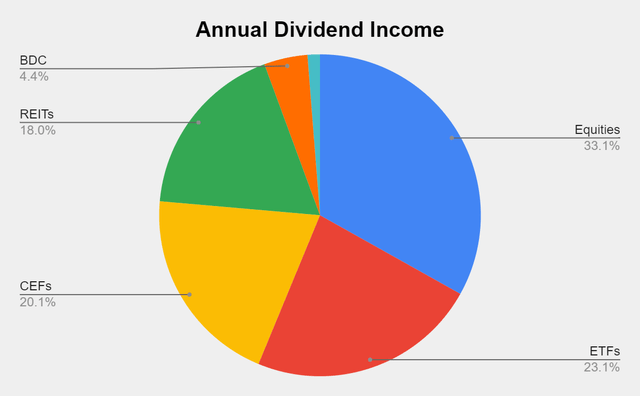

Here’s how much dividend income is generated per investment basket:

- Equities $136.61 (33.12%)

- ETFs $95.38 (23.12%)

- CEFs $83.08 (20.14%)

- REITs $74.21 (17.99%)

- BDC $18.04 (4.37%)

- ETNs $5.15 (1.25%)

Steven Fiorillo Steven Fiorillo

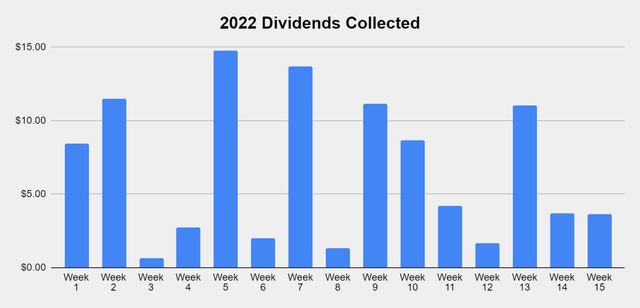

Collecting dividends can serve many functions in a portfolio. Some investors utilize dividends to supplement their income and live off. I am building a dividend portfolio for myself 30 years into the future. Since I am reinvesting every dividend, they serve multiple purposes today. In 2022 alone, I have collected $99.16 in dividend income from 137 dividends across 15 weeks. This has allowed the Dividend Harvesting portfolio to stay in the black while growing the snowball effect. In down markets, these dividends allow me to gain additional equity in my investments while increasing my future cash flow. This style of investing isn’t for everyone, but if you’re looking to generate consistent cash flow while mitigating downside risk, this method has worked for me. I am hoping to collect between $450-$500 in dividends in 2022, which will be reinvested, and finish the year generating >$700 in annual dividends.

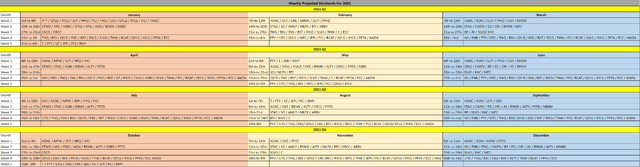

We have some movement as I added AMZA in week 59, adding 12 additional dividends throughout the year. The Dividend Harvesting portfolio is now generating 488 individual dividends throughout the year, with 43 dividends being generated in the months of June, September, and March. We’re approaching 500 dividends, and with reader suggestions in week 60, I have a feeling we’re going to breach that level. The dividend train is getting longer and longer.

The goal of generating enough income from the dividends to purchase an additional share per year has been the never-ending project of this portfolio. There are now 3 positions that are now generating at least 1 share annually through their dividends which include the PIMCO Corporate & Income Opportunity Fund (PTY), Broadmark Realty Capital (BRMK), and the Global X NASDAQ 100 Covered Call ETF (QYLD). I am trying to get more of the current positions over the finish line. Eventually, more positions will generate one share per year in dividend income.

The Dividend Harvesting Portfolio Composition

ETFs remain the largest segment of the Dividend Harvesting portfolio. Individual equities make up 48.86% of the portfolio and generate 35.36% of the dividend income, while ETFs, CEFs, REITs, BDCs, and ETNs represent 51.14% of the portfolio and generate 64.64% of the dividend income. I have a 20% maximum sector weight, so when a singular sector gets close to that level, I make sure capital is allocated away from that area to balance things out. In 2022, I will make an effort to even out these portfolio percentages. As more capital is deployed, the bottom half of the portfolio weighting will increase.

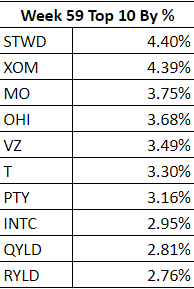

Starwood Property Trust (STWD) and Exxon Mobil (XOM) keep playing tag as they go back and forth between the top spots. Sticking with my 5% rule, I am not in any danger of exceeding this level.

Steven Fiorillo

Week 59 Additions

In week 59, I added 1 share to each of the following positions:

- InfraCap MLP ETF

- Virtus InfraCap U.S. Preferred Stock ETF (PFFA)

- BlackRock Science and Technology Trust (BST)

- PIMCO Dynamic Income Fund (PDI)

- PIMCO Corporate & Income Opportunity Fund

I recently wrote a dedicated article on AMZA, which can be read here. I love the MLP sector, and AMZA is an interesting fund from InfraCap. They are utilizing a call overlay strategy where they are selling covered calls on a small percentage of their positions in addition to cash-backed puts to generate additional income. AMZA is almost yielding 9%, and I think this fund will be a winner in the years to come.

The PIMCO funds (PTY, PDI) have gotten crushed over the past several months, but they have a good long-term track record. Both PDI and PTY sharply bounced off their lows and then sold off again. I am making the decision to stick with these funds even though their declining. I have continued to dollar cost average into these positions, so I am actually not doing that bad on them between that and the dividends. I listened to PIMCO’s outlook on bonds with their CIO Dan Ivascyn and did some additional research. I think in the long run, these funds will be fine.

PFFA is another fund from InfraCap that focuses on preferred shares. I have been adding to this position as I have limited exposure to preferred and haven’t taken the time to analyze them on an individual basis. I like the way this fund is managed and decided to add another share to increase the income generated from preferred shares.

There isn’t much to say about BST. The current market price is $39.78, which is a -5.91% discount from its NAV of $42.28. I am down on BST, and with it trading at a discount and generating a 7.54% yield, I added another share to cost average into the position.

Week 60 Game Plan – Reader Suggestions

In week 60, I will allocate the $100 in capital to positions suggested by the readers. There have been many great suggestions so far so, please keep them coming. Lazard Global Total Return & Income Fund (LGI) is at the top of the list, and I am also considering New York Community Bancorp (NYCB).

Conclusion

Thank you to everyone who continues to read this series. Creating a passive income fund isn’t an investment approach that everyone believes in, but it’s one of my investment cornerstones. I have a comprehensive investment approach where I invest in growth companies, value companies, and dividend companies/funds. I also utilize an indexing approach with funds for my retirement accounts. Income generation is just one aspect that I focus on when planning for the future. The passive income I’m generating will act as additional income in retirement. I look at this as a Barbell approach because I utilize several aspects of investing in my overall approach.

Be the first to comment