AnthonyRosenberg/iStock Unreleased via Getty Images

Investment Thesis

Nordstrom (NYSE:JWN) released unexpectedly negative guidance in its last quarterly earnings. The company reported a slowdown in sales, especially among lower income consumers. But the company’s higher priced segments are still showing strength. I think there could be some value here. The business is deleveraging and set to return more cash to shareholders.

A Declining Outlook

Nordstrom is coming off of a poor second quarter. The company beat expectations on its top and bottom lines. But the real problem was a major guidance cut.

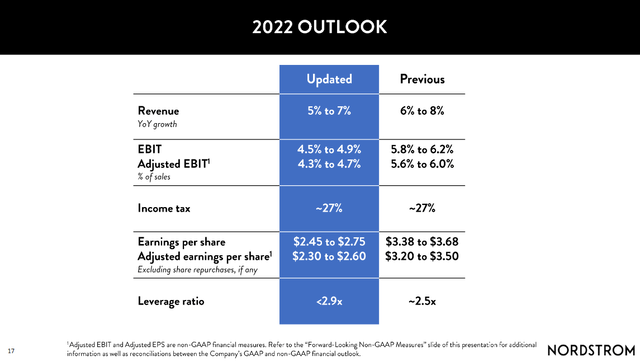

Nordstrom Q2 2022 Earnings Presentation

The company reduced its revenue growth guidance by one percentage point. But the most painful headwind was management’s margin guidance. Adjusted EPS guidance was slashed from a midpoint of $3.35 to just $2.45. Leverage guidance increased from 2.5 times to 2.9 times.

Management attributed these headwinds to a falloff in demand at the end of June. The company’s lower priced segments were hit the hardest. Because of these issues, the company is pivoting its strategy and cutting inventory levels.

A Rift Between Banners

There is a clear difference between the company’s segments. The Nordstrom banner targets higher income consumers. Management still expects this segment to report high single digit sales growth. But the off price Nordstrom Rack division is feeling the negative effects of this slowdown. The banner reported a 900 basis point decline in sales during the last month of Q2 alone. Management attributes this to a slowdown in customers with the lowest income profiles.

Some evidence of this dynamic is the company’s performance between price segments. The business reported that sell through on higher priced items was still strong. Management announced that these more expensive categories significantly outperformed cheaper ones. In the designer business, luxury products outperformed. The brand’s customers valued fashion and newness over lower price points.

This is where I see the opportunity in Nordstrom. Like a lot of other retail stocks, the company is being priced for a severe sales pullback. But the Nordstrom banner targets higher income consumers. This should make the company’s earnings more resilient.

Nordstrom Q2 2022 Earnings Presentation

Nordstrom Rack is where the brand is the weakest. The segment is more exposed to lower income consumers who are pulling back on spending. But I still think that the segment has a chance to perform better than expectations.

The main focus of Nordstrom Rack is premium brand products at discounted prices. But over the past two years, it began stocking inexpensive products from less known brands. This was partially to offset supply chain issues with premium brands. But the company is now backtracking. On their last earnings call, management announced that they’re moving back to their initial strategy.

As we’ve said before, 90% of the top brands at Nordstrom are sold at Nordstrom Rack. Premium brands are a differentiator for the Rack and we are focusing on having the best brands at the best prices at each of our locations. This quarter, sales of our top 100 brands at the Rack increased 17%, which underscores the opportunity from increasing our supply of premium brands. In addition to improving penetration of premium brands, we are shifting away from the lower price point items that have not resonated with Rack customers. As Pete will describe later, we are taking aggressive action to clear through this inventory in the second half of the year. We believe that increasing the penetration of top brands at the Rack will differentiate our offer and fuel our growth.

I think that this is the right move. In the short term, it will likely put pressure on the segment’s gross margins. But it may put the company in a better position to navigate an economic pullback. Nordstrom Rack may even benefit from consumers trading down from other department stores.

Overall, Nordstrom’s performance is a mixed bag. I think that the company’s premium brands will continue to outperform. But the discount portion of the business is the primary risk of this investment. Even so, I think that the outlook isn’t as dire as the market is pricing in.

Leverage, Inventory, and Shareholder Returns

Nordstrom is trading at a forward P/E of 7.3 times and a forward EV/EBITDA of 5.6 times. I think that this type of valuation is pricing in further downside in earnings. The fundamentals are sound enough that I think this is a cheap valuation.

Inventory levels are only slightly elevated. The company reported 85 days of inventory during its last report. This is only 15% higher than its five year prepandemic average. I think this is manageable, even if old inventory may cause gross margin headwinds in the upcoming quarters.

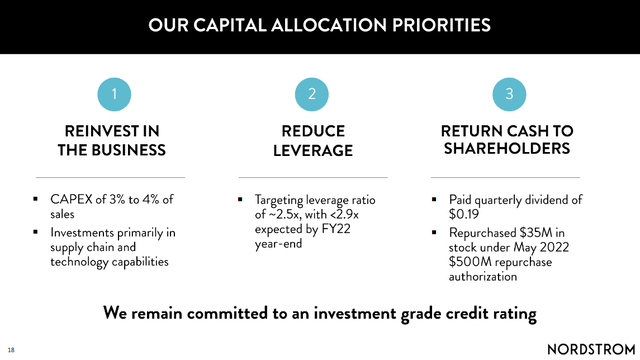

Nordstrom Q2 2022 Earnings Presentation

Nordstrom’s leverage is high but manageable. The business has over $2.8 billion in long term debt. Most of this debt is low interest and not due until at least 2025. The company is on track to hit its leverage target of 2.5 times by the second quarter of next year.

These leverage ratios are low enough for Nordstrom to return cash to shareholders. The business has continued paying its dividend and restarted its share repurchase plan. The company bought back $41 million in shares in the past quarter. This is in addition to its forward dividend yield of 4.2%. At the current run rate, these returns are well covered by Nordstrom’s free cash flow. During the first half, the business generated an 11% free cash flow yield. While this will likely decline in the near term, I think it shows clear potential as the economy recovers.

Final Verdict

Nordstrom’s stock isn’t the first thing I would buy during a severe downturn, but I do think there is upside here. There is a decent amount of risk in the current economic environment. Nordstrom Rack’s results are my major concern.

But I think that the market is discounting Nordstrom’s stock too much. I believe that the risk to reward is slightly favorable at the current valuation. I’d recommend watching this stock if you’re bullish on the continued strength of higher income consumers. I think that this could be a good speculative opportunity.

Be the first to comment