VioletaStoimenova

Problem

Prior to sales and marketing technologies like CRM systems, sales representatives gathered data through in-person meetings and stored this information in their rolodexes. This process was manual, expensive, and inefficient. The data gathered was limited in depth, breadth, and accuracy, and began decaying as soon as it was captured. When sales representatives departed for another organization, they took their rolodexes with them. To address these problems, businesses invested in CRM systems to digitize rolodexes and easily share customer data throughout an organization. However, because the data that supports CRM and sales automation systems were largely collected manually, 30% to 50% of data in customers’ CRM and ERP systems would be incorrect at any given time. Today, sales reps only spend 1/3 of their time actually selling, the rest focused on activities such as researching and organizing leads. Companies that have implemented some B2B intelligence practices and technology, even at limited levels of maturity, have realized 35% more leads and 45% higher-quality leads, leading to higher revenue and faster growth. However, market adoption is still very early, with only 1.2% of companies having mature B2B intelligence practices and technology. A large part of this is due to legacy solutions like D&B Hoovers having weak data quality that is largely still gathered manually.

Solution

ZoomInfo (NASDAQ:ZI) at its core is a B2B contact database. It was able to leapfrog incumbents due to a better data collection methodology by crowdsourcing go-to-market intelligence from an ever-growing customer base. ZoomInfo’s database covers over 220M business professionals across over 100M companies. As of August 2019, only 8% of sales and marketing professionals said that their sales and marketing data is sufficiently accurate (greater than 90% accuracy). ZoomInfo offers a contractual guarantee that at least 95% of the employment information they access will be current. In some cases, ROI can exceed 100 times the annual spend on the ZoomInfo platform.

ZoomInfo gets its data from three main sources: users can log in and update their ZoomInfo profile (<10% of data), ZoomInfo has algorithms that scrape the web (<40% of data), and finally, ZoomInfo has a proprietary Contributory Network where users get 10 contact credits for free a month in exchange for installing an email plug-in that reads the signature block of every person that they correspond with. This data is also reviewed by a team of 50 data scientists for accuracy. This contributory network is why ZoomInfo has the best quality data and why they are ranked as a leader by Forrester, with 80-90% of data being proprietary.

ZoomInfo Analyst Day Presentation

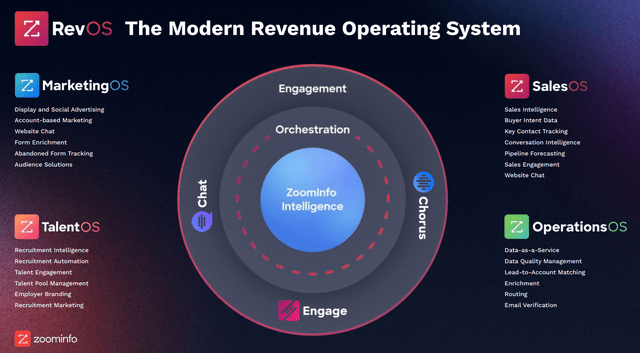

ZoomInfo has built several modules on top of its core data asset to form RevOS, as it moves beyond just a contact database to become a fully-featured go-to-market intelligence platform. SalesOS includes use cases such as intent data which informs sales reps when a company is actively researching their services, org charts which enable sales reps to reach the right people, and recent acquisitions like Chorus for conversation intelligence. MarketingOS allows marketers to build precise audiences for ad targeting, OperationsOS allows companies to use ZoomInfo’s data alongside other data in data warehouses or CRM systems for analytics purposes, and TalentOS allows recruiters to source the right candidates.

Competition and Moat

When ZoomInfo was an independent company, its main competitors were RainKing and DiscoverOrg. DiscoverOrg acquired RainKing in August 2017 and merged with ZoomInfo in February 2019, naming the combined company ZoomInfo under Henry, who was DiscoverOrg’s CEO. Although DiscoverOrg had better data, they could not compete with ZoomInfo’s volume of data and were discounting prices to compete pre-merger. Today, the combined company has no real competition and raised prices by 15% before its IPO which did not have a big impact on churn. In fact, 40% of customers who churn return within one year, and 80% of enterprises who churn return within one year.

Their main competitors besides D&B Hoovers are smaller players like Infogroup, InsideView, Databook, Clearbit, Apollo, etc. The closest peer might be InsideView and some of them like Apollo are even said to have more data than ZoomInfo but none can match ZoomInfo’s quality of data because they lack the contributory network and scale. LinkedIn Sales Navigator is another competitor but it is a closed platform so they don’t have people’s emails and phone numbers, rather relying on InMail. As people go back to the office and use their office phones more, ZoomInfo will be even more important. Organizations usually see LinkedIn and ZoomInfo as complementary because sales reps would find their target on LinkedIn and get their contact info on ZoomInfo. It is very unlikely that LinkedIn would sell user data both because of regulatory concerns against Microsoft (MSFT) and the potential for user backlash. Salesforce (CRM) also attempted to enter the sector with the acquisition of Jigsaw in 2010 which turned into Data.com but was ultimately shut down in 2020. ZoomInfo is the most expensive solution, but they have the power to be. There is a network effect with ZoomInfo’s Contributory Network. Because ZoomInfo has the largest customer base by far at over 30k clients, they can get the best database that everyone wants to access, leading to more free users and better data, leading to even more users. 60% of their paid clients also participate to improve data accuracy. Because contact data changes all the time, ZoomInfo also benefits from their scale and the labor that they’re able to employ (data scientists) and amortize over an increasingly large revenue base.

Financials

ZoomInfo has very strong and accelerating revenue and customer growth. For 2022, they are forecasting 45% growth at a $1.09B run rate with 41% adjusted FCF margins. They have 80%+ gross margins and a best-in-class payback period of under 10 months with LTV/CAC over 10x. The number of customers with ACV greater than $100k grew 8.6% QoQ in Q2’22. Their client list includes innovative companies such as Snowflake (SNOW), Okta (OKTA), Zoom (ZM), DocuSign (DOCU), Shopify (SHOP), and Uber (UBER). International revenue grew 80% YoY to an annualized run-rate of $100M or just over 12% of their total revenue. On TAM, they currently have 30k customers, and the CEO sees white space of 700k businesses.

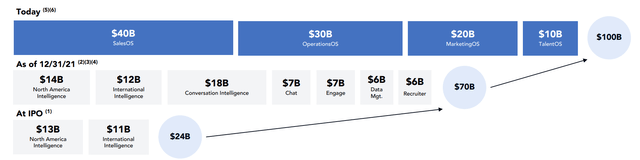

ZoomInfo is also constantly adding new modules to build an application layer around their core, differentiated data asset. This has grown their TAM from $24B at the time of IPO to over $100B today.

ZoomInfo Investor Presentation

So far, they’ve executed well in terms of cross-selling with over 75% of customers now using advanced functionality (ancillary products like Chorus, Engage, Intent, etc.), representing 29% of ACV and growing over 100% YoY. Chorus, a leader in conversation intelligence, has grown 3x since ZoomInfo’s 2021 acquisition and Engage, MarketingOS, and TalentOS added the most ACV ever in a quarter in Q2. Net Retention Rate was ~108% in ’20 which improved to 116% in recent quarters as they cross-sell more modules, an impressive number given their primarily SMB client base. Gross Retention Rate was also over 90% in 2021.

ZoomInfo updated their long-term target to achieve at least a $2B revenue run-rate by Q4’24, implying a 31% CAGR. Although ZoomInfo is seeing elongated sales cycles due to the current macro environment, they note that deals are still closing and they are benefitting from customers choosing to consolidate multiple sales intelligence and automation vendors. ZoomInfo recently reported a strong Q2, growing revenue at 54% YoY with a 40% FCF margin, making them a Rule of 90 company. ZoomInfo’s outperformance despite macro turbulence proves their value-add, with clients able to set it up within days.

Although ZoomInfo is certainly not cheap at 37x EV/NTM FCF, it deserves a premium multiple due to its combination of hypergrowth and profitability, its dominant market position and increasing returns to scale, and its long runway. Assuming ZoomInfo meets its 2025 revenue target, earns 45% FCF margins and trades at 35x FCF, that implies a 20% 3-year IRR. ZoomInfo has $1.2B of long-term debt but should have no issues meeting its interest payments given the amount of cash it generates.

Risks

ZoomInfo has two main risks: regulatory changes in how data is collected and potential competition from LinkedIn.

In terms of regulations, GDPR and CCPA have not been expanded to include B2B data yet. However, recently ZoomInfo has been proactively informing users that their data is being collected and allowing them to opt out. Furthermore, they have now reached a scale where their contributory network is no longer necessary to maintain their lead, given no one else is doing it without the same size user base and they can afford to compete on a scale better than almost everyone else.

The only competitor that might be better positioned is LinkedIn because this data already exists there. However, they are entrusted not to re-sell that data, and it would be a violation of user agreements whereas people are willingly installing the ZoomInfo plug-in in order to access its data. Microsoft may also attempt to potentially block ZoomInfo’s email plug-in from Outlook. However, although such a move would reduce the accuracy of ZoomInfo’s database, again, scale matters due to how often data becomes stale and ZoomInfo would likely maintain its leadership position.

Conclusion

Despite a seemingly mundane product, ZoomInfo has a huge opportunity to change the way businesses sell to each other. They are positioned to capture the most share within this large industry due to their data collection flywheel and scale. The valuation is still aggressive but not unreasonable considering their tremendous business momentum and profitability. Although switching costs are low, they are being built up with more integrations and as the platform improves, there will be very little reason to switch because they will be significantly ahead of the competition.

Be the first to comment