Mongkol Onnuan

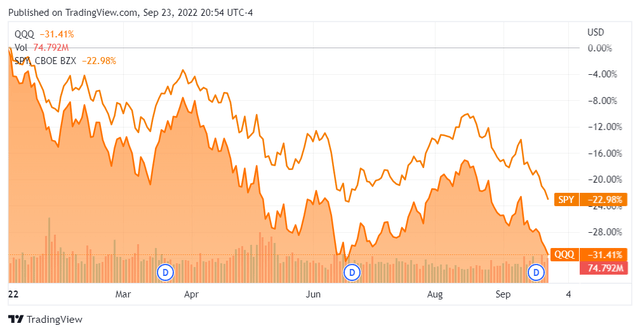

This time last year, the markets were running hot and made new highs during the fall. 2022 has been the exact opposite as the S&P 500 and the Nasdaq have been living in bear market territory. The Nasdaq has now declined by -31.36% YTD, falling from 15,832.80 to 10,867.93. This hasn’t been a lucrative investment environment, and since I can’t time the markets, I don’t play the game of selling and then picking an entry point to get back in. It’s not just technology that’s underperforming; the S&P 500 has fallen -23% YTD as well. Unless you moved to cash or invested heavily in energy, there haven’t been many places to hide. This market environment hasn’t been lucrative for one of my favorite income ETFs, the Global X Nasdaq 100 Covered Call ETF (NASDAQ:QYLD).

QYLD has followed the Nasdaq deep into a sea of red, and the only aspect keeping many investors interested is the large yield. QYLD has proven that its yield, which has reached 16.28% for the TTM, isn’t a gimmick, but a large amount of income hasn’t been enough to keep investors above water throughout the bear market of 2022. While I am not thrilled about being in the red, I am happy with the income QYLD is generating and continue to add to my position as QYLD follows the Nasdaq further into the red. I don’t have a 3-6 month view on QYLD, as I am looking at QYLD as a multi-decade investment where I will collect and reinvest each distribution.

An investment in QYLD is all about the income

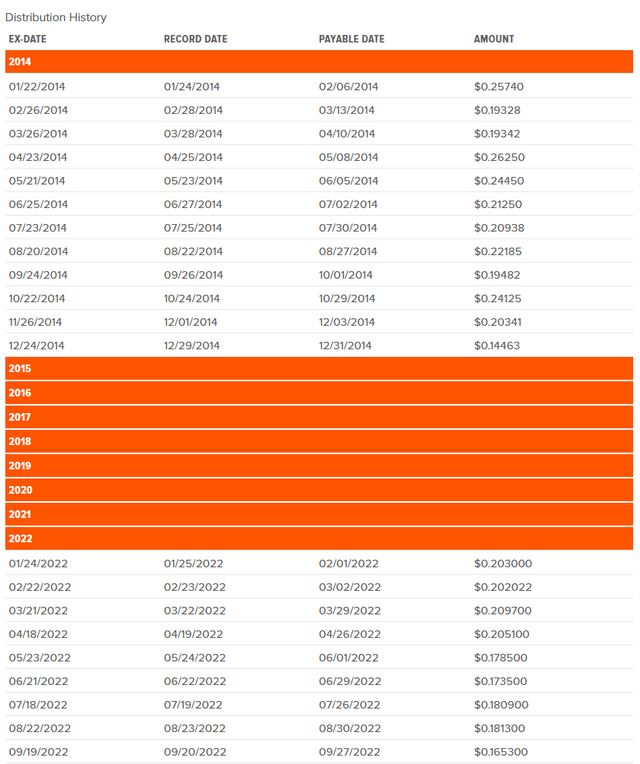

QYLD was started in late 2013 and paid its first distribution on 2/6/14. Since its inception, QYLD has paid 104 consecutive monthly distributions. If you are looking for capital appreciation, don’t invest in QYLD, as this ETF isn’t structured to capitalize on appreciation. QYLD uses a buy-write strategy and covers 100% of its portfolio with covered-calls. Investors are sacrificing future appreciation for upfront income.

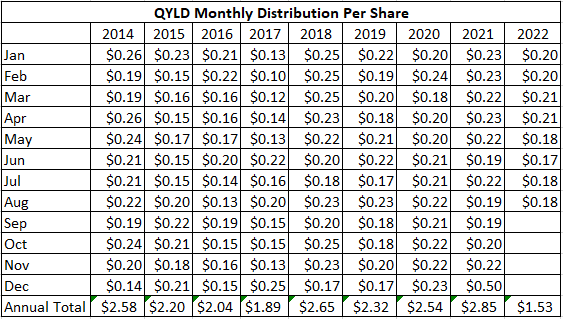

I went through each year and created a table to show the monthly distribution from each share of QYLD. QYLD went public at $25 per share at the end of 2013, and since then, it lost -36.30% (-$9.08) of its value as QYLD closed at $15.92 on 9/23. While the entire market is in disarray, the long-term capital depreciation doesn’t bode well for many investors. QYLD is an investment that is all about income over a period of time, and while its share price has declined significantly, that’s only part of the story.

Steven, Fiorillo, Global X

Since its inception, QYLD has paid $20.62 per share across 104 monthly distributions. Some investors are impatient and can’t envision holding an investment for a decade, but I consider investments like QYLD as multi-decade vehicles to generate income.

If you had allocated $2,500 toward QYLD when it went public and purchased 100 shares, your initial investment would be $1,592, assuming the distributions weren’t reinvested. You would have collected $2,062 in distributions since the beginning of 2014, which is 82.46% of your initial investment. While your initial capital has declined by -36.3%, it still represents 100 shares of an income-producing investment that has generated more than 4/5ths of your initial investment in distributed income. The combination of $1,592 for the value of the 100 shares and the $2,062 in collected income puts your investment value at $3,654. This is a 46.16% return on the initial $2,500 invested, and monthly distributions are still being generated.

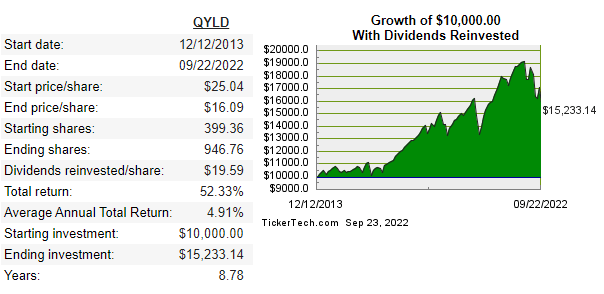

Based on the distribution yield, if you were to have reinvested the distributions since January 2014, you would have more than double the number of shares today. I found an investment calculator that indicates an investment of $10,000 on 12/12/13 at $25.04 per share would have purchased 399.36 shares, and today you would have 946.76 shares. I am not sure where it’s pulling the numbers from on the backend, as it’s indicating that each share would have generated $19.59 in distributions. I am taking this with a grain of salt as the Global X site clearly indicates that each share of QYLD has generated $20.62 in distributions. While I am not sure where the calculator is pulling the data from, it’s safe to say you would have more than double your initial shares over the time period from 12/12/13.

Dividend Channel

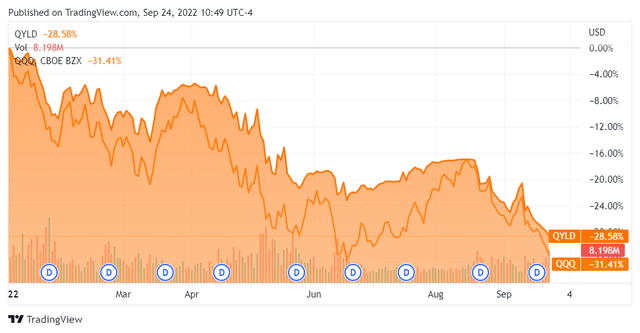

How QYLD is fairing compared to QQQ

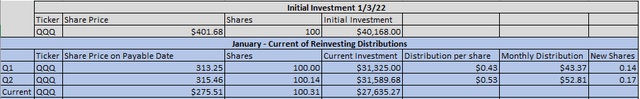

QYLD tracks the Nasdaq 100 index, which is tracked by the Invesco QQQ ETF (QQQ). If you had purchased 100 shares of QQQ on 1/3/22, it would have cost $40,168. It’s 2 small dividends would have generated $96.18 allowing you to purchase 0.31 shares. Your total share count of 100.31 would be worth $27,635.27 as shares fell -$126.17 (-31.41%) in 2022.

Steven, Fiorillo, Seeking Alpha

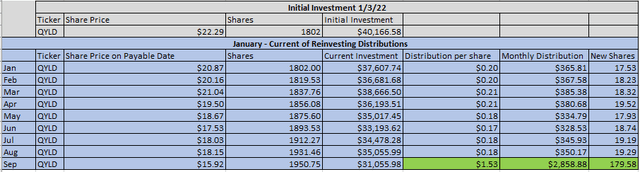

If you had invested the same $40,168 in QYLD, you would have been able to purchase 1,802 shares. QYLD would have generated $2,858.88 in distributions, increasing the share count by 148.75, from 1,802 to 1,950.75. While the investment in QQQ lost -$12,532.73, your share base of QYLD would be valued at $31,055.98 as the initial investment would have declined by -$9,110.60.

The major difference has been the distributions paid from QYLD. While both QYLD and QQQ have fallen into bear market territory, 100 shares of QQQ have paid $96.18 in dividends, while the equivalent investment of 1,802 shares of QYLD has generated $2,858.88 in distributions. This has helped soften the blow, as the initial investment of $40,166.58 in QYLD has declined by -22.68% instead of -31.41% from the investment in QQQ. Reinvesting the distributions from QYLD has increased the share count by 148.75, which has added an additional $389.73 in future annual distributions. This has also increased the annual forward projected income from QYLD to $5,110.97 based on the $2.62 distribution over the TTM.

Steven, Fiorillo, Global X, Seeking Alpha

There is no question that it’s been a tough investing environment, but QYLD has proven it’s not a gimmick fund. Investors can disagree with its premise, but it hasn’t performed worse than QQQ in 2022 from a value perspective. When the distributions are added in, QYLD has done a much better job of mitigating losses than QQQ due to the large amounts of income it generates from selling monthly call options against its portfolio. Regardless if the markets make a year-end rally or if it takes several years for them to bounce back, QYLD will continue to generate monthly income and make this an interesting investment going forward.

Why I am still bullish and buying more QYLD

As an income investor, I love the stream of income QYLD produces. Hypothetically, if my out-of-pocket cost is $19 per share, and in 10 years from now, QYLD only trades at $15 per share, I wouldn’t be disappointed. I am looking at QYLD as a vehicle that I can generate large amounts of income and reinvest the monthly distributions to grow my future cash flow. QYLD is part of my income-producing investments, and not a single dollar of my retirement money is tied to it. Over the next 20-30 years, I am trying to build a dividend portfolio that can pay for all of my annual expenses without having to depend on social security or any of the money I have saved for retirement.

If you had purchased 100 shares of QYLD at inception, it would only be worth $1,592 compared to the $2,500 you had allocated more than 8 years ago. While this is a significant loss, its generated $2,062 in distributions without factoring in reinvesting them. As an income investor, does the capital decline really matter? If you were to buy a business for $2,500, and it paid you $2,062 over 8 years, then you sold it for $1,592, would you be upset? I wouldn’t be, as it provided a stream of cash flow that was more than 4/5ths of the initial value, and I ended up selling the business for $1,592 on top of the $2,062 it had paid me. I am less concerned about QYLD’s share price, and if it fluctuates between $15-$20 for the next 5 years, I wouldn’t be upset. I believe that if I continue to add fresh capital on a monthly basis to QYLD and lower my cost basis while reinvesting the distributions, QYLD has the potential to become a huge stream of continuous income. As long as the combination of the present value of my shares and the distributions paid exceeds my initial investment, I will remain bullish on QYLD.

Be the first to comment