peshkov

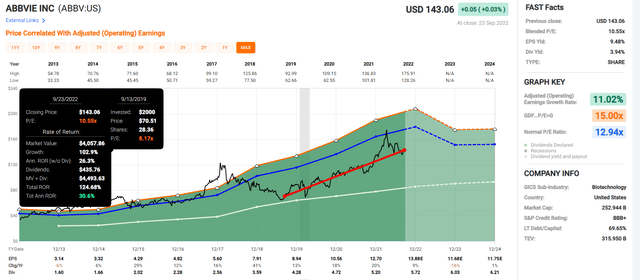

The intelligent investor is a realist who buys from pessimists and sells to optimists.” – Ben Graham, The Intelligent Investor

In times of crisis, the stock market adopts a “sell first, ask questions later” mentality that can reward long-term investors with life-changing blue-chip bargain-hunting opportunities.

Today I wanted to highlight one recent crisis that has exploded into the headlines and is creating incredible blue-chip dividend value for anyone who is willing to take a long-term view in today’s short-sighted market.

The UK Currency Crisis Could Prove A Long-Term Boon To High-Yield Investors

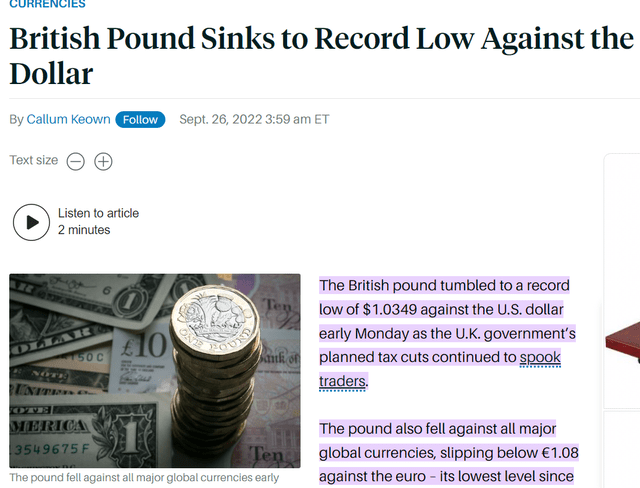

12 months ago, the USD/British Pound traded at $1.38. On Sunday night, it hit an all-time low of 1.0349, a 25% collapse in just one year.

Why is the Pound collapsing faster than many emerging market currencies?

Because of the largest tax cut package since 1972 that was unveiled on Friday, September 23rd, by the government of new Prime Minister Liz Truss.

This news sent the Pound down 3.6% on Friday alone, and over the weekend, the UK Chancellor of the Exchequer (the equivalent of the U.S. Treasury secretary) doubled down on these tax cuts.

- an estimated 400 billion pounds over 5 years

- the equivalent of a $4.1 trillion tax cut package in the U.S.

This is part of the growth plan Liz Truss is betting her career on to fight inflation, and the recession the Bank of England says will last six quarters.

- the package includes energy price caps of 2,500 pounds per household

- with no limits

- the UK government will make up the difference between what households pay and what it costs energy companies actually to deliver energy.

How likely is this proposal to pass?

Tories to rebel against Liz Truss if the pound falls below the dollar” – The Telegraph

The bond market is now pricing in a 25% chance of the Pound falling under $1 in the next six months, up from 1% just a few days ago. Some economists (like Harvard’s Larry Summers) think the Pound could fall well under $1; if that happens, it could create big problems for the UK.

- commodities like energy are priced in U.S. dollars (“USD”)

- the lower the Pound sinks the more inflation the UK will import

The Bank of England is already expecting peak inflation of 13.3% in October and other economists, like Citi and Goldman think it could rise to 18% to 22%.

The collapse of the Pound means that inflation might not just end up worse than expected (13% is already catastrophic) but remain higher for longer.

- the Bank of England was forecasting double-digit inflation for 12 months

- before the stimulus plan was announced.

The bond futures market was pricing a 1% hike by the BOE in November and now thinks the most likely outcome is a 1.25% hike. For context, the highest single rate hike in BOE history was 0.5%.

In fact, some economists think the BOE will do an emergency rate hike in the next few weeks to stem the Pound’s collapse. How likely is that to work? Most economists think it would cause the pound to go even lower.

- a sign of panic by the BOE

When Sweden hiked 1% last week to strengthen its currency, the Kroner fell against the dollar.

But while the collapse in the Pound is terrible for citizens of the UK, it creates potentially glorious blue-chip bargain-hunting opportunities for long-term investors.

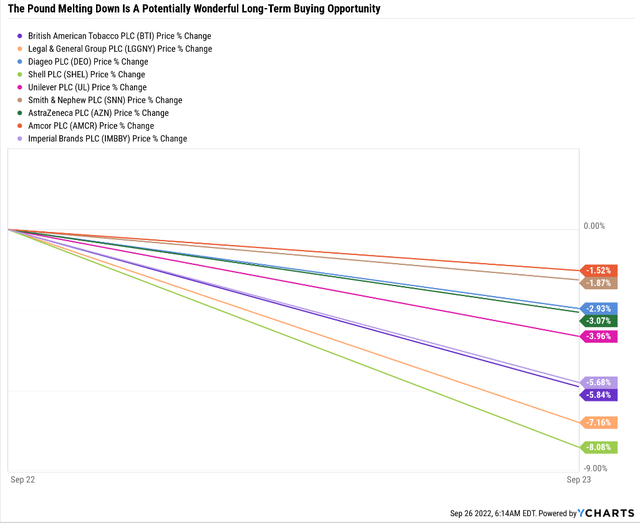

On Friday, the day the 400 billion pound stimulus package was introduced, UK blue-chips fell between 1.5% and 8%. Why?

- general risk-off sentiment in stocks (everything is falling)

- oil prices fell 6% at one point that day (thus Shel’s -8% day)

- dollar-denominated earnings and dividends are going to take a short-term hit from the Pound’s implosion.

How worried should investors be about falling dividends and earnings from UK companies? If you’re a short-term trader very worried; if you’re a long-term investor, not very worried.

Think of it like this. The Japanese Yen is down 25% this year. Japanese investors in JNJ, a dividend king, are seeing a 25% reduction in the dividend. But that doesn’t mean that JNJ’s dividend is any less safe or dependable long-term.

Over time (decades), currency tends to be mean reverting, and changes in currency cancel out.

10 Out Of 11 Master List UK Companies Now On Sale

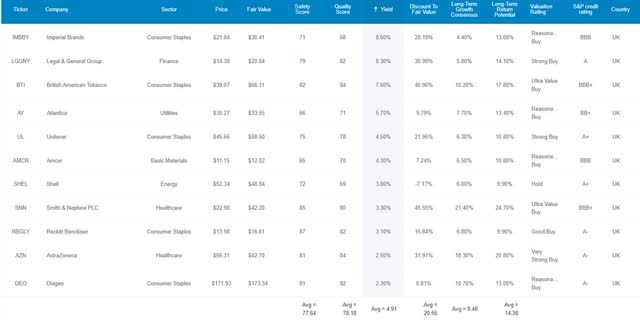

Dividend Kings Zen Research Terminal

Thanks to the bear market and now the panic in the Pound, UK companies are going on sale. In fact, 10 out of 11 Dividend Kings’ Master List UK companies are now reasonable to table-pounding great buys.

- 4.9% yield

- 14.4% CAGR consensus long-term return potential

- Vs. 10.3% CAGR S&P 500, 11.2% dividend aristocrats, and 12.9% Nasdaq

What about the fundamental impact of a terrible UK economy that this currency crisis might trigger?

The Bank of England expects the worst two-year inflation-adjusted income growth in history, worse than the Great Recession. The Bank of England forecasts a 6 quarter recession, with a peak decline worse than the Great Recession.

Couldn’t that cause UK companies to see a collapse in sales, earnings, cash flows, and dividends? Well, that depends on which company you’re looking at.

| UK Company | Ticker |

% Of Sales From The UK |

| Imperial Brands | (OTCQX:IMBBY) | 14% |

| Legal & General Group | (OTCPK:LGGNY) | 94% |

| British American Tobacco | (BTI) | 1% |

| Atlantica | (AY) | 0% |

| Unilever | (UL) | 5% |

| Amcor | (AMCR) | NA |

| Shell | (SHEL) | 8.4% |

| Smith & Nephew | (SNN) | 4.0% |

| Reckitt Benckiser | (OTCPK:RBGLY) | 6.0% |

| AstraZeneca | (AZN) | 9.0% |

| Diageo | (DEO) | 6.0% |

| Average | 14.7% | |

| Median | 6.0% |

(Source: FactSet Research Terminal)

These tend to be highly diversified global blue-chips with a median 6% of sales from the UK. Assuming a severe 10% reduction in sales from a terrible recession and the EPS impact should still be modest given the corporate tax cuts the UK is planning.

And keep in mind that many of these companies are consumer staples or healthcare and have recession-resistant business models (IMMBY, BTI, UL, SNN, RBGLY, AZN, and DEO).

In other words, the currency and economic crisis in England likely won’t significantly impact their actual fundamentals, and almost certainly not in the long-term.

And in the meantime, the market is selling them off with a kind of brutality that is irrational and could make you rich.

Let me show you why British American and Legal & General are my two favorite high-yield blue-chip bargains to buy to profit from the Pound panic.

British American Tobacco: One Of The Best Buffett-Style “Fat Pitches” On Wall Street

Further Reading

- 7% Yielding British American Tobacco Is The Perfect Bear Market Buy

- a deep dive look at BTI’s investment thesis, growth prospects, risk profile, valuation, and total return potential

British American gets just 1% of sales from the UK and is crushing it on its plans for a tobacco-free future.

For the last three years, BTI’s reduced-risk or RRP sales have been growing at 32% annually, while its RRP userbase has grown at 31% CAGR.

- RRPs now make up 14% of sales

- up from 5% in 2019 and 8% in 2020

- up to 72% of sales in Sweden

BTI’s RRP customers have been growing steadily.

- +2.5 million in 2019

- +3.0 million in 2020

- +4.8 million in 2021

They were 18.3 million at the end of 2021; by 2025, management plans to get that to 50 million.

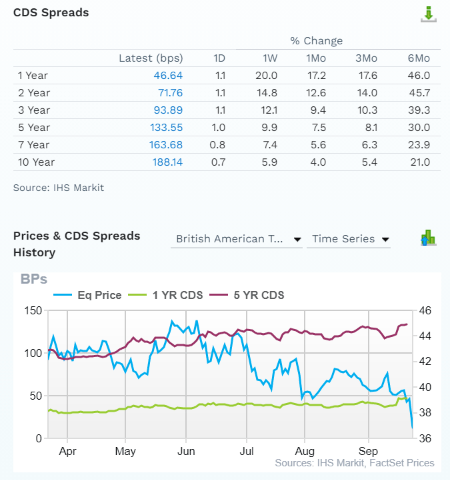

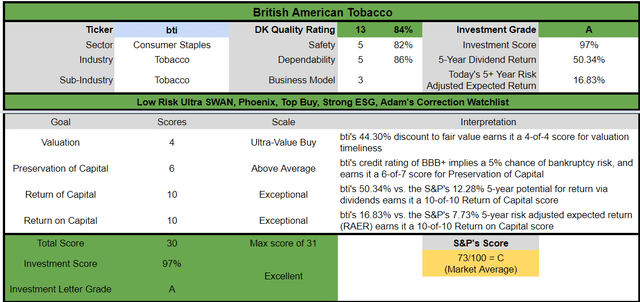

The Bond Market Isn’t Worried About BTI’s Price Crash, And Neither Am I

(Source: FactSet Research Terminal)

Credit default swaps are the insurance policies bond investors take out against default.

- it shows real-time fundamental risk assessment from the “smart money” on Wall Street

BTI’s price has fallen off a cliff, yet its fundamental risk has been far more stable.

- 0.4664% over the next year

- 0.7176% over the next 2 years

- 5.64% over the next 30 years

- BTI’s real-time fundamental risk is consistent with its BBB+ credit rating from S&P

If the bond market isn’t worried about the Pound panic, and neither are rating agencies or analysts, you can buy with confidence that this isn’t a value trap.

- 10.2% CAGR growth consensus from analysts is the highest in 20 years

- BTI is priced for -0.8% CAGR growth

Reason To Potentially Buy British American Tobacco Today

| Metric | British American Tobacco |

| Quality | 84% 13/13 Ultra SWAN (Sleep Well At Night) Global Aristocrat |

| Risk Rating | Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 164 |

| Quality Percentile | 68% |

| Dividend Growth Streak (Years) |

22 years (at least) |

| Dividend Yield | 8.0% |

| Dividend Safety Score | 82% Very Safe |

| Average Recession Dividend Cut Risk | 0.5% |

| Severe Recession Dividend Cut Risk | 1.95% |

| S&P Credit Rating |

BBB+ Negative Outlook |

| 30-Year Bankruptcy Risk | 5.0% |

| Consensus LT Risk-Management Industry Percentile | 72% Good |

| Fair Value | $66.05 |

| Current Price | $36.79 |

| Discount To Fair Value | 44% |

| DK Rating |

Potentially Ultra Value Buy |

| PE | 7.9 |

| Cash-Adjusted PE | 8.1 (Anti-Bubble Blue-Chip) |

| Growth Priced In | -0.8% |

| Historical PE Range | 13 to 14 |

| LT Growth Consensus/Management Guidance | 10.20% |

| PEG Ratio | 0.79 |

| 5-year consensus total return potential |

23% to 28% CAGR |

| Base Case 5-year consensus return potential |

22% CAGR (3.5X better than the S&P 500) |

| Consensus 12-month total return forecast | 43% |

| Fundamentally Justified 12-Month Return Potential | 88% |

| LT Consensus Total Return Potential | 18.2% |

| Inflation-Adjusted Consensus LT Return Potential | 16.0% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 4.40 |

| LT Risk-Adjusted Expected Return | 12.10% |

| LT Risk-And Inflation-Adjusted Return Potential | 9.88% |

| Conservative Years To Double | 7.29 |

(Source: Dividend Kings Zen Research Terminal)

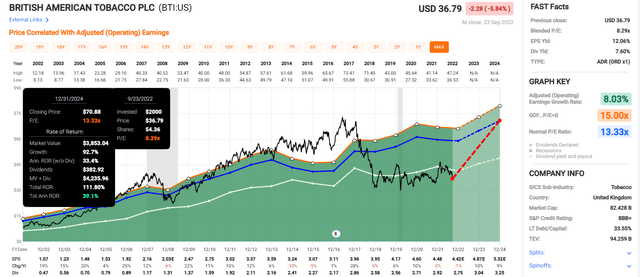

BTI is trading at 8X earnings, a very safe 8% yield, and is at the lowest valuation in 20 years.

Analysts expect 43% total returns in the next year, and it’s 44% historically undervalued, meaning that fundamentals would justify 88% total returns within 12 months.

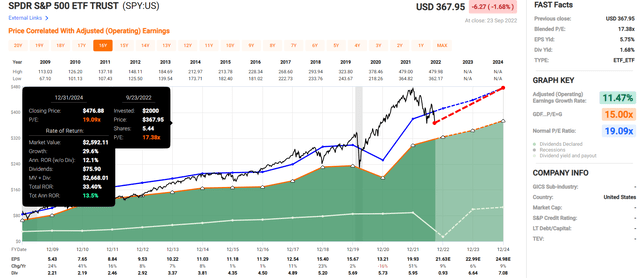

British American 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If BTI grows as expected and returns to historical fair value by the end of 2024, that means 112% potential total returns or a Buffett-like 39% CAGR.

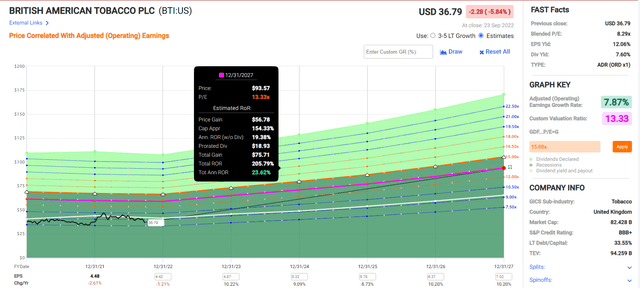

British American 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If BTI grows as expected and returns to its 20-year market-determined historical fair value, it could triple and deliver Buffett-like 24% annual returns.

Now compare that to the S&P 500.

S&P 500 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

Analysts expect a solid 13.5% annual return from the S&P 500 through 2024, though 8% earnings growth during next year’s recession is rather optimistic, to say the least.

- 4X the S&P 500’s return potential

S&P 500 2027 Consensus Total Return Potential

| Year | Upside Potential By End of That Year | Consensus CAGR Return Potential By End of That Year | Probability-Weighted Return (Annualized) |

Inflation And Risk-Adjusted Expected Returns |

| 2027 | 63.21% | 10.29% | 7.72% | 5.40% |

(Source: FAST Graphs, FactSet Research)

Over the next five years, analysts expect about 10% annual returns, the market’s historical return.

- 3.5X the market’s return potential

British American Investment Decision Score

(Source: Dividend Kings Automated Investment Decision Tool)

BTI is a potentially excellent high-yield global aristocrat option for anyone looking for supreme quality and comfortable with its risk profile.

- 44% discount vs. 8% market discount = 37% better valuation

- 8% very safe yield Vs. 1.8% S&P 500 (4.5X higher and safer yield)

- 80% better long-term annual return potential

- 2X better risk-adjusted expected return over the next five years

- 4X better 5-year consensus income

Legal & General: A Rock-Solid Balance Sheet Ready For A Severe Recession

Further Reading

- Legal & General: One Of The Best 6.5% Yielding Blue-Chips You’ve Never Heard Of

- a deep dive look at LGGNY’s investment thesis, growth prospects, risk profile, valuation, and total return potential

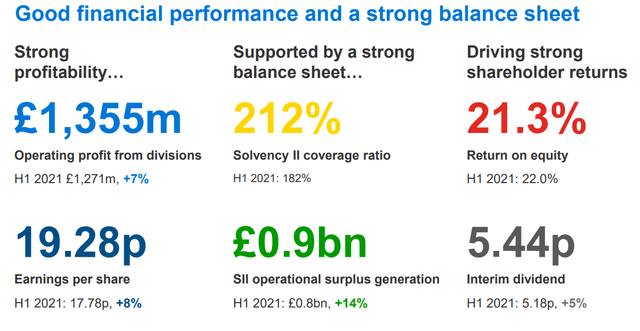

Wait a second? Isn’t Legal & General Group Plc (OTCPK:LGGNY) the most UK-sensitive blue-chip on the Master List, with 94% of revenue derived from England? Indeed it is. But here’s why I’m not excessively worried about LGGNY’s dividend safety, even in a severe UK recession.

LGGNY has a very strong balance sheet, including solvency ratios that are more than 2X regulatory minimums.

LGGNY Credit Ratings

|

Rating Agency |

Credit Rating |

30-Year Default/Bankruptcy Risk |

Chance of Losing 100% Of Your Investment 1 In |

|

S&P |

A stable |

0.66% |

151.5 |

|

Fitch |

A+ stable |

0.60% |

166.7 |

|

Moody’s |

A2 (A equivalent) stable |

0.66% |

151.5 |

|

AM Best |

A stable |

0.66% |

151.5 |

|

Consensus |

A stable |

0.65% |

155.0 |

(Sources: S&P, Fitch, Moody’s, AM Best)

We have four credit rating agencies, all confirming a very conservative and disciplined balance sheet.

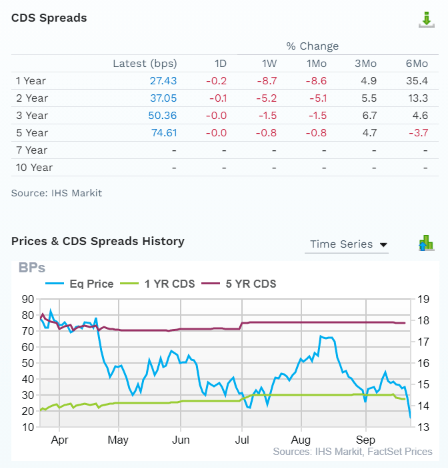

(Source: FactSet Research Terminal)

On the day the Pound fell 3.6%, and LGGNY crashed 7%, the bond market estimated no change in fundamental risk or even slightly lower risk.

Over the past week, its fundamental risk has been falling, the same over the last month.

When fundamental risk stays stable, and the price collapses, then that’s when you can catch a falling blue-chip with confidence.

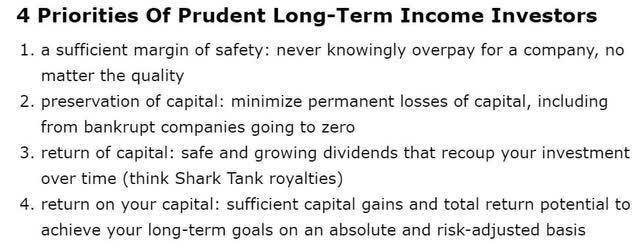

Reason To Potentially Buy Legal & General Today

| Metric | Legal & General Group |

| Quality | 82% 11/13 SWAN (Sleep Well At Night) Financial Manager |

| Risk Rating | Very Low Risk |

| DK Master List Quality Ranking (Out Of 500 Companies) | 207 |

| Quality Percentile | 59% |

| Dividend Growth Streak (Years) |

1 (Frozen in Pandemic) |

| Dividend Yield | 8.7% |

| Dividend Safety Score | 79% safe |

| Average Recession Dividend Cut Risk | 1.0% |

| Severe Recession Dividend Cut Risk | 2.10% |

| S&P Credit Rating |

A Stable Outlook |

| 30-Year Bankruptcy Risk | 0.67% |

| Consensus LT Risk-Management Industry Percentile | 84% very good |

| Fair Value | $20.54 |

| Current Price | $13.35 |

| Discount To Fair Value | 35% |

| DK Rating |

Potentially Very Strong Buy |

| P/E | 6.5 |

| Growth Priced In | -4.0% |

| Historical PE Range | 10 to 11.5 |

| LT Growth Consensus/Management Guidance | 6.50% |

| 5-year consensus total return potential |

14% to 19% CAGR |

| Base Case 5-year consensus return potential |

17% CAGR (2.5X better than the S&P 500) |

| Consensus 12-month total return forecast | 56% |

| Fundamentally Justified 12-Month Return Potential | 63% |

| LT Consensus Total Return Potential | 15.2% |

| Inflation-Adjusted Consensus LT Return Potential | 13.0% |

| Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) | 3.39 |

| LT Risk-Adjusted Expected Return | 10.57% |

| LT Risk-And Inflation-Adjusted Return Potential | 8.35% |

| Conservative Years To Double | 8.62 |

(Source: Dividend Kings Zen Research Terminal)

LGGNY is so undervalued (35% historical discount) that analysts think it will deliver a 56% return within 12 months, which would be 100% justified by its fundamentals.

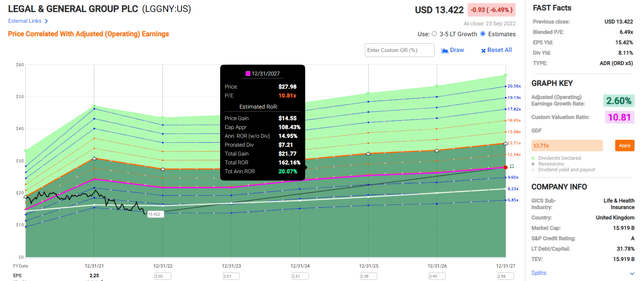

Legal & General 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If LGGNY grows as expected and returns to historical market-determined fair value, it could double in the next 2.25 years, delivering Buffett-like 36% annual returns.

Legal & General 2027 Consensus Total Return Potential

(Source: FAST Graphs, FactSet Research)

If LGGNY grows as expected and returns to historical fair value by 2027, it could deliver Buffett-like 20% annual returns.

- 2.5X more than the S&P 500

Legal & General Investment Decision Score

DK (Source: Dividend Kings Automated Investment Decision Tool)

LGGNY is a potentially excellent ultra-yield dividend growth option for anyone comfortable with its risk profile.

- 35% discount vs. 8% market discount = 27% better valuation

- 8.7% very safe yield Vs. 1.8% S&P 500 (5X higher and safer yield)

- 50% better long-term annual return potential

- 2X better risk-adjusted expected return over the next five years

- 4.5X better 5-year consensus income

Bottom Line: UK Dividend Blue-Chips Are On Sale, And A Potentially Great Way To Profit From The Panic In The Pound

I know that today seems like a terrifying time, with currencies like the Pound collapsing like growth stocks, and blue-chips getting taken to the cleaners on a daily basis.

But these truly are the best times for long-term income investors to earn Buffett-like returns from blue-chip bargains hiding in plain sight.

What if the Pound falls another 10% and takes UK ultra-yield blue-chips like BTI and LGGNY down with it? It’s not going to matter to long-term investors.

Think I’m exaggerating? Here’s what buying blue-chips within 10% of the bottom would have gotten long-term investors.

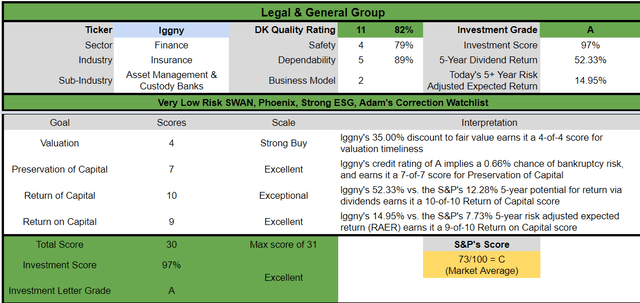

CVS Total Returns 10% Above Ultimate Bottom

(Source: FAST Graphs, FactSet)

21% annual returns in CVS (CVS) over the last two years.

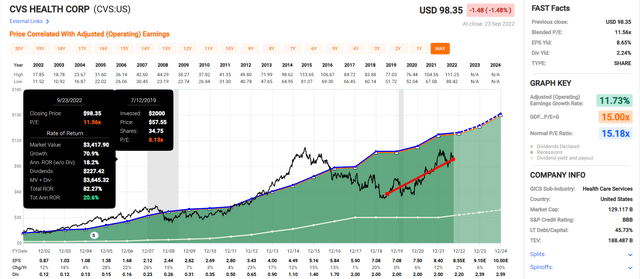

AbbVie Total Returns 10% Above Ultimate Bottom

(Source: FAST Graphs, FactSet)

31% annual returns for three years with AbbVie (ABBV).

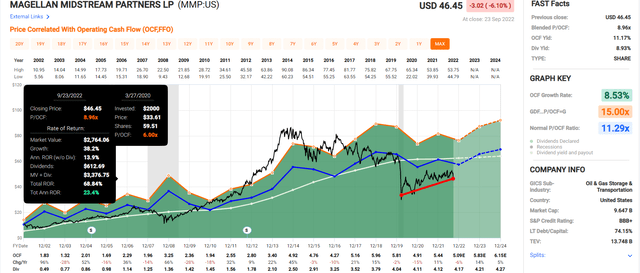

Magellan Midstream Total Returns 10% Above Ultimate Bottom

(Source: FAST Graphs, FactSet)

23% annual returns for 2.5 years with Magellan Midstream (MMP).

You literally can earn Buffett-like returns as well as generous, safe, and growing income in bear markets. And you don’t have to nail the bottom; just get relatively close.

I can’t promise you stocks are done falling; they probably aren’t.

I can’t promise you that UK blue-chips have bottomed (though they are likely close).

I can’t tell you that buying BTI or LGGNY today is going to make you a lot of money in the next few months or even the next year. But what I can tell you is that:

- the pound could take off like a rocket when the currency crisis ends

- and the stimulus package being defeated could easily provide that catalyst

- the currency crisis will end at some point (it’s England, not Argentina, after all)

In 5+ years, anyone buying BTI or LGGNY is likely to be very happy they did, locking in 8+% safe or very safe yields.

And in 10+ years, anyone buying these UK ultra-yield blue-chip bargains is likely to feel like a stock market genius who nailed the bottom, even if they just came relatively close.

Be the first to comment