imantsu

When it comes to investing, whether you are right or wrong is something that will only be proven out in time. Acknowledging when you were wrong about an opportunity is important, not only for the impact that such acknowledgment might have with those you share your information with, but also because it helps us as investors and analysts to more objectively assess opportunities moving forward. One prospect that I had some skepticism about when I last wrote about it earlier this year is Flowserve Corporation (NYSE:FLS). But the events that have played out since then have made me realize that I was not skeptical enough. As a result of investor pessimism in the broader market and driven in part by weakening fundamentals, shares of the company have experienced a decent amount of downside as of late. And given how shares are priced today, it’s safe to say the company is definitely not a prime prospect to consider. Thanks only to the company’s backlog, I have decided to keep my ‘hold’ rating on the business for now. But if the picture deteriorates further, this stance could change.

A recalibration of expectations

Back in April of this year, I wrote an article that took a rather neutral stance on Flowserve. In that article, I talked about the company’s historical volatility but I also pointed out that management was forecasting a favorable 2022 fiscal year. At that moment, I felt as though shares were priced at low enough levels to warrant appropriate upside for investors, but the company’s historical track record led me to rate it a ‘hold’, reflecting my belief that it would likely generate returns that more or less match the broader market moving forward. Unfortunately, the market had other ideas. While the S&P 500 has dropped by 18.8%, shares of Flowserve have generated a loss for investors of 31%.

As a manufacturer and aftermarket service provider of comprehensive flow control systems, including products like pumps, valves, seals, and automation offerings, you might think that Flowserve would always see steady performance because of the demand for such offerings. Unfortunately, that has not proven to be the case recently. When I last wrote about the firm, we only had data covering through the 2021 fiscal year. Today, that data now extends through the first half of 2022.

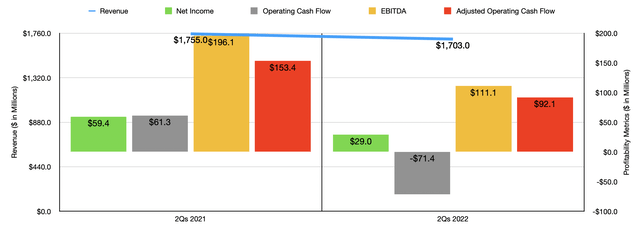

Author – SEC EDGAR Data

To start with, we should touch on the revenue picture of the enterprise in recent quarters. For the first half of the year, revenue came in at $1.70 billion. That represents a decline of 3% compared to the $1.76 billion generated the same time one year earlier. This decline, which amounted to $52.2 million in all, was really driven by a $60 million impact caused by foreign currency fluctuations. Without this, revenue would have increased modestly for the window of time discussed. It is worth noting that the biggest pain for the firm came in the first quarter. In the second quarter, the revenue decline year over year was a more modest 1.8%.

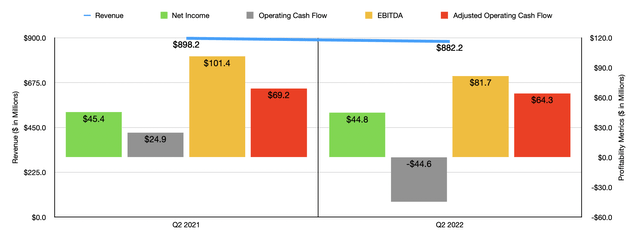

On the bottom line, the picture has continued to worsen. Net income in the first half of the year came in at $29 million. That compares to the $59.4 million generated the same time one year earlier. Part of this pain came from the company’s gross profit margin declining from 30.1% to 27%. This was driven largely because of revenue that was recognized on lower margin original equipment orders and a $4.6 million charge taken in the first quarter of 2022 because of the company’s exposure to Russia. There were other factors as well, such as the lower conversion of customer backlog to revenue and increased freight costs because of global supply chain and logistics constraints. The company also saw a modest increase, relative to sales, in selling, general, and administrative costs. It is worth noting, however, that the picture did improve considerably in the second quarter on its own, with net income of $44.8 million coming in only marginally lower than the $45.4 million reported one year earlier. But a big portion of this related to other income and expenses experiencing a swing of $15.5 million year over year thanks to things like an increase in gains from transactions in currencies and other related factors.

Author – SEC EDGAR Data

This change in that income also impacted other profitability metrics. In the first half of the year, operating cash flow was negative $71.4 million. That compared to the positive $61.3 million reported one year earlier. Adjusting for changes in working capital, cash flow would have fallen from $153.4 million to $92.1 million. Meanwhile, EBITDA for the company also worsened, dropping from $196.1 million to $111.1 million. Even though the net income for the company improved in the second quarter, other profit metrics showed weakness as well. Operating cash flow went from $24.9 million to negative $44.6 million. If we adjust for changes in working capital, it would have gone from $69.2 million to $64.3 million. And over that same window of time, EBITDA dropped from $101.4 million to $81.7 million.

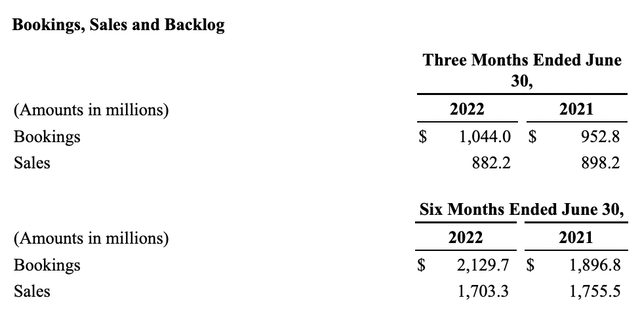

Flowserve

When it comes to the 2022 fiscal year as a whole, management does still expect revenue to come in at between 5% and 7% above what the company achieved last year. Although this may seem unrealistic, the company does have some things going for it. In the first half of the year, bookings for the company came in at $2.13 billion. That compares to the $1.90 billion reported the same time one year earlier. This brought backlog for the company up to $2.32 billion as of the end of the latest quarter. That’s $312.6 million higher than what it was at the end of the 2021 fiscal year. Management did recently say that bookings for the third quarter should be $1 billion or more, but other details regarding the quarter are pretty scarce. When it comes to profitability, management expects earnings per share of between $1.25 and $1.45. On an adjusted basis, this should be between $1.50 and $1.70. Even if we assume that the adjusted earnings per share is the appropriate way to value the company, hitting the midpoint there would imply net income of $209.4 million. That is significantly above the $125.9 million reported one year earlier. But it is below the peak year of $238.8 million that the company saw in 2019. No guidance was given when it came to other profitability metrics. But if we were to annualize results experienced during the first half of the year, then we should anticipate adjusted operating cash flow of $150.2 million and EBITDA of $225.7 million.

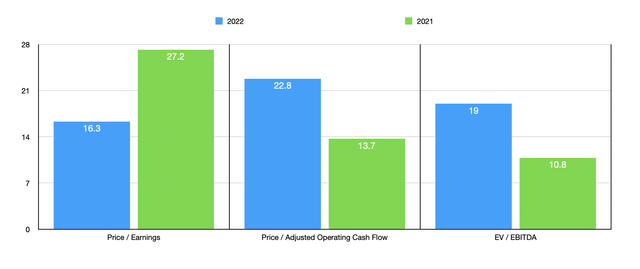

Author – SEC EDGAR Data

Given these figures, we can see that the company is trading at a forward price-to-earnings multiple of 16.3. The price to operating cash flow multiple should be 22.8, while the EV to EBITDA multiple should be 19. These numbers compared to the 27.2, 13.7, and 10.8, readings that we get using data from the 2021 fiscal year. As part of my analysis, I also compared the firm to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 5 to a high of 22.3. Three of the five companies are cheaper than Flowserve. Using the price to operating cash flow approach, the range is between 6.5 and 121.2. Four of the five companies are cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range is between 3.4 and 14.8, with our prospect being the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Flowserve | 16.3 | 22.8 | 19.0 |

| Mueller Industries (MLI) | 5.0 | 6.5 | 3.4 |

| Gates Industrial Corp (GTES) | 13.6 | 15.5 | 9.3 |

| Franklin Electric Co (FELE) | 22.0 | 121.2 | 14.8 |

| John Bean Technologies (JBT) | 22.3 | 19.1 | 14.7 |

| Hillenbrand (HI) | 13.3 | 15.4 | 7.5 |

Takeaway

With all the data we are seeing right now, it’s clear that the 2022 fiscal year is going to be a bit difficult in most respects for Flowserve. Management is forecasting a fairly strong end to the 2022 fiscal year, but the data seen so far is less encouraging. Cash flow in particular has been problematic and there is no strong evidence that the picture will drastically improve on that front. On the positive side, the company is recording strong backlog. And it is for that reason alone that I have not decided to downgrade the company to a ‘sell’.

Be the first to comment