wildpixel

Tech Stocks Down!

Another 75-basis point hike and the Fed is on a roll to curb inflation from heights not seen since the ’80s. It has been said, ‘Don’t fight the Fed,’ so many investors have been offloading tech stocks since the end of 2021. Meanwhile, now is an excellent time to discuss whether mega-tech stocks are a buy for investors seeking opportunities in a beaten-down market.

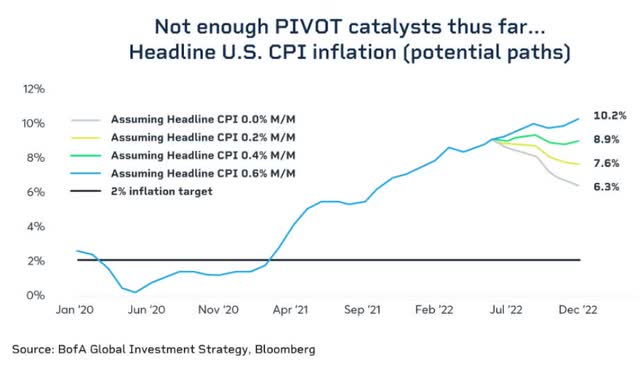

On a year-over-year basis, July CPI fell from 9.1% to 8.5%, and we’ve seen a decline in fuel prices. But, this “good news” for many does not spell that inflation peaked. Although some commodities, products, and services have decreased in price, CPI’s basket of goods is mostly rising. According to research by Bank of America, the prices of consumer goods rose so fast that “Even if we had 0.0% month-over-month inflation growth through the end of the year, the year-over-year rate of change in CPI would still be greater than 6.3%.

U.S. CPI Inflation (Potential Paths) (Bank of America Global Investment Strategy, Bloomberg)

Right now, investing in growth and tech stocks is like trying to catch a falling sword. Looking at the charts above and below, continued pain from a falling Nasdaq, slowing economic growth, and the Fed’s revised dot plot send strong signals throughout the markets. These signals are battering growth and tech stocks.

Nasdaq 100 Ytd Decline

Nasdaq 100 YTD Decline (Seeking Alpha Premium)

While we’ve seen a few bear market rallies and whipsawing in the markets, James Abate, Chief Investment Officer of Centre Asset Management, said it well: “Big tech is a group that will continue to bleed for the foreseeable future. At best, it will match the market’s performance. At worst, it underperforms.” At the end of the day, there’s no reward without risk, and while most of the mega-tech stocks are currently rated Hold, there are still some fundamentally good picks, and one mega-tech I consider a strong buy based upon quant ratings.

Tech Selloff and Baby In The Bath Water

Don’t throw the baby out with the bath water because you could miss some good buying opportunities, like Google: My Only Mega-Tech Strong Buy. Rising rates have prompted the 10-year Treasury yield to top 3.9%, heights not seen in over a decade and resulting in a more attractive U.S. dollar. But with a surge in the USD, rising costs pose export and supply chain challenges for tech companies with substantial business abroad. Add in that investors are gearing up for an October earnings season that may see a further Nasdaq selloff as companies cut costs and improve productivity measures. Every dollar counts. It’s crucial to paint the overall picture and weigh options before diving into tech investments in a volatile environment.

Should I buy tech stocks now?

There’s a lot of money lying in wait, to the tune of a $5 Trillion Cash Pile. So, why not put some of it to work? The short answer is fear. Investors don’t want to risk losing money in a difficult environment, especially with recession talks at the forefront of the news.

Shelter in Money Markets Chart (Investment Company Institute, Bloomberg)

Inflation is north of 8%. Meanwhile, cash is yielding 4%, which is why many seek shelter in money markets, as evidenced in the chart above. But tech is what investors love. Apple (AAPL) anticipates Q4 growth at +6%, and Amazon (AMZN) and Microsoft (MSFT) anticipate around 10% and 16%, respectively, for the upcoming earnings season. But all of these stocks and Google parent Alphabet (GOOG) (GOOGL) and Facebook parent (META) have slid double digits over the last month. Tech is down. Where smaller tech companies may not recover, mega techs with strong balance sheets, strong free cash flow, diversified revenue streams, and reduced social/ethical hurdles are likeliest to fare well, provided they don’t face the extra set of headwinds Meta is facing which includes privacy concerns, a slew of investigations and class action lawsuits that are creating more headwinds than the macroeconomic factors affecting the other big techs. As a result, Meta’s stock price has declined 60% over the last year.

Google, Microsoft, Apple, and Amazon constantly evolve, run efficiently, and possess strong financials, making great options for a portfolio. But they’re part of the baby in the bathwater phenomenon. Tech – no matter how appealing – is taking a beating all the way around. While the market is forward-looking and anticipates Fed increases, forcing a recession which will hurt consumers and business demand and ultimately profits, good tech stocks are being eliminated as the markets expose try to weed out the bad. Let’s look at popular tech stocks’ quant ratings, rankings, and factor grades.

Quant Ratings, Ranking, and Factor Grades (META, AMZN, AAPL, MSFT, GOOGL, GOOG)

Quant Ratings, Ranking, and Factor Grades (META, AMZN, AAPL, MSFT, GOOGL, GOOG) (Seeking Alpha Premium)

Stock Valuation

The tech sector is concentrated with popular names, and those most popular, like our mega-techs, possess stretched valuations. While D and F valuation grades are less than ideal, these tech stocks have seen tremendous success and surges in price. Hence, they come at a premium.

Each stock trades near 52-week lows, with Apple approaching its mid-52-week range. The forward P/E ratio is important when evaluating if a stock comes at a discount or is overvalued. In addition, the forward PEG is also an important metric to consider that blends value and growth. While each of the six picks comes at a premium price compared to the sector, the double-digit YTD and one-year share price declines appeal to some investors looking to buy big tech near their lows. When you factor in that each of these mega techs possesses A+ profitability grades, these stocks look very attractive to some investors wanting to buy the fall.

Growth, Profitability, & EPS Revisions

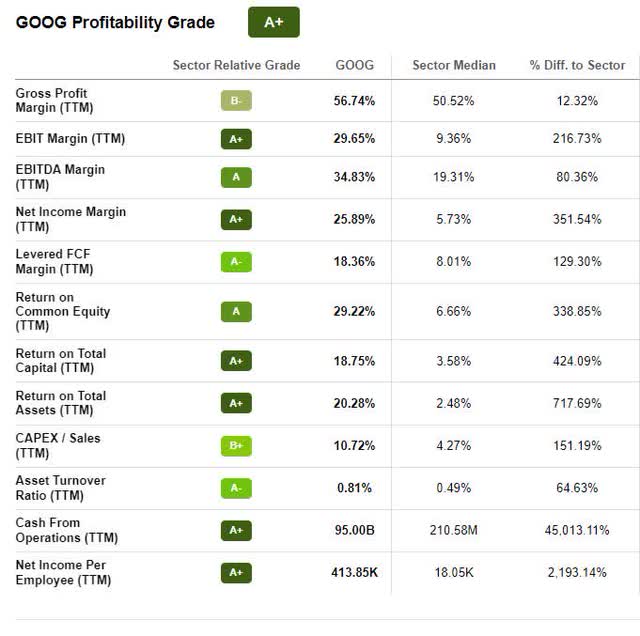

Earnings misses are riddling the tech sector, prompting downward analyst revisions and concerns about October’s earnings. Stocks that underperform their benchmarks should be avoided based on poor quant grades and downward EPS revisions by analysts. Unlike smaller tech companies yet to establish themselves, the benefit of mega-tech is they are already profitable, offering them a cushion to survive a downturn. As an example, check out GOOG’s stellar profitability below.

Alphabet Stock Profitability (Seeking Alpha Premium)

One of the many reasons Google is rated a strong buy by our quant is that the company adjusts to a changing environment. Economies around the globe are experiencing recessionary effects, and Google, like many tech companies’ recent earnings, experienced declines due to a slowdown in ad sales. Headwinds that include weakening demand, a strengthening USD, and market volatility have forced companies to be more strategic to remain profitable. Google is “shifting its focus toward areas where the company can be sharper…Google’s consumer data, along with retailer partnerships, can help it better brace for an e-commerce slowdown,” said Scott Sullivan, chief revenue officer at Adswerve, an online advertising company. Although Google has one of the best balance sheets in the world and its cash reserves are three times that of its rival Apple, each of the six stocks listed here has excellent financials.

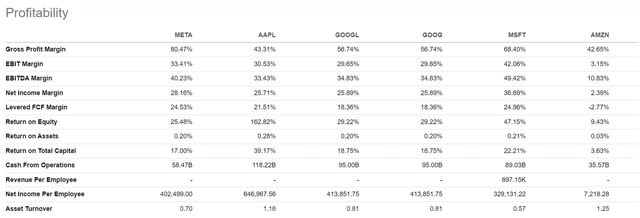

Each of my six stocks possesses double-digit revenue growth, and the table below showcases tremendous EBIT margins and substantial cash hoards from operations. I believe each of these stocks has the opportunity to position themselves to capitalize going forward.

Stocks’ Profitability (META, AAPL, GOOGL, GOOG, MSFT, AMZN) (Seeking Alpha Premium)

Although there is some pain to be experienced in the current market environment and many choices when investing, I maintain that Alphabet is a strong buy based on our quant ratings. Additionally, while META, AMZN, AAPL, and MSFT, remain Holds, there is a chance that investors looking to buy the dips at current prices may prove fruitful. But it’s essential to consider fundamentals first and foremost, especially as Wall Street and Main Street are increasingly turning negative. Beaten down stocks with earnings misses may have further to fall, so heed the warning signs and tread cautiously. Popular high-quality names have their benefits but can also pose many risks. Proceed with caution when investing in this volatile market.

Proceed with caution when buying mega-tech

A lot is happening globally, and the markets are reacting. Economic growth worldwide is slowing, and the projected earnings for technology are anticipating a fall. In addition to the projected lag, some tech stocks can still be great buys if you consider their underlying fundamentals and the macro environment.

Seeking Alpha’s Quant Ratings have a Hold rating on META, AMZN, AAPL, and MSFT and a strong buy rating for Alphabet. Consider mega-tech stocks that offer diversified products and services, remain in demand and possess strong forward EBIT growth. In the current environment where the tech sector is -31%, except for Apple, each of our stocks is trading near 52-week lows. While META faces more headwinds than the other picks, mega techs can provide an opportunity to capitalize on potential upside.

Choose wisely. We have dozens of Top Technology Stocks. Our quant grades and investment research tools help to ensure you are furnished with the best resources to make informed investment decisions.

Be the first to comment