XH4D

Meta Platforms (NASDAQ:META), formally known as parent company of Facebook, has 2 counterweighting sides to the long-term investment thesis, which makes it one of the most interesting potential long term high-upside opportunities.

On the negative side of things, a recent change from Apple (AAPL) regarding application security means that Facebook, or Meta, is not able to as effectively monetize their users for revenues and that has and will result in declining ad revenues for the foreseeable future.

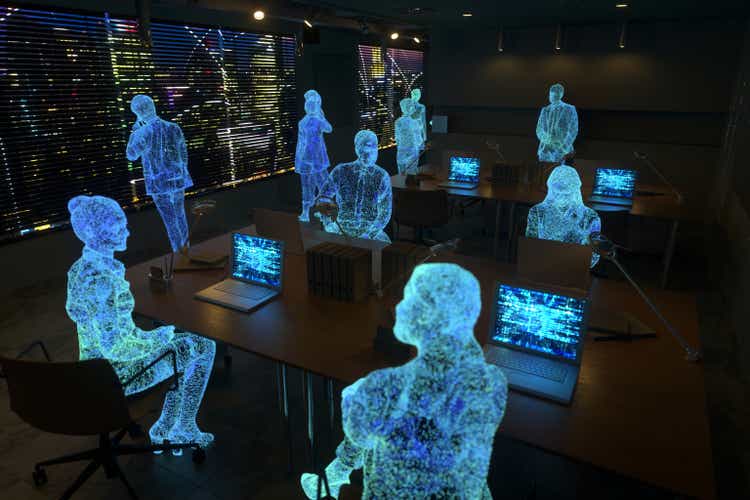

On the positive side of things, the company has been emerging into the Metaverse/AR (augmented reality)/VR (virtual reality) market for quite some time now and is one of the leading players in the industry. This market is set to explode over the coming decade or two and could be worth trillions of dollars.

The real question for investors, assuming the metaverse revenue stream materializes, is if the company’s current revenue stream of ads on their social media platform is enough to keep them going at reasonable valuations until the other revenue stream becomes significant enough to warrant the investments.

Let’s break them down.

The Negatives: Declining Organic Revenues

This is nothing new to Meta/Facebook investors. The company relies heavily on tracking users’ activity across multiple platforms in order to more efficiently target advertisements to said users. Apple’s recent change to those guidelines, which allows users to opt-out of sharing that cross-platform data, limited the company’s ability to do that effective advertising, leading to advertisers either dropping or renegotiating their spending on the platform.

This has resulted in the company’s revenues to miss expectations and decline relative to previous years, and the company’s share price fell substantially. This is due to the fact that the company was trading at higher multiples due to the previously-forecasted high revenue and EPS growth rates – both downgraded.

Even now that analysts expect the comparative drop in revenues to reverse somewhat, and for the company to report a slight jump in sales and profits over the next few years, that growth rate is set to decelerate.

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Sales | $118B | $131B | $148B | $165B | $180B | $191B |

| Growth | +0.1% | +11% | +13% | +12% | +8.7% | +6.3% |

The issue here is not only that the company’s revenue growth is set to further decline, but that after the initial boost, their margins are set to take a hit as they require a maintained SG&A and R&D budget to facilitate the transition into the metaverse, AR and VR markets. This means that although the company should enjoy higher margins than they currently do in the coming years, that’s set to drop off after 2026.

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| EPS | $9.78 | $11.07 | $12.82 | $15.75 | $15.91 | $15.80 |

| Growth | -29.0% | +13.2% | +15.8% | +22.8% | +1.03% | -0.70% |

(Source: Seeking Alpha Earnings Estimate Aggregator)

Even though these figures may look bad for some long-term investors, I don’t think it’s anything to worry about in the long run as the company transitions into their other business segments and away from exclusively relying on ad revenue from their social media platforms Facebook, Instagram and others.

The Positives Of The Negatives: Transitions

The bottom line is – even though the revenue growth is decelerating in the longer run from the company’s core organic social-media ad revenue, they have more than enough resources to get them to a place where they are a more diverse company. Let’s dive into the numbers.

First of all, even if the company underperforms the previously-mentioned expectations, they still have a whopping $12.7 billion in cash and equivalents and an additional $27.8 billion in short-term investments, totaling more than $40 billion in liquid cash reserves. Even if their gross profit drops from $95 billion to $80 billion, their cash reserves can sustain them through the transition period, given the fact that they spend about $50 billion in operating expenses, which can certainly be reduced, as the company has said it would.

They’re aiming to cut costs by about 10% over the next quarter, which means that the company will be saving about $5 billion in those costs, and they can certainly go even further if they need to.

Another positive here is that the company has zero long-term debt, which means that for a short period of time during a transition period, they have the opportunity to tap those markets, especially if we do head into a recession and interest rates come back down to tackle that, which can easily sustain them through the 2030 to 2040 period of fully embracing the metaverse, AR & VR.

The Positives: Trillions In Potential

This market breakdown is in 2 parts: the metaverse and AR/VR.

According to market experts, the metaverse is set to grow at a very high rate and reach over $1.5 trillion by 2029, growing at a CAGR of almost 48%. This industry is broken into 3: software/platform, hardware and services. Meta does all 3 in one way or another, which means they have the potential to have their foot in each segment and maximize their impact.

Why I am so bullish on Facebook’s/Meta’s leading potential in the space is because their platform already constitutes one of the largest in the industry. What I mean by that is that they operate in key segments set to expand:

1 – Social Media is set to be one of the leading sub-industries within the AR/VR & metaverse world and Meta has both Facebook and Instagram, as well as potential with WhatsApp and Messenger. This means that they’re likely to maintain a significant portion of the metaverse social media world as it moves into the AR/VR components.

2 – Online shopping is another one which is set to become a major part of the metaverse with AR/VR measuring and trying on clothes, matching with celebrities in real time and others. Facebook’s Marketplace is one of the leading social e-commerce platforms in the world, and although they pale in comparison to companies like Amazon’s (AMZN) platform, they’re investing heavily into making it a more friendly place for the billions of monthly users through Facebook and Instagram.

3 – Gaming and content creation are the other segments set to grow rapidly in the AR/VR and metaverse spaces, and Meta’s metaverse launch was already being seen as a big source of participation among the community. The further integration of these systems with Facebook and Instagram can potentially lead to millions of people who use those social media sites every day to join the system over starting a new account through a new or other platform. The company’s Oculus is also a huge component in metaverse gaming and content.

As such, I believe that in the first few years from 2030 through 2040, Meta, along with all of its current and potential subsidiaries, will hold a significant market share relative to the other companies who are operating in this space.

Risks & Investment Conclusion

The obvious risk here is competition. Companies like Apple are notorious for waiting out the kinks of certain new industries or features and then adopting them using their tens of billions in spare change lying around. Them, along with other large companies like Microsoft (MSFT) and other hardware manufacturers, social media platforms and more, present a stiff competitive environment for Meta.

While I still believe that Meta will hold a significant advantage over other companies, it’s still a risk to keep in mind as the company’s ad revenue growth continues to decline while they invest heavily into this new industry, which may limit the amount of cash flow them generate in the next 5 years or so.

Even so, with potentially trillions of dollars to be made around the world in the space through 2040 and with the company being almost the only one with a presence in multiple different segments, I believe that with a 15% to 25% market share (my own projection) in the first few years of this rapidly growing industry – that Meta can be one of the best long term investments for the next 20 years.

With ad revenue sales remaining relatively flat at around $200 billion annually and metaverse/AR/VR related sales growing at around 50% annually to the same levels, an annual sales growth rate from 2030 to 2040 of about 20% to 25% means that the company has the potential to be worth significantly more than their current share price and grow at 20% to 25% a year.

As a result, I am highly bullish on the company’s long-term prospects and believe they can adequately weather the ad revenue storm while they invest and transition to the metaverse money.

Be the first to comment