SolStock

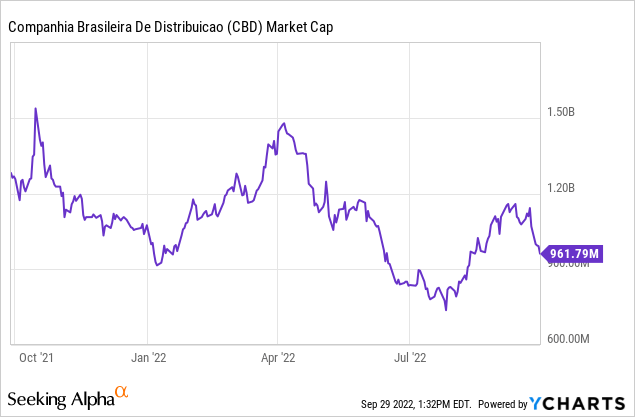

Coming on the heels of a preliminary announcement in August, Companhia Brasileira de Distribuição (NYSE:CBD) has finally decided to move ahead with spinning off its stake in Colombian retailer Exito. Given the limited synergies with the rest of the CBD portfolio (which is run independently), this move should be well-received by investors. More importantly, a spinoff will shed light on Exito’s underlying value, which has been clouded by the intrinsic holding discount priced into CBD’s market cap. Exito currently trades at a ~R$5.5bn (or ~$1bn) market cap – a premium to the ~R$5.4bn (~$1bn) equity valuation for the whole of CBD (including its ~96% stake in Exito). Net, a spinoff should catalyze significant value unlocking, clearing the path for the remainco valuation to converge with global peers.

Splitting Off Exito

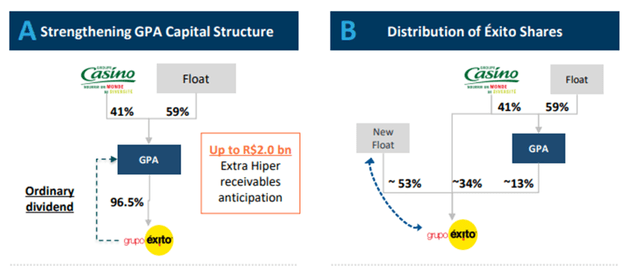

CBD recently disclosed its intention to reduce its stake in Exito to ~13% (from the current ~96%) via the distribution of Level II Exito Brazilian Depositary Receipts (BDRs) and American Depositary Receipts (ADRs) to shareholders.

Companhia Brasileira de Distribuição

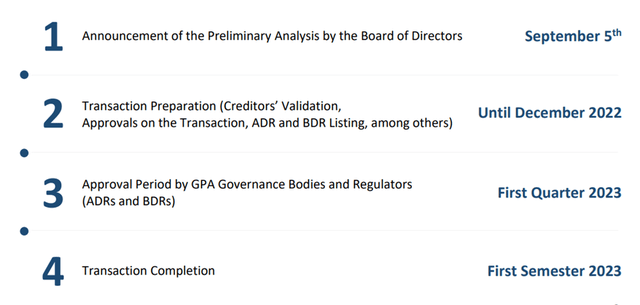

For context, GPA currently owns ~96% of Exito, which is listed on the Colombian stock exchange (albeit with limited free float and liquidity). This spinoff comes on the heels of prior spinoff and re-IPO exercises involving Via Varejo (a durables retail business) and, more recently, the listing of Assai (cash & carry business previously under the CBD banner) on the Bovespa. Per the transaction terms, the company will split Exito shares by three and deliver them at a four-to-one ratio to shareholders for every CBD share owned at book value. As the spinoff will not involve material costs, the current guidance is for no capital gains/losses for CBD. The key hurdle from here is Board approval, following which completion is expected in H1 2023.

Companhia Brasileira de Distribuição

Value Unlocking Potential

First off, the transaction should accelerate the achievement of CBD’s deleveraging targets. This comes in addition to the projected ~BRL2bn influx from the Extra Hiper receivables and another ~BRL1bn from the Extra Hiper installment by year-end. Exito dividends are another key factor – ~BRL400mn in dividends are expected ahead of the transaction (likely in Q1 2023), supporting the GPA Brasil deleveraging process. For context, GPA Brasil’s net debt position isn’t too bad at ~R$4.5bn (equivalent to net debt/EBITDA of 3.2x), so the incremental balance sheet capacity significantly raises the chances of more capital return. If the transaction closes, the dividend and cash from the Exito spinoff should bring the pro forma net debt closer to a healthy ~R$1.5bn (or net debt/EBITDA of ~1x).

The valuation implication is perhaps more interesting. It’s no secret that CBD has been plagued by a holdco discount (like most conglomerates); thus, a spinoff should unlock value for shareholders. Ultimately, the amount will depend on the value the market is willing to assign to Exito post-transaction. While the timing isn’t quite ideal, CBD deserves credit for addressing key investor concerns, including the limited free float and the low liquidity of Exito stock traded on the Colombian stock exchange. Given the wide disparity between where Exito trades vs. CBD as a whole, I am bullish on the final outcome. Relative to Exito’s ~R$5.5bn (or ~$1bn) market cap, CBD (including its ~96% Exito stake) trades at a discounted ~R$5.4bn (~$1bn) equity valuation. Thus, a convergence toward global peers for the remainco (i.e., GPA Brasil) and Exito (CBD will retain ~13%) would imply significant upside from here.

Simplifying the Structure

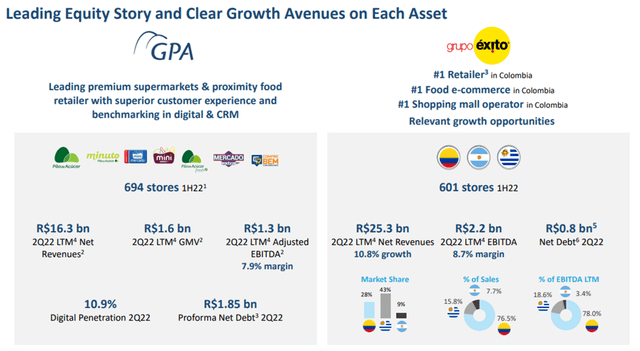

From a strategic standpoint, it’s hard to deny the transaction’s rationale – the core GPA Brasil and Exito businesses are run independently, and thus, a separation poses no loss in operational synergies. CBD will lose a far bit of revenue, though – of Grupo Exito’s current food retailing operations, most of the revenue generation comes from Colombia at ~74% of revenues as of Q2 2022, followed by Uruguay and Argentina at ~17% and ~9%, respectively. Assuming the current run-rate sustains, FY22 would have seen Exito contribute ~60% of CBD’s consolidated revenue base and >60% of EBITDA. Yet, this loss is more than offset by the post-transaction simplification of CBD’s corporate structure, which has long been a key investor concern. The pro forma corporate structure will be cleaner, with Casino holding ~34% and GPA at ~13%, with the spinoff also boosting free float levels to >50%. The latter is key, as greater liquidity and market visibility for Exito stock should improve the valuation.

Companhia Brasileira de Distribuição

That said, there are headwinds – spinoffs are typically sold down post-transaction, and given investors’ negative risk perception of directly holding a Colombian asset (vs. indirectly via CBD before), expect Exito stock to come under pressure immediately post-spin. Over the long run, though, Exito’s fundamentals should shine through, allowing for a re-rating in CBD’s stock as well (via its remaining ~13% stake).

Exito Spinoff to Catalyze Value Unlocking

CBD’s decision to proceed with the spinoff of its Grupo Exito holding marks another step forward in addressing the holding company discount. By unwinding the complex LatAm shareholding structure (in line with the prior Assai carve-out), the market should eventually reward CBD shareholders by further reducing the holdco discount upon completion. For context, Exito currently trades at a premium to CBD, with its current market cap at a slight premium to the entire CBD entity (which holds a ~96% stake in Exito). The pending separation of Exito from the remainco GPA Brazil asset should, thus, allow both entities to converge toward global peers, implying significant upside from here.

The key risk is that CBD might not get the valuation it wants, given the weak market conditions. Yet, the remainco will retain an ~13% stake in Exito, so there remains an opportunity to 1) monetize on better valuation terms later when market conditions improve and 2) further strengthen the balance sheet going forward.

Be the first to comment