Editor’s note: Seeking Alpha is proud to welcome Growth And Value Trading as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

RobsonPL/iStock Editorial via Getty Images

Shell (NYSE:SHEL) is an oil supermajor with its headquarters in London. At the start of the year the company was still known as Royal Dutch Shell, but the company moved to London last January. This is mainly because of the better conditions for the company. Over the last few years the company was being sued by environmentalist groups and faced many days in the courthouse defending itself from these organizations. This was up to the point where Shell was being forced by the court to change its goals to be CO2 neutral. The involvement of the court into the plans of a business is never good. The strangest part of all of this is that Shell might be the cleanest of all the oil majors, yet it’s the one most under fire.

In this article I will show you why Shell is the best investment in the oil and gas (and renewables) sector, why it is better than the other oil majors, and why it’s a good investment overall. The industry had a lot of tailwinds this year so far, but the coming years might become more challenging again with inflation, recession risks, an aggressive Fed, and dropping oil and gas prices. There are a lot of risks, yet it’s still a great buying opportunity for future returns.

Company Overview

Shell is one of the six oil majors. The company has a market cap of $159.52 billion, which makes Shell the fourth largest only behind Saudi Aramco (ARMCO), Exxon Mobil (XOM) and Chevron (CVX). Over the last 12 months the company posted $329.59 billion in revenue and $36.17 billion in net income. This is a massive improvement compared to the 12 months of 2020, in which the company only managed to post $180.54 billion in revenue and a loss of $21.68 billion in earnings.

2020 might have been one of the worst years in history for Shell. It is also the legendary year in which Shell decided to cut its dividend, an action that scared away a lot of investors and meant a new low for Shell stock. Where a dividend cut is always a bad sign, it does not mean it is also a bad decision. It might not be the most popular opinion, but I think it was the best decision made by Shell management over the last few years. Because Shell cut its dividend, and as such cut some liabilities, it created more financial room for itself. In my opinion, a healthy balance sheet is most important for a good investment. Shell could have kept returning excessive amounts of dividend to its shareholders, which might sound good, but it would have had to take on more debt to finance that, which would have given it less room to grow and invest.

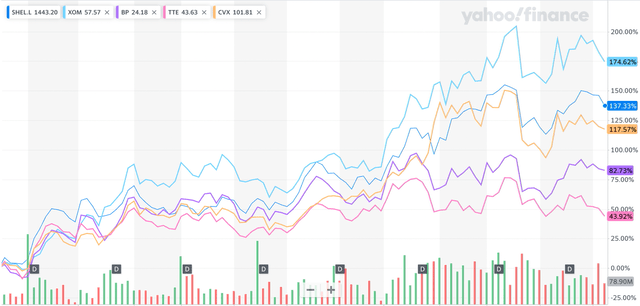

Because of the dividend cut, Shell created some breathing space for itself and invested the money in places where it thought it could earn more cash in the future. This was also the bottom for Shell stock – Sept. 27, 2020. Since then, Shell stock has returned 137% (at the time this was written). Within this time frame, of the oil majors, only Exxon Mobil showed better returns (excluding dividends) – as you can see in the graph below.

Over the last year Shell boosted its dividend again and bought back a good number of shares. The forward dividend yield is 3.9%. This results in a payout ratio of 20.7%. That is a very safe and well supported dividend.

stock returns from 9-27-20. until 9-25-22 (Yahoo finance)

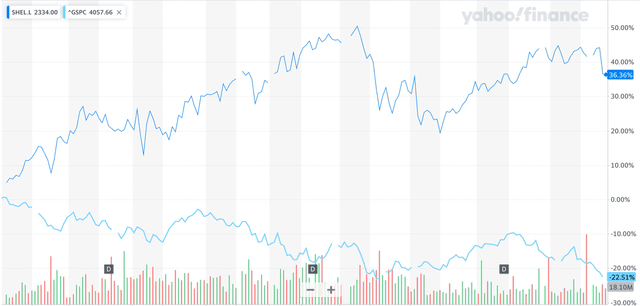

So far this year Shell returned 36.36%, which is a massive outperformance vs. the S&P 500, with a 22.51% loss.

YTD performance of Shell PLC vs S&P 500 (Yahoo finance)

The outperformance of Shell so far this year is the result of great earnings during the first two quarters, thanks to the very high oil and gas prices. Of course, the high commodity prices are a result of the Russia-Ukraine war, which caused a loss of supply and more demand. So far, the high prices have been great news for Shell, although over the last few weeks prices are coming down again. This might be bad news for Shell in the near term, but the current prices mean Shell is still highly profitable.

During the first two quarters Shell posted $68.17 billion in free cash flow, a massive amount of which they want to return a big amount to shareholders and improve their balance sheet. For the third quarter alone, Shell will return $6B to shareholders in form of share buybacks.

In the first half of the year Shell posted revenue of $184.26 billion, with net income of $25.16 billion. We can conclude that Shell made a massive amount of money during the first half of 2022, as it made great use of the high oil and gas prices. The company used a lot of the high free cash flow to reward its shareholders through dividends and buybacks. It also paid off a huge amount of debt. Over the last 12 months the company lowered its debt from $100 billion to $86 billion in the last quarter. It paid off $14 billion in just 12 months.

Looking Ahead

Now we get to the most important part of this article, where I want to talk about the company’s potential, future initiatives, and why you should buy Shell. I will split it into four points.

Frontrunner in green initiatives

Obviously, Shell is a company much hated by all environmentalists. And, yes, I get where they’re coming from – Shell does business in one of the dirtiest industries one can invest in. Most of the time people try to avoid dirty oil companies and weapon manufacturers. These are seen as industries that are bad for the world. Over the last few years Shell has had to fight multiple court cases and pay a good number of fines.

However, Shell is not the dirtiest company of all the oil majors. It might even be the most invested in clean energy initiatives of all the oil majors. The only one coming close might be TotalEnergies (TTE). Shell is heavily invested in charging stations, supported by its large amount of petrol stations that already existed in its legacy business. Shell is putting large amounts of money into developing more charging stations all around the world.

Right now, Shell operates around 90,000 charge points for electric cars at homes, business, and Shell retail sites and destinations. In addition, they currently offer access to over 300,000 additional charge points through their roaming networks. Shell has set a target to operate over 500,000 charging points by 2025. Shell is very committed to their targets, growth, and the quality of charging ports. They are already one of the larger facilitators and at the same time also one of the fastest growing ones. According to Shell, they are installing one new charge point every 20 minutes.

Shell also proposed plans to build Europe’s largest hydrogen plant in Rotterdam. The facility is supposed to produce 60,000 kg of renewable hydrogen per day. Power for the plant will come from the offshore wind farm Hollandse Kust. According to Shell, it is another effort to show their commitment for net-zero by 2050:

Holland Hydrogen I demonstrates how new energy solutions can work together to meet society’s need for cleaner energy. It is also another example of Shell’s own efforts and commitment to become a net-zero emissions business by 2050.

Renewable hydrogen will play a pivotal role in the energy system of the future and this project is an important step in helping hydrogen fulfill that potential.

For those not familiar with hydrogen, here is a brief explanation – hydrogen is the first and most important element in the universe. It consists of a positively charged nucleus (proton) and a negatively charged electron and has the lowest atomic weight of any element. Under normal or standard conditions, hydrogen is a colorless and odorless gas.

Hydrogen is abundant, but is rarely found in its pure form. It has to be produced through chemical reactions. Most of the hydrogen around today is produced through fossil-fuel reforming, a process that produces a reaction between natural gas and steam. Hydrogen can also be produced from renewable sources, for example through electrolysis using electricity generated by renewable sources. Shell already has multiple hydrogen hubs around the world.

In addition to the previous two points of innovation, Shell is also working on wind energy. Shell started working with wind energy 20 years ago, and today wind energy is yet again a big growth opportunity for the company. Today, offshore wind is once again a key growth area for Shell. They have more than 2.2 gigawatts of offshore wind capacity in operation and under construction, and 9.2 GW in the funnel of potential projects across North America, Europe, the UK, and Asia (Shell equity). They are also investing in the next generation of wind technologies, including floating wind.

This shows the commitment Shell devotes to wind energy. In Q2 2022, renewables and energy solutions posted $1 billion in adjusted EBITDA. This, for now, is not a big part of total income, but way more reliable and higher growth than the oil and gas production. There is massive growth potential for Shell in this area and they are investing heavily. This has put them ahead of the competition so far.

Great balance sheet and shareholder returns

As discussed before, Shell has a great balance sheet with not too much net debt and plenty of cash reserves. This takes away a lot of risk in the situation of another oil crash. Shell is well leveraged; a 20% payout ratio of its dividends is more than safe. The 3.9% yield is below its historical average, but growing quickly. I expect another raise when it reports its Q3 2022 results. The large share buybacks are another boost to shareholder returns, with $6 billion in the current quarter.

Valuation

Shell is massively undervalued, currently trading at a forward P/E ratio of 4.69. By way of comparison, Exxon Mobil trades at a forward P/E of 8.08 and Chevron trades at a forward P/E of 9.18. It’s a fact that European oil majors are cheaper than American oil majors. This is probably because of less renewable energy push from the U.S. government. Yet, an almost 100% discount seems like way too much to me. I do not like putting a price target on stocks because I feel as if these are subject to being influenced by way too many outside conditions. In my opinion, an almost 100% discount compared to U.S. peers is just too much, but that might not be true for everyone. The valuation story is the same for Shell’s European peers TotalEnergies and BP (BP). I believe that these valuations compared to American peers at least give these stocks less downside risk.

Revenue mix

I think the revenue mix at Shell will become less volatile and more future proof in the coming years. A large part of this is, of course, the green energy push within the company. Renewables should become a larger part of income every quarter. In addition, LNG is a big business for Shell. I think integrated gas and LNG will become the biggest revenue source for Shell as it slowly exits the oil business. Oil clearly is not the future. Cleaner gas, and mostly LNG, is much more future proof. We can already see this happening with the LNG boost in Europe because of the Russia-Ukraine war. Shell is one of the largest players in LNG around the world, and this is another business opportunity for the company.

Risks

Recession and lower oil prices

Extreme inflation has been a huge subject on Wall Street since the start of the year. This caused the central banks, mostly the Fed, to increase the interest rates from historical lows. The Fed already raised interest rates to a 3.25% recently. All these rate hikes are a drag on the market. Combine this with extreme inflation and less consumer spending and we’re likely heading toward a recession. The bear market is almost one year old. For Europe the last highs were in November of last year. The S&P peaked in January. Many analysts are now expecting a mild recession by end of the year and into 2023. All economic measurements are pointing to a recession, and I agree with analysts that we might see a mild recession in 2023.

Historically, during times of recession this also comes with less economic activity and, as a result, lower oil prices. I think OPEC and all major oil corporations learned from prior recessions and oil crashes and are acting more careful now. The reason I say this is because oil companies started acting differently after 2014. Oil majors stopped boosting R&D to catch up with demand. I think for the coming recession this means oil prices will remain higher than expected. Even in the case of less demand, it will remain high enough to keep prices at decent levels for the oil majors. This is great news for Shell since they can keep making great money, even during a (mild) recession.

Windfall taxes

Windfall taxes are a threat to the business of Shell and an even bigger threat if prices start to get lower. A windfall tax is a higher tax rate on profits that result from a sudden windfall gain to a particular company or industry. In the case of Shell, these are the extra profits it makes from the extreme oil prices as a result of the Russia-Ukraine war. In Great Britain, they already imposed a windfall tax on all oil and gas profits. If a lot of countries start doing this it could take a big bite out profits for Shell.

Green energy profits

Right now, Shell’s renewables segment is posting $1 billion in quarterly revenue. This is only a very small amount of total revenue. Revenue-wise we could say there is not much meaning to the renewables segment, not yet at least. There is still the question of whether renewables in the form of solar power, wind power, and hydrogen can be just as profitable as oil and gas are right now to Shell. Could Shell create the same revenue with just renewables in the future? That is a huge uncertainty.

Oil reserves

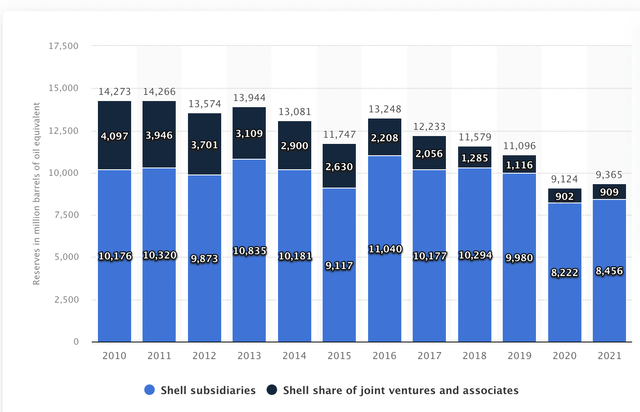

Shell’s oil reserves have been dropping over the last few years.

Shell oil and gas reserves (Statista)

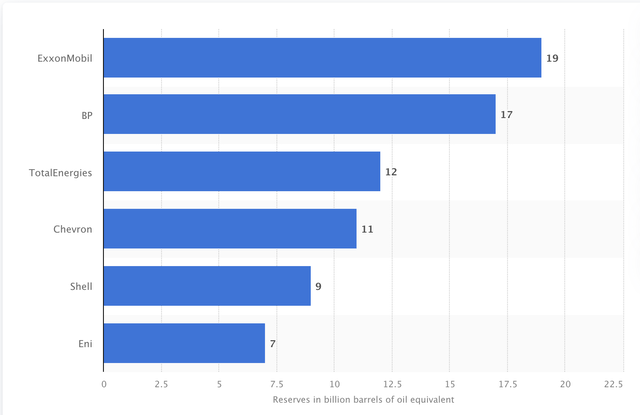

This is not horrible news, but it certainly isn’t great. The oil reserves are also way behind the company’s peers.

Oil reserves of the supermajors (Statista)

We know Shell will be slowly exiting the oil industry, but that’s not supposed to happen in the next few years. Of course, this is an exaggeration, but Shell will need to step up its game to not fall behind its peers as is happening right now.

Conclusion

Shell is a giant company with massive free cash flows. So far this year it outperformed the S&P by a fair margin. It is one of the big winners so far in 2022, and it will be one of the big winners over the next few years as well. I believe Shell will manage during a recession and oil prices will stay relatively elevated. I put a “buy” rating on the stock. It is still crucial to any portfolio to keep some exposure to the oil and gas industry and to the energy sector. The best thing about Shell is that it gives you this exposure and is one of the biggest players in the renewables segment as well.

Be the first to comment