Christa Boaz/E+ via Getty Images

Wednesday, September 28, was a good day for many biotech stocks developing drugs for Alzheimer’s, as Biogen (BIIB) and Eisai (OTCPK:ESALY) reported success in a phase 3 study of lecanemab on Tuesday after hours. Success for BIIB and ESALY however, didn’t provide a sustained rally for Cassava Sciences (NASDAQ:SAVA). This article takes a look at why the Alzheimer’s space might have partied without SAVA.

Should lecanemab’s efficacy mean much for SAVA’s simufilam?

A potential suggestion as to why SAVA didn’t rally, in response to a success story in Alzheimer’s disease, is that lecanemab works by an at least somewhat different mechanism of action to simufilam. Lecanemab is an antibody against amyloid-beta, whereas simufilam supposedly targets altered filamin A.

Lecanemab selectively binds to neutralize and eliminate soluble, toxic amyloid-beta (Aβ) aggregates (protofibrils) that are thought to contribute to the neurodegenerative process in AD.

BIIB & ESALY press release, September 27, 2022.

SAVA’s corporate presentation (slide 9) nonetheless suggested that targeting altered filamin A has the potential to address the amyloid pathology. Altered filamin A apparently allows signalling through Toll-like receptor 4 (leading to the release of inflammatory cytokines) and the α7-nicotinic acetylcholine receptor (leading to hyperphosphorylation of tau protein).

Still, even if we say SAVA’s simufilam is completely unrelated to lecanemab, Anavex Life Sciences (AVXL) still closed up 13% on Wednesday despite its Alzheimer’s drug ANAVEX 2-73 binding Sigma-1 receptors, not amyloid-beta. As with simufilam, any link between amyloid-beta and ANAVEX 2-73 is indirect, as targeting Sigma-1 receptors might reduce neurodegeneration which may be caused by amyloid beta in Alzheimer’s disease.

What is more likely causing the issue for SAVA?

A recent rally is still cooling off

In November last year, The Wall Street Journal reported that SAVA was under SEC investigation according to “people familiar with the matter.” Last week (the week beginning Monday, September 19), a letter was circulating, the result of a Freedom of Information Act request, that appeared to suggest the Securities and Exchange Commission (SEC) would recommend closing any investigation into SAVA.

The potential case closing recommendation was also reported on by Benzinga. SAVA then filed an 8-K noting they hadn’t received any “termination letter” as of September 22, which seems to have poured cold water on the rally. Some might still argue that although a case closing recommendation had been made, a termination letter sent to SAVA, which the company could then announce, might be ideal.

On November 15, 2021, Cassava Sciences, Inc. (“the Company “) disclosed that certain government agencies had asked for corporate information and documents. These were confidential requests and remain confidential.

As of September 22, 2022, the Company has not received any “termination letter” or the like from any government agency regarding any confidential requests for corporate information and documents…

SAVA 8-K filing, September 22.

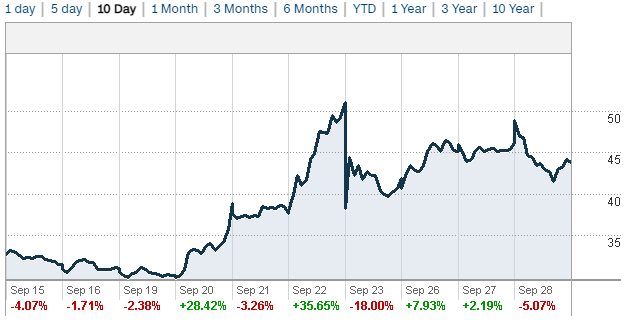

CNN money

Figure 1: Past 10 days of SAVA trading.

That didn’t matter, SAVA had already rallied 35% from an open of $37.92 to a close of $51.06 on September 22. Of course, the stock was back into the $40’s the next day with the 8-K from SAVA. It isn’t clear where SAVA stands now. In the best case scenario for SAVA, if there is any investigation, there is simply a delay between any case closing recommendation and a termination letter being sent to SAVA. That is quite speculative though and it makes sense that the 8-K seemed to deflate the rally.

In any case, on July 27, 2022, Reuters reported that, according to “two people familiar with the inquiry,” the US Department of Justice (DoJ) had opened a criminal investigation into SAVA. Due to a potential DoJ investigation into SAVA, if that is actually happening, I can see how the end of an SEC investigation might not mean much anyway to someone sitting on the side-lines considering whether to go long SAVA or not. Either way, SAVA hasn’t ended up back where it started following the 8-K, and that rally still cooling off might be why SAVA didn’t rally with the rest of the Alzheimer’s space on the BIIB/ESALY news.

SAVA has a long way to go itself

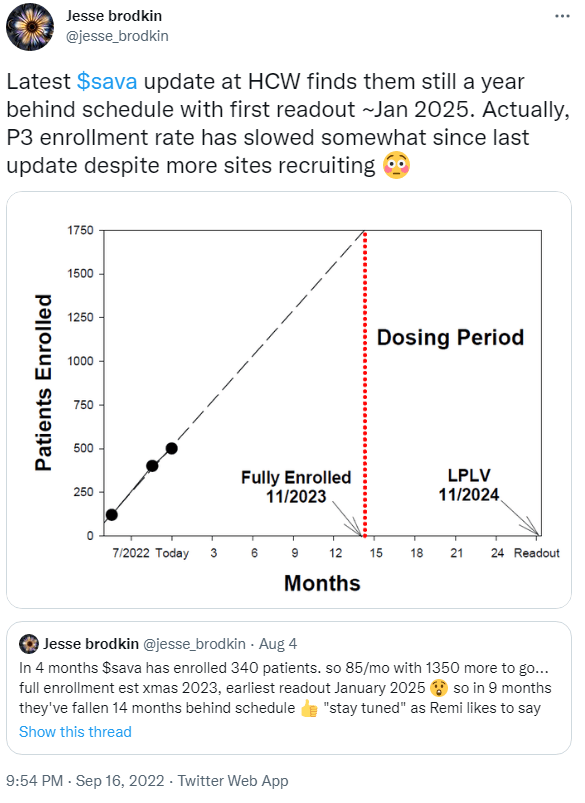

If SAVA longs were hoping the company might follow up on the good news from BIIB/ESALY sometime in the coming years, it might be worth considering just how many years that will take. The most recent update on enrolment numbers was that SAVA had > 500 patients enrolled in its phase 3 studies as of September 13, out of a targeted 1750 patients. At these rates of enrolment, even after SAVA opened more sites, it isn’t surprising to see predicted enrolment and completion of these studies taking until late 2024 or beyond.

@Jesse_Brodkin on Twitter

Figure 2: SAVA bear Jesse Brodkin notes that completion of SAVA’s phase 3 studies could be two years away.

SAVA had $197.2M in cash and cash equivalents as of June 30, 2022, and noted an estimated use of cash in operations of $45-55M in H2’2022. Taking the midpoint of that rate, SAVA would be out of cash in four quarters, by mid-2024. If these studies continue to trend towards taking two years from now to complete, concern over SAVA’s cash balance is certainly relevant, especially if there are any delays. With 40.1M shares outstanding, at $43.84, SAVA has a market cap of $1.76B, and wouldn’t need to issue that many shares to raise another few quarters of cash. Still for those waiting for something definitive on the efficacy of simufilam, readouts from those phase 3 studies are a while away and may require some dilution for SAVA to get there.

Regarding other potential readouts, perhaps SAVA could try to raise funds off the back of the cognition management study it is running, but that study won’t report results until Q3’23. Further, the cognition management study involves randomizing Alzheimer’s disease patients who have already completed 12 months of open-label treatment with simufilam, to continue taking simufilam or begin taking placebo, rather than an entirely new cohort of patients.

Notably, SAVA’s August update on the existing open-label extension (OLE) phase 2 study was not all good news. The results from the first 100 patients completing 12 months of treatment (ADAS-Cog11 improvement of 1.5 points) were not nearly as strong as those seen with the first 50 patients (ADAS-Cog11 improvement of 3.2 points). This suggests that the second set of 50 patients didn’t really improve at all. An absence of pronounced worsening can still be seen as a positive, but the disparity between the first 50 patients evaluated and the next 50 patients is the takeaway for me.

Conclusions

While drug developers in the Alzheimer’s space may have rallied on the news of BIIB/ESALY succeeding in phase 3, SAVA didn’t experience a sustained rally. The company did enjoy a rally last week, but uncertainty still hangs over the stock when we have no press release from SAVA saying it has received a termination letter, and a potential DoJ investigation could be in play. That being said, the DoJ investigation might not exist at all, but then that just means the uncertainty will hang over SAVA anyway because Reuters reported that there was an investigation.

Even if there are no investigations into SAVA, there is still The City University of New York’s (CUNY) investigation into their scientific collaborator’s work and the company still has a long way to go on its own phase 3 studies. If enrolment rates don’t pick up, and instead hold their current trend, it would become more obvious that SAVA might need to raise cash before those studies are complete. Lastly, since SAVA’s most recent clinical update of its own wasn’t really a slam dunk, the OLE data seems to soften a bit with 50 patients more data following 12 months of simufilam treatment, it isn’t all that surprising SAVA didn’t rally. Due to these issues, I’ve marked this article with the “Strong Sell” tag.

With regards to shorting SAVA or any short-biased position, such as buying puts, there are several risks, a few of which are mentioned here. Firstly, future updates from the open-label study could convince some market participants to buy SAVA or cover their short position, causing the stock to rally. Secondly, rates of enrolment in the phase 3 studies could increase, causing the stock to rally. Lastly, SAVA could announce a termination letter has been received from the SEC, or that some other investigation has concluded, causing the stock to rally.

Be the first to comment