alvarez/E+ via Getty Images

Finding a company that can generate continued revenue growth is a great way to get a positive return on your investment as a shareholder. Having said that, there are some things that are more important than increasing sales. At the top of the list would be the cash flow that a particular enterprise can create over its life. Because after all, any company’s true value is only determined by how much cash it can generate for its investors. Unfortunately, one firm that has experienced rising sales as of late but that continues to generate negative bottom line results is Hyster-Yale Materials Handling Inc. (NYSE:HY). In the event that the company sees its financial performance revert back to what it was a couple of years ago, shares might offer a nice bit of upside. But until then, investors would be wise to look elsewhere for opportunities.

Hyster-Yale needs a lift

According to the management team at Hyster-Yale, the company is a leading, globally integrated, full-line lift truck manufacturer. But to leave the description at that would be too vague to truly encapsulate all that the enterprise does. For instance, the firm does offer a wide array of solutions that help customers meet their specific materials handling needs. Examples include attachments and hydrogen fuel cell power products, telematics, automation and fleet management services, And various other power options for its lift trucks. The lift trucks that the company produces, as well as the attachments and aftermarket parts that it markets globally, are mostly sold under the Hyster and Yale brand names, mostly to independent retail dealerships.

The firm also has other assets that it owns. For instance, it currently owns a 90% interest in Hyster-Yale Maximal Forklift, a Chinese manufacturer of low-density and standard lift trucks and specialized material handling equipment. That entity also produces specialized products in the port equipment and rough terrain forklift markets. The company also has the option to purchase the remaining assets of that entity between now and June of 2056 in exchange for $16.8 million. On top of this, the company operates some other entities. One of these is Bolzoni S.p.A., a producer and distributor of attachments, forks, and lift tables. On top of this, it also operates Nuvera Fuel Cells, an alternative power technology company focused on hydrogen fuel cell stacks and engines.

Although the company does have its hands in a lot of different things, it is also true that, based on data from 2021, most of its sales come from the production of lift trucks. 73% of total revenue that year came from this particular activity. Another 15% of revenue came from various parts the company produces. Service, rental, and other activities make up 6% of sales, while Bolzoni does the same. And that leaves Nuvera to account for less than 1% of revenue. When it comes to the lift trucks that the company produces, 42% of revenue is still attributable to those with internal combustion engines. However, the company has been moving in the direction of electric lift trucks which, last year, made up an impressive 31% of sales.

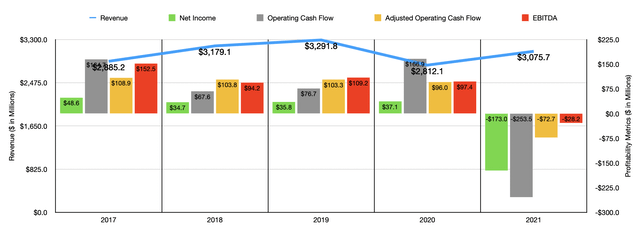

Financially speaking, the fundamental picture for Hyster-Yale has been quite volatile in recent years period between 2017 and 2019, revenue rose year after year, climbing from $2.89 billion to $3.29 billion. In 2020, sales dropped to $2.81 billion before climbing back up to $3.08 billion in 2021. This is understandable given the COVID-19 pandemic. However, the picture when it comes to profitability is more problematic. Net income fell from $48.6 million in 2017 to $35.8 million in 2019. It ticked up slightly to $37.1 million in 2020 before plunging to a negative $173 million last year. A similar trend can be seen when looking at operating cash flow. During the firm’s 2021 fiscal year, cash flow was negative to the tune of $253.5 million. This compares to the positive $166.9 million reported for the 2020 fiscal year. If we adjust for changes in working capital, the picture is still complicated. In fact, in this case, we would see operating cash flow falling for each of the past five years, dropping from $108.9 million in 2017 to $96 million in 2020. In 2021, it was negative to the tune of $72.8 million. A very similar trend can even be seen when looking at EBITDA, with the metric falling from $152.5 million in 2017 to $97.4 million in 2020 before turning negative to the tune of $28.2 million last year.

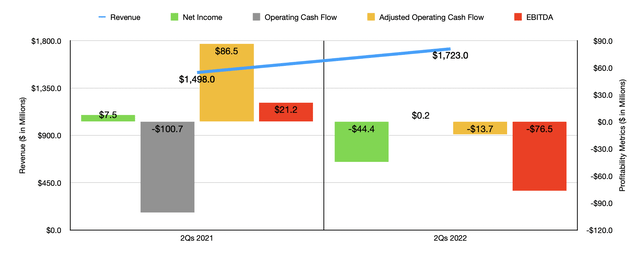

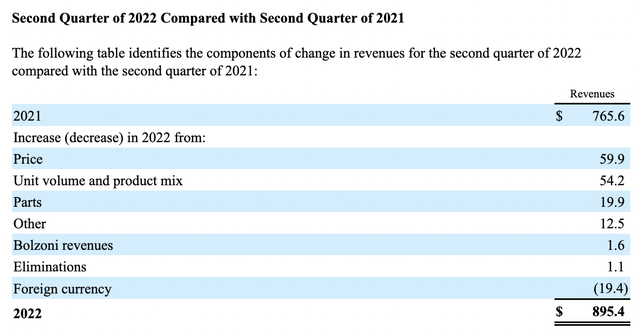

If this bottom line pain had only been temporary and if we were seeing that picture improve, then that might be excusable. But that’s not the case here. In the first half of the company’s 2022 fiscal year, revenue came in at $1.72 billion. That’s 15% higher than the $1.50 billion reported one year earlier. This surge in revenue was driven largely by a 23% increase in revenue associated with its lift truck operations in the Americas. Pricing certainly helped the company, but the firm also benefited to the tune of 12.6% from a rise in shipment volume. Although there were other contributors to the sales increase, none of them were anywhere near as significant as what we saw in this region.

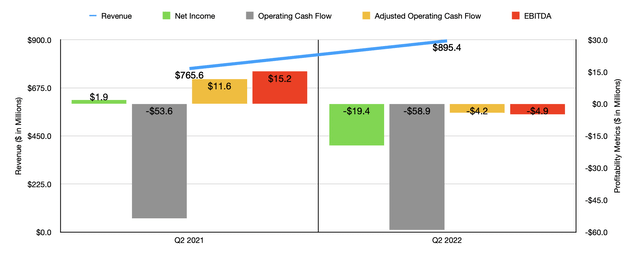

Author – SEC EDGAR Data Author – SEC EDGAR Data

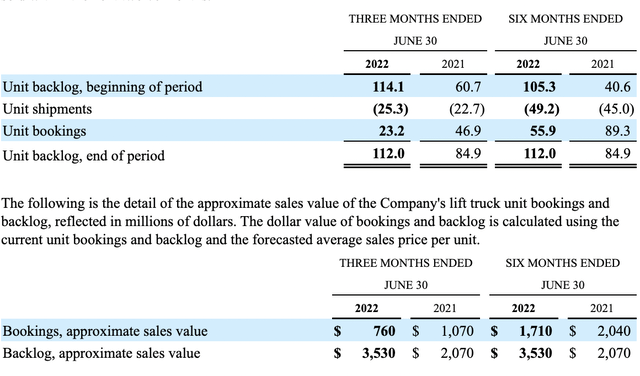

Even in spite of this significant improvement, the company saw its backlog figures continue to grow. At the end of 2020, the firm had $1.07 billion worth of backlog amounting to 40,600 units. Backlog exploded to $2.88 billion in 2021 as the number of units produced rose to 105,300. By the end of the second quarter of this year, backlog expanded further to $3.53 billion. That’s up from the $2.07 billion experienced one year earlier and it amounts to 112,000 units on order. This is not to say, however, that everything is great for the enterprise from a sales perspective. Although backlog is rising, the value of bookings is decreasing. In the first half of the 2022 fiscal year, the company saw bookings amount to just $1.71 billion. That’s down from a $2.04 billion reported one year earlier. This, in turn, was driven by unit bookings dropping from 89,300 to 55,900. This kind of weakness occurred in both the first quarter of the 2022 fiscal year and the second quarter. But by far the greatest weakness was in the second quarter, with bookings of $760 million coming in far lower than the one point 07 billion dollars reported the same time last year. Bookings in that quarter have plunged by 50.5%, dropping from 46,900 units to 23,200. This likely has to do with the portion of revenue from the company that came from price increases. On a constant currency basis, sales at the business in the second quarter compared to the same time last year were $149.2 million higher. Of this, $59.9 million was associated with price increases for its lift trucks.

Hyster-Yale Materials Handling Hyster-Yale Materials Handling

In addition to seeing some weakness on the top line, the company is also experiencing some issues with profitability. Net income in the first half of the 2022 fiscal year was negative to the tune of $44.4 million. This compares to the $7.5 million profit achieved one year earlier. Operating cash flow did improve, going from negative $100.7 million to positive $0.7 million. But if we adjust for changes in working capital, it would have gone from $21.2 million to negative $13.7 million. And over that same window of time, EBITDA also worsened, dropping from $86.5 million to negative $76.5 million.

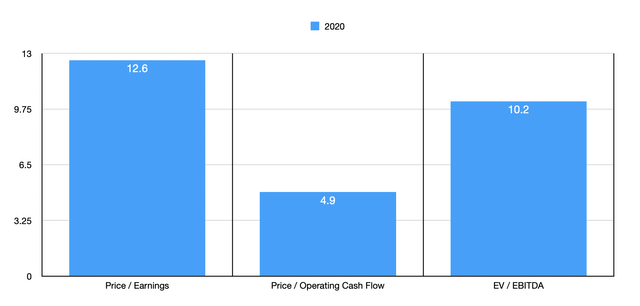

Truth be told, it’s really difficult to understand what kind of value might exist here. You can’t really value a company with negative cash flows and earnings. And it seems clear to me that the rest of the 2022 fiscal year we’ll see both of these worsen compared to last year. In a best-case scenario, if financial performance were to revert back to what it was in 2020, shares would look quite attractively priced. The price-to-earnings multiple would be 12.6. The price to adjusted operating cash flow multiple would be 4.9, while the EV to EBITDA multiple would come in at 10.2. Using data from 2020, I looked at two similar firms. And as you can see in the table below, Hyster-Yale would be the cheapest of the three across the board. But again, this assumes that financial performance will eventually recover.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Hyster-Yale Materials Handling (2020) | 12.6 | 4.9 | 10.2 |

| Crane Holdings Co (CR) (2020) | 25.3 | 14.8 | 13.4 |

| Columbus McKinnon (CMCO) (2020) | 103.9 | 8.5 | 18.2 |

Takeaway

In some respects, Hyster-Yale looks like it could be a great prospect. Revenue is rising and backlog is growing as well. Having said that, everything else about the company is problematic. Cash flow and earnings are both negative and trending lower. Bookings data suggests that the market is weakening for this enterprise. That is not a great situation to be in if we truly are heading into an economic downturn. And any sort of valuation is predicated on the idea of the company returning back to the kind of health that it was in prior years. And even in that case, it’s not like shares would look incredibly cheap. Because of these uncertainties, I do think that a ‘sell’ rating, reflective of the idea that the company should underperform the broader market for the foreseeable future, would be appropriate at this time.

Be the first to comment