noel bennett

Introduction

Philip Morris International Inc. (NYSE:PM) is a relatively unagitated stock with moderate volatility, reliably growing cash flow through dividends, but poor overall performance in recent years. Its moderately high yield makes it a favorite among investors who rely on income-generating assets. For most of 2019 and 2020, Philip Morris shares traded at a very attractive valuation and a correspondingly above-average dividend yield of up to 7.5%. After these trough years, investors have increasingly turned to “safe assets”, such as value stocks with good current earnings. As a result, Philip Morris’ stock traded in the $100 range during most of 2021 and the first half of 2022.

PM’s $16 billion cash offer for Swedish Match (OTCPK:SWMAY, OTCPK:SWMAF), which would certainly make PM the king of smoke-free nicotine products, helped the stock regain its earlier high in the $105 to $110 range. However, growing doubts about the deal’s viability, the company’s withdrawal from Russia and an overall weak market environment have sent the stock back to the low $90s, which could be considered “value territory”.

The company will report its second-quarter results tomorrow, so I would like to share with you my thoughts on the Swedish Match transaction in particular and on investing in the company at this time in general.

The Takeover Bid – Will Philip Morris Increase Its Offer?

PM offered $16 billion to acquire Swedish Match, the king of oral nicotine products with its flagship product line Zyn. According to PM’s May 11, 2022 presentation, the oral nicotine pouch segment is a $2 billion global category with approximately 50% share in the US. Global category volume growth of 65% in 2021 was most likely a major factor that sparked PM’s interest in Swedish Match, same as is the company’s 40% share of the category (globally, by volume). In the U.S., Swedish Match controls about 64% of the category’s market share by volume. Margins are understandably very high (45% in 2021), and cash flow from operations has grown at a compound annual growth rate (CAGR) of 20% since 2018. Capital expenditures appear to have stabilized at around 20% of operating cash flow in 2020. The $16 billion offer represents a free cash flow yield of around 3%, which seems quite compelling given Swedish Match’s leading position, strong growth, and profitability. From an enterprise value perspective, the valuation also appears to be in order, as Swedish Match is a conservatively financed company (total net debt in 2021 of SEK 13 billion, or about $1.3 billion).

The acquisition would make PM and Altria (MO) direct competitors. PM’s entry into the U.S. market through Swedish Match could result in the company marketing its “heat-not-burn” IQOS product line itself, potentially using Swedish Match’s distribution capabilities. Altria and Philip Morris International disagree over whether the goals associated with the initial marketing of the product in the U.S. have been met. The outcome of this dispute could have lasting implications, as the exclusive marketing agreement can only be extended for an additional five years at Altria’s option if the performance targets are met.

As a PM shareholder who viewed Swedish Match with a bit of envy but did not invest due to the cumbersome Swedish withholding tax reclaim process, I actually welcome the takeover offer as it would make me a part owner of this great company and save me bureaucratic hassle. However, given the valuation and PM’s stronger position as a result, it is not surprising that several major investors have opposed the takeover and activist Elliot Investment Management has even begun building a stake in Swedish Match. This makes it much more difficult for PM to get 90% of the voting power in favor of the deal.

As a result, the market’s optimism has waned in recent months, and PM shares are now trading at levels where the deal had not yet been announced. Personally, I am still optimistic about the deal, but would expect PM to increase its offer, which does not seem unreasonable given PM’s financial flexibility (see below) and also Swedish Match’s capital structure.

Reasons Underlying Philip Morris’ Premium Valuation

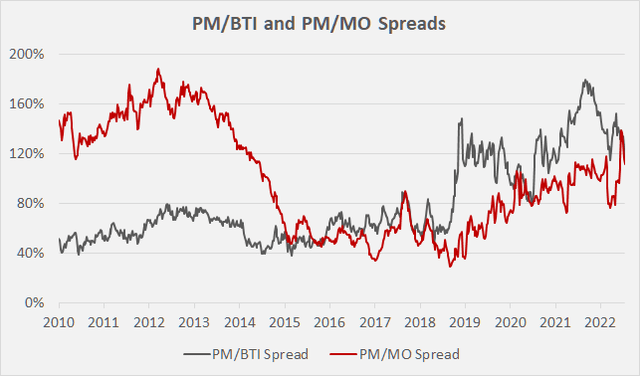

Philip Morris shares have traded, and continue to trade, at a premium to their major peers British American Tobacco (BTI, OTCPK:BTAFF) and Altria. Since 2018, PM has appreciated in value relative to BTI and MO (Figure 1). Moreover, PM is currently trading at a significant premium to its peers not only from the perspective of share price spreads, but also a number of other metrics such as price-to-earnings ratio, free cash flow yield, enterprise value to EBITDA, and dividend yield. There are several reasons for this valuation gap.

Figure 1: Spread between PM and BTI, and PM and MO; note that BTI’s share price in USD incorporates exchange rate fluctuations, as the stock’s original shares trade on the London Stock Exchange (own work, based on the companies’ weekly closing share prices since 2010)

Philip Morris International has been insulated from U.S. regulators since the spinoff from Altria in 2008. Concerns about a possible ban on menthol in the U.S. and the FDA’s plan to reduce nicotine content in cigarettes to non-addictive levels have contributed to the stock’s relative outperformance. British American Tobacco owns the number one menthol cigarettes brand in the U.S. (Newport), and Altria’s position in the reduced-risk segment is relatively weak (also taking into account the proposed ban on JUUL products), which may make it overly sensitive to decisions related to the aforementioned regulatory initiatives.

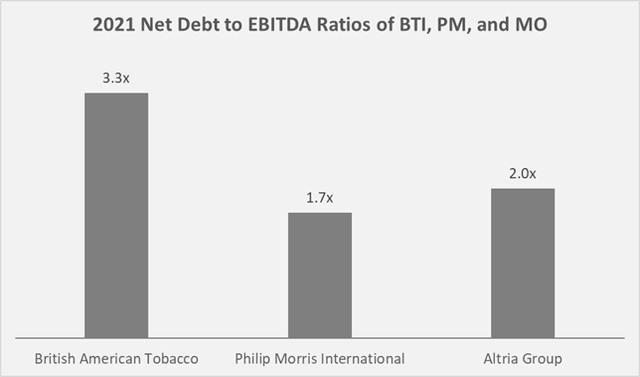

Secondly, PM is far more moderately leveraged than its other major international competitor BTI, even though its balance sheet looks anything but conservative at first glance (its equity is negative). At 1.7 times EBITDA, PM’s net debt is indeed very manageable (Figure 2), and its interest coverage ratio is also very reassuring at almost 15 times 2021 free cash flow. British American is still working to reduce the large amount of debt it incurred when it acquired Reynolds American Inc. in 2017. Altria took on significant debt to fund its acquisition of a 35% stake in JUUL Labs for $12.8 billion in 2018; however, leverage has already fallen significantly due to earnings growth and debt reduction. The fact that the transaction turned out to be an absolute disaster is a story in itself. I have covered Altria in detail in articles published in late April and mid-May.

Figure 2: Leverage ratios of BTI, PM, and MO (own work, based on the companies’ 2021 annual reports)

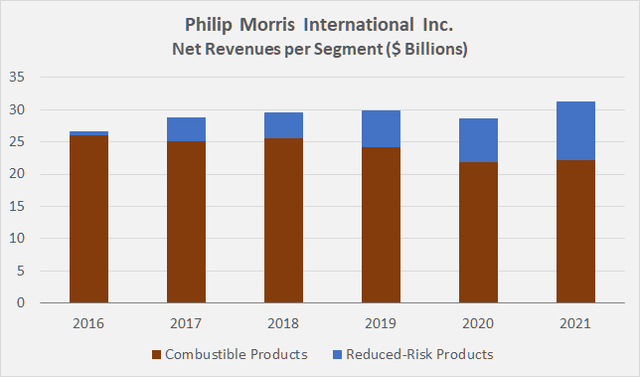

PM has an ambitious target of generating more than 50% of its net revenues from smoke-free products by 2025. The planned acquisition of Swedish Match is an important step on PM’s path, which should further reduce the risk of government interventions against the tobacco company. Other recent takeover bids and acquisitions, such as those of Vectura Group (manufacturer of innovative inhaled drug delivery solutions), OtiTopic (respiratory drug development company), and most recently Fertin Pharma (manufacturer of pharmaceutical and wellness products based on oral delivery systems), confirm that the company is strongly focused on diversifying away from traditional cigarette sales. The shift is also reflected in the company’s 2021 net revenues, 29% of which came from risk-reduced products, compared with 24% and 19% in 2020 and 2019, respectively (Figure 3).

Figure 3: PM’s net revenues per segment (own work, based on the company’s 2016 to 2021 annual reports)

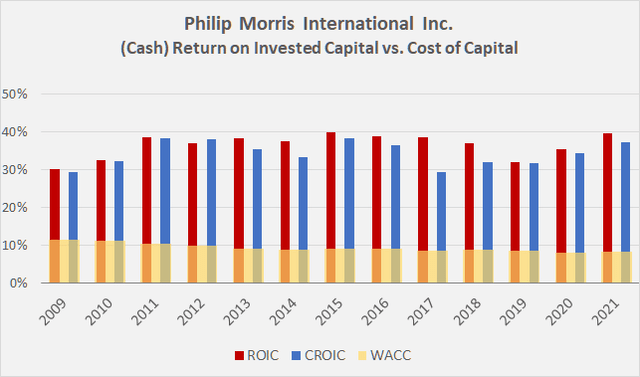

Finally, PM is a highly profitable company that continues to outperform its peers by a wide margin. Investors in tobacco companies rightly expect high returns on invested capital, both from the perspective of after-tax net operating income (ROIC) and free cash flow (CROIC), because input costs and capital expenditures are generally low and the industry can be characterized as an oligopoly without much requirement for advertising. In fact, cigarette advertising is highly regulated or outright banned in many countries around the world. As shown in Figure 4, Philip Morris has managed to generate a substantial excess ROIC and CROIC since 2009, i.e., well above the weighted average cost of capital based on a 10% risk premium. From an academic perspective, only ROIC should be compared to WACC, and profitability ratios based on free cash flow should be compared to cost of equity. However, given the magnitude of PM’s excess returns, this inaccuracy can be safely ignored. By comparison, Altria’s ROIC is typically in the high 10% to low 20% range, while BTI has barely been able to generate excess returns above its cost of capital in recent years.

Figure 4: PM’s (cash) return on invested capital compared to its weighted average cost of capital, assuming an equity risk premium of 10% (own work, based on the company’s 2009 to 2021 annual reports)

I am a long-time Philip Morris International shareholder and applaud the company’s significant and successful efforts in transforming its portfolio to reduced-risk products. The products offer consumers lower-risk products and also reduce the risk of government interventions, which typically target traditional cigarettes. In addition, several reduced-risk products offer higher profit margins than traditional cigarettes, which should help the company maintain or even expand its excellent profit margins (gross margin in the 60% range, free cash flow margin in the 30% range). In addition, as mentioned above, PM’s likely re-entry into the U.S. market via Swedish Match will open up new growth opportunities in a traditionally high-margin market.

Why Philip Morris’ “Safe Haven” Status Should Not Be Overestimated

Particularly given PM’s ambitious target, the company’s efforts in oral nicotine products, and the IQOS product line in particular, are not surprising. Competition from BTI’s Glo is fierce, and marketing of PM’s product in the U.S. has been off to a rough start, due in part to ongoing patent disputes.

Besides acquisitions, there are significant additional costs associated with the portfolio transition. The cost of marketing, administration and research (MAR) have increased from $5.9 billion in 2009 to $8.3 billion in 2021. Over the years, asset turnover has remained stable and working capital management has improved, as evidenced by a steady increase in days sales outstanding (28 days in 2009, 111 days in 2021), stable inventory days (approximately 320 days), and stable days sales outstanding (approximately 43 days). However, given the slow net sales growth (2009-2021 CAGR of 1.2%), it is not surprising that the company has had to improve its gross margin to offset rising MAR costs. Given the current environment, further gross margin expansion seems unlikely, while MAR costs are likely to remain high for the foreseeable future.

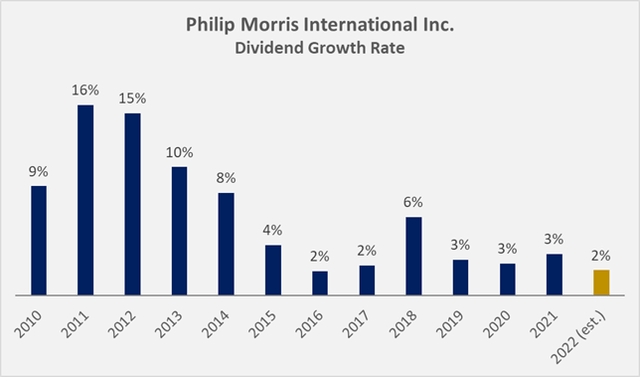

The company’s free cash flow grew between 2009 and 2012, followed by a decline until 2017. Since that year, free cash flow has grown at a CAGR of over 8%. Dividend growth has slowed in recent years, which does not seem entirely understandable given the strong free cash flow growth. Management remains focused on transforming the portfolio, and while it indicated during the recent conference call related to the Swedish Match transaction that the dividend will continue to play an important role, it could be sensed that investors will likely have to accept relatively modest increases going forward. With a current dividend yield of 5.5% and assuming long-term dividend growth of 3%, investors would have to wait 15 years to reach MO’s current yield (8.4%). BTI’s current yield (6.2%) would be reached after five years if dividends are not reinvested. Given the slightly declining payout ratio due to share buybacks and expected free cash flow growth, as well as the generally solid balance sheet, I believe the dividend is very safe. However, from a historical perspective, the shares are only fairly valued, while Altria’s shares are significantly undervalued, which is, of course, a reflection of the company’s geographic concentration risk.

Figure 5: PM’s dividend growth rate, based on the dividends declared during each calendar year (own work, based on the company’s 2010 to 2021 annual reports and own estimates)

Finally, Philip Morris will exit its operations in Russia in response to the country’s invasion of Ukraine. Russia and Ukraine are important revenue sources, and their assumed permanent loss will likely result in a 6% decline in operating profit. It should also be noted that both countries have been important growth drivers for IQOS and management could be criticized for overly relying on these markets. Assuming that the situation in Russia and especially Ukraine does not improve at some point in the future seems conservative, but I find it very difficult to assign a probability to a positive outcome. Therefore, I do not expect the company to resume operations in Russia, while a recovery of sales in Ukraine is likely to take a long time. Of course, British American Tobacco is also affected by the developments in Russia and Ukraine.

Conclusion

Philip Morris deservedly trades at a substantial premium to Altria, due to the much lower regulatory risk, much stronger reduced-risk products portfolio, and potential untapped growth markets. However, I believe that Altria’s current valuation reflects the risks more than adequately. At the current share price and as an income investor, I would prefer PM over BTI if I had a choice, as BTI’s dividend yield is only marginally higher and I do not think the market is very conservative right now when it comes to factoring in the increased risk associated with the U.S. business and much greater leverage.

However, I would not overemphasize the perceived “safe haven” character of PM. The Swedish Match deal has encountered resistance and its failure could delay or endanger PM’s ambitious transformation. In addition, further acquisitions carry integration risks, and the company has placed a strong emphasis on Eastern European countries in marketing its IQOS product line – efforts that have likely been largely in vain.

In part due to the comparatively low yield and the expected below-inflation dividend growth for the foreseeable future, income-oriented investors who do not already own tobacco stocks might want to consider owning all three companies, or probably BTI and PM, if two companies with solid reduced-risk product portfolios are preferred.

However, given that the market currently offers a number of solid opportunities – with comparatively lower dividend yields but much better growth prospects – I am not particularly enthusiastic about adding to my position in PM. As a well-managed company with reliable cash flow, I consider it a long-term hold.

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment