bfk92

ZIM Integrated Shipping (NYSE:ZIM) has fallen 50% in the last two months since I last covered the company. Over the same timeframe, the S&P 500 fell 17%. However, ZIM’s drop was certainly more dramatic. And not entirely undeserved, as freight rates have accelerated their decline as the macroeconomic situation remains bleak. Despite this, ZIM now offers an even higher nominal yield and is trading at levels not seen since shortly after its IPO. Could this cheap share price mean ZIM is still an attractive investment?

Freight Rates Cratered, Will ZIM’s Earnings?

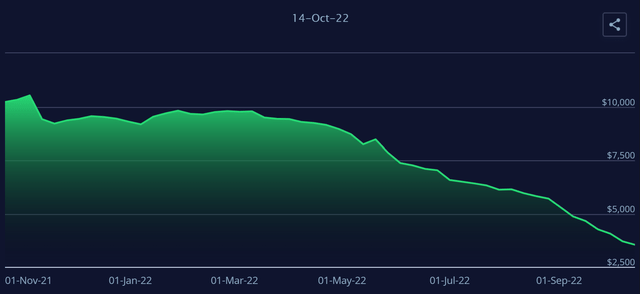

When I last covered ZIM, I was forecasting the company’s potential earnings based on a theoretical slide in freight rates from what was then $5,820 to $4,500 per forty-foot-equivalent unit (FEU). Since then, rates have slid even further to $3,540 with little sign of stopping.

Global Container Freight Index (Freightos Baltic Index (FBX))

To be quite frank, freight rates have dropped much lower, much quicker than I expected. For a company, like ZIM, that is very spot-dependent, this is not good. However, this is not a game-ending crash. ZIM was still profitable even at sub-$2,000 levels in 2020, earning $144.4 million in the third quarter. The fourth quarter for ZIM is also more likely to look like the fourth of 2020 when rates rose from around $2,000 to $3,500.

Global Container Freight Index (Freightos Baltic Index (FBX))

However, ZIM is also working with much higher operating costs now, thanks to fuel prices and more expensive charters. This does not foreclose profitability at the aforementioned levels, but the company’s breakeven point is likely a bit higher. Though it also has a much larger fleet earning revenue.

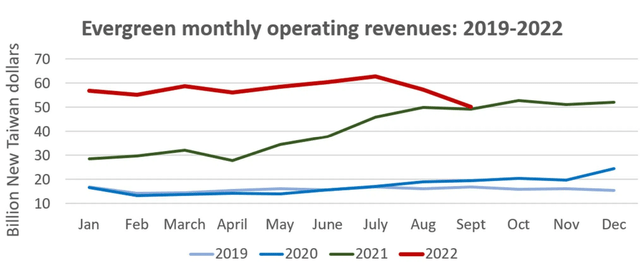

Drawing from other shipping companies, like Evergreen, that report monthly revenue, there has been a drop in August and September, but we are still well above pre-2021 levels.

In short: ZIM’s revenue is preparing to drop. So will its income. But that doesn’t mean the company is going to be unprofitable. ZIM is still well-positioned to profit even at the current level that freight rates are at. The big unknown is how much further rates can drop and whether rising fuel prices and more expensive charters will undermine the company’s profitability.

We may see some freight market stabilization in 2023 with the integration of shipping into the European Union Emissions Trading System and new IMO emissions standards that could trigger further slow steaming and scrapping of older vessels. At the same time, a significant number of new vessels are projected to hit the water in 2023, which will increase the overall supply. In the end, it may come down to a question of the larger economy.

Is ZIM Integrated’s Dividend Safe?

Yes and no. ZIM will probably continue paying a dividend if the company is reasonably profitable. However, the payout is not going to be nearly what it has been. Pessimistically, the company may be back to earning $1 billion per year (or the average of Q3 and Q4 of 2020). That would give investors a payout of between $300-500 million. At a current market cap of $3 billion, you would still receive a 10-17% yield, which is not bad at all. But it’s no “screaming buy 80% yield” of the past. Additionally, as the company plans fleet growth, there may be greater pressure for the dividend payout to be at the lower end of its 30-50% range.

Again, these are fairly pessimistic numbers based on a longer-term estimate of the company’s profitability in consideration of the current economic environment. This is not a dividend estimate for the next quarter. ZIM will pay out more than the above amount for the third quarter. But that doesn’t tell us whether the company makes a good investment, maybe a good short-term trade.

ZIM Share Price Plummeted, Are Shares Cheap?

Shares are cheap. I think that, as outlined above, ZIM could pessimistically be earning $1 billion per year if rates hit $2,000. This would give the company a price-to-earnings ratio of 3. More than the 0.64 forward PE ratio based on $40.04 in earnings, but still cheap. ZIM’s shares have looked like catching a falling knife for some time now and it is unclear whether they will continue to fall. But it is clear that the company is cheap. Its assets are essentially unencumbered (though it has most of its ships on lease) and the company has nearly $1 billion in cash. Counting its $2.5 billion in short-term investments, ZIM has more money in the bank than its market cap. And the company is still posting strong free cash flow each quarter. As a result, I can only conclude that shares are in fact, yet again, cheap. But that does not necessarily mean they will not continue to fall.

Takeaway

ZIM is a complicated investment. The company has essentially zero debt and more cash in the bank than the market cares to value it for. Plus it is still paying a very generous dividend. At the same time, the company’s business is linked to a volatile freight rate that has been falling sharply for months now and nobody is sure when it will stabilize. With all this in mind, I think that ZIM is still a buy at this rock-bottom price, but it is a high-risk play when cutting so heavily against the momentum of the market. Though the company would be smart to keep a healthy cash reserve, deploying cash for a buyback on the third quarter conference call could be the kick the company’s stock needs. And the company has the cash for it.

Be the first to comment