stockcam

After my previous article about how I think that the bottom is in for Netflix (NASDAQ:NFLX), this article aims to provide updates on the company ahead of its 3Q22 results.

Investment thesis

I have previously written articles on Netflix that can be found here. I continue to have confidence in the investment thesis for Netflix. I think that the expectations and sentiment around the company is particularly negative, and that the market concerns are overblown. I think that Netflix continues to remain attractive given that it has a business model that is expected to generate substantial free cash flows in 2022 and beyond. Furthermore, management guided that content costs will be flat in the near-term, which will imply that we will see free cash flows accelerate in the years to come as the business benefits from the large content investments made in the past. In addition, I think that we are starting to see some stabilisation trends in terms of Netflix maintaining its leadership position in the streaming market, as well as improving fundamentals on global app downloads. The second quarter results positive beat does also imply that we could see a beat on low expectations in the coming 3Q22 results. Lastly, I think that we will see success in the 2 new initiatives for the company as it looks set to monetise the many shared accounts on the platform, as well as introduce advertisement supported tier in November 2022, and these initiatives will drive long-term revenue and profitability for the company.

Stabilising trends

The most important thing right now for Netflix is subscriber growth and more concrete details on its new initiatives.

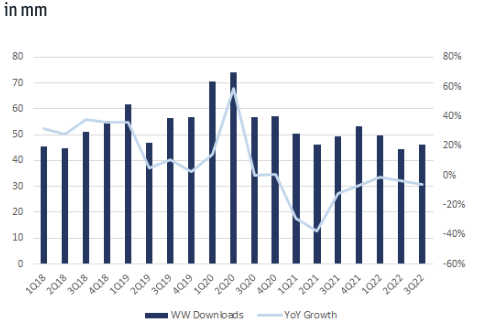

Based on Sensor Tower data, we can see that in 3Q22, there will likely be a slight decrease in Netflix app downloads globally. This, in my view, seems to also be a slowing down in the decrease in global downloads as things looks to be stabilising. As a result, I think that this might signal a potential turnaround situation for Netflix as it seems that the worst of the decline in subscribers has been experienced.

Netflix Worldwide App Downloads (Sensor Tower, Goldman Sachs)

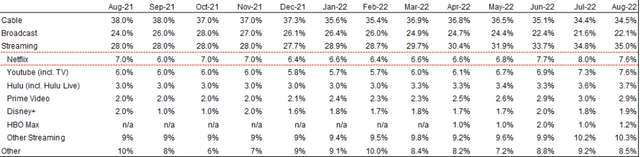

Below, we can see the market share data of streaming companies compared to cable and broadcasting companies. One clear trend is the continued market share growth in streaming as the new way to watch content as market share increase from 31.9% at the end of 2Q22 to around 35% in August 2022. Netflix remained the top player amongst streaming companies, and while market share continues to gain, we also see increasing competition from other players in the market like Amazon’s (AMZN) Prime Video and Disney’s (DIS) Disney+. I think that it’s good that based on the data, we see that Netflix continues to maintain its lead over the market and continue to gain share, especially in July 2022.

US streaming market share (Nielsen, Goldman Sachs)

Lessons from 2Q22 results

I think that a recap of the company’s 2Q22 results could provide us with a better perspective of what might be coming for the 3Q22 results. First, Netflix posted a better than expected subscriber loss of negative 1 million compared to the guide of negative 2 million. Second, another bright spot is that the management did provide more details on their advertising supporting tier, and also brought along with it positive commentary about the company’s longer term revenue and profit situation. Third, I thought it was also positive for the business that content costs were expected to remain relatively flat at $17 billion in the next few years.

However, challenges remain as the revenues for 2Q22 came in slightly lower than expected due to the APAC and EMEA regions, and for 3Q22, they guided for an expectation that there will be larger headwind impact on revenues, impacting about 7 percentage points of revenue growth and also 26 percentage points of EBIT growth. In addition, we continue to hear about the macro factors that remains to be a headwind for its business like inflation, competition and geopolitics, that hampers future growth.

In addition, management continues to expect that free cash flows will come in around $1 billion, subject to material impact from foreign exchange. I think that we will continue to see a self-funding business model as Netflix will likely remain positive free cash flow in the future as it continues to increase its revenues, bring strong profitability, and leverage on its investments it has made over the many years in operation.

Strong prospects from advertisement supported tier pricing

Netflix announced that the pricing for its advertisement supported tier, at $6.99 in the United States, which is about 30% discount from the basic tier without the advertisements. The advertisement supported tier will also be launched in 11 other markets, with a similar 30% discount from the basic tier without advertisements. The advertisement supported tier will be launched in these 12 markets in November. In my view, the new advertisement supported tier will be accretive to its long-term revenues and profitability but it could take some time for the business to scale.

I estimate that the new advertising supported tier can provide 10% in revenue growth to the company’s revenues. This takes into account a portion of existing customers in the current basic tier that might want to downgrade into the advertisement supported tier, new customers this new tier will attract as well as the expected lower churn as a result of the different variety of plans on the platform. As elaborated before, the advertisement supported tier will be mainly focused on attracting price sensitive customers that do not mind having advertisements. That said, 2023 could be a transition year as it starts to roll out the new advertisement supported tier as it will likely experience pressures on the foreign exchange front and also with regards to having some upfront costs incurred.

Valuation

Netflix trades at a significant discount to its 5-year P/E range, as the company is trading at 20x 2023 P/E at current levels. While competition is something that has increased in the past few years, I think that Netflix does look more like a more sustainable and self-funding company compared to 5 years ago. Furthermore, if its new growth initiatives succeed, we could see Netflix having a higher growth profile in the future.

My target price is based on an equal weight P/E multiple method as well as a DCF method. I assume 2024F P/E of 22x, while I apply a discount rate of 12% and terminal multiple of 15x. I think that the multiple already incorporates the near-term lower growth we will see for Netflix given the difficult macroeconomic environment.

My 1-year target price for Netflix is $281. This implies an upside of 22% from current levels and I maintain my buy rating for the company.

Risks

Risks of subscribers miss

As elaborated above, one of the key metrics market looks at right now is the ability to outperform subscriber expectations. While I argue that there have been low expectations set for subscriber growth, if the company faces further headwinds in the quarter, we may see the company once again miss subscriber guidance. If so, this will lead to downside revisions in the company’s forecasts as the market remains uncertain about the direction in which subscriber numbers are heading.

Competition

One of the reasons for Netflix’s slower growth profile today is the rise of the many other streaming platforms that compete directly with Netflix. In the past, as a pioneer in the streaming space, Netflix was the first in the industry with no material competition as it provided the best content with the content investments it made. However, today, there are many other deep pocketed companies like Amazon, Disney and even Apple (AAPL) that have entered the streaming space. This leaves Netflix needing to fight for market share as consumers today have a wider range of streaming platforms to choose from. I have incorporated the risks of competition, including slower growth and lower margins in my forecasts, but there remains risk that competition may drag Netflix’s growth and margins down even further.

Deterioration of the macroeconomic environment

Netflix’s estimates may need to be revised downwards if the global macroeconomic environment softens or if consumer sentiment weakens. The macroeconomic environment will affect streaming platforms like Netflix as consumers reduce discretionary spending and consolidate the number of streaming platforms that they subscribe with. Arguably, the advertisement supported tier may help in a weak economy, but management will take time to roll out the new advertisement supported tier which could lead to loss in subscribers and revenues in the meantime if the economy weakens.

Content costs

I would emphasise that the company has already guided a flat content cost expectation for the next few years. That said, I think that there could be a risk of needing to spend more on content to compete with its rivals as other players start to spend more on content to churn out quality movies and films. As a result, if Netflix one day needs to match the spending levels of its competitors and churn out better content, this may lead to an impact on its free cash flow position.

Price hikes

I think that there could be a reduced scope for Netflix to raise prices in the near-term, especially so if the macroeconomic environment weakens. As a result of tighter consumer pockets, this means that raising prices for its subscription could lead to a relatively more loss in subscribers and lead to a net loss situation. This could be detrimental to Netflix in the near-term if price hikes are now out of its playbook.

Conclusion

In the coming 3Q22, I think we need to watch for subscriber numbers as well as more details on the monetisation of shared accounts. With the recent announcements for the advertisement supported tier pricing and launch in 12 markets, I think this could drive greater interest in Netflix as investors will be curious about the potential benefits the business could see from the new advertisement supported tier. In addition, we are seeing stabilising trends for Netflix’s market share as well as app downloads globally, which will likely further improve with the new advertisement supported tier. Lastly, we saw I’m the 2Q22 results that expectations were too low for subscriber numbers and we could see a similar beat on subscriber numbers as we head into 3Q22. More importantly, the company continues to be on track to reach $1 billion in free cash flows in 2022 and this will continue to accelerate in the future, in my view. My 1-year target price for Netflix is $281, implying an upside of 22% from current levels.

Be the first to comment