Justin Sullivan/Getty Images News

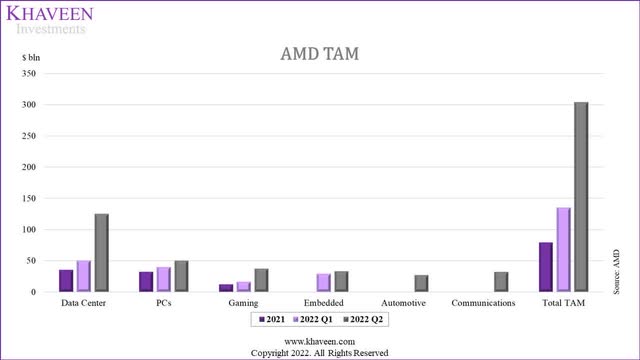

Based on Advanced Micro Devices, Inc’s (NASDAQ:AMD) recent Financial Analyst Day 2022, we identified three major updates to the company including the acquisition of Pensando, its updated TAM from $135 bln to $304 bln within the next 5 years and its integration with Xilinx with updated revenue opportunities of $10 bln according to management.

Thus, we first looked into its acquisition of Pensando at a cost of $1.9 bln and identified potential benefits to the company including performance, portfolio expansion, competition and revenue growth. Moreover, we also estimated the potential revenue synergies by leveraging AMD’s key customers.

We analyzed the company’s TAM as it had increased significantly from $304 bln to $135 bln. Based on its breakdown by end markets including Data Center, PC, Gaming, Embedded, Automotive and Communications, we forecasted its revenue opportunity based on its share of TAM by end market.

Finally, we examined its integration with Xilinx following the deal completion in Q1 2022, and followed up on our previous analysis of the acquisition of Xilinx and the potential benefits we saw such as product integration and cross-selling with its data center customers. With management’s updated revenue synergies, we updated our revenue projections for Xilinx’s revenue through 2025.

Acquisition of Pensando Boosts Revenue by 2%

In May 2022, AMD completed the acquisition of Pensando Systems for $1.9bln which is a P/S of 17.27x based on its estimated revenue of $110 mln. We believe the acquisition could benefit the company in 4 ways which are:

- Increase performance of AMD’s products

- Expands AMD’s Data Center product portfolio with a fuller stack

- Stronger competition against Intel and Nvidia

- Boost its revenue growth

According to AMD, Pensando’s distributed services platform will expand AMD’s data center product portfolio with a high-performance data processing unit (DPU) and software stack that is deployed at scale across cloud and enterprise customers. According to Nvidia, a DPU-based SmartNIC is a “network adapter that accelerates functionality and offloads it from the server (or storage) CPU” and improves overall system performance.

The data center remains one of the largest growth opportunities for AMD. The addition of the Pensando Systems team with their hardware and software portfolio will enable us to offer cloud, enterprise and edge customers a broader portfolio of leadership compute engines that can be optimized for their specific workloads, – Chairman and CEO Dr. Lisa Su.

With the acquisition of Pensando, the company adds distributed services platform to the company’s portfolio of CPU, GPU, FPGA, and adaptive SoC for its cloud, enterprise and edge customers and expands its portfolio with a fuller stack for data centers.

Pensando’s leadership DPU complements our data center product portfolio, enabling AMD to offer solutions that can significantly accelerate data transfer speeds while providing additional levels of security and analytics that will play a larger role in defining the performance of next-generation data centers. – AMD

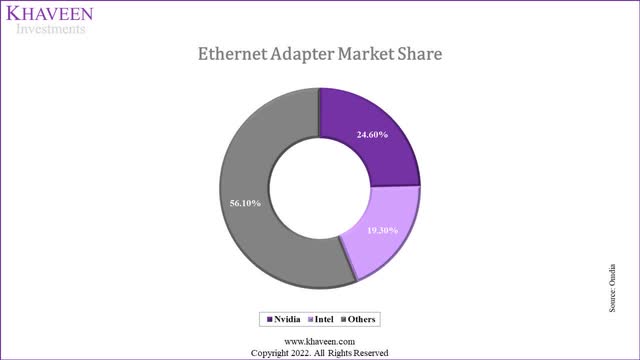

Furthermore, the acquisition of Pensando enables the company to compete against Intel (INTC), Nvidia (NVDA) and Marvell (MRVL) according to Moor Insight & Strategies. In 2019, Intel acquired Barefoot Networks, a chipmaker for switches. Nvidia’s smartNIC technology is the programmable BlueField DPU. According to Omdia, Intel was the second largest company in the Ethernet adapter market with a share of 19.3% in 2020 trailing behind Nvidia through its Mellanox acquisition as the market leader with a 24.6% market share. In terms of product specifications, Pensando’s Elba DPU is capable of delivering up to 400 Gbps of connectivity which is on par with Nvidia BlueField 2 and ahead of Intel’s Mount Evans DPU with 200Gbps.

Expert Market Research forecasted the ethernet adapter market to grow at a CAGR of 33.5% through 2026 to a market size of $12.2 bln. To forecast the company’s synergies, we expect the company to derive revenue synergies from leveraging AMD’s key customers of 31 cloud services providers, server hardware partners and enterprise customers in comparison to Pensando’s customers which include Microsoft Azure (MSFT), IBM Cloud (IBM), Oracle Cloud (ORCL), Equinox (EQX), HP (HPQ), Dell (DELL), NetApp (NTAP) and Goldman Sachs (GS). We divided Pensando’s revenue by its key customers (8) and multiplied it by AMD’s key customers (31) to derive a total revenue synergy of $426 mln which we prorated through 2025.

|

Pensando Revenue Forecast ($ mln) |

2022F |

2023F |

2024F |

2025F |

|

Pensando Revenue |

110 |

146.9 |

196.0 |

261.7 |

|

Growth % |

33.5% |

33.5% |

33.5% |

|

|

Pensando Synergies |

106.6 |

106.6 |

106.6 |

106.6 |

Source: AMD, ZoomInfo, Khaveen Investments

Overall, we believe that although the acquisition of Pensando may appear to be expensive with a P/S of 17.27x, we expect the deal to benefit AMD by increasing the performance of AMD’s products and expanding AMD’s Data Center product portfolio with a fuller stack. With the acquisition, we believe it could enable the company to better compete against Intel and Nvidia with its high-speed specs on par with Nvidia and boost its revenue growth as the market is forecasted to grow by a CAGR of 33.5%. In terms of revenue synergies, we expect the company to leverage AMD’s key customers and estimate a total revenue synergy opportunity of $426 mln.

$78 bln Revenue Opportunity from Increased TAM

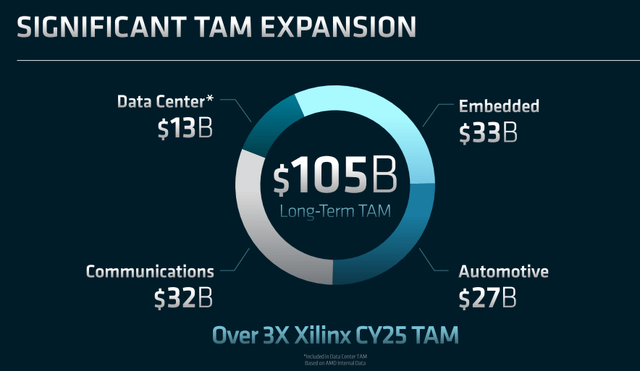

In AMD’s Financial Analyst Day 2022, AMD provided an updated TAM figure of $304 bln from $135 bln previously. Its TAM has further expanded with Automotive ($27 bln), and Communications ($32 bln). Its TAM for Xilinx is $105 bln, which includes $13 bln from Data Center and $33 bln from Embedded with the remaining in Automotive and Communications. To determine the revenue opportunity of AMD based on its TAM provided in 2025, we examined its TAM based on its end markets including Data Center, PC, Gaming, Embedded, Automotive and Communications and its relative competitive positioning based on its market share.

- Data Center: Within Data Center, we previously analyzed the company’s increasing competitiveness against Intel in terms of continuous product innovation with improving average server CPU benchmark scores. We based its share of TAM on our analysis of AMD’s competitive positioning based on its data center stack of hardware and software in Nvidia with a weight of 30%.

- PCs: We also analyzed in our previous analysis of the company’s improving average CPU benchmark performance against Intel in desktop and notebook CPU and based our share of TAM forecast in 2025 based on our average market share forecast of its desktop (46.4%) and notebook (24.5%) share.

- Gaming: In Gaming, we based the company’s share of TAM in 2025 on its market share in discrete GPUs of 19.4% by Tech Analyst as we believe Nvidia dominates the end market with its market share dominance of 80.6%.

- Embedded, Automotive and Communications: For the remaining end markets which are Embedded, Automotive and Communications, we based its share of TAM in 2025 on Xilinx’s market share in FPGA of 59.3% in 2021 as we previously analyzed its market leadership in the FPGA market factored in with the revenue breakdown of Xilinx by end market segments.

|

End Markets ($ bln) |

TAM (2025) |

AMD Share |

AMD Revenue Opportunity ($ mln) |

Calculation for AMD Share |

|

Data Center |

125 |

30.0% |

37.5 |

|

|

PCs |

50 |

35.5% |

17.7 |

|

|

Gaming |

37 |

19.43% |

7.2 |

|

|

Embedded |

33 |

27.28% |

9.0 |

59.3%*46% |

|

Automotive |

27 |

11.27% |

3.0 |

59.3%*23% |

|

Communications |

32 |

13.64% |

4.4 |

59.3%*11% |

|

Total |

78.8 |

Source: AMD, Xilinx, Khaveen Investments

Overall, we summarized AMD’s 2025 TAM in the table above with our share of TAM estimates to derive its total revenue opportunity based on each end market for a total revenue opportunity of $78.8bln. In contrast, we projected the company’s revenue growth based on its revenue segment breakdown to only reach $68 bln by 2025. This is because our revenue projections based on revenue segment also factor in our forecast of the company’s market share and ASP growth as well as a tapered-down growth rate beyond 2022 for a conservative estimate which we believe is more accurate.

$10 bln Synergies With the Integration of Xilinx

In our previous analysis of AMD’s acquisition of Xilinx, we expected the deal to benefit AMD in data centers with the cross-selling of FPGAs with server CPUs for hardware acceleration, integration of Xilinx’s products as AMD filed a patent integrating FPGAs into its CPU as well as leverage common customer base of cloud service providers.

Based on AMD’s Financial Analyst Day 2022, the company highlighted the complementary mix of its CPUs and GPUs with Xilinx’s FPGAs and has more than 6,000 customers. Furthermore, the company also announced its plans to use Xilinx’s AI engine technology for its products with the introduction of AMD XDNA which consists of technologies including the FPGA fabric and AI Engine (AIE). According to AMD:

the FPGA fabric combines an adaptive interconnect with FPGA logic and local memory, while the AIE provides a dataflow architecture optimized for high performance and energy-efficient AI and signal processing applications.

Based on the press release, AMD plans to integrate AMD XDNA IP across multiple products in the future starting with AMD Ryzen CPUs in 2023. AMD also stated that it would also be incorporated into its server CPUs in the future.

With a combined portfolio, AMD targets a spectrum of AI applications such as training and inferencing through the mix of its GPUs and CPUs infused with its AI engine and Xilinx’s adaptive chips. Though, Xilinx’s FPGAs are also deployed as adaptable accelerator solutions in other various applications including “embedded industrial, automotive, data center AI, wireless and wired networking, aerospace and video broadcast/streaming”. Based on its presentation, it highlighted its expanded TAM including Embedded, Communications and Automotive.

Moreover, the company provided an update on its synergies from the Xilinx deal with a higher cost synergy of $400 mln, an increase of $100 mln previously, as well as identified revenue opportunities of $10 bln. Thus, we continue to believe that the company could derive synergies with its Xilinx acquisition through product integration.

|

AMD (Xilinx) Revenue Forecast ($ mln) |

2022F |

2023F |

2024F |

2025F |

|

Xilinx Revenue |

4,052 |

4,467 |

4,924 |

5,427 |

|

Growth % |

10.2% |

10.2% |

10.2% |

10.2% |

|

Xilinx Synergies |

2,500 |

2,500 |

2,500 |

2,500 |

|

Total Xilinx |

6,552 |

6,967 |

7,424 |

7,927 |

Source: AMD, Khaveen Investments

To sum it up, AMD’s acquisition of Xilinx has been in line with our expectations with the mix of its product portfolio of AMD’s CPUs and Xilinx’s FPGAs as well as the leverage of its common customer bases in data centers. We continue to expect the company to integrate Xilinx as it announced its AI technology integration from Xilinx with the company’s CPUs. Furthermore, the company also provided an updated TAM for Xilinx across a broader range of end markets including Embedded, Automotive and Computing as well as revenue synergies of $10 bln which we assumed to be realized by 2025 in our revenue projections.

Risk: Overestimated TAM

AMD provided an updated TAM of $304 bln within 5 years and is a major increase from its previous TAM provided of $135 bln. We compared its TAM which is based on its end markets with our estimate of its TAM based on product groups including GPU, CPU, FPGA, ethernet adapter, gaming console SoCs and embedded processors based on market research reports which total to $248 bln in 2025, below AMD’s TAM of $304 bln.

|

Estimated TAM By Product |

2021 |

2022 |

2023 |

2024 |

2025 |

|

GPU |

33.47 |

44.62 |

59.47 |

79.28 |

105.68 |

|

Growth % |

33.30% |

33.30% |

33.30% |

33.30% |

33.30% |

|

CPU |

51.99 |

60.67 |

69.59 |

78.43 |

86.82 |

|

Growth % |

18.70% |

16.70% |

14.70% |

12.70% |

10.70% |

|

FPGA |

6.2 |

6.68 |

7.20 |

7.77 |

8.37 |

|

Growth % |

7.80% |

7.80% |

7.80% |

7.80% |

7.80% |

|

Ethernet Adapter |

3.15 |

4.21 |

5.62 |

7.50 |

10.01 |

|

Growth % |

33.50% |

33.50% |

33.50% |

33.50% |

33.50% |

|

Gaming Console SoC |

5.6 |

5.90 |

6.21 |

6.54 |

6.88 |

|

Growth % |

5.30% |

5.30% |

5.30% |

5.30% |

|

|

Embedded Processors |

22.67 |

24.53 |

26.54 |

28.71 |

31.07 |

|

Growth % |

8.20% |

8.20% |

8.20% |

8.20% |

8.20% |

|

Total |

123.08 |

146.60 |

174.63 |

208.22 |

248.83 |

|

Growth % |

19.1% |

19.1% |

19.2% |

19.5% |

Source: AMD, Verified Market Research, IC Insights, Markets and Markets, Expert Market Research, Fortune Business Insights, Taiwan News, Khaveen Investments

Valuation

We updated our revenue projections for the company from our previous analysis with its Pensando acquisition revenue and synergies and Xilinx synergies as discussed above. Compared to our previous analysis, our revenue projections are increased with a 3-year average of 49.2% compared to 41% previously with the higher synergies from Xilinx and Pensando acquisition revenues.

|

AMD Revenue Forecast ($ mln) |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

|

Computing and Graphics |

6,432 |

9,332 |

11,927 |

15,511 |

19,370 |

23,185 |

|

Growth % |

36.6% |

45.1% |

27.8% |

30.1% |

24.9% |

19.7% |

|

Enterprise, Embedded, and Semi-Custom |

3,331 |

4,163 |

5,716 |

7,850 |

10,784 |

14,818 |

|

Growth % |

64.7% |

25.0% |

37.3% |

37.3% |

37.4% |

37.4% |

|

Server CPU |

2,939 |

5,379 |

9,263 |

14,948 |

22,505 |

|

|

Growth % |

83.0% |

72.2% |

61.4% |

50.6% |

||

|

Total AMD |

9,763 |

16,434 |

23,022 |

32,624 |

45,102 |

60,509 |

|

Growth % |

45.0% |

68.3% |

40.1% |

41.7% |

38.2% |

34.2% |

|

Xilinx Revenue |

6,552 |

6,967 |

7,424 |

7,927 |

||

|

Growth % |

– |

– |

6.3% |

6.6% |

6.8% |

|

|

Pensando Revenue |

217 |

253 |

303 |

368 |

||

|

Growth % |

– |

– |

– |

16.6% |

19.8% |

21.5% |

|

Total Company Combined |

9,763 |

16,434 |

29,790 |

39,844 |

52,828 |

68,804 |

|

Growth % |

45.0% |

68.3% |

81.3% |

33.7% |

32.6% |

30.2% |

Source: AMD, Khaveen Investments

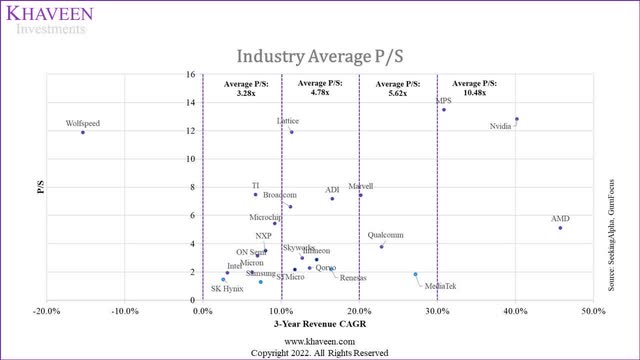

As we projected it to have strong revenue growth, we valued the company with a P/S valuation based on the chipmaker average of 10.48x (30%+ Revenue CAGR) which shows an upside of 64.3% for its shares.

SeekingAlpha, GuruFocus, Khaveen Investments

|

Valuation |

2022F |

2023F |

2024F |

|

Revenue ($ mln) (2024F) |

29,790 |

39,844 |

52,828 |

|

P/S |

7.17x |

8.63x |

10.48x |

|

Valuation ($ mln) |

213,650 |

343,979 |

553,812 |

|

Shares Outstanding (‘mln’) |

1,636 |

1,636 |

1,636 |

|

Price Target |

$130.59 |

$210.25 |

$338.50 |

|

Current Price |

$81.11 |

$81.11 |

$81.11 |

|

Upside |

61.0% |

159.2% |

317.3% |

Source: AMD, Khaveen Investments

Verdict

All in all, we believe the acquisition of Pensando could benefit the company with enhanced product performance and expands its data center portfolio to better compete against Nvidia and Intel as well as provide a revenue boost to the company with a forecasted growth CAGR of 33.5%. Moreover, based on its Financial Analyst Day 2022, we believe the company’s higher updated TAM indicates strong revenue growth opportunities with an estimate of $78.8 bln by 2025 based on its TAM of $304 bln. Furthermore, we believe the integration of Xilinx is going on track as we expected from our previous analysis with product integration and leveraging its common customer base and we believe its revenue synergies of $10 bln could benefit its revenue growth outlook.

Overall, we obtain a lower price target compared to our previous analysis despite a higher 3-year forward average revenue growth projection of 49.2% compared to 41% previously, due to a lower P/S average of 10.48x, down from 12.57x previously with the market sell-off. This still translates to a Strong Buy rating with a target price of $130.59.

Be the first to comment