Ljupco

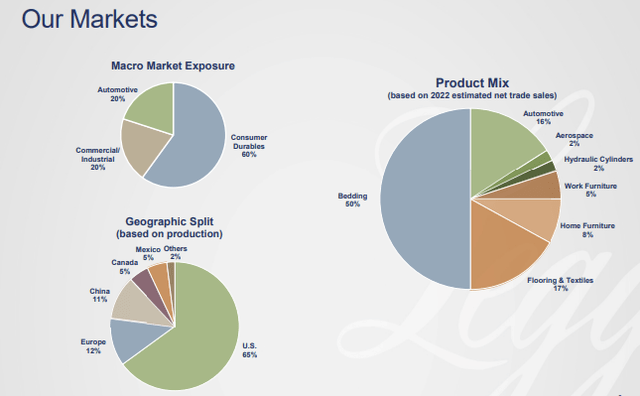

Leggett & Platt (NYSE:LEG) is an unknown company on the surface but with products for everyday settings and everywhere. It produces, among other things, bed components, furniture mechanisms, and vehicle components for vehicles delivered by virtually all global OEMs. Some well-known customers are Ford (F), General Motors (GM), Home Depot (HD), Walmart (WMT), etc.

LEG has significant exposure to volatile consumer markets that are susceptible to the economic environment. It managed this very well in the past and became a dividend king despite rough times like corona and the financial crisis.

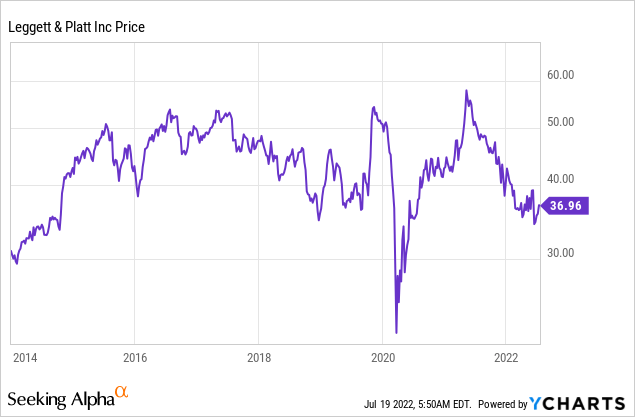

LEG’s stock price is surprisingly volatile for a dividend king that increased its dividend for 51 years in a row. The company is sensitive to the economic environment but could get more credit for its excellent past performance, clear strategy, and strong execution.

Growth

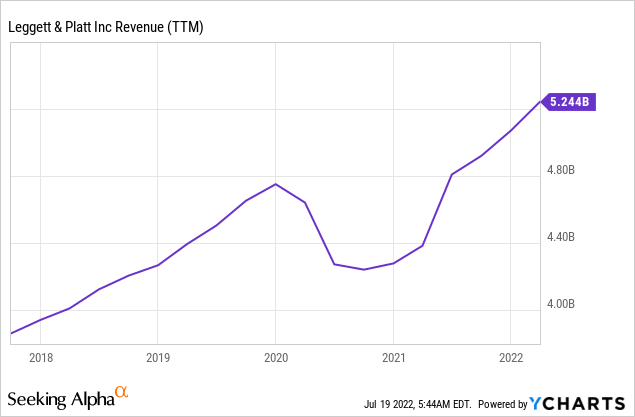

Leggett & Platt increases its revenue with organic growth and strategic acquisitions. It managed to grow its revenue at a 6.5% CAGR from 2017 until 2021. It performed a bit over its 10-year CAGR of 4.5%.

Revenue growth looked steady, except for the corona dip. The recent increase comes primarily from price inflation recently. It passed through cost inflation without growing its volumes in recent quarters.

Forecast

LEG expects 4% to 10% revenue growth in 2022. It guides in a wide range of $5.3B to $5.6B. The wide range gives a bit of near-term uncertainty. Most growth would come from passing on cost inflation.

Leggett & Platt

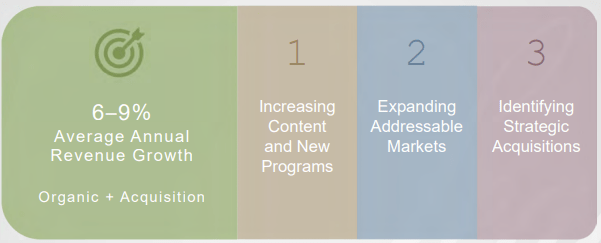

Over the long-term, it targets a sturdy 6-9% growth. The bottom end is in line with its current growth rate and should be achievable.

Free Cash Flow

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash.

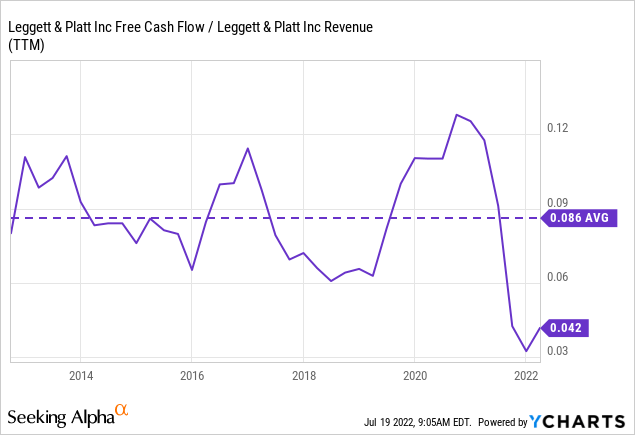

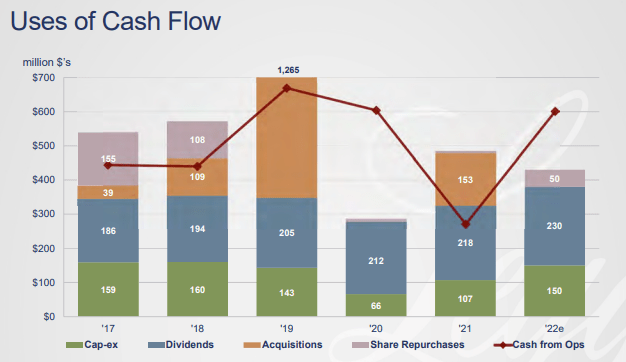

Leggett & Platt consistently produces positive free cash flows at an average of 8.6% of revenue. It has a decent conversion rate and expects to get it back up towards its old average as it expects $600M in operating cash flow and $150M CAPEX. $450M free cash flow on 5.45B revenue would mean a conversion rate of 8.2%.

Stock-based compensation is negligible as it makes up less than 1% of revenue, so I didn’t take it into account.

Shareholder Returns

An excellent free cash flow becomes more interesting if it’s used for shareholder returns. LEG is very shareholder friendly as it pays a regular dividend and uses excess cash for buybacks when possible.

As LEG states in its fact book (an interesting read):

Our long-term priorities for use of cash are: 1) fund organic growth, 2) pay dividends, 3) fund strategic acquisitions, and 4) repurchase stock with available cash. We have a standing authorization from the Board to buy up to 10 million shares each year; however, no specific repurchase commitment or timetable has been established.

Leggett & Platt

LEG rewards shareholders continuously with its growing dividend, and repurchases shares with excess cash. In 2022, the buybacks will offset its stock-based compensation. It also plans to reduce its total debt.

I expect dividend growth over the next couple of years will be slower than its earnings growth as it currently has a forward payout ratio of 65%, and its target is 50%.

LEG’s primary financial measure to assess long-term performance is total shareholder return. It targets an average of 11-14% through revenue growth, margin expansion, dividends, and share repurchases.

Balance Sheet

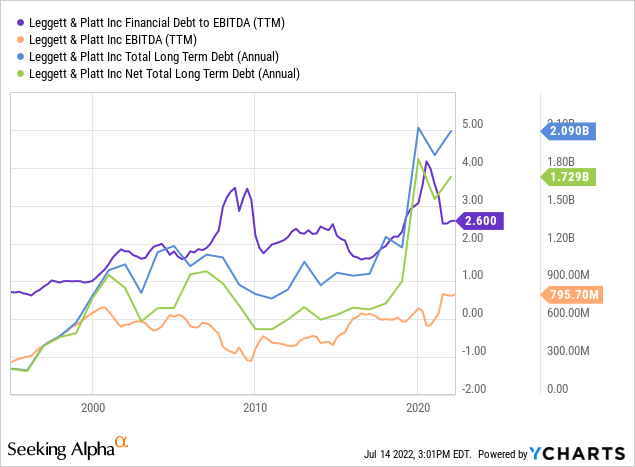

LEG acquired Elite Comfort Solutions in 2019 for $1.25B. The acquisition increased its long-term debt position significantly. The following pandemic measures in 2020 shortly increased its leverage ratio significantly.

The company recovered from corona and had to digest cost inflation throughout 2021. The debt to EBITDA is reasonable again and should decrease further as it gets more quarters with normal margins. The debt is well spread through time, with the most recent notes from November only maturing in 2051.

Valuation

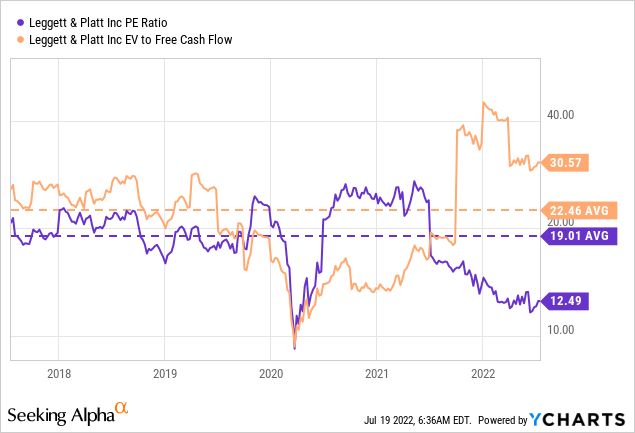

LEG is cheaply valued. The TTM PE ratio of 12.5 is far below the S&P 500 PE of ~20.8. It’s also well below LEG’s average of 19. A possible explanation would be the cash conversion that has been below par the past year. The forecast looks pretty good at $450M FCF. The EV/FCF would come down to 15 at this level. Also well below its historical average.

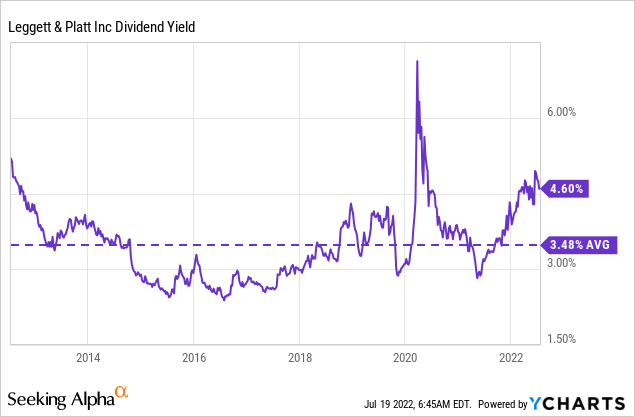

Another way to look at LEG’s valuation is its dividend yield.

Leggett & Platt’s dividend history of a stable growing dividend makes its dividend a more stable indicator than earnings or cash flows. The dividend yield also shows an undervaluation of the stock. The forward payout ratio of ~65% is now well above its target of 50%.

Risks

An economic downturn is the biggest risk for LEG. It still carries a relatively large amount of debt and wants to keep its investment-grade ratings. Keeping healthy leverage could become challenging. In a worst-case scenario, such an economic downturn could lead to a dividend cut, putting more pressure on the share price. It’s a short-term and unlikely risk, in my opinion, as the company should be able to recover swiftly.

I Rate LEG As A Buy

Leggett & Platt offers a relatively simple value investment case. A return to its “normal” 19 PE ratio gives the stock a 50% potential upside. That’s the possible short-term upside. The long-term looks much better as the company seems set to perform at least in line with its historic growth.

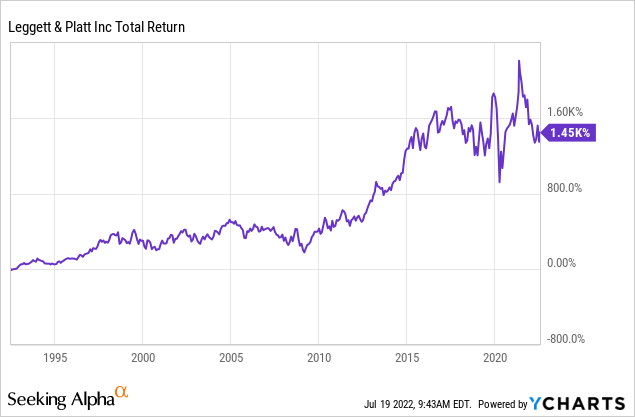

From 1992 to today, revenue grew at a 5.2% CAGR. It also did significant buybacks over those 30 years, which led to an EPS growth of 7.92%. Adding a reinvested dividend, you get a total return of 1,450%:

LEG’s strategy points towards higher revenue growth, and LEG trades at a lower PE ratio than in 1992, so the long-term looks promising.

Conclusion

Leggett & Platt is a dividend growth stock at a low price. The dividend isn’t acutely in danger and should increase further at a moderate pace. The company expects to restore its cash flow as it passes on cost inflation. Beyond 2022, volume growth should pick again so the company can move towards the 6-9% long-term target.

Economic uncertainty will probably hit Leggett & Platt. It’s not the first time the company goes through such turmoil. It managed the financial crisis and 1980s inflation without having to cut its dividend. It’s plausible the company will manage to do so again.

Be the first to comment