Jamie McCarthy/Getty Images Entertainment

Deckers Outdoor Corporation (NYSE: DECK) is a key figure in the footwear and apparel industry. Its steady revenue and income generation remain strong despite challenges in inventories. Also, its financials remain intact, given its stable Balance Sheet. Market volatility continues, but its efficient asset management remains one of its strongholds.

Meanwhile, the stock price has dropped considerably. But, the recent upside shows promise, matched with slight undervaluation. For long-term investors, it remains an attractive option. Also, it has a higher margin of safety, which is good timing to buy.

Company Performance

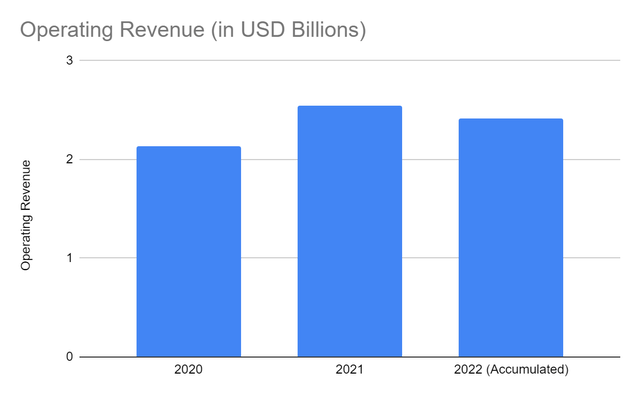

Deckers Outdoor Corporation continues to show stable financials, making it an ideal stock. Its FY 2020 and 2021 proved its resilience amidst the disruptive effects of the pandemic. It has brick and mortar stores, making it vulnerable to changes in restrictions. Also, its products are mostly for outdoor activities. But, its performance remains impeccable, given the consistent revenue growth.

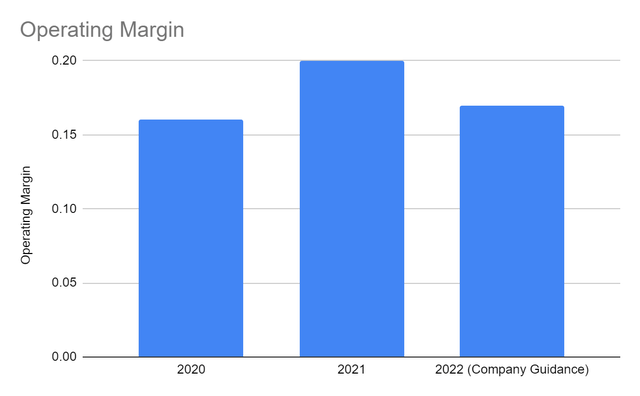

However, supply chain headwinds have been hampering its journey in the last two years. It has become more evident this FY 2022, which limited its operating capacity. In 3Q, the operating revenue amounted to $1.19 billion, a 10% year-over-year growth. But, it was lower than the 15% revenue growth in the previous year. Also, the operating margin was lower at 24% versus 30% in 2021.

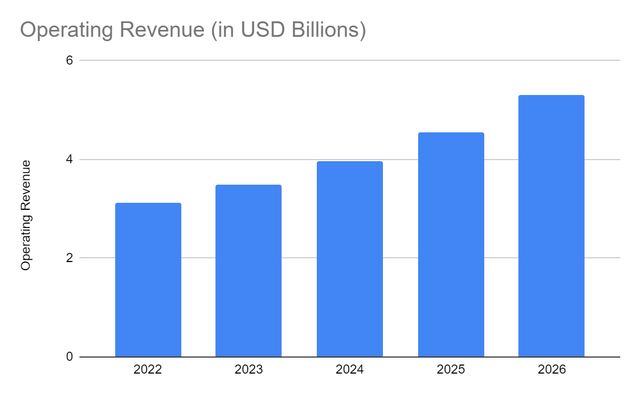

Operating Revenue (MarketWatch)

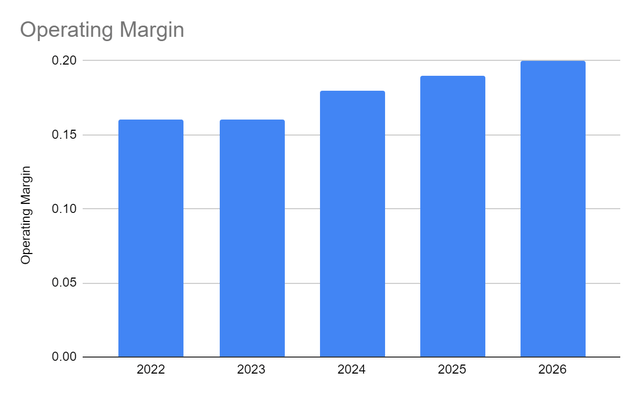

Operating Margin (MarketWatch)

The continued port congestion remains a problem, limiting its market presence in other countries. The amount of inventory in transit in September 2021 rose from 20% to 45%. In December, the amount was even higher at 50% versus 25%. It disrupts the supply chain, which is evident in the recent financial results. The company partly relied on air freight to compensate for its delays and missed revenues. But, it is more expensive, which increases its operating expenses. Also, it had to increase its marketing expenses to strengthen its performance in local markets.

Nevertheless, we can see an improvement in its core business amidst these headwinds. The first half of FY 2022 was more problematic as the port was more congested. But this quarter, the company shows more promise, although the problem will persist in 4Q FY 2022. Revenue growth persisted in all quarters. On a quarter-to-quarter basis, the operating margin is way higher at 24% than 18% in 2Q. Indeed, DECK may still perform and maintain efficiency despite supply chain headwinds.

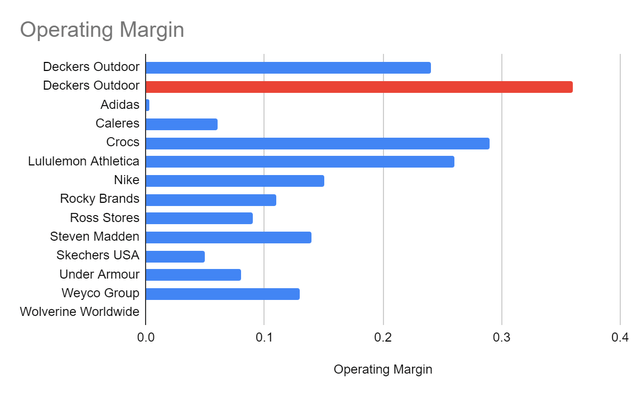

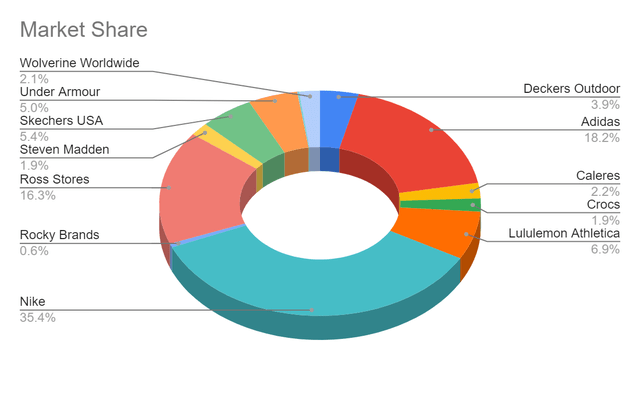

DECK does not have the most impressive revenue growth relative to its peers. But, it keeps its positioning, given the slight increase in its market share from 3.8% to 3.9%. So despite the disruptions, it may go head-to-head with its peers. It makes sure that none of its portions will be eaten out by its primary competitors. It keeps growing while securing the same demand for its products.

Also, it is one of those with the most efficient core operations, given its operating margin. It shows how the other companies deal with supply chain disruptions. DECK appears to outdo many of its peers. Its revenue and market share keeps growing while keeping its costs and expenses low. Note that I computed the operating margin of DECK from its quarterly release.

Meanwhile, I referred to MarketWatch for other companies for easier access. If I also used the website to compute the operating margin of DECK, it would be 38%, the highest among all companies. Indeed, it has the best margin of safety.

Operating Margin (MarketWatch)

How Deckers Outdoor Corporation Can Sustain Its Operations Amidst Supply Chain Challenges

Deckers Outdoor Corporation remains a household name with a strong market positioning. Its strategic management of costs and expenses keeps its profitability above its peers. Today, the accumulated revenue is $2.4 billion, a 20% year-over-year growth. Also, it is already 95% of the full-year operating revenue in FY 2021.

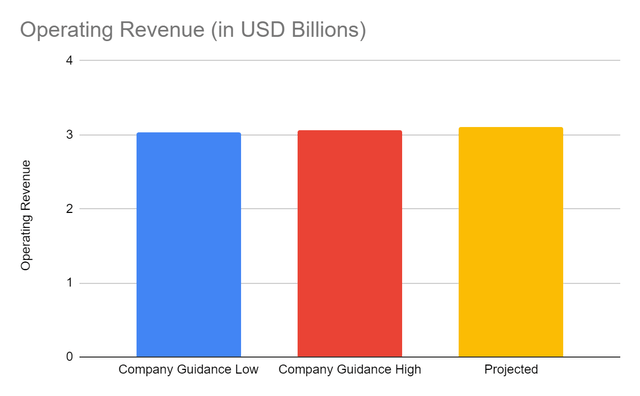

But with the current supply chain headwinds, the operating revenue guidance for 2022 is $3.03-$3.06. This will lead to a 19-20% year-over-year growth, lower than the previous year. But, the quarterly value will still be higher than its comparative value, showing its stable revenue growth. Note that the whole industry is dealing with this problem, so it is still logical for DECK to go through the same thing.

The thing is, DECK continues to operate and find alternatives amidst supply chain disruptions. Although it is a challenge to its core market, it continues to meet the demand and expand its local market. Based on my projection, the operating revenue will range from $3.07 to 3.13, a 20-23% increase. It is still in line with the average revenue in the three quarters.

Operating Revenue (Deckers Outdoor Corporation Company Guidance and Author Estimation)

In FY 2023-2024, I project that revenue growth will be lower at 14%. The congestion problem will not be solved in a short period. But, I expect DECK to adjust, find better alternatives, and strengthen its local demand. It continues to transform to keep up with the footwear and apparel trends.

Operating Revenue (Author Estimation)

The UGG and HOKA remain its primary growth drivers. So, the HOKA and Bodega collaboration will help increase its local market presence. It aims to supply designs that ensure comfort regardless of the terrain. It is timely as outdoor activities increase, especially this spring and summer. For 2025-2026, growth may rebound as the reopening of borders may improve its supply chain.

For its operating margin, both the company guidance and my estimation are lower at 17%. In FY 2023, it may still be lower at 15% due to higher expenses on air freight. I expect FY 2024-2026 to rebound to 20%, assuming that the situation will improve.

Operating Margin (Author Estimation)

Stable Cash and Lower Financial Leverage

DECK continues to show a solid performance despite supply chain problems. Its market demand remains stable, given its slight increase in market share. But, it does not depend on market demand and core operations alone. It remains sustainable, given its impressive cash flows and lower financial leverage. Despite its lower inventories, it continues to suffice its operations and product transformation.

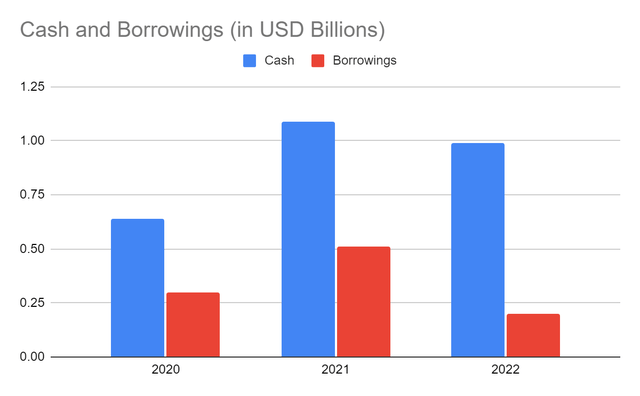

Its cash only amounts to $998 million as of 3Q 2022. But, its borrowings are lower by over 50%. Note that it has already repurchased shares worth $270 million approximately. So, the company now has more means to cover its financial obligations. It can even make a single payment for all its borrowings and payables using cash only.

Cash and Borrowings (MarketWatch)

The company has adequate capacity to sustain its operations despite supply chain disruptions. Also, it does not have outstanding borrowings, making its Balance Sheet stable. That is why it can still suffice higher expenses and expand its local market.

Moreover, its impressive revenue and net income show efficient asset management. Its Return on Asset (ROA) of 15% shows over $15 for every $100 asset. With that, we can tell that its assets generate enough revenue and income. It can be proven by the positive Free Cash Flow ((FCF)) of $185 million despite the 40% increase in CapEx. The increased profitability and liquidity show consistency across all financial statements.

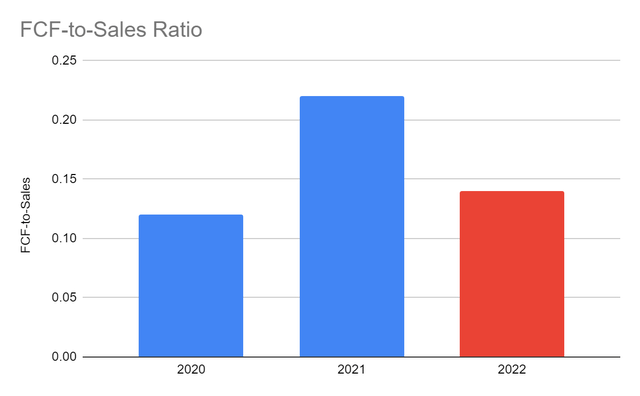

This FY 2022-2023, I project FCF-to-Sales Ratio to decrease to 14%. It may be due to increased CapEx and expenses. FY 2024-2026 may rebound as port congestion, and the core operations become manageable.

FCF-to-Sales Ratio (MarketWatch and Author Estimation)

Price Valuation

The stock price has been in a decrease since the latter part of 2021. It is in line with the stock market crash and supply chain disruptions. But since March 7 at $234.80, it has shown a slight upside. At $270-$280, it already has a 16-19% upside. It is also 24% lower than the start price, but volatility has been more noticeable recently.

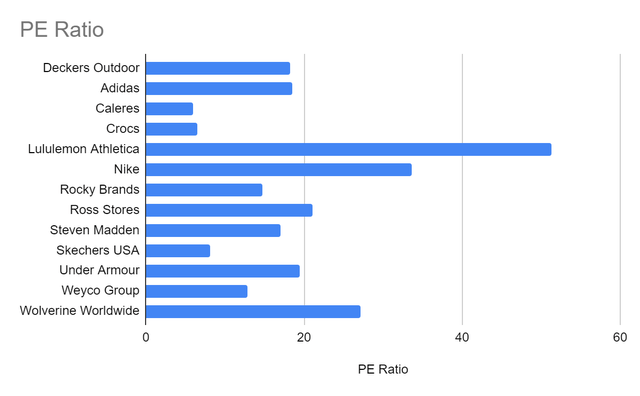

Its PE Ratio of 18.18 shows potential undervaluation by 7-9%. Relative to its peers, it is lower than the average ratio of 19.57, making it cheaper by 8%. To estimate the price better, we can use the DCF Model using FCFF.

|

FCFF |

$248,000.000 |

|

Cash |

$900,000,000 |

|

Outstanding Borrowings |

$80,000,000 |

|

Perpetuity Growth Rate |

4% |

|

WACC |

8% |

|

Common Shares Outstanding |

27,000,000 |

|

Stock Price |

$270 |

|

Derived Value |

$292 |

Given the derived value, the stock price is still undervalued. It is the same as the potential undervaluation shown by the PE Ratio. The value may show that DECK is still cheaper and may have a 7.4% upside. Hence, the price remains in line with its fundamentals. An increase may be anticipated.

Bottom-Line

Deckers Outdoor Corporation shows robust core operations despite problems with its supply chain. The Balance Sheet and Cash Flow prove the consistency in profitability and sustainability. Its stable cash flows and low financial leverage allows it to cover its operations. Also, it can improve its products and expand its local market even without borrowing. Meanwhile, the stock price remains undervalued and consistent with its fundamentals. There may be an upside given the PE Ratio and the derived value. The recommendation is that DECK is still a buy.

Be the first to comment