georgeclerk

Thesis

FirstSun Capital Bancorp’s (OTCQX:FSUN) share price could go either way as it is very risky. Current PnL performance implies mistakes have been made and profit could continue declining if hedging positions are poor and provisions increase. On the other hand, the higher rate environment is beneficial to the company and could lead to a higher interest income that may offset other losses. Either way, as it is a risky stock, we do not recommend holding it.

Intro

FSUN, headquartered in Denver, consists of 3 subsidiaries, Sunflower Bank, First National 1870, and Guardian Mortgage. Sunflower Bank provides a range of banking services such as personal banking, commercial banking, and wealth management, operating across a number of states in the US, with total assets of $7.1bn.

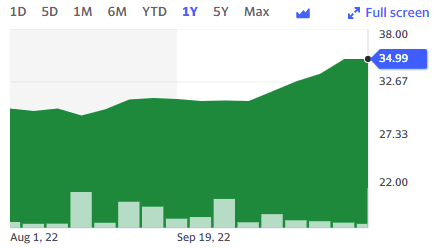

The share price is currently at around $35, up 45% in the past year.

Yahoo Finance

Financial Analysis

The company have not had the greatest success in profits recently. While there has been growth in income for the banking segment, from a -$2m loss in 2020 to a $35m profit in 2021, this was primarily driven by a $20m decrease in provisions which the company accounted for due to an expected favorable change in economic conditions and performance of their loan portfolio. Given that the economic environment has now soured, as inflation has increased significantly, followed by rate rises, indicating that both consumers and businesses are in trouble, we can expect loan performance to worsen over 2022 and 2023, where these provisions should now be increased, rather than decreased. And potentially be higher than what was previously accounted for.

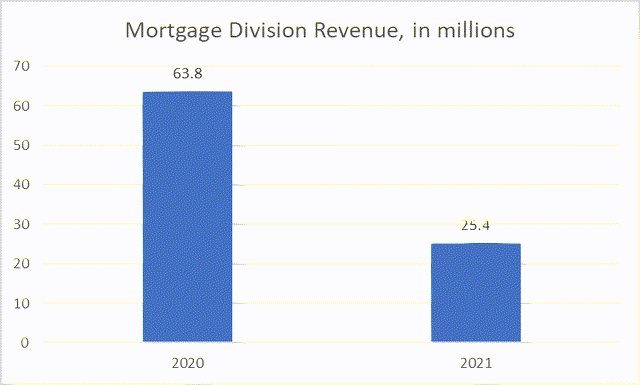

And even though mortgage demand remained elevated last year, with strong house price growth, you would have expected their mortgage division to be making good money. Unfortunately, this is not the case, as the mortgage division sales actually declined over the year, by a massive -60%.

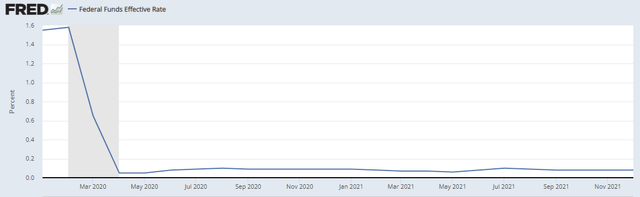

The company stated that this decline was a result of changes in market interest rates and their corresponding hedging positions. But as illustrated above, the rate decreased in early 2020 due to covid, and remained flat over the 2-year period, so FSUN wiped out 60% of their mortgage revenues with faulty hedging positions. Sounds like something went seriously wrong here.

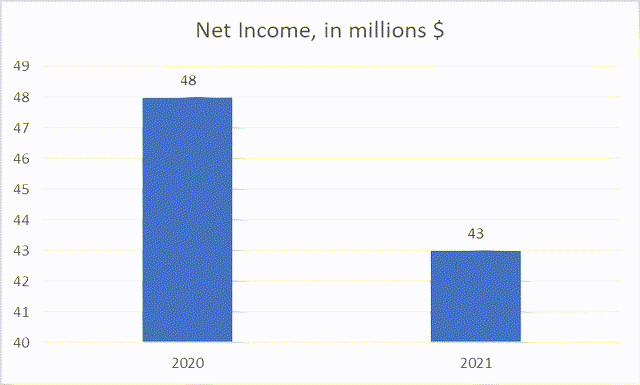

This result led to a decline in net income by -10% AFTER the decrease in provisions by $20m was taken into account.

This resulted in a decline in EPS from 2.6 to 2.3, a decline in return on average assets from 1% to 0.8%, and a decline in net interest margin from 3.1% to 3%.

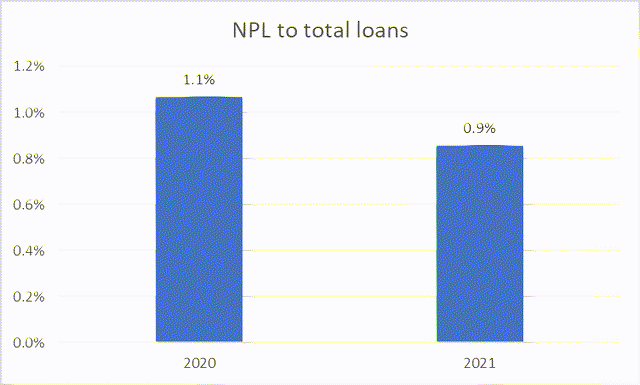

As discussed, economic conditions have worsened since these results, and we can expect provisions to increase and profits to decrease. The accounts show that NPL to total loans decreased from around 1.1% to around 0.9% over the year. We can expect this figure to rise up in the current year and going forward.

If the company were to record the $20m provisions instead of decreasing them, this means that net income would fall from $43 million down to $23 million, and result in a substantial decline in all metrics, including net interest margin, and therefore a decline in valuation.

This is the scenario if sales remain the same and only provisions are amended. However, the company already had issues with mortgage rate movements and corresponding hedges. Given that interest rates have moved significantly since last year, where the base rate has risen from around 0% to above 3% in less than 12 months.

This could potentially mean that FSUN could suffer even more losses if there hedge positions are still weak and the company did not prepare for the rate rises. Furthermore, as the rate has risen at such a steep level, we could expect a significant depression in mortgage demand, and therefore a further hit to revenue from the mortgage division.

These potential losses could be entirely (or more than) offset by a strong increase in banking interest income. Banking assets now sit at above $5 billion, and net interest income for the company as a whole grew 13%. As rates have increased substantially since this period, we could see a very large jump in net interest income, which could result in a large improvement in profit, and subsequent net interest margin.

Valuation

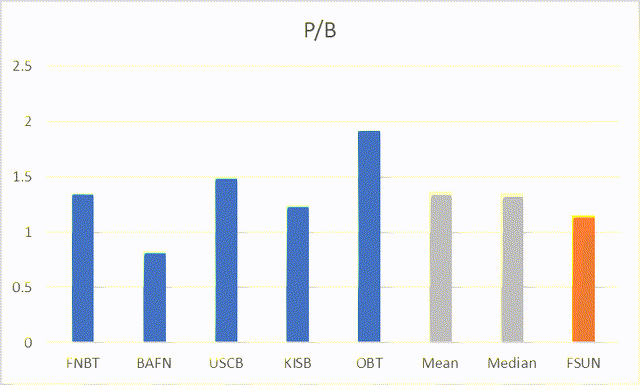

If we compared FSUN to a set of peers with somewhat similar market cap and business models, FSUN look more attractive. On a P/B basis, the peer group average at around 1.35x, whereas FSUN currently sits at around 1.15x. While this would normally indicate that FSUN is undervalued at a comp basis, the P/B remains above 1 for FSUN as well as most peers.

As economic conditions become more favourable to the company and lead to potentially higher interest income, we could see FSUN’s share price gradually increase. But unfortunately, there is not yet an indication that FSUN will outperform both peers and the market.

Risks

- As discussed previously, economic conditions, such as increasing interest rates, are becoming more favourable to FSUN, which could lead to an increase in net interest income and therefore net income overall. If this figure were to increase substantially, outpacing rises in cost and leading to a much higher net interest margin, then we could potentially see an outperformance of the share price.

- Secondly, we discussed that the company should probably reinclude the provisions figure in their PnL, if not increase it, given that both consumers and businesses are now struggling with inflation. But if the group’s loan portfolio is strong enough, there may not be a need to increase provisions by a significant amount. It very much depends on what the loan exposure looks like. If provisions do not go back up as much as we expect, then we could see the company’s financial health improve and lead to an increase in the net interest margin.

- Thirdly, the recent declines in profit are due to poor hedging from FSUN, despite a static interest rate over the period. There is a risk of both successful hedging as rates have increased or poor hedging positions that lead to further losses. Again, this is hard to predict and depends on the group’s capabilities.

Conclusion

Overall, FSUN has improved their interest income in their banking segment, but its mortgage division has suffered, which offset the gains made from the increase in banking profits. This has resulted in a decrease in net income, despite a reduction in provisions over the period. From here, the company could go two ways. Either they could significantly benefit from the changing economic conditions (higher rates) that leads to higher interest income, or they could make the same mistakes as before, where hedging positions result in a decrease in profit, and provisions for loans increase as consumers and businesses suffer under the high inflation environment. Therefore, this stock is currently very risky, and we wouldn’t recommend having it in your portfolio despite potential for upside (as well as downside).

Be the first to comment