CUHRIG

Introduction

After discussing LNG earlier this week, it’s time for another deep dive into a topic we have discussed quite frequently since 2020: coal. In this article, we will discuss the massive comeback of coal, despite coal being the most polluting fossil fuel in the world – and all the headwinds that come with that. Despite its reputation, coal is making a full comeback. High global energy prices make a strong case for a continuation of reliable coal energy. Moreover, because of the pressure on this fuel, supply is subdued, causing prices to remain elevated. When adding geopolitical issues, this is unlikely to change anytime soon.

In this article, we will discuss all of that and two actionable ideas that, I believe, offer more upside for investors and provide handy trading tools for traders.

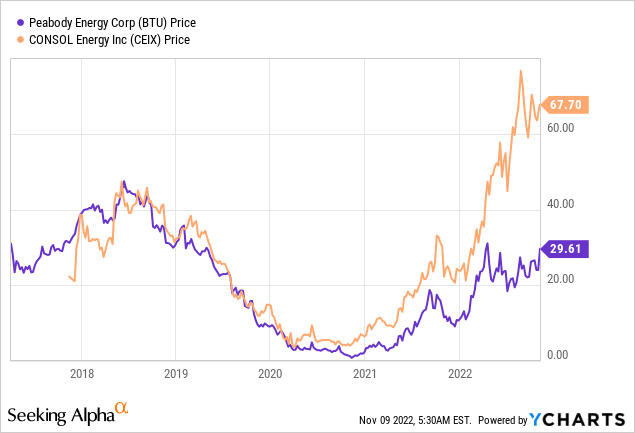

The stocks are CONSOL Energy (NYSE:CEIX), a well-diversified producer of coal, benefiting from export facilities, higher production, and healthy fundamentals. The other is Peabody Energy (NYSE:BTU), owner of the world’s largest coal mine.

So, let’s get to it!

Demand & Supply

Let’s assume you hadn’t seen any economic news or any stock prices since 2019 for some reason. Now, I’m telling you that close to 85% of global GDP is slowing down. 50% of global GDP is in contraction.

Where do you think coal prices are trading? Or, how do you think coal is doing this year?

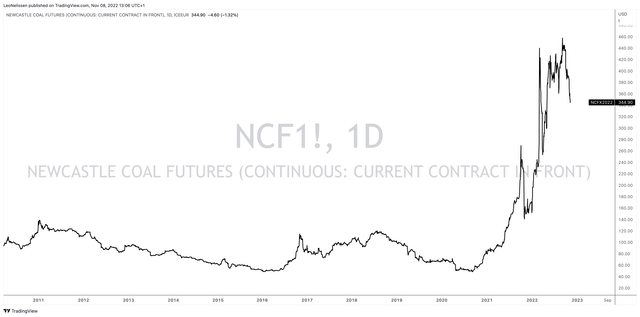

Well, Newcastle Coal futures (my favorite benchmark) are trading at $344 per ton. That’s 190% above 2018 peak levels.

TradingView (Newcastle Coal Futures)

Think about this for a second.

Especially in light of the current climate change conference in Egypt, I found the headline below, which tells us so much about failed policies to kill coal.

Bloomberg

Don’t get me wrong, I am a fan of transitioning to clean energies (mainly nuclear) and improving the sustainability of our economies. However, I’ve always made the case that an energy transition cannot be forced.

After all, reliable and affordable energy is the backbone of every single economic success story. We’re currently finding that out the hard way.

Instead of ending coal, we’re now in a situation of subdued supply growth and high demand. That’s why prices are so strong.

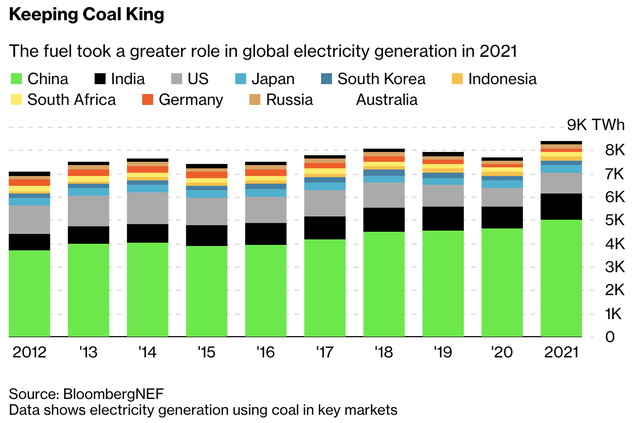

Essentially, global coal power generation is about to set a record for a second straight year as it remains the largest source of global energy. Consumption is up in Europe to replace shortfalls in hydro, nuclear, and Russian gas. Top producer China is boosting output to detach itself from volatile global energy markets.

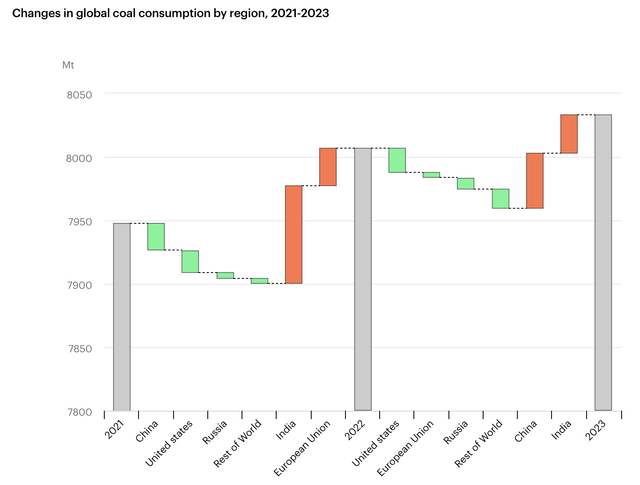

In June of this year, the International Energy Agency estimated that global coal consumption would rise above 2022 levels as both China and India were continuing to boost demand. In China’s case, consumption was expected to rise by 1%, which translates to no less than 43 million tons. However, the IEA estimated that growth in renewables in the European Union would be enough to reduce coal demand. That’s not happening this year, which means we’ll see global consumption come in close to 8,050 million tons, in my opinion.

International Energy Agency

Moreover, as the chart above shows, India has grown quite significantly in both 2021 and 2022 (expected), which makes sense as India is growing faster than China. Moreover, India’s geographic location puts even more emphasis on energy as a rising middle class needs climate control – to name one of many things.

When looking at the bigger picture, India is still a somewhat minor force compared to China. I believe that we’ll continue to see a lot of future demand growth in India.

Bloomberg

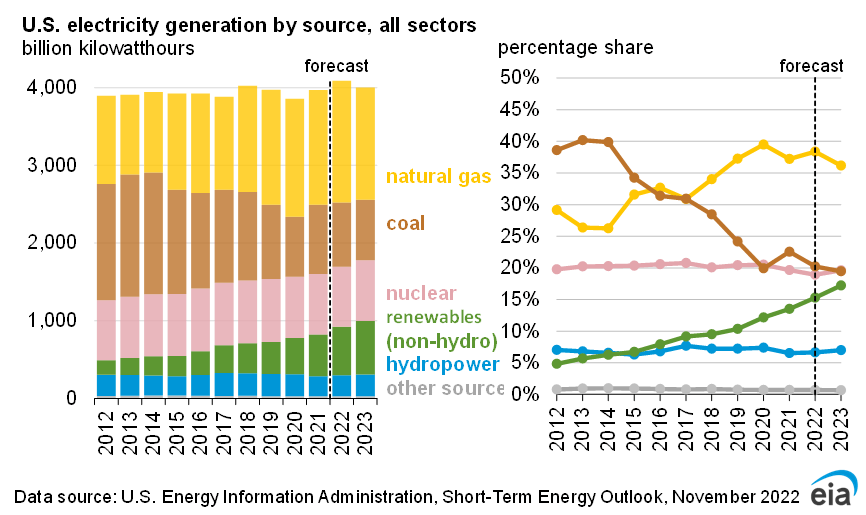

The same goes for the United States. So far, estimates are that demand will decline by 28 million short tons – almost entirely because of plant closures.

U.S. Energy Information Administration

However, dozens of coal plant closures will be delayed, as reported by Bloomberg.

As many as 40 US coal-fired power plants that were slated to shut will run for longer than expected, with operators delaying plans to retire them as supply-chain issues and reliability concerns slow the transition to greener energy.

The plants have almost 17 gigawatts of capacity, and some have pushed back their planned closures by as long as five years, according to Andrew Blumenfeld, director of data analytics at McCloskey by Opis.

Now, it’s becoming an increasingly political topic for a number of reasons. The most obvious is that everyone is feeling the pressure from rising energy costs. The second reason is that liberal (progressive, or whatever you want to call them) politicians are looking for a faster coal exit.

On November 6, the Wall Street Journal wrote an interesting article titled “Biden Embarrasses Joe Manchin”.

Wall Street Journal

Last week Friday, President Biden said that he is shutting down coal plants across America. Technically, that’s true as all major coal operators have (long-term) exit plans.

However, going into the Midterm elections, that was a risky thing to say. Not only because his press conference wasn’t even about America’s energy supply.

He risked losing support from a key Democrat as Joe Manchin is a Democrat Senator from West Virginia, a coal-producing state generating 90% of its electricity from coal.

Moreover, it triggered a chain reaction. According to the Wall Street Journal:

Eight state coal associations sent a letter to Mr. Manchin warning the legislation will “severely threaten American coal” in part by “turbocharging the lofty incentives that already extend to renewable energy.” Generous subsidies for wind and solar have made coal power uncompetitive in wholesale markets. Coal plants can’t cover their costs running only some of the time. Mr. Manchin said the companies were wrong in a reply letter.

Not only that, but it’s now such a widespread issue that even more moderate Democrats are hoping that voters didn’t hear Biden’s remarks:

Note the Administration didn’t disavow the President’s remarks. No doubt Democrats running for Senate in Ohio (Tim Ryan), Pennsylvania (John Fetterman) and Wisconsin (Mandela Barnes)—states where economies and electric grids depend on coal—hope voters didn’t hear what Mr. Biden said. But voters should know what they’re voting for, even if Mr. Manchin now claims he didn’t.

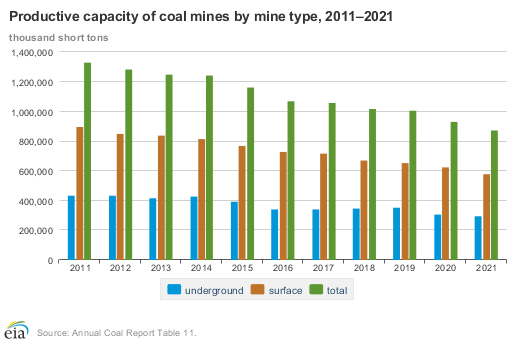

While the impact of Biden’s statements and the failed energy policy didn’t have a major impact on the initial Midterm election results (while I am writing this), the problem here is that the United States is seeing an increasingly tight supply. Between 2011 and 2021, production fell from roughly 1.3 billion short tons to less than 900 million short tons. This trend will continue on a long-term basis as phasing out coal is unstoppable.

U.S. Energy Information Administration

However, demand isn’t coming back down as fast as anticipated. Especially because we’re in what I like to call a new era for oil and gas as well.

I highlighted that in this article (among many others).

Now, this situation is about to get even worse. Russia made up roughly half of the European Union’s hard-coal imports prior to the war. Now, sanctions and less financing from banks are taking their toll. Just like in some oil markets, companies now rely on private funding.

As reported by Bloomberg:

The rally has been a problem for traders, which were already under pressure as banks pulled back from financing thermal-coal transactions in recent years. With each cargo now worth much more, funding shipments has become trickier, pushing traders toward private funds — which typically charge higher interest.

“Most of the banks and insurance companies won’t touch it, so traders are coming to the alternative market,” said Peter Ryan, managing director at private finance fund Goba Capital. Goba has more than $500 million in its commodities lending pipeline — the majority in coal — according to Ryan.

As I briefly mentioned, in oil a lot of companies are also depending on private funding as larger corporations aren’t touching “dirty” oil anymore. It’s one of the reasons why I’m also bullish on oil, as it’s bad for supply growth.

The European Union, for example, will have to import close to 100 million tons of thermal coal. That’s more than twice what it imported in 2021 and roughly what it imported in 2019.

Add global supply issues, and we’re getting a pretty strong bull case for coal. Similar to oil, yet a bit different.

Now, this finally brings me to the stocks I mentioned in the introduction. Both stocks are coal mining companies. Both benefit from the tight supply, high export demand, and their ability to turn these tailwinds into real shareholder value.

CONSOL Energy (CEIX)

With a market cap of $2.4 billion, CONSOL is one of the largest coal companies in the world. Headquartered in Pittsburgh, Pennsylvania, the company has a well-diversified network of mines and logistics.

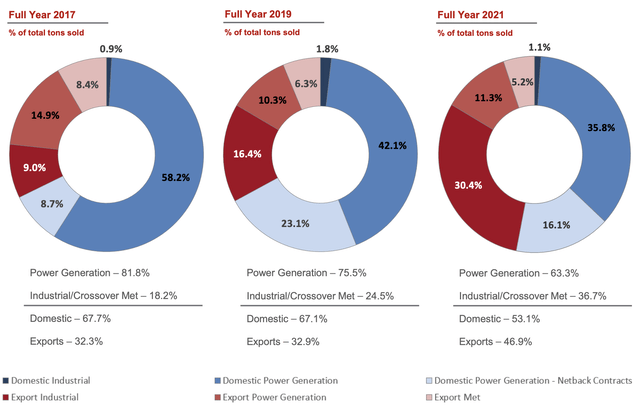

Its coal output is highly diversified with roughly half of its products going overseas. The company owns the CONSOL Marine Terminal, which provides coal export terminal services through the Port of Baltimore. The terminal can store coal and load coal directly into vessels from rail cars.

Moreover, roughly 63% of its coal output was power generation (thermal) coal, which is different from metallurgical coal used in industrial processes.

CONSOL Energy

On top of that, the company is expanding its production. The Itmann mining project was 80% complete when I wrote my most recent article in August. In 2Q22, the project produced 35,000 tons of low-vol metallurgical coal and 51,000 tons of export coal. On a full-year basis, production is set to be between 200,000 and 300,000 tons. The total capacity of this mine with at least 20 years of mine life is 900,000 tons per year.

The company is also getting close to completing the development of its fifth long wall at the Pennsylvania mining complex, located at the Enlow Fork mine.

Moreover, and this shouldn’t be a surprise, the company sees strong global thermal coal markets. Demand remains robust as a result of tight supply. The company also mentioned a delay in domestic coal retirements and a comeback of international coal demand.

As a result, the company secured another six million tons of long-term demand through 2025. CEIX now has 21.8 million tons contracted for 2023 and 8.8 million tons contracted for 2024. These numbers will continue to rise as a result of shorter-term demand.

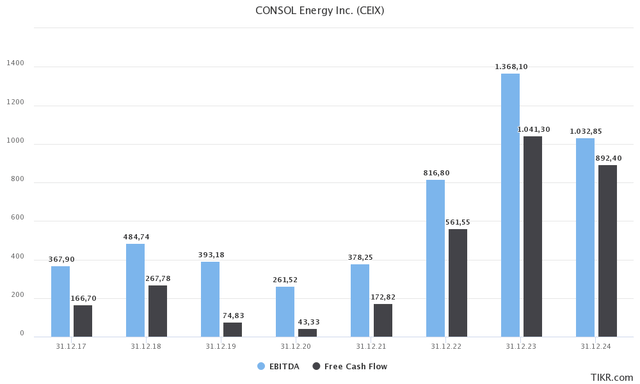

The company is now in a much better position than at any point in its history. Like a lot of oil and gas stocks, CEIX is now a free cash flow machine, likely to generate more than a billion in FCF in 2023 based on lasting high prices and higher production. That’s 41.2% of its current $2.4 billion market cap. Unless I’m forgetting something, that’s the highest free cash flow yield I have discussed this year.

TIKR.com

Moreover, CONSOL is in a good spot to repair its balance sheet, invest in its own business, and boost shareholder distributions.

In 3Q22, the company generated $107 million in FCF. The company repaid debt worth $56 million, bringing total YTD debt repayments to $211 million. Gross debt is now at a mere $450 million.

This number is set to fall to $400 million as the company submitted a redemption notice for $25 million of its second-lien notes at the end of October. Moreover, $25 million of its Term Loan B will be repaid.

Total dividend payments in the quarter were $35 million. The company is now paying $1.05 per share. That’s roughly 35% of its 3Q22 free cash flow. It also translates to a 6.3% implied dividend yield.

Moreover, the company has an unrestricted cash balance of $269 million as of September 30.

According to the company:

As mentioned previously, most of our remaining free cash flow will be allocated towards our debt reduction goals. However, once the target gross debt level is achieved, we expect to further increase the percentage of free cash flow located to our shareholder returns, including potential share buybacks.

This means at least three things. First, investors who bought “low” will benefit from a high double-digit yield on cost, allowing them to quickly recapture large parts of their initial investment. Congrats to these investors, as I know that some of them will read this article.

Second, like its oil peers, CEIX is now in a terrific spot to become a great source of income. Even for investors buying at current levels. However, I do not recommend investors buy coal for income. See it as a bonus. Coal is extremely volatile and it could do damage to a portfolio if investors go overweight into coal.

Third, even after rising 200% this year, CEIX is still far from overvalued.

Using its $2.4 billion market cap, $400 million in gross debt, $269 million in cash, and $340 million in pension-related liabilities, the company has an enterprise value of $2.9 billion. That’s 3.5x 2022E EBITDA of $816 million.

On a longer-term basis, it looks like the company could maintain a billion in annual EBITDA, which would push this valuation to less than 3.0x EBITDA. Also, note that high free cash flow generation will consistently lower net debt and boost shareholder valuations. That’s highly favorable for its valuation.

Now, onto number two.

Peabody Energy (BTU)

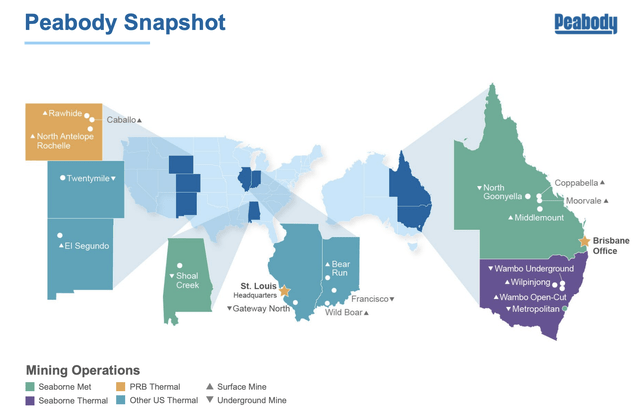

Peabody Energy is larger than CONSOL. With a market cap of $4.3 billion, the company is one of the largest thermal coal producers in the world with assets in both North America and Australia.

Peabody Energy

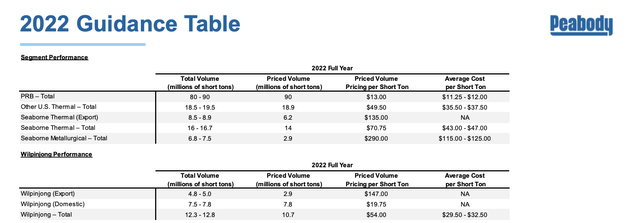

The company’s North Antelope Rochelle Mine, located 65 miles south of Gillette, Wyoming, is the largest coal mine in the world. This mine helped the company’s Powder River Basin operations to produce 88.4 million tons of coal last year. On top of that, the company produced 17.3 million tons of seaborne thermal coal, 5.5 million tons of Seaborne metallurgical coal, and 16.9 million tons of “other US thermal coal”.

These numbers are expected to rise this year. Note that this is expected despite severe weather-related headwinds in Australia, where Wambo and Wilpinjong have received 190% and 155%, respectively of the 10-year historical rain averages.

Peabody Energy

Just like CONSOL Energy, Peabody is seeing strong industry fundamentals:

Across the globe, all coal price indices remain at strong levels. The outlook for all our operating segments continue to be favorable with the constrained supply base serving a market that is reallocating the scarce availability of coal. Seaborne coal markets remain volatile with near-term markets being driven by continued energy supply security issues caused by the Russia-Ukraine conflict, the global inflationary environment, concerns with the severity of the impending win in Europe, and the wet season in Australia and Indonesia.

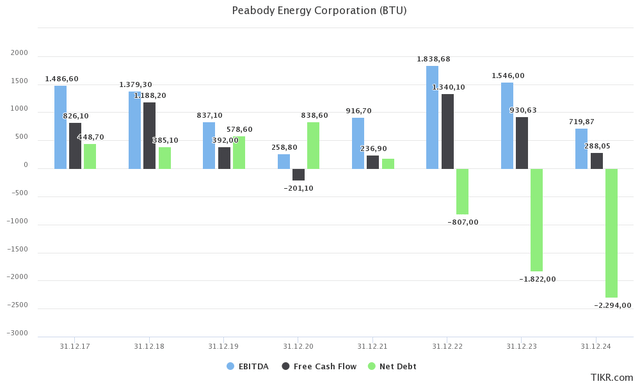

Like its peer CONSOL Energy, its financials are fantastic. The company is on pace to deliver accelerating shareholder returns thanks to high free cash flow and EBITDA. Year-to-date, adjusted EBITDA is $1.3 billion. That’s three times what the company did in the prior-year period. Free cash flow was $461 million in the third quarter, the best result in 18 quarters, leading to $1.4 billion of cash and cash equivalents.

TIKR.com

The company now has $485 million more in cash than total debt, allowing it to retire $186 million of secured debt and $143 million of additional repurchase offers on the Wilpinjong 10% debt, currently outstanding.

Moreover, as of September 30, the company classified all remaining secured debt as a current liability. Meaning it intends to repay all of it over the next 12 months, except for its 2028 convertible notes.

Adding to that, the fourth quarter is expected to be one of the best quarters ever.

[…] we expect the seaborne thermal and metallurgical segments to report their highest quarterly sales volumes of the year in the fourth quarter. The seaborne thermal segment is expected to ship 2.4 million tons, with 1.2 million export tons priced on average at 122, including 564,000 metric tons hedged at $84.

With that said, there are no clear plans for buybacks and dividends.

As Seeking Alpha contributor Michael Wiggins De Oliveira writes:

This is part of the reason why Peabody’s valuation is so compressed. Because investors that are interested in investing in other coal companies will probably opt for those that can buy back their shares or return capital to shareholders via dividends.

While I don’t recommend coal stocks as a source of income, I’m not too worried about distributions. The company is on track to achieve nearly $3 billion in net cash in 2024. If coal fundamentals remain strong, there is no way around high shareholder distributions. Hence, I expect some good news on that front in 2023.

With that said, the valuation is highly attractive. The company has a current enterprise value of $4.0 billion, based on its $4.3 billion market cap, $200 million in pension-related liabilities, and $490 million in net cash. I’m not even incorporating fourth-quarter cash generation or anything beyond that.

This valuation is 2.7x 2023E EBITDA of $1.5 billion.

Even if we assume that coal prices normalize after 2023, the company is still trading at 5.6x 2024E EBITDA of $720 million. Note that the company Could be sitting on more than $3 billion in cash by then. So, that lowers the valuation significantly.

I also believe that coal prices will remain elevated beyond 2023.

Takeaway

Coal is back. A combination of sanctions and environmental policies to lower supply has caused a perfect storm. We’re not only seeing high coal demand growth in emerging markets but also a return to the world’s most common fossil fuel in developed nations.

America is delaying planned shutdowns as a mix of high energy prices and political consequences (and risks) make it impossible to force an energy transition without severe economic consequences.

China is boosting demand to avoid the impact of global energy price volatility. India is boosting demand to fuel the growth of its middle class. Europe is going back to coal to save as much natural gas as possible.

Now, formerly hated coal mining companies are laughing all the way to the bank. Both CONSOL and Peabody Energy are in a great spot to repair their balance sheets, boost output, and benefit from both domestic and international demand growth.

Even after rallying for more than two years, both stocks are attractively valued, offering a high likelihood of longer-term outperformance.

(Dis)agree? Let me know in the comments!

An additional note from the author

I usually don’t add stuff after my takeaway. However, in this case, I need to remind people that coal stocks are highly cyclical and volatile. As bullish as I am on coal, I do NOT recommend investors to go overweight coal. Please keep your positions limited and carefully assess whether coal is the right fit for your portfolio.

Be the first to comment