CHUNYIP WONG

Natural Gas Volatility: What’s Causing It?

The historic volatility in natural gas (KOLD) continues. Last Friday, I told Weather Wealth subscribers about a change in the weather pattern with a potential colder-than-normal period in late November and December for the United States. Natural gas prices proceeded to rally $1.00 from last Thursday’s lows and bearish EIA number to this Monday’s highs ($7.22) based on other firms changing their weather forecast a few days later.

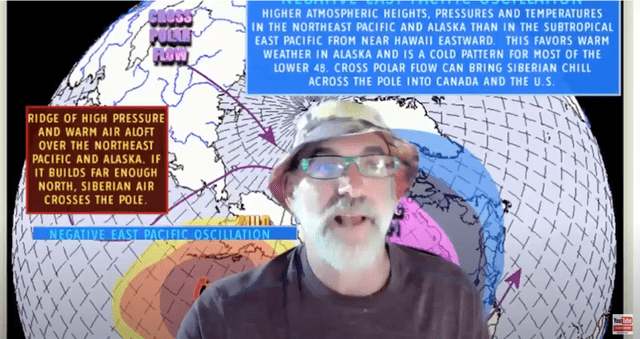

This video describes both La Niña and what we call a “negative Eastern Pacific Oscillation Index.” The combination of these two climatic variables, when working together, can produce a cold early winter. Why, then, did natural gas prices pretty much give everything back in one day? Incredible.

Jim Roemer video about winter weather (Weather Wealth newsletter)

Here are the reasons I felt that natural gas (UNG) prices ran up too much, too quickly in the face of the changing weather forecasts. After all, we had a near-record warm fall (globally) that has hurt natural gas.

In sum: demand, plus the main LNG export terminal in Texas has been down for months.

- Natural gas prices above $5-$6 this time of the year are very unusual as U.S. production continues to grow.

- While the Freeport LNG export terminal will reopen soon, the weather forecast is warm for Europe. Hence, we need to see sustained cold weather, not just here in the U.S. but in Europe to help the demand part of the equation.

- The weather last week was very warm across the United States, with near-record temperatures this week. Hence, while potential colder late-November and December weather could well occur, the natural gas market was anticipating another bearish EIA report this Thursday.

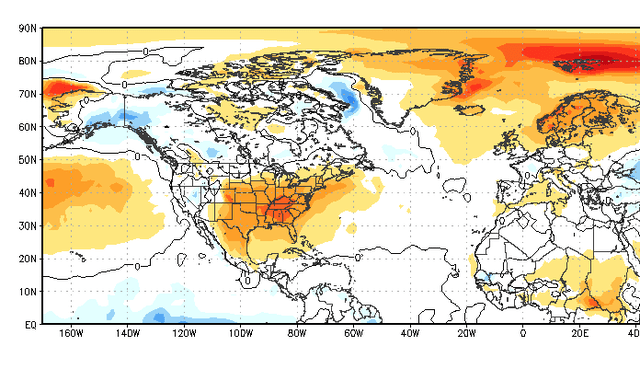

- The European forecast models suggest that after just a week or so of U.S. cold weather, it will warm (red=warm, below) up again.

European Model warm December forecast (Stormvista Models)

Trading commodities successfully

Regarding trading right now: patience, patience, patience in the midst of global economic uncertainty, bearish chart patterns in some commodities, a stronger dollar, Russia’s war on Ukraine, and mixed weather signals.

The next big questions I will be answering for traders are:

- 1) Will the Plains states drought continue into next spring and impact winter wheat (WEAT)?

- 2) How serious will the flooding be that may lower the Australian wheat crop?

- 3) When will demand worries and a stronger dollar (which has been bearish for corn) be offset by the potential for bullish corn (CORN) weather in Argentina?

- 4) How will a change in the Jetstream pattern north of Alaska bring colder late autumn weather and put the brakes on the drop in natural gas (BOIL) prices?

Anyway, there are two commodity trades that have been our home runs recently. They were natural gas and coffee. (Some of this is old news now. We already caught the huge move down in prices.)

So, lesson #1 below pretty much highlights one of the most successful rules for successful commodity trading: Stick to the markets you know best. For a complete list of my favorite rules and how to trade commodities successfully, I invite you to see this article I wrote.

Be Patient: Wait to hit in your strike zone (www.bestweatherinc.com)

Conclusion

So… what to do in the UNG natural gas market currently? Based on extraordinary natural gas and weather volatility, using certain option positions is the way to go in this market. This is something we advised quite successfully in several commodity markets in the last few months. There are very mixed weather signals because of La Nina and the EPO index, but also the warming Arctic and record warm weather globally.

The European model discussed above has been horrible, and we will be using our in-house weather software to help energy traders around the world.

Is this (natural gas) a market you know best, and how did you trade it successfully in the past? Ask yourself that and make sure you follow the weather.

Be the first to comment