cemagraphics

Despite continued deterioration in leading economic indicators, equity markets have remained resilient over the past few months. A return to a low inflation environment in 2023 now appears to be priced into markets, but a decline in earnings does not. Interest rate sensitive parts of the economy have been hit hard and investment is weakening, but consumer spending remains robust. Given the likelihood of a softer labor market going forward and a drop in consumer spending, equity markets appear to have far more downside than upside at current levels.

Valuation

A range of indicators point towards equity markets being richly valued, despite a substantial pullback from the highs of 2021. It should be noted that there is a large dispersion in valuation across sectors and market capitalization though, some of which is driven by fundamentals and some of which is related to sentiment.

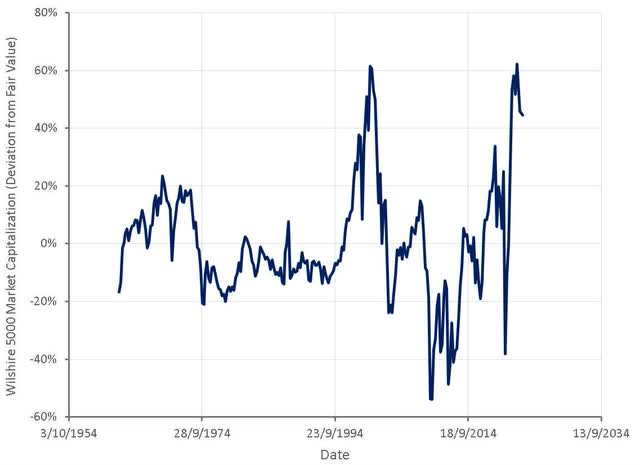

Adjusting the Wilshire 5000 Market Capitalization to GDP ratio for interest rates and detrending makes this indicator potentially more useful. Based on this, markets appear to be significantly overvalued, but this is largely the result of current interest rate levels. A return to a low and stable inflation environment would make equity markets appear more reasonably valued, assuming that there is no decline in earnings.

Figure 1: Wilshire 5000 Market Capitalization Relative to Calculated Fair Value (source: Created by author using data from The Federal Reserve)

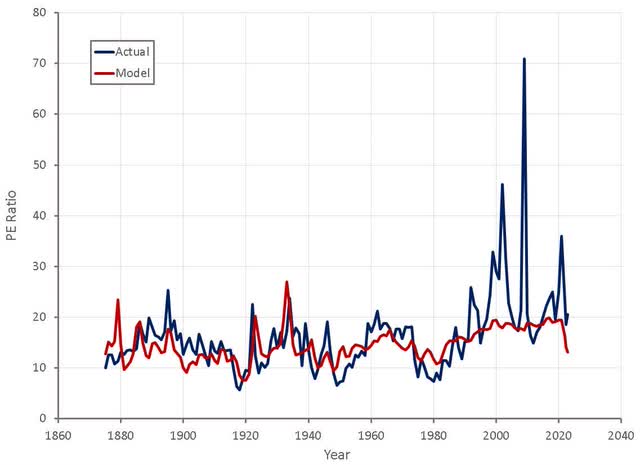

Modeling the S&P 500 PE ratio based on the inflation rate and the volatility of inflation shows that these 2 factors explain much of the variation in valuations. If the current inflationary environment were to become the norm, equity markets would be extremely overvalued.

Figure 2: Modeled S&P 500 PE Ratio (source: Created by author using data from multpl.com)

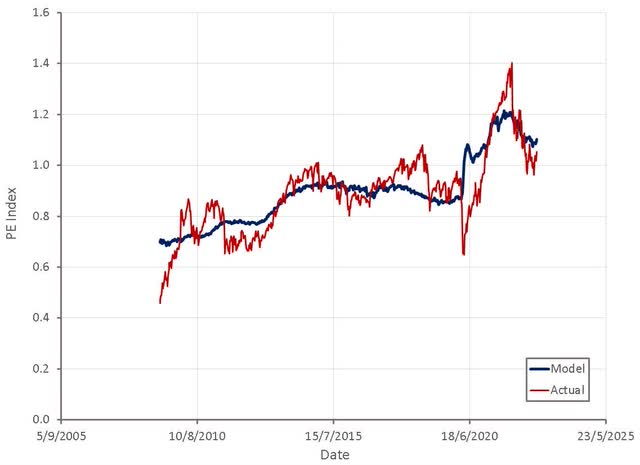

Monetary and fiscal policy also continue to be important considerations, alongside corporate profits. Liquidity has been declining as the Fed has engaged in quantitative tightening, which is likely to be a drag on equity markets. A PE Index adjusted for interest rates and liquidity levels indicates that the S&P 500 is slightly undervalued, although earnings and liquidity are both declining, reducing the fair value over time.

Figure 3: Liquidity Based Model of S&P 500 PE Ratio (source: Created by author using data from The Federal Reserve)

Recession

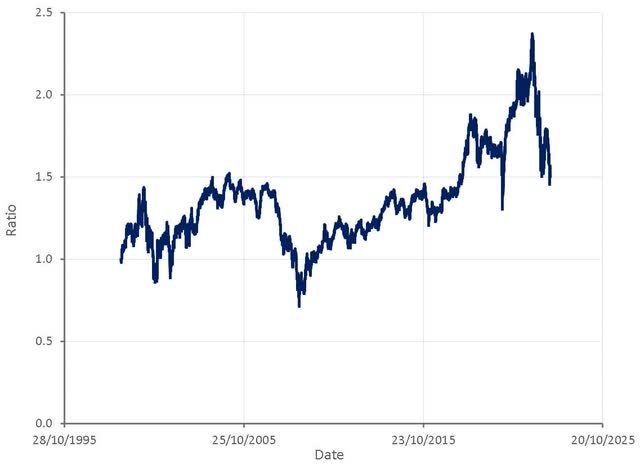

Given the rapid rise in consumer debt levels and rapid decline in personal savings, it seems likely that a drop in consumer spending will be inevitable at some point in the next 1-2 years. This, along with weak investments, creates substantial risk of a recession. There is little indication that this is currently being priced in by markets though. Consumer staple stocks have been outperforming consumer discretionary stocks, but this is probably due to a normalization of spending after a boom in discretionary spending during the pandemic, along with inflation shifting spending towards staples.

Figure 4: XLY (consumer discretionary) to XLP (consumer staples) Ratio (source: Created by author using data from Yahoo Finance)

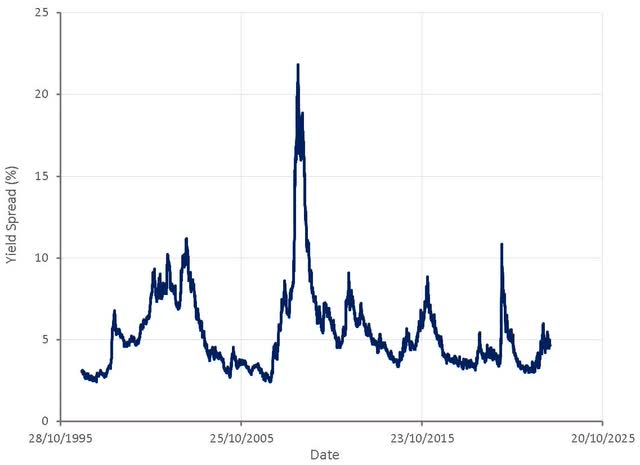

Yield spreads remain fairly modest, and do not appear to be pricing a recession as a significant probability.

Figure 5: High Yield Index Option Adjusted Spread (source: Created by author using data from The Federal Reserve)

The yield curve is currently deeply inverted, but it should be kept in mind that interest rates have risen extremely quickly, and are now well beyond the typical range of the past few decades. Given that inflationary pressures are now easing, the yield curve may simply be reflecting a moderation in monetary policy rather than a recession.

Conclusion

Interest rate rises are hitting more sensitive parts of the economy, like housing, but consumer spending remains robust. In the near term it appears that business and residential investment will continue to be weak while consumer spending remains strong. Lower inflation and less hawkish rhetoric from the Fed are likely to be supportive of equities, but it is difficult to see earnings continuing to increase rapidly from current levels.

Be the first to comment