sankai

Gold miners are finally perking up after a massive drubbing since the middle of 2020. The group rallied big off its Covid lows, but high inflation was not a tailwind for both small and large miners. Rising real yields hurt the niche during the first half of this year, but there are rays of hope shining through for one ETF.

According to VanEck, the VanEck Junior Gold Miners ETF (NYSEARCA:GDXJ) seeks to replicate an index that tracks the overall performance of small-capitalization companies that are involved primarily in the mining of gold and/or silver. Portfolio of small gold miners, some of which are in early exploratory stages with upside potential, and gold miners have historically provided leveraged exposure to gold prices.

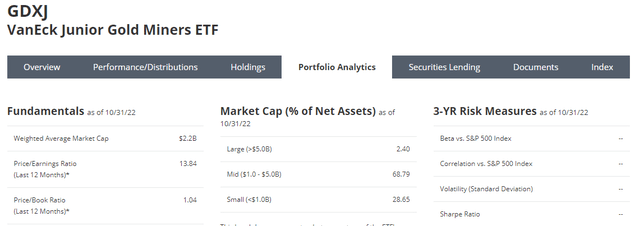

GDXJ sports an annual expense ratio of 0.52% and pays a 1.06% 30-day SEC yield. So, it’s a somewhat low-cost vehicle, albeit with a low yield, for getting access to a high-beta niche of the global stock market that appears to be turning more favorable. With a price-to-earnings ratio under 14, below the market’s multiple, the fund looks cheap on valuation.

GDXJ: An Improved Valuation

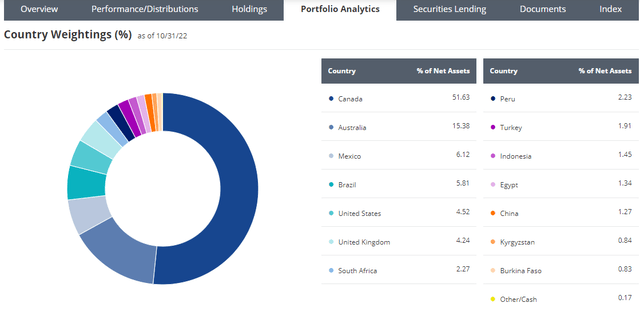

It is important to recognize that GDXJ is largely a foreign fund with just a 4.5% weight to the U.S. stock market. Goings on in Canada and Australia are especially important to how the ETF performs.

GDXJ Country Weights: Oh Canada!

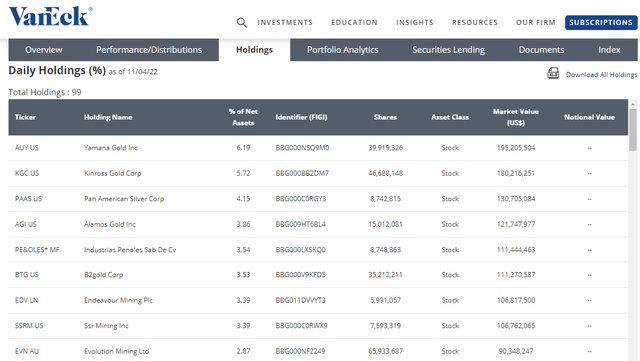

The fund’s largest holding, Yamana Gold (AUY), was recently rumored to be acquired by fellow gold mining company Gold Fields (GFI). There’s drama, though, as Gold Fields said it will not raise its bid after Pan American Silver (PAAS) and Agnico Eagle Miners (AEM) submitted competing bids for AUY. That M&A news has buoyed shares in both GDXJ and the larger VanEck Gold Miners ETF (GDX) in the last week.

GDXJ Holdings: Yamana In M&A Discussions

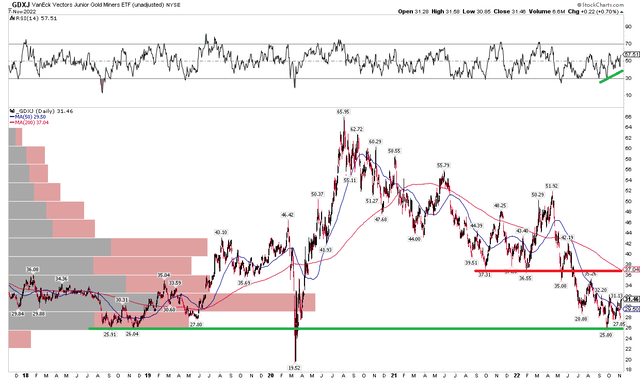

The Technical Take

GDXJ depicts a few interesting chart features that traders and investors should pay attention to. First, notice how the $25 to $26 area was key support before the pandemic. While shares dipped sharply lower in a very thin market in March 2020, I think $25 is more critical support. The reason for that thesis is rooted in volume evidence. The volume-by-price indicator on the left of the chart shows very few shares traded under $25 in the last five years, so it should not be that significant from a supply and demand perspective.

Next, notice how the recent defense of the mid-$20s comes with a rising RSI. The RSI indicator is a momentum gauge, and the thought is that momentum turns before price inflects. In this case, I think shares could lift from support since the RSI is already on the move up.

There could be resistance, though, in the $35 to $37 range. That zone was pivotal dating back to September of last year. Once $35 broke to the downside in June, it then became resistance on the way back up during August. I would like to see shares rise above this congestion zone before getting too excited long term.

Overall, I like GDXJ here for another, say, 15% of upside.

GDXJ: Holding Support, Bullish RSI Trend, Resistance Ahead?

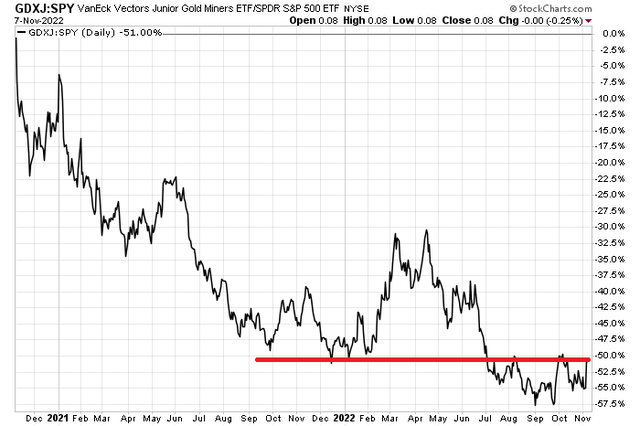

Finally, keep your eye on a key relative price level in GDXJ vs the S&P 500 ETF (SPY). A move higher in the next few days could help cement a bearish to bullish relative price reversal.

GDXJ/SPY Relative: Watching For A Bullish Breakout Soon

The Bottom Line

Small gold miners look good for a bounce into-year end. With a valuation that is below that of the broad market and with improving absolute and relative price action, I assert an overweight to GDXJ is warranted now through the next few months.

Be the first to comment