grinvalds/iStock via Getty Images

A 2-sided network effect is without much doubt one of the best network effects and economic moats a company can have. A dense network of buyers and sellers is difficult to replicate for new competitors, and one of the companies that managed to establish such a network in the last few years is Etsy, Inc. (NASDAQ:ETSY).

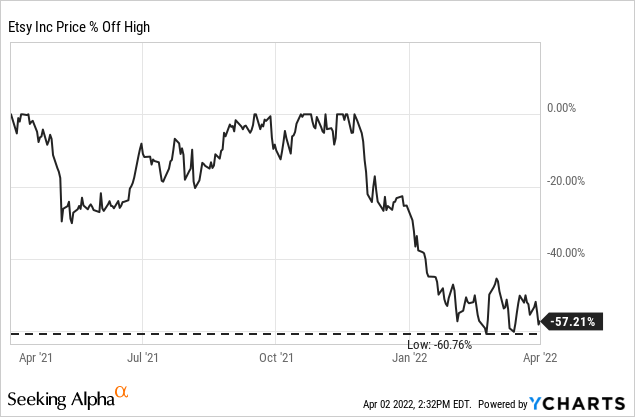

Etsy declined about 60% from its previous all-time highs, and such a steep decline is justifying the question of whether the stock could be a bargain. In this article, we take a closer look at the business and try to determine if the stock is cheap enough to be a good investment right now. We start by looking at the most recent annual results.

Annual Results

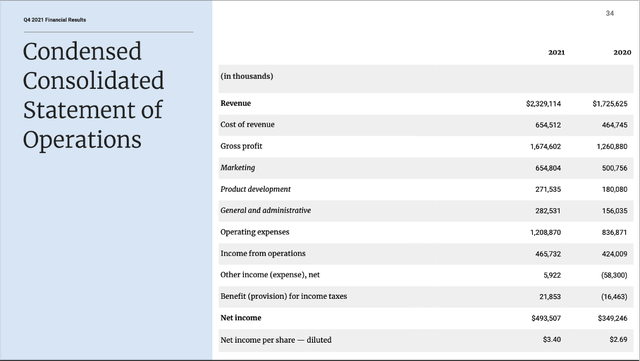

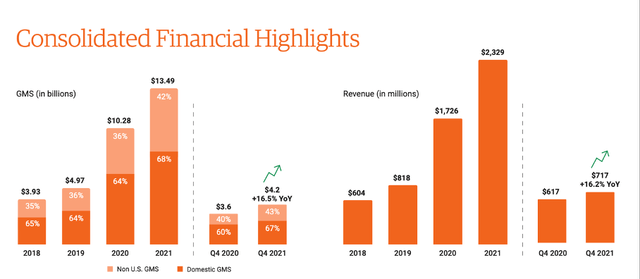

When looking at the annual results for fiscal 2021, we see strong growth rates for Etsy once again. Revenue increased from $1,726 million in fiscal 2020 to $2,329 million in fiscal 2021, resulting in 34.9% year-over-year growth. Income from operations (operating profit) increased 9.9% from $424 million last year to $466 million in fiscal 2021. And finally, diluted earnings per share increased from $2.69 in fiscal 2020 to $3.40 in fiscal 2021 – representing 26.4% year-over-year growth.

Etsy Q4/21 Earnings Presentation

Aside from the income statement, we can look at a few more metrics such as Etsy’s gross merchandise sales, which increased from $10,281 million in fiscal 2020 to $13,492 million in fiscal 2021 – an increase of 31.2% year-over-year. And the percentage of non-U.S. GMS (the dollar value of items sold in Etsy markets within the applicable period, excluding shipping fees and net of refunds associated with canceled transactions) increased from 36% in fiscal 2020 to 42% in fiscal 2021 – indicating that Etsy is expanding outside the United States.

Growth Company or Pandemic Play?

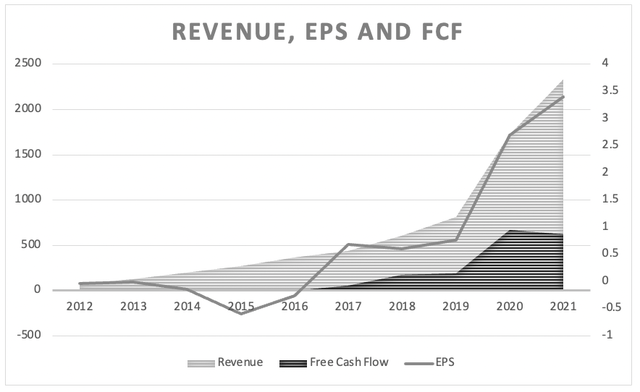

When reading articles or opinions about Etsy, we often see the narrative of Etsy being a “pandemic play” and authors arguing either for or against this thesis. For starters, we can’t deny that Etsy profited immensely from the pandemic. As we can see in the chart below, Etsy increased its GMS 107% in fiscal 2020, and its revenue grew even more, 110%, in fiscal 2020. We can also see that growth rates slowed down again – supporting the thesis that Etsy is a “pandemic play.”

But we must also question ourselves, if we are actually expecting Etsy to grow in the high double digits or even triple digits. Fiscal 2020 is clearly an outlier, and Etsy probably won’t be able to repeat that success any time soon. That by itself, though, is no argument that Etsy is just a pandemic play.

When looking at the last ten years and especially the years before the pandemic, we can see an impressive revenue CAGR of 46.48% since 2012, and thus not only the pandemic contributed to growth. Etsy is also profitable since 2017 and also generated a positive free cash flow since 2017. Between 2017 and 2021, earnings per share increased with a CAGR of 49.53% and free cash flow increased even with a CAGR of 84.30% during that timeframe.

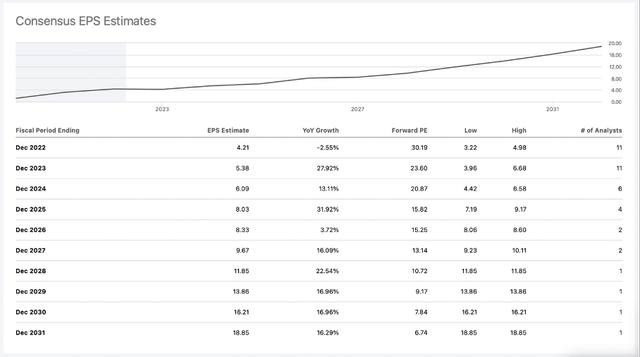

And growth will clearly slowdown in the years to come. But analysts are still expecting high growth rates for earnings per share in the next ten years. On average, analysts are expecting Etsy’s bottom line to grow with a CAGR of 15.87% in the years until fiscal 2031.

In 2021, Etsy was also growing due to two important acquisitions. The company acquired the Elo7 marketplace for $217 million in an all-cash acquisition, as well as Depop for $1.625 billion. Elo7 is ranked among the top 10 ecommerce sites in Brazil, specializing in unique, handmade items. Depop is a marketplace for unique fashion (including vintage pieces). And in both cases, Etsy sees growth potential – in the case of Elo7 especially, as Brazil’s ecommerce sector is still in the early stages of development and Brazil is one of the largest economies in the world.

Balance Sheet

One result from the acquisitions is lower cash and higher debt levels on the balance sheet. When looking at Etsy’s balance sheet (as of December 31, 2021), we can see $2,275 million in long-term debt (and no short-term debt). When comparing the total debt to the stockholder’s equity of $629 million, we get a D/E ratio of 3.62, which is rather high. Additionally, we can compare the total debt to the operating income Etsy can generate in a single year. When using the operating income of the last four quarters ($466 million), it would take almost five years to repay the outstanding debt. This also indicates that the debt levels of Etsy might be rather high.

But we must put these numbers in context. First, Etsy has $780 million in cash and cash equivalents on its balance sheet as well as $204 million in short-term investments. And, in theory, Etsy could use these rather liquid assets to repay about 43% of its outstanding debt. Additionally, Etsy is expected to grow at a rather high pace and should be able to generate higher amounts of operating income and free cash flow in the years to come. Therefore, neither solvency nor liquidity should be an issue.

While Etsy has rather high amounts of liquid assets on its balance sheet (which is good), it also has $607 million in intangible assets and $1,371 million in goodwill. Compared to $3,832 million in total assets, goodwill is responsible for 36% of total assets – and while this does not have to be problematic, it is also not great.

Wide Economic Moat

I previously mentioned that Etsy has a wide economic moat which is based on network effects, and I have described this network effect in several articles in the past (in an article about eBay (EBAY), for example). Etsy has a 2-sided network of buyers and sellers on its marketplace and is connecting people that want to sell an item with people that want to purchase an item. And the more sellers a marketplace has, the more interesting it is for buyers, and the more buyers a marketplace has, the more interesting it is for sellers. And, therefore, a marketplace creates an economic moat and network effect from this advantage.

When looking at visits per month, Etsy is already in the 8th spot of online marketplaces in the world. With 391 million visits per month, Etsy is still lagging behind eBay with 1.7 billion visits per month and Amazon (AMZN) with 5.2 billion visits per month. However, Etsy has found its niche (selling handmade and vintage items), and this is differentiating Etsy from competitors.

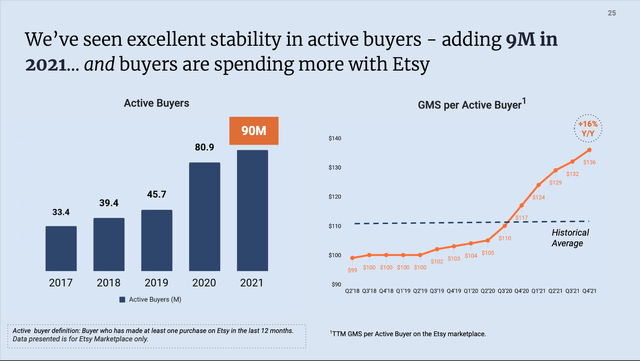

And the number of active sellers increased from 4.37 million on December 31, 2020, to 7.52 million active sellers on December 31, 2021. The number of active buyers increased from 81.90 million to 96.34 million in the same timeframe. And while these numbers also including buyers and sellers from other marketplaces (like Depop), Etsy itself is able to increase the number of active buyers and the GMS per active buyer – and both are a good sign for a growing network.

Etsy Q4/21 Earnings Presentation

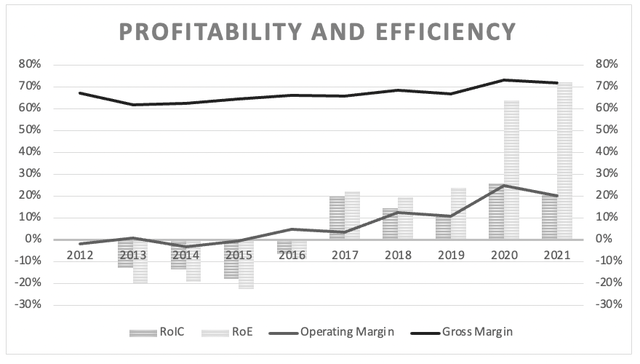

Etsy is a rather young company and lacks data for several decades to demonstrate stability and consistency over a long timeframe. But in the last few years, we see the first hints for a wide economic moat. While operating margin and gross margin are still improving, the gross margin can be described as more or less stable. And especially when looking at return on invested capital in the last few years, we see strong numbers. On average, RoIC was 18.17% over the last five years, and the numbers seem to improve over time.

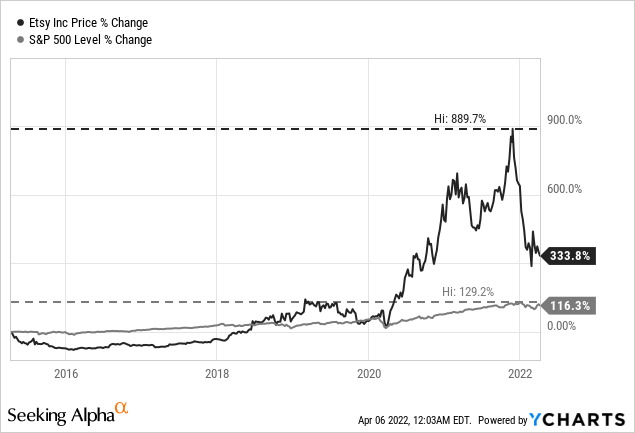

And Etsy clearly has outperformed the S&P 500 (SPY) since the IPO (334% increase vs. 116% increase, respectively). As we are looking at only 7 years (and to be more precise: 7 years during a bull market), we should be cautious about any conclusions from the stock performance. Clear outperformance over only a few years could just be the result of irrational exuberance and not indicative of the fundamental business.

Risk: Competitors

Although Etsy has a wide economic moat around its business, that will keep most competitors at bay. It makes it especially difficult for new businesses to enter the market. We should not ignore the fact that many other online retailers and marketplaces have similar networks or even bigger networks. Aside from the above-mentioned companies such as Amazon or eBay, which are already operating in a similar market, we should also look out for potential competitors like Meta Platforms (FB).

In his last few earnings calls, Meta’s Mark Zuckerberg mentioned again and again that Facebook will also focus on commerce. Facebook (or Meta Platforms) is a competitor every business should take seriously – even if the current sentiment surrounding the company is rather negative. And although Etsy is in a strong position in its niche of handmade and vintage, we still must keep an eye on these competitors for two different reasons. First, they have enormous financial strength (in many cases huge amounts of free cash flow and cash on the balance sheet), which they can use. Second, these companies already have strong network effects in place.

Risk: Share Dilution

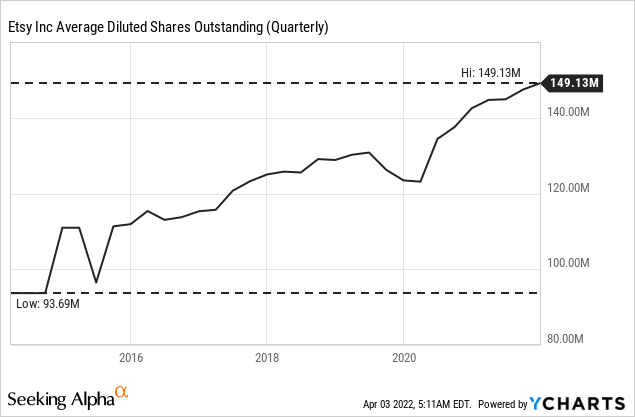

A second major risk we must mention is the constant dilution of shares in the last few years. When looking at the income statement, we see a huge difference between the basic earnings per share (which were $3.88 in fiscal 2021) and the diluted earnings per share (which were $3.40). Almost every company has a small deviation between basic EPS and diluted EPS, but diluted earnings per share being 12.4% lower than basic earnings per share is a warning sign.

And it should also not be surprising, that the diluted number of outstanding shares has increased constantly since 2015. It is also not completely surprising for a young company that the number of outstanding shares is increasing. But Etsy increased the number of outstanding shares from 93.69 million in 2015 to 149.13 million right now, reflecting an increase of 59% over just seven years. I don’t want to sound too dramatic, but this is resulting in a negative impact of 6.87% on the bottom line caused by dilution. This means that Etsy must grow its net income at least 7% annually to offset dilution when the company increases the number of outstanding shares in a similar pace. We also point out that this is only the case if all convertible securities are converted.

Intrinsic Value Calculation

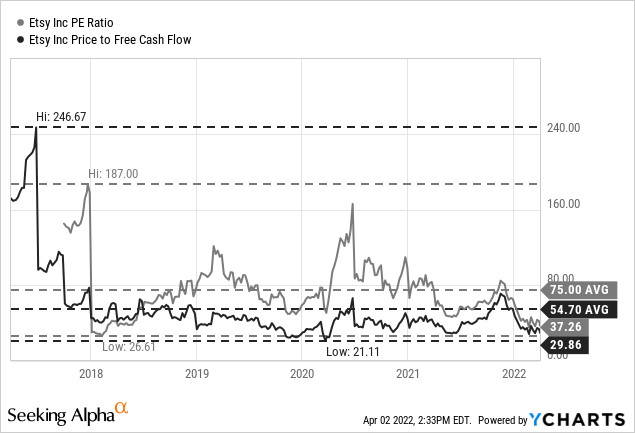

When trying to answer the question of whether Etsy is fairly valued or not, we can start by looking at some simple valuation metrics. Right now, Etsy is trading for a P/E ratio of 37. This is not only one of the lowest P/E ratios Etsy has ever traded for, but also far below the average P/E ratio of the last five years, which was 75. When using the expected non-GAAP earnings per share for fiscal 2022 ($4.21) we get a P/E ratio of 30 right now. From this point of view, Etsy seems to be rather cheap right now. Additionally, we can also look at the price-free-cash-flow ratio (P/FCF), which is 29.86 right now and also one of the lowest P/FCF ratios Etsy has traded for. In comparison, the average Etsy P/FCF ratio over the last five years was 54.70.

We can also use a discount cash flow calculation to determine an intrinsic value for the stock and estimate growth rates that are necessary for the stock to be fairly valued right now. When taking the free cash flow of fiscal 2021 ($623 million) as our basis and assuming a 10% discount rate as well as 147 million diluted shares, Etsy must grow 9% for the next decade, followed by 6% growth till perpetuity to be fairly valued right now. When using the analysts’ assumptions for the next ten years (see here) followed by 6% growth till perpetuity, we get an intrinsic value of $251.04 for Etsy. The stock would be deeply undervalued under these assumptions.

I don’t want to be as optimistic as analysts, but growth rates in the high single digits or even double digits seem achievable for Etsy in the years to come. I would call Etsy at least fairly valued (probably even a bit undervalued).

Conclusion

Although we focused in the article on one single business, we should keep a second eye on the bigger picture (macroeconomic conditions and sentiment for example). And we should keep in mind, that the yield curve inverted recently – at least when looking at the 2-year treasury and 10-year treasury yield. And although this does not mean trouble right away, it is indicating a recession could start in 2023 as well as a bear market (that usually goes hand in hand with a recession).

Although Etsy performed quite well during the last recession, it does not mean it will perform in a similar way in the next recession. The last recession was an exception, and Etsy clearly profited from the pandemic. In the next recession, Etsy will most likely be punished hard. But right now, Etsy could be slightly undervalued and worth a shot.

Be the first to comment