Hispanolistic

As a value-oriented investor, I’m always on the lookout for fundamentally cheap companies that offer attractive upside. One of those I have come across is a company called American Axle & Manufacturing Holdings (NYSE:AXL). As a major global automotive and mobility supplier that focuses on driveline and metal-forming technologies for electric, hybrid, and internal combustion engines, as well as other products, American Axle & Manufacturing Holdings may not seem like all that exciting an opportunity. But recent financial performance has been largely positive, and shares of the business are trading at cheap levels. Given these factors, I believe that keeping the ‘buy’ rating I had on the stock previously makes a great deal of sense for the foreseeable future.

A solid player in this space

Back in early March of this year, I wrote an article that took a rather bullish stance on American Axle & Manufacturing Holdings. In that article, I acknowledged that the prior few years had been rather bumpy for the company. However, I remained optimistic based on recent financial performance that showed the overall condition of the firm to be improving. I was particularly drawn by the strong cash flows of the company, and I felt as though shares were cheap enough to warrant an attractive upside. Because of this, I ended up rating the company a ‘buy’, reflecting my belief at the time that shares should meaningfully outperform the broader market for the foreseeable future. So far, that call has gone on quite well. While the S&P 500 is down by 13.6%, shares of American Axle & Manufacturing Holdings have generated upside for investors of 3.8%.

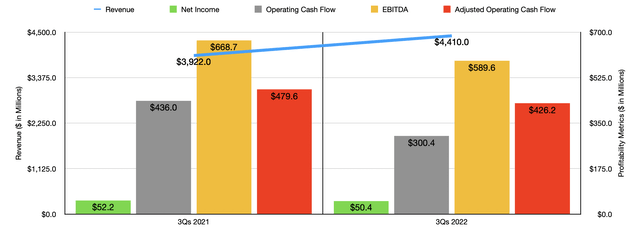

This return disparity has been entirely warranted in my opinion. To see what I mean, we need only look at financial results covering the 2022 fiscal year so far. You see, when I last wrote about the company, we only had data covering through the end of 2021. Now, we have data covering through the first three quarters of 2022. During this window of time, revenue for the company came in at $4.41 billion. That’s 12.4% higher than the $3.92 billion the company generated at the same time last year. According to management, there were multiple drivers behind this sales increase. For instance, the company benefited to the tune of $55 million from pushing higher metal prices onto its customers and from the favorable impact of foreign currency fluctuations. The company also benefited to the tune of $121 million thanks to its acquisition of Tekfor that was completed in the second quarter of this year. Interestingly, management actually believes that sales would have been higher had it not been for the semiconductor shortage. Their overall estimate is that this, combined with other supply chain constraints affecting the automotive industry, affected revenue to the tune of $303 million in the first nine months of this year. Though in the year prior, the belief is that sales were impacted to the tune of $471 million.

This strength on the top line has not, unfortunately, translated into improved bottom line results for the year-to-date period. Net income, for instance, fell from $52.2 million in the first three quarters of 2021 to $50.4 million at the same time this year. A big driver behind this was a decrease in the company’s gross profit margin from 14.9% to 12.2%. Higher metal market costs and foreign currency fluctuations negatively impacted profits. The company also was hit to the tune of $118 million because of the impact on production volumes caused by the semiconductor shortage and other supply chain constraints. And it was also hit to the tune of $116 million because of the aforementioned acquisition. Fortunately, some of this pain was offset by a reduction in the selling, general, and administrative costs for the company, a figure that fell from 6.8% of sales to 5.8%. This was due to lower compensation costs, even as the company otherwise invested more in research and development. Naturally, these items also impacted other profitability metrics for the company. Operating cash flow, for instance, fell from $436 million last year to $300.4 million this year. Even if we adjust for changes in working capital, it would have fallen, dropping from $479.6 million to $426.2 million. And over that same window of time, even EBITDA dropped, declining from $668.7 million to $589.6 million.

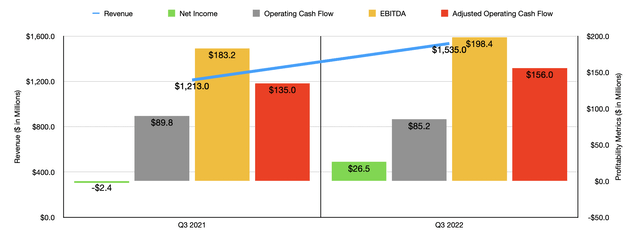

Although bottom line results for the first nine months of the 2022 fiscal year as a whole were negative, the company posted really impressive results in the third quarter. Sales, for instance, came in at $1.54 billion. That’s 26.5% higher than the $1.21 billion reported one year earlier. The company saw its bottom line go from negative $2.4 million to positive $26.5 million. Operating cash flow unfortunately still fell, dropping from $89.8 million to $85.2 million. But if we adjust for changes in working capital, it would have risen from $135 million to $156 million. And over that same window of time, we also saw EBITDA improve, climbing from $183.2 million to $198.4 million.

Clearly, American Axle & Manufacturing Holdings is showing signs of strength as the year is coming close to an end. But unfortunately, that strength has not been great enough to prevent the company from reducing guidance for the year. Now, management is forecasting revenue for 2022 of between $5.75 billion and $5.85 billion. That compares to the prior expected range of between $5.75 billion and $5.95 billion. Meanwhile, EBITDA has been forecasted to be between $745 million and $765 million. Previously, the forecast was for between $790 million and $830 million. No guidance was given when it came to other profitability metrics. But if we assume that adjusted operating cash flow will change at the same rate that EBITDA, at the midpoint, is expected to, then we should anticipate a reading for that this year of $474 million.

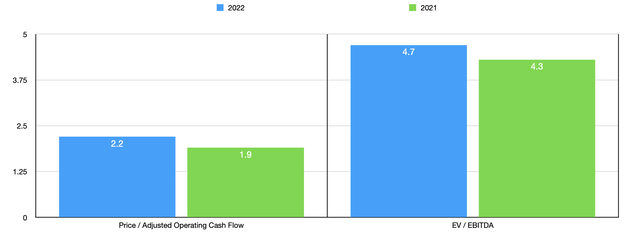

Given these figures, shares of American Axle & Manufacturing Holdings are trading at a forward price to adjusted operating cash flow multiple of 2.2. They are also trading at a forward EV to EBITDA multiple of 4.7. By comparison, using the data from 2021, these multiples would be 1.9 and 4.3, respectively. As part of my analysis, I also compared the company to five similar businesses. On a price-to-operating cash flow basis, these companies ranged from a low of 3.3 to a high of 29.3. In this scenario, American Axle & Manufacturing Holdings was the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was between 3.6 and 10.2. In this case, only one of the five was cheaper than our target.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| American Axle & Manufacturing Holdings | 2.2 | 4.7 |

| Patrick Industries (PATK) | 3.3 | 3.6 |

| Modine Manufacturing Co. (MOD) | 29.3 | 7.1 |

| Standard Motor Products (SMP) | 11.6 | 7.1 |

| BorgWarner (BWA) | 7.4 | 5.9 |

| Lear Corp. (LEA) | 20.6 | 10.2 |

Takeaway

The data available to us today tells me that while the 2022 fiscal year as a whole may not be as great as management or investors were anticipating, the results of the company most recently have been positive. The firm is showing improved results as the year is nearing its end. While it is disappointing that results may not be as anticipated, shares do look incredibly cheap at this point in time. Fundamentals aside, there are also some rumors that the company could be a takeover target. This initially led to an 18% surge in price on November 3rd of this year. But the stock subsequently fell after management denied any such discussions. Given how cheap shares are, though, it would not be surprising to see somebody eventually step up and make an offer. But, of course, investors should not bank on something so speculative. If it does come to pass, upside could be material for investors. But in the meantime, buying a company because of strong fundamentals could result in an upside no matter what happens with a potential takeover.

Be the first to comment