Justin Sullivan

Undoubtedly, one of the most well-known snack-oriented companies in the US is Hostess Brands (NASDAQ:NASDAQ:TWNK). In addition to owning a vast portfolio of iconic brands, the company has succeeded in leveraging those brands to grow both its top and bottom lines in recent years. That growth continues in the current fiscal year and will likely continue far beyond that. On an absolute basis, shares do not look exactly cheap.

Normally, I would even make the case that they are fairly valued. But compared to similar firms and considering the space that the company operates in, shares do look quite affordable. All things considered, I would argue that the business probably does have some additional upside from here. Perhaps not a lot, but definitely enough to warrant a soft ‘buy’ rating right now.

A sweet prospect

According to the management team at Hostess Brands, the firm is a leading sweet snacks company that’s focused on selling its variety of offerings throughout the North American market. Examples of brands in the company’s portfolio include its hallmark Hostess brand, as well as the Voortman brands. The company produces treats under other names as well. For instance, some of its leading treats include Donettes, Twinkies, Ho Hos, CupCakes, Ding Dongs, and Zingers. The Voortman brand, meanwhile, is focused on cookies and wafers.

There are multiple ways that you can slice and dice the snack category to determine just how large an opportunity this is. But if you focus solely on the sweet snacking universe, management says the opportunity is worth $91 billion. What’s even better is that the market is growing at a fairly quick pace, with an annual growth rate estimated at 4.8% over the past three years. In fact, according to management, the number of consumers eating five or more snacks per day has increased at double-digit rates since 2018.

To fuel this demand growth, the company has expanded to be fairly large. As of the end of its 2021 fiscal year, for instance, it operated five different bakeries across North America and four distribution centers, with one of these being both a bakery and distribution center. The company has office space in Chicago, Nashville, and Burlington, Ontario. It also has third-party warehouses throughout select parts of the nation and its headquarters are in Kansas.

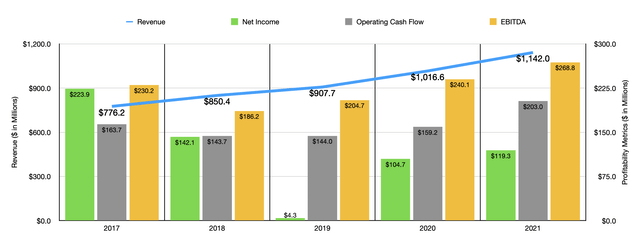

Author – SEC EDGAR Data

Over the past few years, the management team at Hostess Brands has done a really good job growing the company’s top and bottom lines. Revenue went from $776.2 million in 2017 to $1.14 billion in 2021. This growth seems to have been fairly spaced out, meaning that there was not a time frame where we saw a sudden surge for any particular reason. Regarding the time from 2020 through 2021, management attributed its sales growth to higher volumes that added 7% to the company’s top line. A particularly fast-growing part of the enterprise involved the cookies that it sells. Net revenue there jumped by 21.1% thanks to distribution growth.

On the bottom line, the picture has been quite positive as well. After seeing net income drop from $223.9 million in 2017 to $4.3 million in 2019, it began a consistent year-over-year increase, rising to $119.3 million in 2021. Operating cash flow bottomed out in 2018 at $143.7 million. After that, it began rising year after year, hitting $203 million last year. A similar relationship can be seen when looking at EBITDA. After falling from $230.2 million in 2017 to $186.2 million in 2018, it began a steady ascent. By 2021, it had risen to $268.8 million.

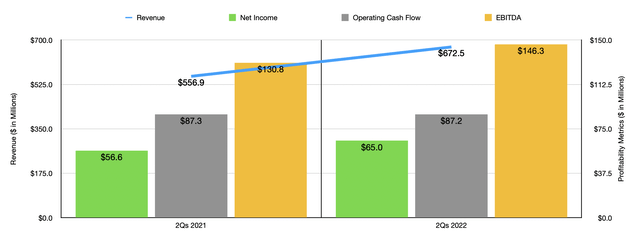

Author – SEC EDGAR Data

Despite concerns about the broader economy, Hostess Brands has so far been immune from any real pain. To see what I mean, we need only look at financial performance covering the first two quarters of the company’s 2022 fiscal year. Sales during this timeframe rose from $556.9 million in 2021 to $672.5 million this year. This 20.8% rise in revenue was driven by a combination of factors. Prior pricing actions and a favorable product mix provided nearly 12.1% of the growth year over year. Higher volumes, meanwhile, added 8.7% to the company’s top line. Cookie sales were particularly impressive, climbing by 28.2% year over year.

Naturally, profitability for the company also moved higher. Net income rose from $56.6 million in the first half of the 2021 fiscal year to $65 million at the same time this year. Operating cash flow inched down slightly from $87.3 million to $87.2 million. On the other hand, we did see a nice increase when it came to EBITDA, with the metric climbing from $130.8 million last year to $146.3 million this year.

Management has high hopes for the 2022 fiscal year as a whole. Their current forecast is for revenue to grow by at least 15%. They also now believe that EBITDA should come in at the higher end of their prior expected range of between $280 million and $290 million. For the purpose of this article, I will use a reading of $287.5 million. No guidance was given when it came to other profitability metrics. But if we assume that those would increase at the same rate that EBITDA should, then we should anticipate adjusted net income of $132.7 million and operating cash flow of $217.1 million.

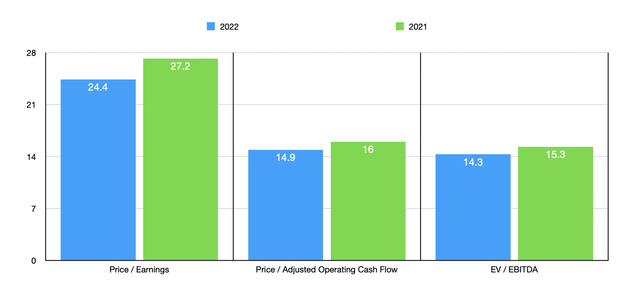

Author – SEC EDGAR Data

Using these figures, I decided to price the company. On a price-to-earnings basis, using estimates for 2022, the firm is trading at a multiple of 24.4. This compares nicely to the 27.2 reading that we get using data from 2021. The price to operating cash flow multiple should be 14.9. That stacks up against the 16 reading that I get using data from last year. And finally, the EV to EBITDA multiple should come in at 14.3. If we were to use data from last year, we would get a reading of 15.3 instead. To finish my analysis, I also decided to compare the company from a pricing perspective to five similar firms.

On a price-to-earnings basis, these companies ranged from a low of 22.3 to a high of 137.3. And when it comes to the EV to EBITDA approach, the range is between 13.9 and 27.1. In both scenarios, only one of the five companies was cheaper than Hostess Brands. Meanwhile, using the price to operating cash flow approach, the range was between 15.6 and 59.8. In this scenario, our prospect was the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Hostess Brands | 24.4 | 14.9 | 14.3 |

| Utz Brands (UTZ) | 137.3 | 59.8 | 27.1 |

| The Hershey Company (HSY) | 28.8 | 21.5 | 21.1 |

| Mondelez International (MDLZ) | 22.3 | 19.9 | 17.9 |

| J.M. Smucker Co (SJM) | 25.6 | 15.6 | 13.9 |

| J&J Snack Foods Corp. (JJSF) | 57.5 | 55.0 | 24.6 |

Takeaway

Although I generally prefer value stocks over high-quality companies that are trading at loftier prices, I will make the case that Hostess Brands makes for an appealing opportunity. While the company is not the cheapest firm on the planet, it is a high-quality operator that has demonstrated consistent and attractive growth. It’s also cheaper than most of its peers while also bringing with it a significant degree of stability should the broader economy suffer from here on out. For all of these reasons, I have decided to rate the business a ‘buy’, reflecting my belief that it should outperform the broader market for the foreseeable future.

Be the first to comment