Lorado/E+ via Getty Images

When it comes to the healthcare industry, particularly of companies that own and lease hospitals and other facilities in order to provide various health-related services, the objective of management becomes to get bigger in order to create additional profits and synergies that, in turn, can be recycled into growing the enterprise further. But not every player has gone in this direction. One firm, Community Health Systems (NYSE:CYH), decided years ago that having a smaller footprint can actually yield better results. By shrinking the enterprise and focusing on increasing its cash flows, this business has created some interesting shareholder value. On top of this, shares of the business currently look quite cheap. This is not to say that it’s not without its risks. Although shares look affordable today, leverage at the company is elevated and is something that management should continue to work on. But so long as the business can maintain this leverage and work to decrease it moving forward, the enterprise appears to offer interesting prospects to value-oriented investors.

When smaller is better

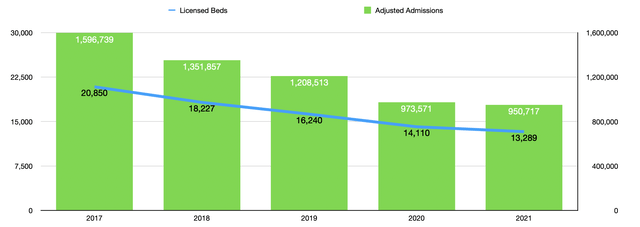

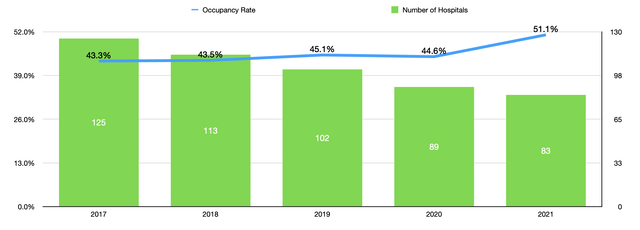

Community Health Systems describes itself as one of the largest publicly traded providers of healthcare services in the US. The company acts as a leading operator of general acute care hospitals and outpatient facilities with locations spread across at least 16 states. Operationally, the business is a fairly large organization, with 83 facilities under its ownership or under leases that it has. But at one point, the company was larger. Back in 2017, for instance, the business had 125 hospitals in its portfolio. Management boasted 20,850 licensed beds across these properties and the company had annual admissions, on an adjusted basis, of nearly 1.60 million people.

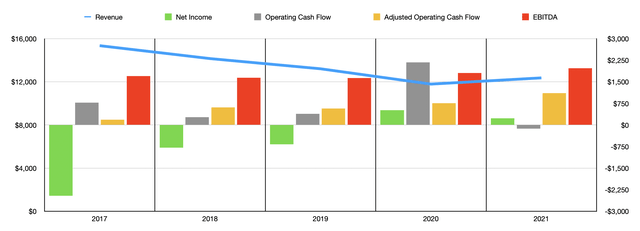

At first glance, seeing such a move away from a larger footprint to a smaller footprint might seem worrisome. After all, the nature of capitalism leads investors to applaud continual growth, even going so far as to punishing companies that shrink in size. But also consider that, in that 2017 fiscal year, the company had some serious problems. Although operating cash flow was positive to the tune of $773 million, this figure decreased, if you adjust for changes in working capital, to just $248 million. And that ignores an estimated $63 million that was attributable to non-controlling interests. Even worse, the company generated a net loss that year of $2.46 billion.

In an effort to improve its business, management started what would become an unwinding of much of its portfolio. The number of hospitals dropped to 113 in 2018 to 102 in 2019 to 89 in 2020, and then to 83 by the end of 2021. Naturally, this resulted in the number of licensed beds at its properties declining. In 2021, this metric came out to just 13,289. Admissions at the company also declined year after year, eventually hitting just 950,717 in 2021. Perhaps the only good thing, excluding some financial data I will cover shortly, is the fact that occupancy rates at its properties did gradually improve. In 2017, occupancy was just 43.3%. By 2021, this figure had increased to 51.1%, though it is unclear how much of this improvement was driven by COVID-19.

As one might expect, the amount of revenue generated by the company also declined over this time frame. Revenue went from $15.35 billion in 2017 to $11.79 billion in 2020. Then, in 2021, the rise in occupancy, combined with other factors, pushed sales up some, resulting in revenue that year of $12.37 billion. Management also expects the 2022 fiscal year to look up for the business, with revenue likely to come in at between $12.6 billion and $13.1 billion. At the midpoint, this would imply a year-over-year improvement of 3.9%.

Generally speaking, when you see revenue decline like this, you would also expect to see the company’s bottom line worsen. It is true that net profits for the company have been inconsistent. For instance, each year between 2017 and 2020, the business did see its bottom line improve. In 2020, in fact, net profits came in at $511 million. But then, in 2021, profits dropped, totaling just $230 million for the year. But what can you expect for any business, especially during such a volatile time? When you dig deeper, you start seeing some really interesting data. Operating cash flow for the firm has been all over the map over the past five years, with a net outflow of $131 million in 2021 representing the worst year for the business. But if you strip out changes in working capital, you would actually see operating cash flow increase almost every year, climbing from $248 million in 2017 to an impressive $1.25 billion in 2021. Another profitability metric that followed this trajectory was EBITDA. After dropping from $1.70 billion in 2017 to $1.63 billion in 2019, EBITDA jumped in 2020 and 2021, coming in last year at $1.97 billion. For the full 2022 fiscal year, management has provided some guidance. Net profits should drop again, coming in at just $166.9 million if management hits midpoint expectations. But EBITDA should still be robust at between $1.825 billion and $1.975 billion. Taking the midpoint of $1.90 billion and applying that same year-over-year change to operating cash flow should result in operating cash flow, net of non-controlling interests, of about $1.07 billion.

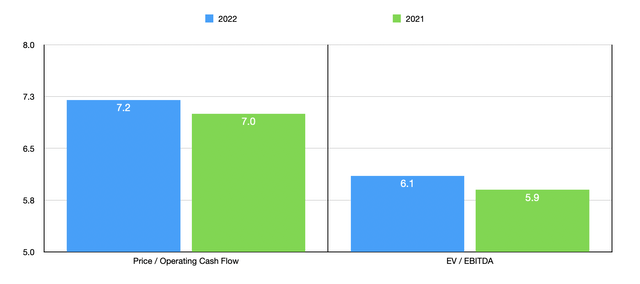

Taking this data, we can effectively price the company. But we have to be careful about how we interpret the results. For instance, using the firm’s 2021 figures, we find it trading at a price to adjusted operating cash flow multiple of just 1.4. This increases to 1.6 if we rely on 2022 estimates. Such an absurdly low valuation looks too good to be true. And, in a way, it is. The fact of the matter is that the company has a significant amount of debt, with net debt coming in at $11.63 billion. Admittedly, this is an improvement of $1.72 billion compared to what the company posted five years earlier. But with a net leverage ratio, using 2021 results, of 5.9, the company clearly has a lot of leverage that needs to be factored into the equation. To do this, I also looked at the business through the lens of the EV to EBITDA multiple, ending up with a reading of 7 if we rely on 2021 figures and of 7.2 if we rely on 2022 forecasts by management.

To put the pricing of the company into perspective, we need only look at a few similar firms. On a price to operating cash flow basis, these companies range from a low of 6 to a high of 80.3. Our prospect was the cheapest of the group. If, instead, we rely on the EV to EBITDA approach, we end up with a range of 5.1 to 16. In this case, two of the five companies were cheaper than Community Health Systems.

| Company | Price/Operating Cash Flow | EV/EBITDA |

| Community Health Systems | 1.4 |

7.0 |

| Sonida Senior Living (SNDA) | 80.3 | 5.1 |

| HCA Healthcare (HCA) | 9.5 | 8.2 |

| Tenet Healthcare (THC) | 6.0 | 6.5 |

| Acadia Healthcare (ACHC) | 16.0 | 16.0 |

| Ensign Group (ENSG) | 17.9 | 14.7 |

Takeaway

Based on all the data provided, I believe that Community Health Systems is an interesting company that could offer some attractive upside for long-term investors. The business does have a leverage issue that it needs to continue working on. But when you look at cash flows, it’s clear that shrinking has had a positive impact on the company’s results. How much further the business should shrink is anybody’s guess. But so long as we continue to see improvements like we have, the picture is not all that bad. Relative to similar firms, the business is probably more or less fairly valued. But on an absolute basis, I would say that they are cheap. But given the relative valuation, for investors who don’t want a risky, leveraged prospect, I do think that there could be safer prospects out there that offer similar or even greater upside.

Be the first to comment