Sundry Photography/iStock Editorial via Getty Images

Introduction and Thesis

In my past articles, I have been bullish on Intel (NASDAQ:INTC), and my buy rating on the company stands. I believe Intel offers great value and stability as well as a strong growth opportunity in the coming decade as the company aims to turn around its business from pursuing stability to growth. There are massive trends in both the industry and the political landscape that are shaping up in favor of Intel, and the company’s new CEO, Pat Gelsinger, has so far proven his execution skills. Therefore, I continue to believe that Intel is a buy.

Intel’s Vision

Before going into the article, I would like to quickly explain Intel’s vision because the company’s vision and its execution skills will ultimately decide if the company will be relevant in the coming future.

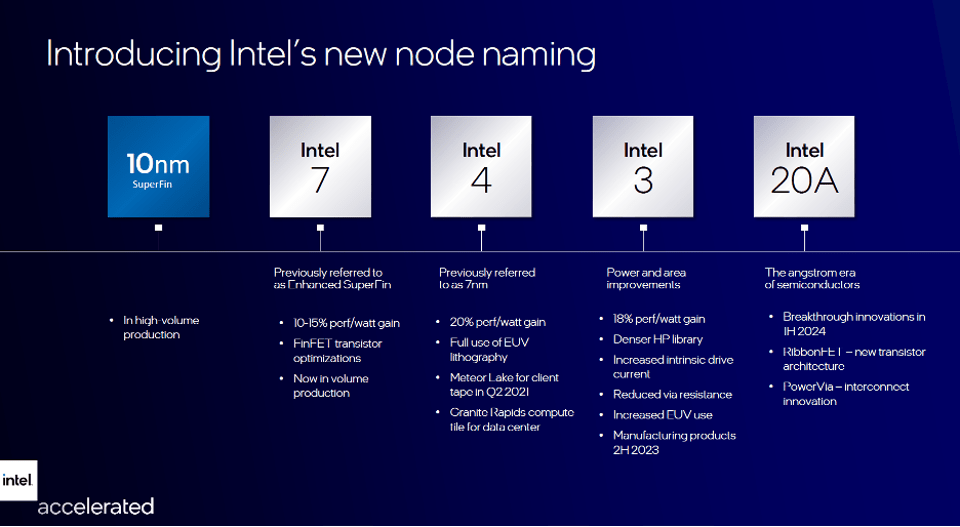

Intel has a grand plan. The company plans to overtake its competitors in manufacturing semiconductors by 2025, becoming the most advanced and only semiconductor fabless and fabrication company. Intel hopes to become the leader in the semiconductor fabrication.

Forbes

Underlying Trends

Political Trend

I believe there are two underlying trends that are shaping up to be favorable for Intel, aiding the company along its path. From the pandemic, companies and governments around the world learned their lesson. Globalization has its side effects. Because so many products were sourced from different countries, a problem in a single piece of the supply chain caused significant damage to the entire supply chain operation creating a ripple effect throughout the economy.

Also, the growing geopolitical tensions in critical regions including Taiwan and Ukraine have led to many countries and companies wanting critical supplies like chips to be produced on-shore. Today, most of the advanced semiconductors are produced in Taiwan and South Korea, exposing most western countries to supply chain risks. Therefore, Intel is expected to gain government support from various countries to build a factory in their respective local regions.

Starting with the United States, the support for the CHIPS act is growing. This is a $52 billion bill that aims to incentivize companies manufacturing semiconductors inside the United States. The CHIPS act was approved without funding in January 2021 under the National Defense Authorization Act before being passed in the Senate. Today, the bill is awaiting approval from the House.

The massive governmental support for manufacturing inside the United States is primarily expected to benefit Intel because the company aims to build $20 billion fabrication plants in both Arizona and Ohio. Further, I believe this bill will eventually be passed in the House due to its benefit. American government and corporations heavily rely on foreign manufacturers such as TSMC (TSM) and Samsung (OTC:SSNLF) to produce critical semiconductors for various applications from consumer electronics to fighter jets. Thus, reducing foreign reliance risks as geopolitical risk surrounding Taiwan grows while supporting American business is sensible. Moreover, since the Russian invasion of Ukraine, the possibility of the Chinese invasion of Taiwan became more realistic, raising concerns.

Digitalization

Another massive trend is underway. More semiconductors are expected to be needed for years to come and extreme digitalization and development are leading to more advanced machines. For example, in a revolutionary transition from the internal combustion engine, ICE, vehicles to electric vehicles, semiconductor demand increases. Because electric vehicles are more software-based and complex, they require at least about two times more semiconductors in comparison to traditional ICE vehicles.

Further, as technological innovation continues to progress, more electronic devices and internet connections are becoming necessary, prompting more use cases while existing electronics are becoming more advanced, also requiring more semiconductors. Therefore, the current technological innovation is creating a long-term underlying trend that is set to benefit Intel.

Execution and Progress

To capitalize on these massive changes, CEO Pat Gelsinger has been showing great executions so far. In a course of a year, numerous manufacturing expansions have been announced and are on or earlier than scheduled. These include a $20 billion Arizona investment, $20 billion Ohio investment, $7 billion Malaysia investment, and a 33 billion Euro Europe investment. Further, the Arizona fabrication plant, the first expansion plant to be announced, is currently 3 months ahead of its schedule. These new factories will not be operational until 2024 to 2025, but the company is finally moving in the right direction at a fast pace.

Intel made significant progress in its semiconductor development as well. Intel’s Alder Lake PC chips are on par with the latest AMD (AMD) chips, with additional versions of Alder Lakes to be rolled out in the coming months. Further, the company is attempting to further secure its leadership in the laptop market by offering Intel’s own GPU that is optimized to work with Intel’s CPUs. Because the company holds the overwhelming majority of the laptop CPU market, the creation of Intel’s PC ecosystem creates massive opportunities. Finally, Intel’s future chips are expected to be released on schedule, including Raptor Lake, Sapphire Rapids, and Alchemist.

Since Gelsinger became CEO, Intel has been turning its business around in the right direction to pursue future growth opportunities. To date, he has been successful in showing strong execution. For this reason, I continue to believe that the company is on track to reach its goal and opportunities. Semiconductor demand and geopolitical trends combined with Intel’s business turnaround are starting to shape a bright future for the company.

Valuation

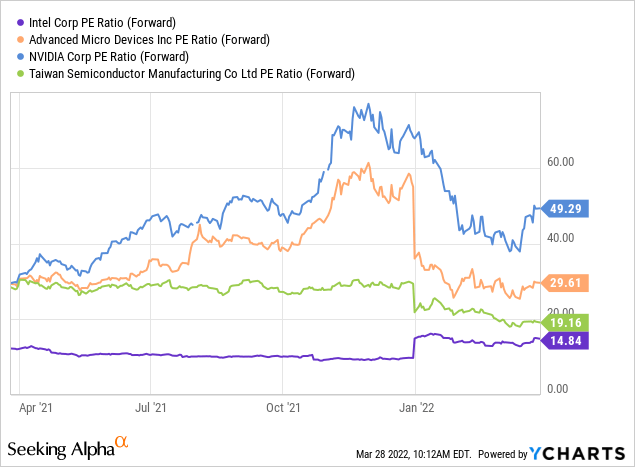

Intel, because of its ongoing but unproven turnaround story, has a low valuation multiple providing growth and safe dividend opportunities for investors. I believe that because the valuation is so low in comparison to its competitors in the industry, upside potentials far outweigh downside potentials. The company currently has a market capitalization of about $211 billion, with a forward price-to-earnings ratio of 15. In my opinion, for a company with a strong moat and an ongoing turnaround story, I think this is unreasonable. Looking at Intel’s closest competitors, this view is further solidified.

Risks

The company is still in the early stages of transformation. Intel has been taking steps in the right direction at an astonishing pace over the past year; however, the company has not proved its abilities just yet. Its competitors TSMC and Samsung continue to invest in innovation just like Intel, so until Intel can prove that it can regain market share and prove its technological dreams, the market will continue to see the company’s transition as a risk. Therefore, the execution risks remain.

Summary

Intel, after years of lagging behind, is finally moving in the right direction at a critical time. Expected demand for semiconductor production is massively increasing as semiconductor supply chains are heavily exposed to geopolitical risks. Being the most prominent chip maker in the Western countries, Intel is likely to benefit from government policies when the company starts manufacturing chips on-shore in Europe and the United States. The turnaround effort is expected to take multiple years, but given the strong dividend, dividend growth, and growth opportunities, I believe Intel is a long-term buy.

Be the first to comment