Artush

Momentum is building for nuclear power. As the drive to slow climate change intensifies, there is growing recognition that the pathway to net zero will be faster and easier if nuclear energy is part of the solution.

Net zero pledges now cover 91% of global greenhouse gas (GHG) emissions and 95% of global GDP. Governments around the globe are adopting policies supporting nuclear.

Plans to build large nuclear power plants based on existing reactor designs are gathering momentum. Dozens of advanced designs are under development, supported by private and public funding.

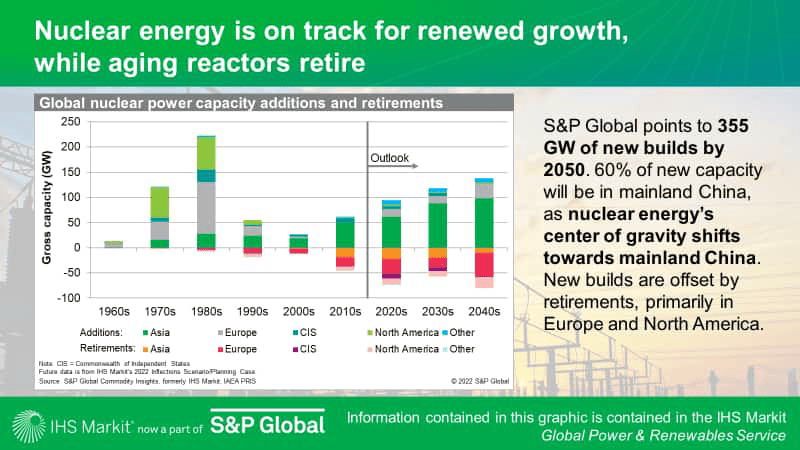

Global nuclear capacity additions to double, but generation share to decline. IHS Markit’s Planning Case points to additions of 355 GW of new nuclear capacity between 2022 and 2050, about 2.5 times the rate of the past three decades.

Retirements in North America and Europe, however, will offset much of the new build. As a result, global installed capacity will grow only modestly, from 415 GW (gross) in 2022 to 555 GW in 2050.

As power demand grows and renewable growth outpaces all other technologies, nuclear energy’s share of global power generation will decline, from 10% to 7% over the same period.

Nuclear’s center of gravity to shift from North America and Europe to mainland China. Currently, the United States has the largest nuclear fleet at 100 GW, with France second at 64 GW.

Over the coming decades, our analysis indicates more than 60% of global new build will be in mainland China, whose total will overtake France within 5 years, and the United States within 10 years.

Countries building nuclear power plants for the first time, including the United Arab Emirates, Turkey, Bangladesh, and Egypt will contribute to the new build. Additional countries are working toward joining the nuclear energy club.

Risks and opportunities in the nuclear supply chain. Declines in nuclear new build over the past three decades and financial duress from construction difficulties have hampered the supply chain outside of mainland China.

Russia has become the biggest exporter of new nuclear plants over the past decade. Its invasion of Ukraine and the ensuing consequences have put Russia’s leading position in question but give export opportunities to mainland China, France, South Korea, and the United States.

Evolution of small modular reactors (SMRS) and advanced designs. Dozens of SMRs and advanced designs are under various stages of development, supported by public and private funding.

Chances are good that demonstration and initial commercial units of some new designs will be built before 2035. Much like wind and solar photovoltaic (PV), sustained government policies and support from multiple countries are necessary to ensure volume, enable the buildup of supply chains, and drive down costs.

Substantial volume from advanced designs, if it happens, would come post-2040 at the earliest. IHS Markit’s Planning Case currently includes only modest additions from new designs by 2050.

Broader use of nuclear energy. New reactor designs come in varying sizes and temperatures. High-temperature designs hold the potential for direct hydrogen production and to replace fossil fuels in several hard-to-decarbonize industrial sectors. Small-sized reactors could be used in power systems not suitable for large ones, at industrial sites, and in remote locations.

Overcoming major challenges – delays and cost overruns, and high-level waste disposal. For new builds large and small, nuclear needs to overcome long-standing cost and schedule issues.

Advanced designs also face substantial first-of-a-kind hurdles. Progress in permanent disposal of high-level waste has been slow. Finland is within a few years of opening a deep geological repository for operation, the world’s first.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment