Vertigo3d

A Quick Take On Beamr Imaging Ltd.

Beamr Imaging Ltd. (BMR) has filed to raise $15 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The company provides video and image compression technologies via a licensing model.

Given the company’s changing strategy and ultra-high valuation expectation, I’m on Hold for the IPO.

Beamr Overview

Herzeliya, Israel-based Beamr was founded to develop advanced video and image optimization software technologies that ‘maximize[s] quality and remove[s] visual redundancies resulting in a smaller file size.’

Management is headed by founder, Chairman and CEO Sharon Carmel, who has been with the firm since inception in 2009 and was previously co-founder of BeInSync and Emblaze.

The company’s primary offerings include:

-

Beamr HW-Accelerated Content Adaptive Encoding

-

Beamr 4 H.264 encoder and related

-

Beamr 5 HEVC encoder and related

-

Beamr JPEGmini photo optimization software

-

Beamr Silicon IP block

Beamr has booked fair market value investment of $30.2 million as of December 31, 2021 from investors including Marker, Innovation Endeavors, Disruptive Technologies and Verizon Ventures.

The firm has disclosed no company-level ESG initiatives.

Beamr – Customer Acquisition

The company seeks to license its technologies to large media customers.

Customers to-date include: Netflix (NFLX), Snapfish, ViacomCBS (PARA), Microsoft (MSFT), VMware (VMW), Vimeo (VMEO), Citrix (CTXS), Walmart (WMT) and others.

Sales & Marketing expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

|

Sales & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2021 |

29.1% |

|

2020 |

43.2% |

(Source: Beamr Amended Registration Statement)

The Sales & Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Sales & Marketing spend, was 0.1x in the most recent reporting period. (Source: Amended Registration Statement)

Beamr’s Market & Competition

According to a 2022 market research report by Datamation, the global market for data compression was an estimated $3 billion in 2020 and is forecast to reach $4.5 billion by 2026.

This represents a forecast CAGR of 5.2% from 2020 to 2026.

The main drivers for this expected growth are a continued high growth in the volume of data used by businesses and consumers and increasing use of video streaming services.

Also, network service providers seek to understand compression parameters for their storage planning and resource allocation decisions.

Major competitive or other industry participants include:

Beamr Imaging Ltd. Financial Performance

The company’s recent financial results can be summarized as follows:

-

Slightly growing topline revenue

-

Increased gross profit and gross margin

-

Reduced operating loss

-

A swing to positive cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2021 |

$ 3,300,000 |

3.9% |

|

2020 |

$ 3,176,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

2021 |

$ 3,210,000 |

4.2% |

|

2020 |

$ 3,082,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

2021 |

97.27% |

|

|

2020 |

97.04% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2021 |

$ (425,000) |

-12.9% |

|

2020 |

$ (1,667,000) |

-52.5% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

2021 |

$ (952,000) |

-28.8% |

|

2020 |

$ (2,459,000) |

-74.5% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2021 |

$ 569,000 |

|

|

2020 |

$ (1,020,000) |

|

(Source: Registration Statement)

As of December 31, 2021, Beamr had $1.0 million in cash and $6.2 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021, was $565,000.

Beamr’s IPO Details

BMR intends to sell 1.36 million shares of common stock at a proposed midpoint price of $11.00 per share for gross proceeds of approximately $15.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $115.4 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 11.56%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $4.7 million for our research and development efforts;

approximately $2.7 million for sales and marketing activities;

approximately $2.7 million for cloud operating costs;

approximately $3 million for general and administrative corporate purposes, including working capital and capital expenditures.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not subject to any pending material legal proceedings.

The sole listed bookrunner of the IPO is ThinkEquity.

Valuation Metrics For Beamr

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$129,794,599 |

|

Enterprise Value |

$115,411,599 |

|

Price / Sales |

39.33 |

|

EV / Revenue |

34.97 |

|

EV / EBITDA |

-271.56 |

|

Earnings Per Share |

-$0.08 |

|

Operating Margin |

-12.88% |

|

Net Margin |

-28.85% |

|

Float To Outstanding Shares Ratio |

11.56% |

|

Proposed IPO Midpoint Price per Share |

$11.00 |

|

Net Free Cash Flow |

$565,000 |

|

Free Cash Flow Yield Per Share |

0.44% |

|

Revenue Growth Rate |

3.90% |

(Source – SEC)

Commentary About Beamr

Beamr is seeking U.S. public market investment to fund its general corporate R&D and growth initiatives.

The firm’s financials have produced slowly growing topline revenue, higher gross profit and gross margin, lower operating loss and a swing to positive cash flow from operations.

Free cash flow for the twelve months ended December 31, 2021 was $565,000.

Sales & Marketing expenses as a percentage of total revenue have dropped as revenue has increased and its Sales & Marketing efficiency multiple was 0.1x for 2021.

The firm currently plans to pay no dividends on its capital stock and anticipates that it will use future earnings to reinvest back into the company. Also, the Companies Law imposes additional restrictions on the firm’s ability to declare and pay dividends, and Israeli law may subject dividends to withholding taxes.

The market opportunity for data compression technologies is moderately large and expected to grow at a mid-single-digit rate of growth in the coming years.

ThinkEquity is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (66.8%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is the firm’s change in strategy toward a SaaS offering aimed at the middle and lower end markets, which may or may not be effectively commercialized.

As for valuation, management is asking IPO investors to value the firm at an EV/Revenue multiple of around 35x, so the IPO is priced to perfection.

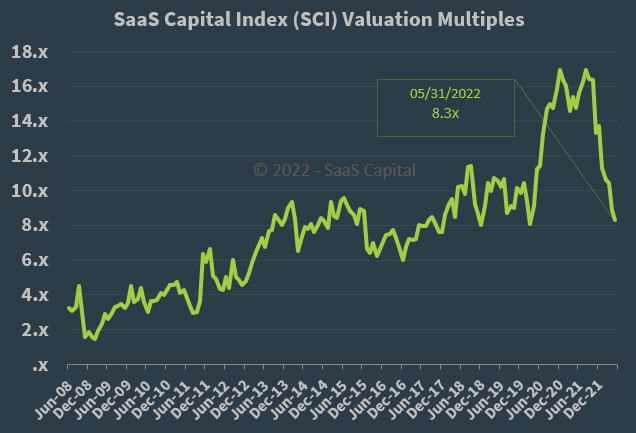

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 8.3x at May 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, BMR is seeking a valuation at a large premium to the SaaS Capital Index, at least as of May 31, 2022.

Given the company’s changing strategy and ultra-high valuation expectation, I’m on Hold for the IPO.

Expected IPO Pricing Date: Week of July 18 – 22, 2022.

Be the first to comment