Marcus Lindstrom

Prologis: A Top 5 REIT

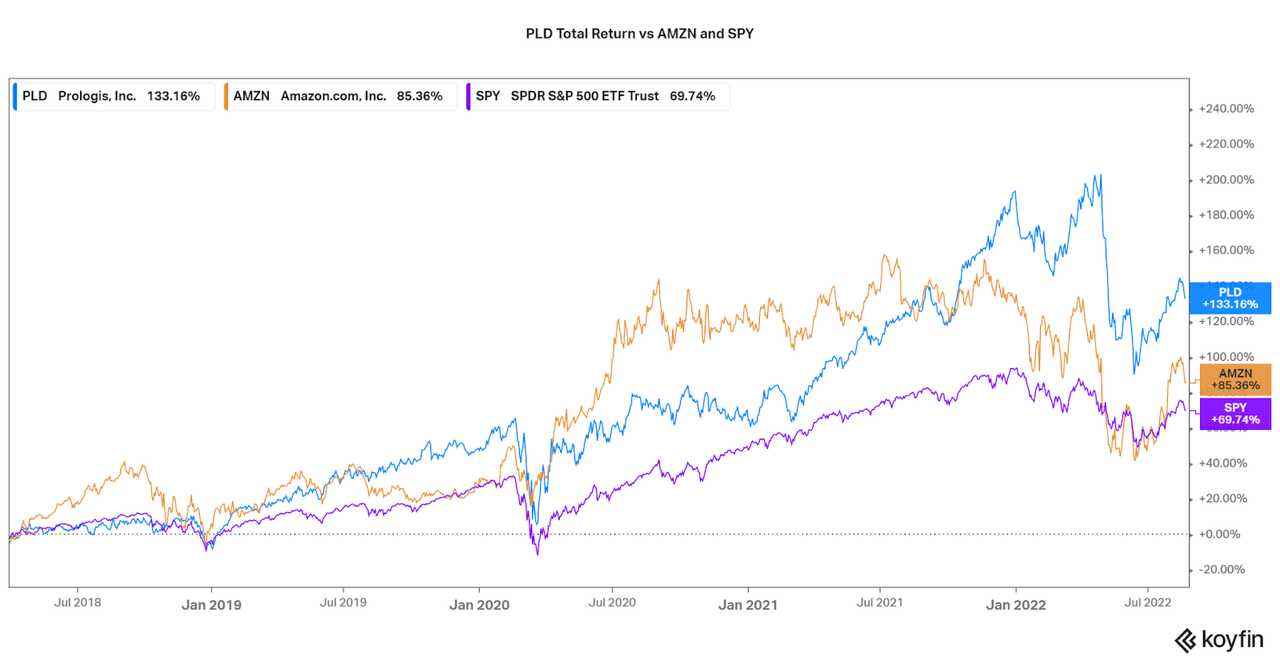

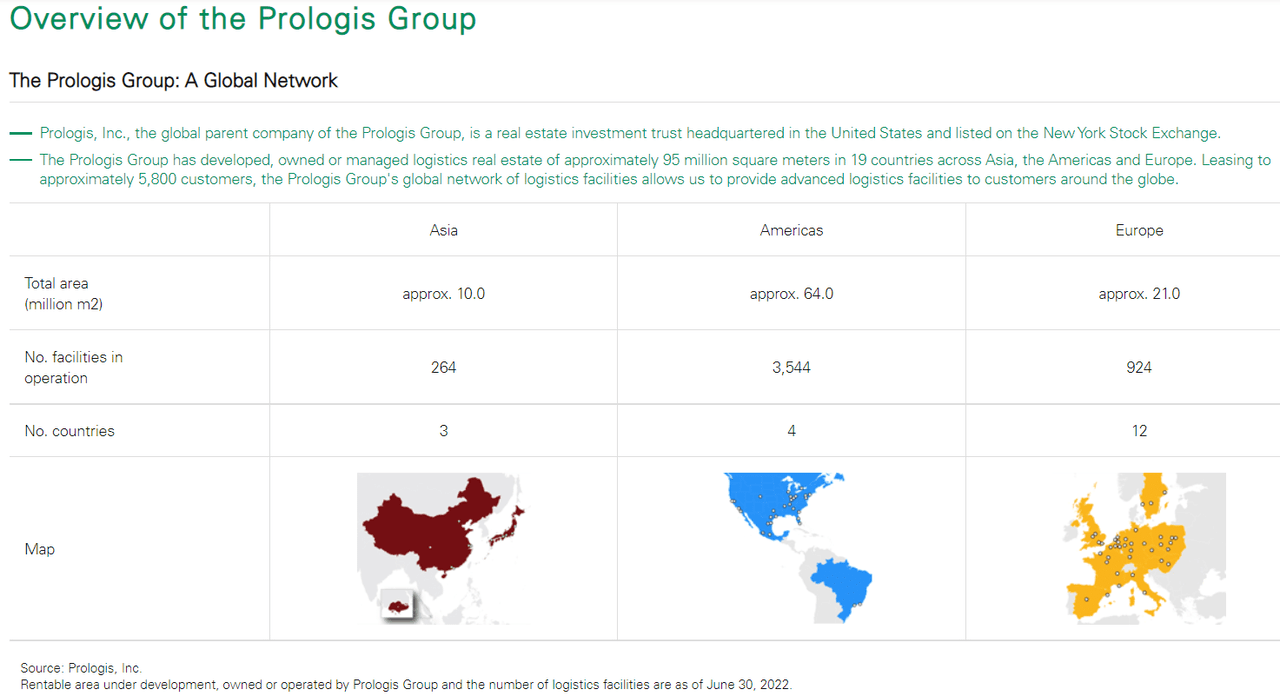

Not all REITs are about yield, instead, they are able to grow just as fast as any growth company. One such example is Prologis (NYSE:PLD), a leader in logistics facilities worldwide. As the world yearns for faster and more efficient logistics, the need for these facilities has allowed Prologis to grow rapidly. In fact, total returns are even in line with Amazon (AMZN) over the past three and five years, with far less volatility. I expect that PLD is set to continue their market-beating form, compared to S&P 500 ETF (SPY), for years to come. As such, some investors may want to double down on the holding, but I suggest a similar company with broader exposure to help reduce the risk of an overweight position, Nippon Prologis REIT (OTCPK:NPONF)(TSE:3283).

Koyfin Nippon Prologis Website

The Secret Japanese Sponsorship

As Nippon Prologis no longer trades OTC, this investment is best suited for investors with access to foreign exchanges with their brokerage. There may be difficulties to access for some, so please keep that in mind.

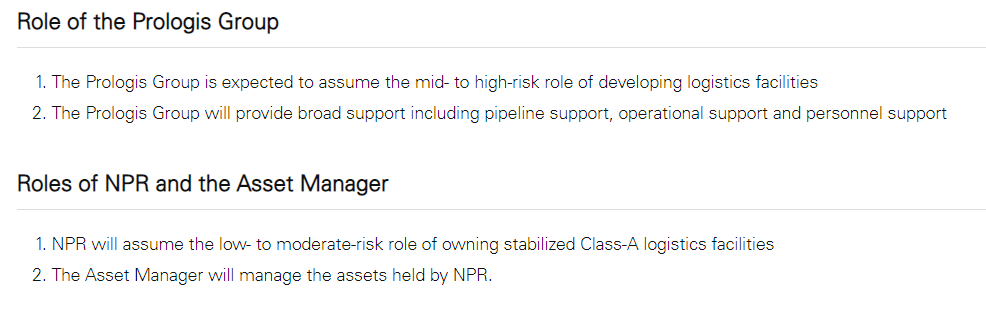

Nippon Prologis holds the reins in terms of their operations, but a sponsorship with PLD allows for the continuation of operational excellence seen with the global entity. As 15% owners of Nippon Prologis REIT (NPR) units, PLD holders do have some exposure, but the two companies have a major difference in ideology. Prologis Global is used as the researcher and developer, taking on more risk but offering higher returns overall. When facilities are developed and tenants filled, Nippon Prologis acquires the facilities to manage them long-term at a measured pace. While this is a major difference, there are a few other points to consider for additional safety in the investment.

NPR Website

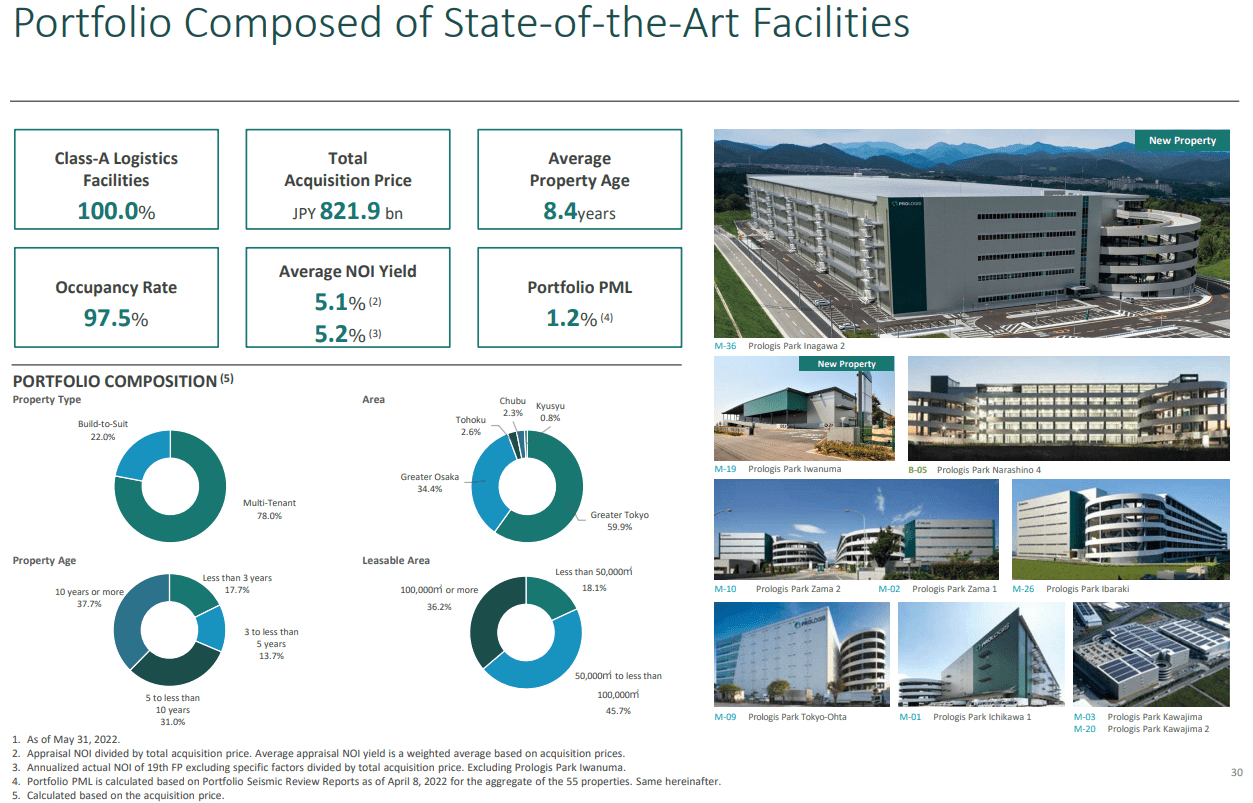

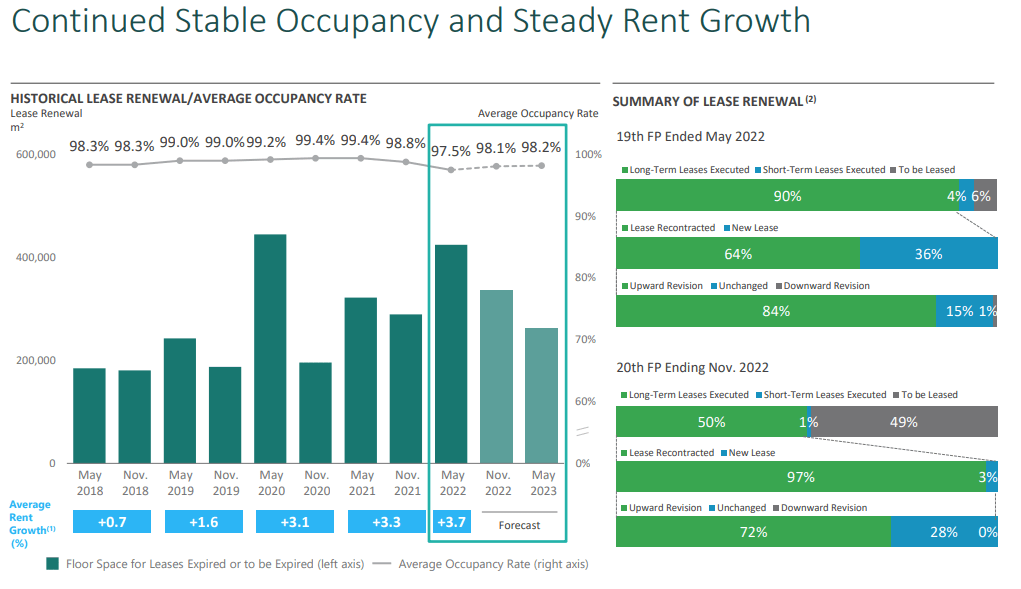

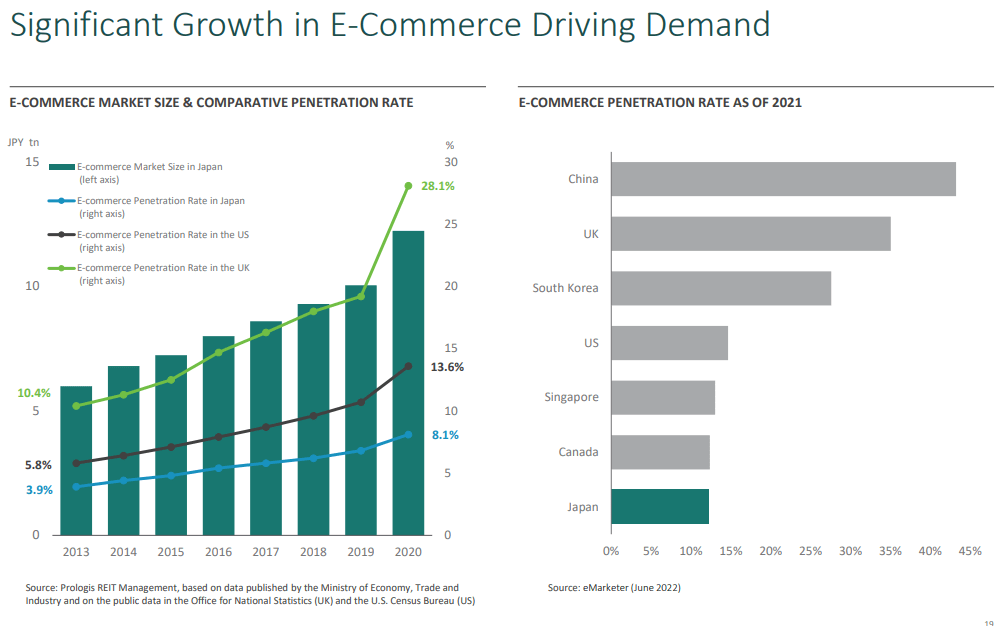

The major benefit for NPR is that their portfolio is entirely Class A facilities developed by the industry leader, PLD. With that comes a fairly young portfolio of assets with high occupancy rates and first-class tenant base. One of the major catalysts for growth is the fact that e-commerce has yet to take off as much in Japan. As of 2020, the country has 8.1% penetration in e-commerce while the US has over 13% penetration and is growing rapidly after the pandemic. While there are sociocultural and infrastructure factors influencing why penetration is far lower in Japan, there is an underlying trend of growth and innovation that is the main driver of growth for the aging country.

When compared to the 45% e-commerce penetration rate of China, I suspect that consumers may soon increase their favorability of e-commerce in the coming years. This is especially true as the population ages, and the need for advanced logistics will inherently drive growth for Prologis. The four acquisitions over the past year or so signal the high growth rate in the post-pandemic, locked down environment. Then as economies of scale increase, the feasibility of e-commerce logistics supports non-pandemic organic growth as well.

NPR NPR NPR

Financials Support the Thesis

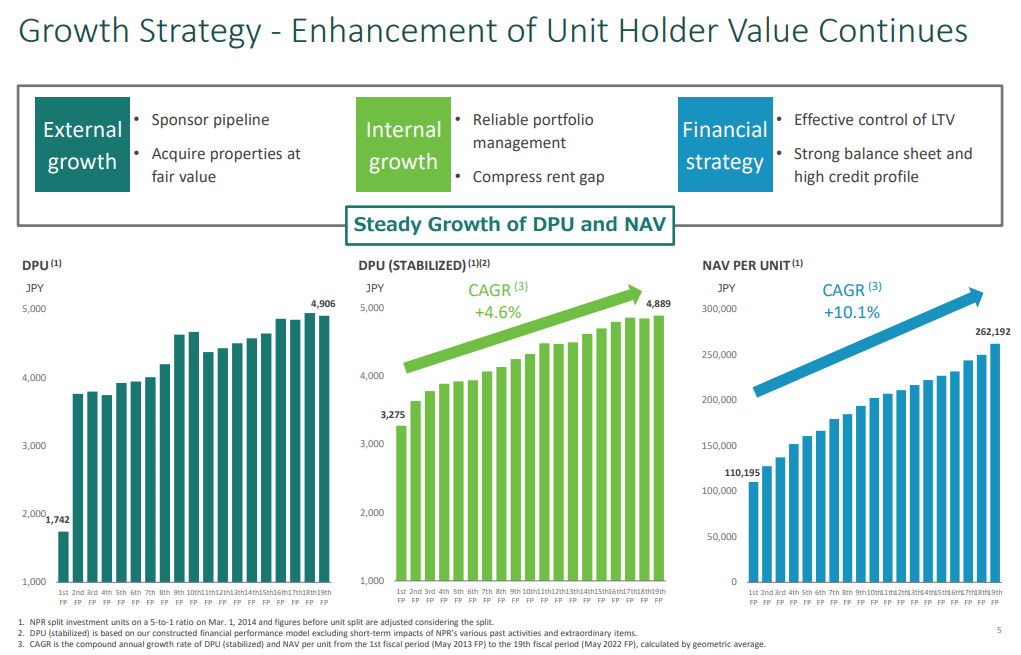

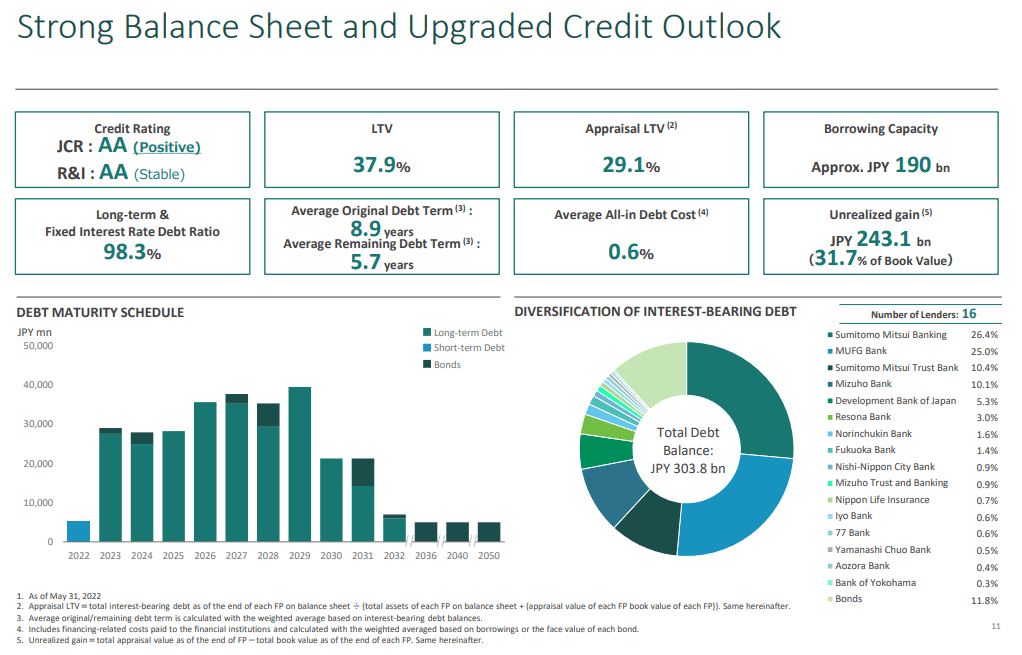

However, e-commerce is not the only column of support and growth has been steady over the past 10 years. NPR’s assets have grown at ~10% per year, in-line with PLD. While growth is not as fast as PLD, safety is more of a priority and NPR offers a strong balance sheet. In fact, NPR recently was upgraded by the Japan Credit Rating Agency (JCR) and they had the following comments:

For future external growth, it appears that NPR continues to secure opportunities to acquire high-quality properties as the Sponsor’s support system remains robust. Given that the attainment of good quantitative indicators in terms of properties and finances, buildup of the stable track record, steady property management, continuous external growth and conservative financial management can be expected into the future, JCR upgraded the ratings on NPR by one notch to AA+ and changed the outlook to Stable.

Therefore, NPR offers investors a way to balance the more volatile nature of PLD’s share price, but also keeps the same qualities that make the company great. Also, don’t forget that the dividend yield for NPR is slightly higher, so yield seekers and low risk investors may enjoy NPR on its own. However, the complementary nature, overall safety, and well rounded return profile of NPR and PLD allow for most investors to be happy, no matter their goals.

NPR

NPR

PLD and NPR Direct Comparison

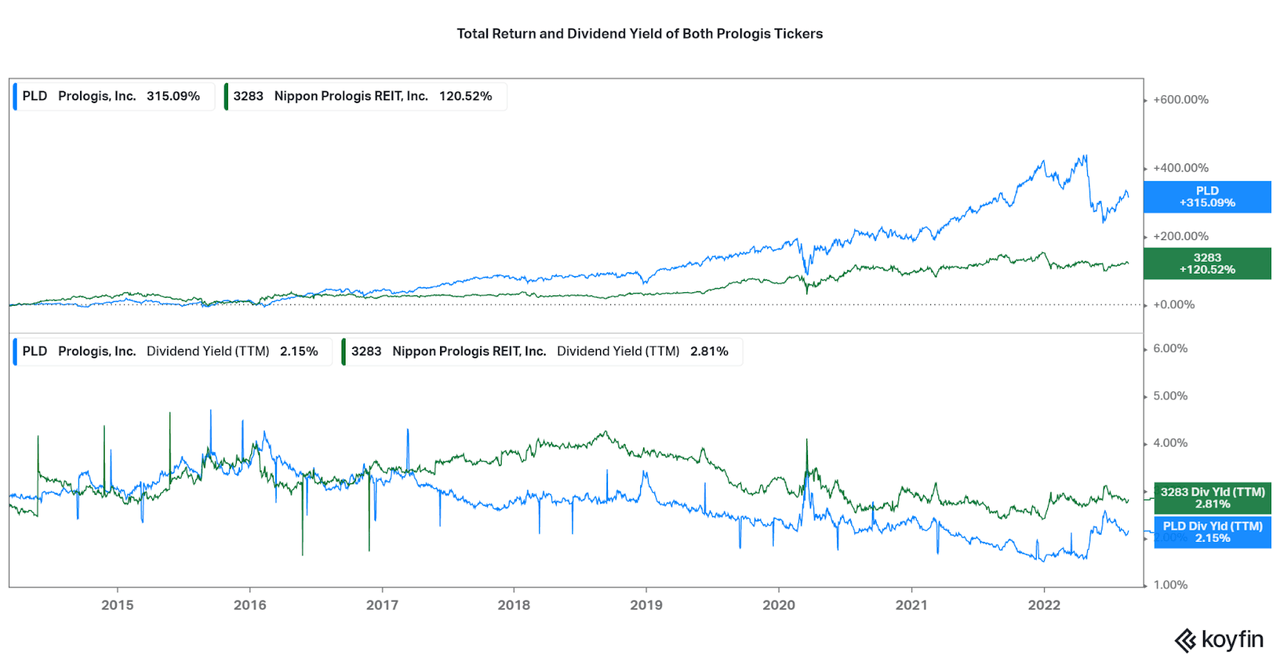

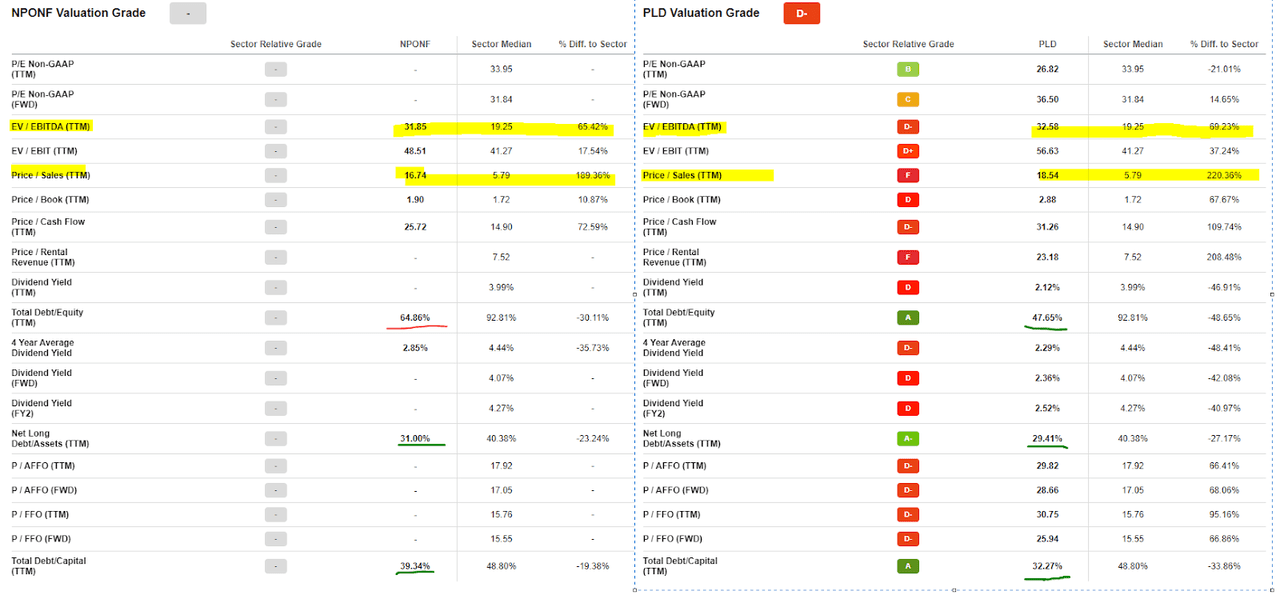

Let’s look at the exact differences. As shown below, NPR sees far less volatility, but total returns are only a third of PLD’s over 10 years. However, NPR traditionally holds a higher dividend yield between 2-4%, compared to 2-3%. There is one issue to consider, valuation. Prologis currently rates poorly on SA Quant measurements, only due to their premium valuation. I personally believe the discrepancy compared to other REITs is certainly justified, the industry is facing headwinds due to rising interest rates and the economic cooldown after the pandemic.

Also, on paper, NPR holds more debt compared to the value of equity, but the significant assets and capital temper that valuation risk (see image highlights below). Considering the historical pattern of linear growth, I suggest that timing purchases to be insignificant compared to time in the market. Therefore, recurring investments will negate any valuation risk long-term, especially when patterns of under/overvaluation remain for multiple quarters to years. Remember, you get what you pay for, and a strong company is almost always worth a buy!

Koyfin Seeking Alpha Valuation Pages

Conclusion

PLD and NPR are two sides of the same coin, a very expensive gold coin. Nippon Prologis offers rock solid fundamentals, conservative management, and foreign exposure, while Prologis is a global leader in logistics development and research. With plenty of organic growth available, industry leading profitability, and balance sheet health, I am bullish on both companies and I believe it is worth doubling down on both. While it may be difficult to find retail exposure for US-based investors, at least Prologis remains a solid choice. Not all REITs are dying malls or lackluster office developments, so take advantage of the rise in advanced logistics.

Thanks for reading.

Be the first to comment