ArtistGNDphotography/E+ via Getty Images

Most of my individual stock investing I do within the confines of my retirement ambitions in a Roth IRA, but on very rare occasions I see an individual stock as a reasonable investment for another reason. Over my working life I’ve set some funds aside for my children’s future needs, and these are mostly held in CDs and US government I-bonds, with a small allocation held in a brokerage account. Within those brokerage accounts, the funds are actually mostly sitting in cash, but some has been invested into index funds tracking the S & P 500 (SPY) and Nasdaq (QQQ). However, in the last few months I did decide I was comfortable putting a small portion of their funds into one stock that I had already bought for my Roth IRA, the utility NorthWestern Corporation (NASDAQ:NWE). For my kids’ needs, I am looking for relative safety with some dividends to sweeten the pot, since my time horizon for needing the funds back is growing short.

Overview

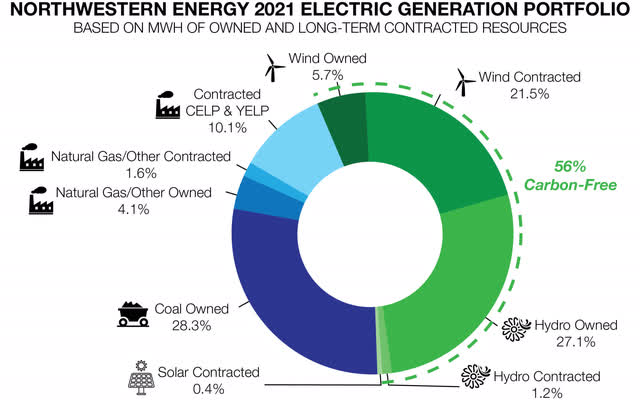

This company provides natural gas and electricity in the north central plains states of Montana, South Dakota and a sliver of Nebraska, with the bulk of its 750,000 customers being in Montana, including Yellowstone National Park. It has approximately 750 MW of peak capacity, which is not enough to meet full market demand by about half, so it purchases whatever additional is necessary from other sources. NorthWestern’s portfolio of power production includes hydro, wind, coal, and natural gas; it has negligible solar. Between the energy assets it owns and its contracted supply, the company is able to say that around 55% of the electricity it sells is from non-carbon sources.

Northwestern Company Electricity Portfolio (Northwesternenergy.com)

Like utilities all around the United States, it is attempting to walk the tight-rope between meeting the energy needs for areas it serves, investing in the transition to more renewable sources in a timely way, all while keeping energy prices affordable. The company recently announced its goal to be net zero in its carbon emissions by 2050.

As the chart shows 28% of the portfolio is coal, and it is worth pointing out that NorthWestern is in the midst of arbitration related to a coal-fired power plant in Colstrip, Montana. This facility has a total of 4 units – two older units that are slated to be shut down, and two newer units that remain operational. Northwestern has a partial ownership in these assets, and some of the other owners are exiting, and the question comes down to whether NorthWestern can increase its stake.

Besides the potential of accessing more capacity from these coal-based assets, NorthWestern is in the midst of a $2.4 billion plan over five years for expanding capacity with a combination of new projects and building additional capacity at existing sites, with one project slated to break ground this month in spite of delays from some local opposition and its own errors in following the correct permitting process. The $2.4 billion needed for the assorted investments is coming from multiple sources – internal cash, new debt issuance, and additional equity, including $321 million of new shares issued in November 2021. Nevertheless, the transition will be an expensive one to make, and ratings agency Fitch downgraded NorthWestern from BBB+ to BBB a few weeks ago, while retaining a stable outlook. Specifically, Fitch noted,

The downgrade reflects weaker leverage metrics than previously anticipated as a result of significant regulatory lag during a period of heavy capex. Fitch projects FFO leverage metrics will approximate 6.0x through 2024 before strengthening to approximately 5.3x in 2025-2026 as capital spending subsides and large projects enter service.

Review of 2021 Results and 2022 Estimates

Management shared full year 2021 results in mid February, with 15% revenue growth over 2020, coming $1.37 billion in revenue, a combination of stronger pricing and stronger demand, bearing in mind that 2020 comparisons on the demand side were impacted by Covid-19. Nevertheless, it was a strong year, with gross margin coming at 27.5%, flat, but helping to drive a jump in earnings per share, from $3.06 in 2020 to $3.60 for 2021.

Inflation is definitely taking a toll on the company’s strategic decisions, and not just around natural gas prices or contracting for additional capacity from other sources. Most noticeably, NorthWestern withdrew from a planned investment in Aberdeen, South Dakota due to the significant rise in costs, a figure that was estimated at 50% higher than originally planned according to Brian Bird’s description in the Q3 2021 earnings call.

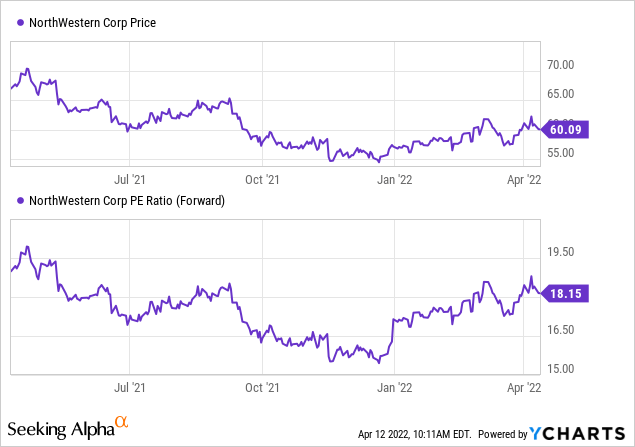

The broader point is that 2022 is not expected to deliver the same or better EPS than 2021, but rather the forecast suggested is in the range of $3.20 to $3.40. Bearing in mind that the decrease in earnings per share results from the combination of a higher share count and some margin compression, it still leaves NorthWestern with a 2022 forward P/E of around 18x. For comparison, Seeking Alpha has the sector median at just over 20x, so even though the share price has held steady since the lower EPS guidance for 2022 was released in February, NorthWestern remains at a slight discount to the sector.

As guidance, management is striving for fairly conservative EPS earnings growth, in the range of 3% – 6% per year off of the 2020 baseline. The current $2.52 dividend is around 75% of the earnings, and while the dividend has grown pretty reliably, I anticipate slower dividend growth than earnings growth.

NorthWestern’s Value and Income Profile

Before I settled on NorthWestern, I had something of the opinion that utilities were going to all present more or less the same strengths and weaknesses, as fairly safe bond-like stocks with relatively high degree of safety and strong credit ratings, low or limited growth prospects, and decently competitive yields. Other than those outliers like California’s beleaguered PG&E (PCG), I assumed that there was little difference between one utility and another, so I was surprised when I actually started looking into them the sort of diversity that I found; for example, I was stunned to find in PPL Corporation (PPL) an American utility that also provided energy to parts of the United Kingdom (it has since sold the UK assets and exited that business).

I started by looking into my local gas and electric provider, and thought it generally ticked all the boxes – a 3.7% yield, a BBB rating from Fitch, and nothing suggesting it would generate terrific growth. Since I didn’t want to invest without doing at least some minimal due diligence, I started looking at other utilities for comparisons, and that was when I started realize the landscape of utilities was far more diverse than I had imagined, and at the time I made the final decision on one, NorthWestern was where I landed.

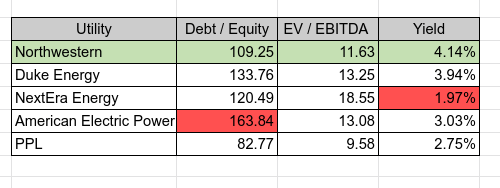

If I were starting over again today, I would look at the same general parameters:

- Debt to equity for a sense of credit risk, knowing that utilities may need to carry significant debt loads to fund their capital expenditures, especially in a time of a transition away from fossil fuels.

- EV to EBITDA valuation, simply as one way to look how well a utility is using its non-cash assets to generate earnings, and finally

- Dividend yield, more or less as a sort of tie-breaker; if all else were equal I’d go for higher yield over lower, realizing that even utility dividends are not sacrosanct.

What these screens help me do, in theory, is attempt to maximize income within acceptable risk while hopefully not overpaying. There are far too many utilities for me as an individual to stay on top of, but based on these criteria, NorthWestern continues to come out looking like a winner. It is attractively valued, rates on the lower end of credit risk, and offers a modestly higher dividend yield. While there could certainly be peers that compare more favorably, overall NorthWestern screens well on these measures.

Utility Comparison (Author’s spreadsheet; data from Seeking Alpha)

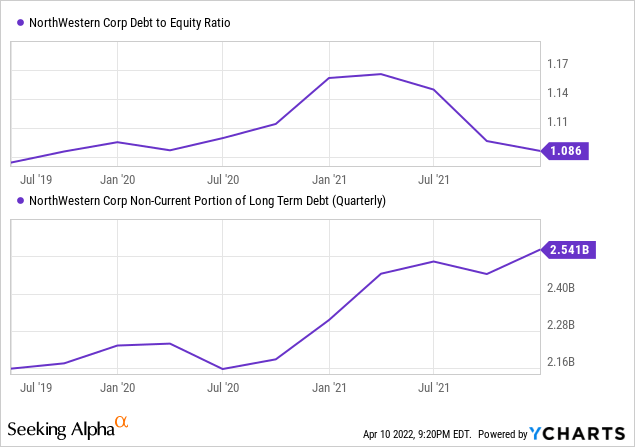

On these strengths, I would still select NorthWestern, at least out of these choices. Still, knowing that the company intends to take on some additional debt as part of the equation for its $2.4 billion of investments, I am keen to see where debt coverage has been in the past and what impact additional debt would have.

So even as the debt to equity ratio has been coming back down as equity has gone up, long-term debt has also been rising, some $250 million year over year through 2021, and additional debt yet to be issued could certainly push the debt coverage back in the other direction. This might not have been overly concerning in an ultra-low rate environment, but assuming rates continue to rise through 2022 and combined with being a notch lower in credit quality, the debt burden question could become much more relevant, and will be something to keep an eye on. However, given that the $2.4 billion in investment plans is to be spread over 5 years, the net impact to its debt servicing capacity may not be that great.

Conclusion

During times of higher market turbulence, utility stocks have the reputation for being defensive holdings, a reputation that is broadly well supported on account of being a necessity for consumers through all business cycles and providing reliable and predictable cash flows. Although that contention is under increasing scrutiny, in the case of NorthWestern, there is a somewhat reduced risk relative to the much higher debt loads of some other utilities. Even assuming that debt will very likely go up in the coming years, NorthWestern will not rely exclusively on the bond market to fund its growth needs. I think the greater risk is that NorthWestern has underestimated the investment amount needed to reach its goals, especially in this moment of rather staggering inflation. Management has already demonstrated they are willing to pull back on projects that get too expensive, but if every project starts pushing significantly over cost, then something will have to give. However, for the moment, given the combination of attractive valuation, good debt coverage, and reasonably covered dividend that yields better than several peers, I like NorthWestern as part of a conservative defensive selection in an income focused portfolio.

Be the first to comment