asbe/iStock via Getty Images

Following Q1 results, investors in Target Corporation (NYSE:TGT) took a beating. The stock dropped 25%, the largest single day drop in the share price since 1987.

However, the impetus for the sell-off goes beyond the numbers revealed in the earnings call. To some extent, Target’s fall reflects concerns investors have for ongoing issues, particularly inflation and supply chain woes. In many respects, Target’s problems are symptomatic of the trials and travails consumers are facing in this uncertain economy.

While there were a number of glaring negatives in the latest earnings report, there were also some very favorable trends to consider. The questions investors must answer revolve around the long term impact these factors will have on Target moving forward.

Why Did Target Stock Drop?

Target provided Q1 2022 earnings on May 18th. One writer claimed the company’s results were the equivalent of dropping “a profitability bomb on the retail sector.”

The firm’s operating income plummeted 43.3% to $1.3 billion. Target’s adjusted EPS also deteriorated markedly to $2.19, a plunge of 40.7%. The retailer’s cost of sales increased from $16.7 billion in the comparable quarter to $18.5 billion.

Throughout the quarter, we faced unexpectedly high costs, driven by a number of factors, resulting in profitability that came in well below our expectations, and well below where we expect to operate over time.

Brian Cornell, CEO

In many respects, Target’s results were similar to that of rival Walmart (WMT), only worse. Although the company had taken measures to combat the inflationary and supply chain issues retailers are facing, management was caught off guard by the magnitude of the problem.

But the actual conditions and costs have been much more challenging than expected. More specifically, first quarter freight and transportation costs came in hundreds of millions of dollars higher than our already elevated expectations.

John Mulligan, COO

The steps taken to ameliorate the logistics headwinds ended up working against Target.

Management over ordered certain merchandise to meet surging customer demand amid supply chain disruptions. However, inflation strained the finances of many customers, resulting in the purchase of essential items while discretionary products gathered dust. Management cited home, electronics, sporting goods and apparel products as merchandise that wasn’t moving.

In turn, management was forced to make some hard decisions. In some cases, TGT slashed prices to rid the company of excess stock. In other instances, the company opted to lease additional warehouses to store overstocked product lines. Even so, Target ended its Q1 with $15.1 billion in inventory. That marks the company’s highest-ever quarterly inventory level.

…we saw much higher-than-expected rate and transportation costs, and a more dramatic change in our sales mix than we anticipated. This resulted in excess inventory, much of it in bulky categories, which put additional strain on an already stretched supply chain.

Brian Cornell, CEO

Either way, the bottom line suffered. The mark downs reduced gross profit, and adding storage facilities increased costs.

One needs to look no further than this excerpt from the company’s last 8-K to see how far the company’s profit margins have fallen.

First quarter operating income margin rate was 5.3 percent in 2022, compared with 9.8 percent in 2021. First quarter gross margin rate was 25.7 percent, compared with 30.0 percent in 2021.

However, there were also a number of positives sprinkled throughout the earnings report.

For one, foot traffic grew by nearly 4%. That is particularly impressive considering the company notched a 17% increase in traffic last year. Target also posted 3% comps, and sales of beauty products increased by double digits year over year.

Management maintained its guidance for 2022 of low to mid-single digit revenue growth above 2021.

Something investors must factor into the equation is that Target experienced gangbuster growth during 2021, with EPS and net income more than doubling since 2019. In 2021, the company also posted a record-high $8.95 billion in operating income along with a 10-year high operating margin of 8.4%. An argument can be made that simply maintaining last fiscal year’s comps is a positive.

A Bit More Of the Good, The Bad, And The Ugly

Kudos to the exceptional progress Target’s management team has made in its ecommerce offerings. In FY18, only 5.5% of the company’s sales were generated online. That increased to 7.1% in 2019, 8.8% in 2020, and then, spurred on by pandemic restrictions, to 17.9% in FY 21.

In fact, $13 billion of the $28 billion increase in Target’s revenue over the last two years was the result of ecommerce sales. Furthermore, over 95% of Target’s sales are fulfilled by stores, and this results in faster fulfillment times and reduced shipping costs. In fact, the company’s related same-day services notched revenue growth of 235% in 2020 and 45% in 2021.

In part due to its success in ecommerce, TGT just notched its 20th consecutive quarter of sales growth.

Target also has a number of initiatives designed to drive foot traffic and create customer loyalty. Target’s store-in-store concepts with Ulta Beauty (ULTA) and Apple (AAPL) are two examples, and they work well to differentiate the company from other retailers.

However, in the current environment, that may become a negative. Comparing Target to Walmart, we learn that the latter company has a larger percentage of sales stemming from discretionary items. This is due to Walmart’s greater reliance on food sales. This generally results in bigger margins for TGT. However, during the recent earnings calls, the management teams from both companies emphasized that inflationary pressures were leading to less spending on discretionary items.

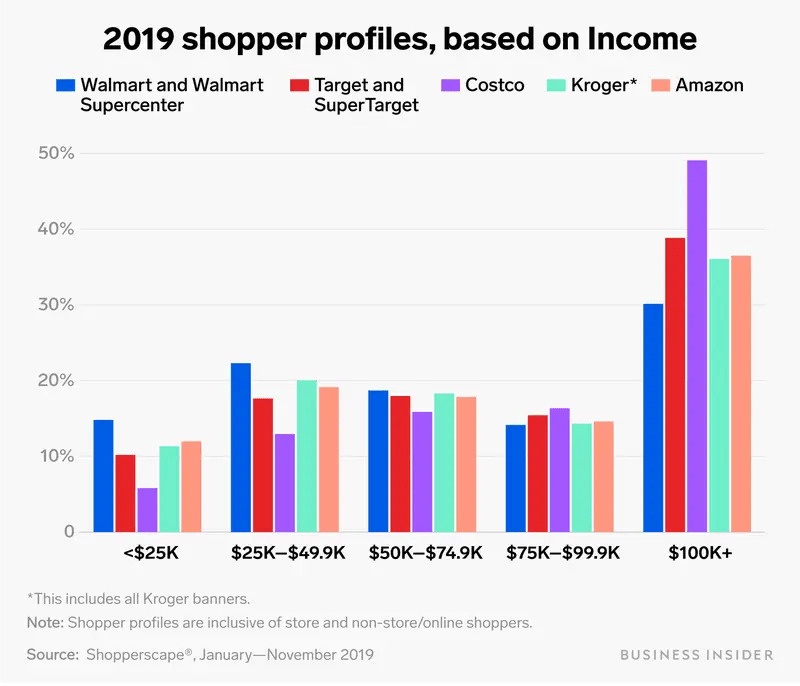

Even so, there is one area where TGT likely holds an advantage over Walmart. Target’s customers tend to be more affluent than Walmart shoppers, and that could serve as a bit of a buffer in a floundering economy.

Business Insider

One other factor to consider is that Target’s management is very reluctant to increase prices, as there is a perception that higher prices could result in the long term loss of otherwise loyal customers. This could create a short to mid term headwind that reverberates through upcoming quarterly results.

And even as we face multiple cost pressures, our team is working tirelessly to maintain prices wherever possible. But of course, while it’s always the last lever we pull, external conditions led us to raise prices across a broad set of items in multiple categories.

Brian Cornell, CEO

TGT Stock Key Metrics

Target’s credit ratings are in the single -A range, which is solidly investment grade.

The company owns around 80% of its stores with another 8% of locations being owned buildings on leased ground. Target’s balance sheet values the properties and equipment at $28.7 billion.

TGT currently trades for $161.041 per share. The average twelve month price target of the 24 analysts rating the company is $215.29. The average price target of the 19 analysts that rated the stock following the last earnings report is $205.37.

Target’s forward P/E of 15.18X is nearly two points below its 5-year average P/E of 16.95x. The company’s 5-year PEG ratio provided by Seeking Alpha is 0.75x. Yahoo calculates the 5-year PEG at 1.24X.

Target’s current yield is 2.24%. The payout ratio is a hair over 28%, and the 5-year dividend growth rate is 8.45%.

Is TGT Stock A Buy, Sell, or Hold?

There is no doubt that Target has a loyal customer base. Furthermore, the company has made great strides in its move to increase ecommerce sales. Target has a solid financial foundation, and the company has investment grade credit. With nearly $6 billion in cash and short-term investments, and operating cash flow of over $8.5 billion in 2021, it is reasonable to question whether the recent drop in the share price provides a good point to initiate or increase an investment in the company.

Additionally, should a recession materialize, we can look to FY ’08 and ’09 to determine how Target weathers economic downturns. During that time frame, Target’s comparable sales fell by low-single-digit percentages. While investors never welcome a disruption of a company’s business, long term, a recession should have a minimal effect on the retailer.

However, with or without a recession, Target is facing real headwinds in the form of logistics disruptions, a tight labor market, and persistent inflation that is beginning to affect consumer behavior.

While Target’s sales tend towards a broader range of discretionary items, thereby resulting in a stronger profit margin than rival Walmart garners, the latter company’s grocery offerings drive recurring foot traffic and may serve it better in a period of economic malaise.

Even so, these concerns, while real, do not constitute a long term argument against investing in Target. Nonetheless, I do find weakness when considering an investment in the stock.

Walmart and Amazon define the space. Both have economies of scale that even a company as large as Target cannot match. In fact, the primary source of Walmart’s moat is its ability to bargain with vendors to drive down prices. Target does not have this advantage, and I contend that the company has no moat. This means investors in Target are one poorly performing management team away from enduring subpar performance.

For those that disagree, consider the ignominious failure that was Target’s foray into Canada.

I also question the company’s potential for growth. With 1,926 stores in the US, Target has been adding new locations at the rate of approximately 25 per year.

While it is true that Target shares are trading a bit below its 5-year average P/E ratio, that metric is inflated in part by the surge in sales when Target was considered an essential business and other retailers were shuttered. If one looks back over a longer time horizon, it has been common for the stock to trade at a much lower P/E ratio for extended periods.

I think it wise to remain on the sidelines while the macroeconomic situation develops, and until a few quarters of results provide greater clarity.

As John mentioned, in the second quarter, we expect the challenges we faced in the first quarter will continue to impact our near-term profit performance.

Michael Fiddelke, CFO

With all of this in mind, I rate TGT a HOLD.

Be the first to comment