ilbusca/iStock Unreleased via Getty Images

Thesis

Major financial services companies are trading ridiculously cheap. All diversified US banks, notably JPMorgan (JPM), Citi (C), Goldman Sachs (GS), and Morgan Stanley (MS), are a Buy in my opinion. But the valuation for the European majors is ridiculous at a completely different level. In this article, I would like to highlight Barclays (NYSE:BCS) which is trading at P/E of x3.9 and a P/B of incredible x0.3. I believe that investors who accumulate at these levels will enjoy 100% upside within 3 years. I anchor my argument on a residual earnings valuation, which implies a fair implied share-price for BCS of $15.14. Strong Buy.

Why Barclays Is A Quality Company

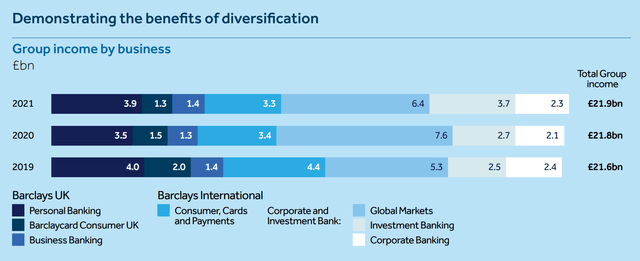

Barclays is the UK’s biggest investment bank with diversified revenue exposure to retail banking, private banking, investment banking, wealth management and global markets.

Barclays Annual Report 2021

This diversified profile is important, as it puffers the revenue/income profile of banks from cyclical exposure. For example, in low interest rate environments and steady markets, the investment banking and wealth management arm is poised to deliver strong performance.

In rising rates and volatile markets, FICC and Equities trading as well as retail and commercial lending do very well. That said, even though this year will be a weak FY for investment banking and wealth management, the global markets and commercial banking department are booming, as highlighted by the Q2 results of Citi and JPM. Risk from credit-losses, and balance sheet losses in general, are overstated, in my opinion. Barclays CET1 ratio stands at a strong 13%-14%. Accordingly, the company is resilient for an economic downturn and well-positioned to delight shareholders with share-buybacks.

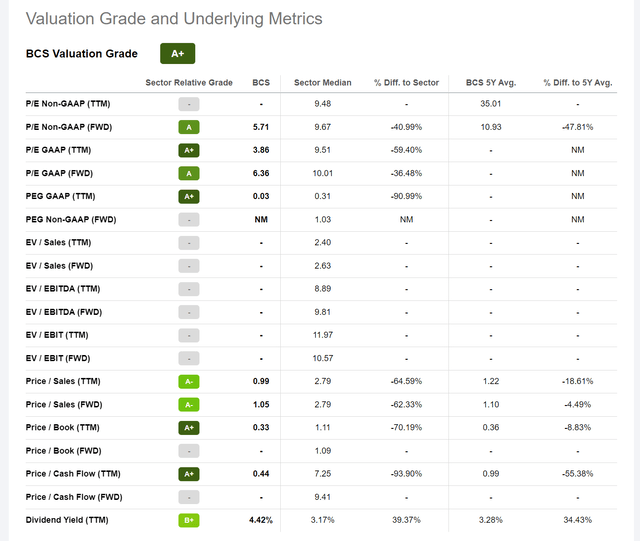

Valuation Is Ridiculously Cheap

Barclay’s valuation is ridiculously cheap. Not only on an absolute basis, as I will highlight later, but also on a relative basis as compared to peers. Most notably Barclays is trading at unbelievable x0.33 P/B versus about x1.3 for JPMorgan. Respectively, Barclays P/E ratio for the trailing 12 months is at x3.9 versus about 8.3 for JPMorgan. Notably, this is a >100% discount for P/E and >400% discount for P/B. Although I believe a premium for JPMorgan is absolutely justified, given the company’s high-quality management and market-leading position, the premium is stretched too far.

Seeking Alpha

Despite strong financial results in 2021 and Q1 2022, Barclays shares have underperformed the S&P 500 by about 13 percentage points. Again, I believe this dispersion is absolutely not justified, given that the major driver for the market’s sell-off (higher interest rates), should actually be a revenue tailwind for lenders such as Barclay’s. UK’s net interest margin may touch 3% by year end and this could provide significant margin uplift for Barclays.

Seeking Alpha

As it is difficult to analyse a bank’s financials without a considerable margin of error, I advise investors to rely on analyst consensus forecasts. For 2-3 years projections, analyst consensus is usually quite precise. That said, analyst consensus estimates for Barclays 2022 and 2023 revenues are at $27.8 billion and $28.5 billion. Respectively, EPS are estimated at $1.27 and $1.19.

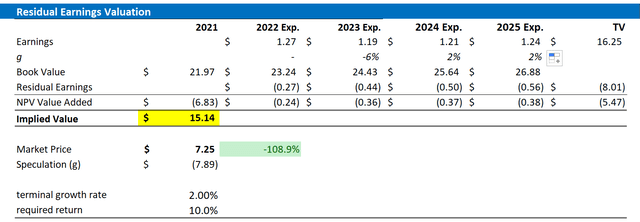

Residual Earnings Valuation

In my opinion, banks are prime candidates to be valued with a residual earnings valuation, given that the RE framework anchors on both the income statement and the balance sheet as well as accrual accounting. That said, I apply the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2023. In my opinion, any estimate beyond 2023 is too speculative to include in a valuation framework–especially for banks.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the FTSE 100 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 15, 2022. My calculation indicates a fair required return of 10%.

- To derive BCS’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 2% percentage points, slightly below estimated nominal GDP growth in order to reflect a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for BCS of $15.14/share, implying material upside of more than 100%.

Analyst Consensus EPS; Author’s Calculation

I understand that investors might have different assumptions with regards to BCS’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Risks

While I believe that investments in banks are less risky than the market implies, the tail-risk exposure is still elevated and if materialized this might depreciate BCS share-price significantly. For reference, the company has still not recovered the share-price levels seen before the great financial crisis. In any case, Barclays’ 14% CET1 ratio should puffer the company for most market stress scenarios, even severe ones. In addition, investors should note that my bullish thesis for BCS is connected to the implication that there are no structural differences between European and US banks. This, however, is not necessarily true since the respective regulatory exposure is somewhat different and US banks have a history of outperforming European peers. Nevertheless, a 100% relative valuation discrepancy is not justified, in my opinion.

Conclusion

I am very bullish on BCS stock, as I believe the bank is considerably undervalued. Especially if we consider a relative valuation versus US peers, BCS trades at an unjustifiably large discount. I believe that investors who accumulate BCS stock at levels < $8/share could enjoy 100% upside within 3 years. My argument is anchored on a $15.14/share target price, which I calculate based on a residual earnings valuation. Strong Buy.

Be the first to comment