Robert Way

When we initiated Novartis‘ (NYSE:NVS, OTCPK:NVSEF) coverage, we were optimistic about the Swiss pharmaceutical giant versus consensus analyst expectations. Wall Street analysts were highlighting the following topics:

- concern about Sandoz;

- higher corporate cost;

- no guidance on Roche disinvestment proceeds;

- lower guidance for 2022.

Point by point, our internal team reiterated inconclusive the four considerations, and we confirmed our long-term buy opportunity (also reiterated in the Q1 results). Today, Novartis AG just released its half-year results. No better comment was affirmed by the CEO. Thus, he says that the company “delivered a solid second quarter. Sandoz’s performance allows us to increase its guidance for the full year and the strategic review is on track. Implementation of our streamlined organizational model is progressing well and is now expected to deliver approximately USD 1.5 billion in savings. We reconfirm our 2022 Group guidance“.

Q2 Results comment

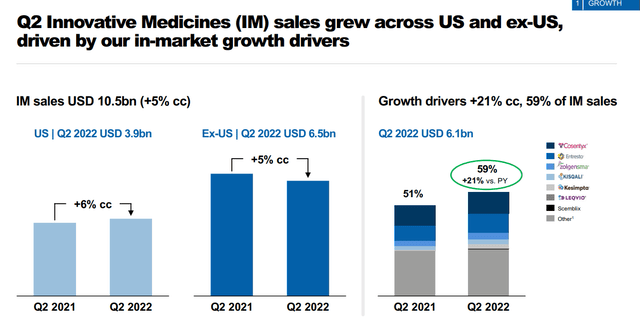

Q2 performance was in line with analyst expectations. Looking at the Novartis division, we see that innovative medicines top-line sales increased by 5% and also Sandoz delivered a positive quarter. More in specific, IM revenue growth was positively impacted by volume with a minor drag from pricing and generic competition. We positively note Zolgensma, Entresto, and Cosentyx performance, posting a plus 26%, 33%, and 12%, respectively. Whereas key misses were coming from Mayzent and Gilenya. This was probably due to the suspension of radioligand facilities that was announced in May, now operations are back online.

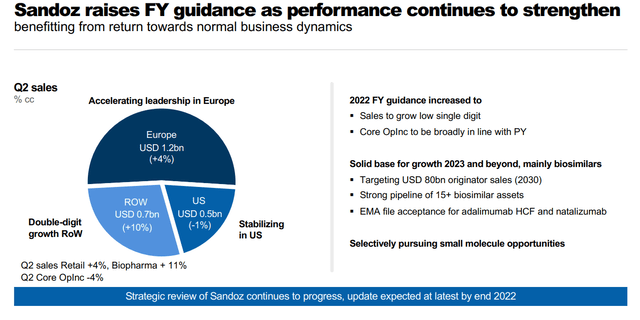

Looking at Sandoz, we note that the division increased the revenue line by 6% with a 13% higher volume and a minus 7% from currency effect. We should note that the positive performance was achieved thanks to a better cold season compared to last year. In the meantime, Sandoz’s strategic review is currently ongoing. We note that the buyout sale to private equity is more complicated. This would require important financial leverage that the banks are reluctant to grant. Whereas it appears more viable an IPO, as already done by other pharmaceutical giants. According to Bloomberg, Sandoz’s valuation would have an estimated value of $25 billion (13% of Novartis market cap).

Conclusion and Valuation

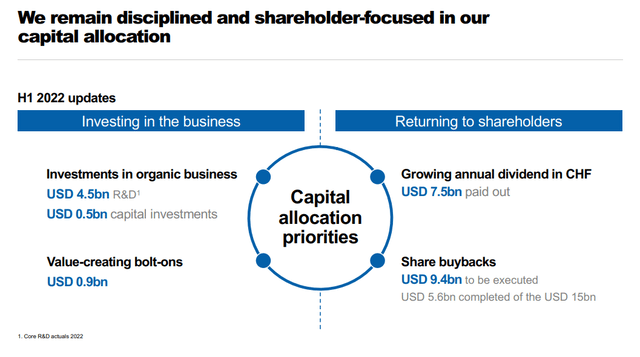

Aside from the pharmaceutical sales performance, the company also revealed a further $500 million in SG&A cost savings by 2024. There was already a restructuring plan in place to streamline the oncology division and to consolidate the IM segment in the commercial operations. Novartis group reaffirmed its guidance, raising also Sandoz’s performance.

As already mentioned, the Swiss pharma giant was not particularly impacted by its Russian activity. This year, we should note that Novartis already raised the DPS by 3.3% and is currently moving on with the buyback plan ($5.6 billion completed out of the $15 billion announced).

Thanks to a strong pipeline and also a better Sandoz valuation, our internal team sees no justification for a P/E discount compared to its peers. We reaffirm our buy rating with a target price of CHF 95 per share.

Be the first to comment