jovannig/iStock via Getty Images

Co-produced with Treading Softly

Have you heard about crazy gas prices and inflation? You’d have to be living under a rock and making all your own food to have missed all the headlines and worries across the globe.

Gas prices are the primary driver of inflation year-to-date. Everybody loves to complain about it, including those who don’t even own a car. Gas prices are up, and they are up a lot.

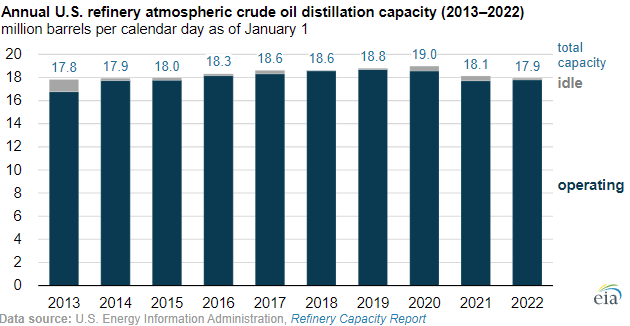

Furthermore, there isn’t any easy solution, as U.S. refining capacity is the lowest it has been in 8 years, and refiners are operating near full capacity.

EIA

There isn’t enough supply to meet demand. What happens when supply is less than demand? Prices go up. While Americans love to complain about the price of gasoline, the price of gasoline doesn’t make a major change to their driving habits.

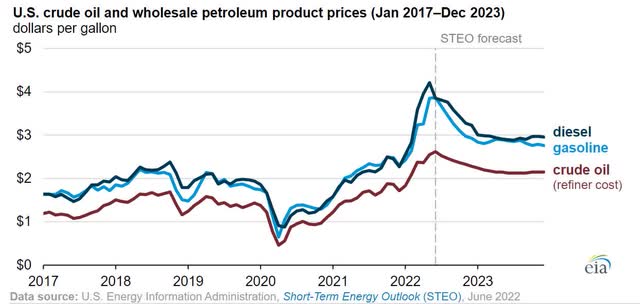

Since the cost of gasoline has outstripped the cost of oil, refining margins have increased dramatically.

EIA

When gas prices and oil prices are high, vertically integrated distributors are well positioned to thrive. They profit from wholesale sales and from retail sales to the end consumer.

Let’s look at two great picks that are benefitting from high demand and supply constraints for oil and gas.

Pick #1: GLP – Yield 10%

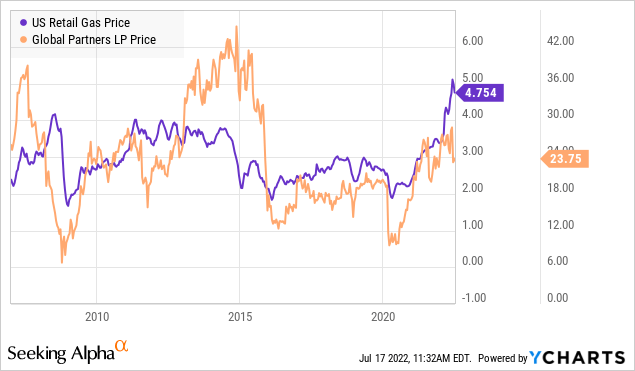

Given its business model, it shouldn’t be a surprise that Global Partners LP (GLP) has a share price that strongly correlates with retail gas prices.

At least it used to. Over the past year, even as gas prices have surged, GLP’s share price has stagnated. Over the past year, GLP has hiked its distribution twice, gas prices are up, and conditions for its business are ideal, but the share price is down.

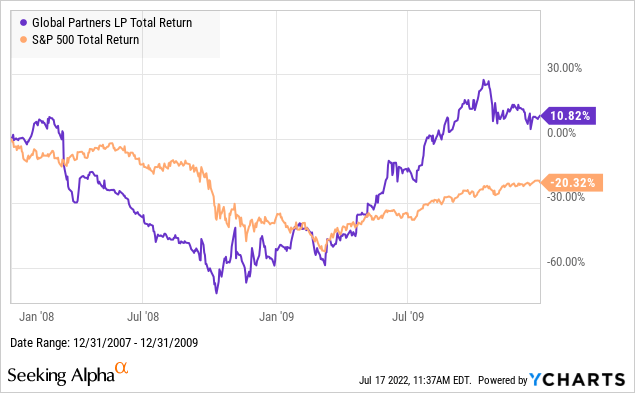

Clearly, the market is fearing a recession will reduce gas prices, but in selling off GLP it is misplacing that fear. Recessions can cause gas prices to fall. The Great Financial Crisis did, yet, gas prices were also one of the first things to recover. How did GLP fare?

Its price fell with everything else, but recovery was much faster than the S&P500. GLP’s distributions remained unchanged through the sell-off, remaining flat for 2008 and 2009, then being raised in 2010.

Nobody knows for sure when a recession will come. Nobody knows how much a recession might impact gas prices. The Great Financial Crisis caused gasoline prices to fall 60% from +$4 to under $2. It was a very severe recession that reverberated throughout the economy. During the 2001 recession, gasoline went from the $1.40-$1.60 range to a little under $1.20. So we certainly can’t say that all recessions have a major impact on gasoline prices.

We know that gas prices are high today, and we know that they are especially high relative to crude oil. For GLP, that means they are making a lot of money right now. A recession might or might not happen, if it does, it might or might not reduce gas prices.

I tend to think that the fundamental lack of supply will keep gas prices relatively elevated, even if a recession is significant enough to hurt demand. If a recession does come, GLP has demonstrated its ability to navigate through such times. I’m happy to hold and collect my distribution. In the long run, the large cash returns I am realizing with each distribution will consistently outshine the speculative price movements.

I can’t tell you for sure what the price of gasoline will be next year. If I’m betting on that, I’d bet on higher than 2021. What I can tell you is that GLP will be profiting on the gasoline shortage and sending those gains along to me as distributions into my brokerage account. While others are complaining about the prices at the pump, I’m profiting from them!

Note: GLP is a partnership and issues a K-1.

Pick #2: CAPL – Yield 10.5%

CrossAmerica Partners LP (CAPL) in many respects is a GLP-lite. While GLP offers storage, terminals, and other ancillary services on top of C-store operation and fuel distribution, CAPL is much more focused. As such, they cannot leverage the same benefits that GLP can in gas price swings. What they can do however is be strongly profitable in all environments.

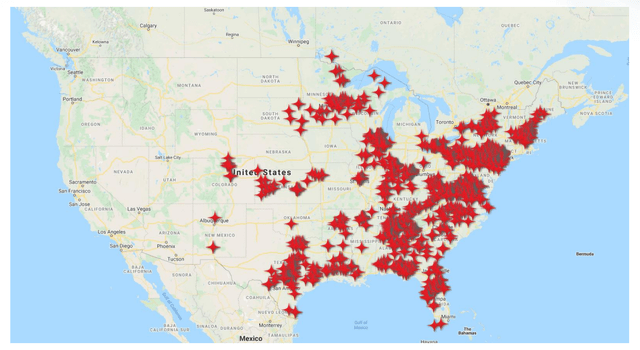

CrossAmerica Partners

CAPL has a vast range of fuel distribution locations along with locations they own and operate. Their focus is on the eastern United States, much like GLP.

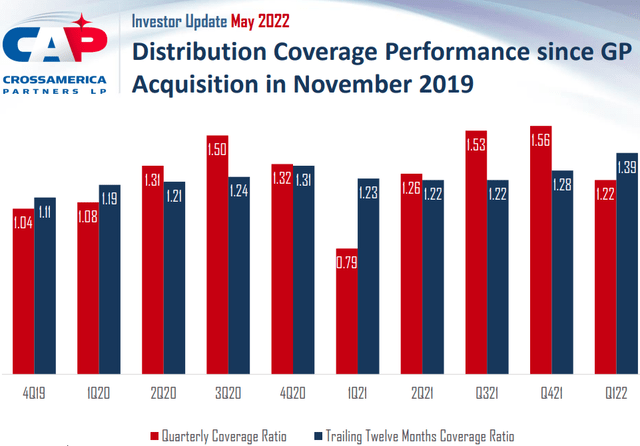

CAPL has been taking diligent steps to bring its distribution coverage higher and reduce leverage:

CrossAmerica Partners

CAPL saw its General Partner change in November of 2019, this switch removed Alimentation Couche-Tard (OTCPK:ANCUF) as the General Partner, and brought back Joe Topper to the controlling position of CAPL. ANCUF is the single largest C-store operator in the world and is the primary force behind Circle K locations. Mr. Topper would best be remembered as the CEO of CAPL when it was formed originally.

Since this handover, CAPL has been focused on raising its distribution coverage and lowering its debt profile. This makes CAPL a prime buy when thinking of monetizing every fill-up at the gas station.

Looking for a straightforward, shareholder-rewarding second pick to add to your portfolio alongside GLP? CAPL is a perfect choice.

Note: CAPL is a partnership and issues a K-1.

Dreamstime

Conclusion

When it comes to the gas pump, I love getting discounts and money off. I love it, even more, when I get cash into my pocket from every single person who pumps gas.

I own the gas pump and get cash back from it. You can too.

What do I do with this cash? Whatever I want! That’s the beauty of income investing. The money I get from my portfolio comes without strings attached. I can reinvest it. I can keep it for emergencies. I can buy my wife flowers. I can get that new lawnmower I have been eyeing. I have the freedom and flexibility to choose.

That’s financial freedom.

I don’t like rising gas prices, but I do enjoy getting money from the gas pump, and so can you.

Be the first to comment