Bet_Noire

Key themes for 3Q 2022

- Global economic defenses are being tested; United States economy to face recession next year

The U.S. economy will likely surrender to recessionary pressures in 2023, slightly later than Europe, which is more exposed to the energy price shock. By contrast, China could see stronger growth this year as policy stimulus rises. - Inflation will only decline at a painfully slow pace; food and energy inflation are wild cards

Although U.S. inflation could peak soon, the broadening and stickiness of price pressures implies headline Consumer Price Inflation (CPI) will only fall to 6.5% this year, before recession accelerates the decline in 2023. - The Federal Reserve is focused on price stability; significant monetary tightening is still to come

Policy rates are set to hit 3.5% by year-end, before peaking at 4.25% next year. Other developed market central banks will also hike in response to higher inflation, but they’ll likely stop short of the Fed’s peak, keeping the U.S. dollar strong. - The equity market drawdown has been primarily rates-led; earnings weakness is next

A near-term bear market rally is possible as Fed rate expectations settle and inflation peaks. However, with margin pressures growing and demand weakening, earnings concerns are mounting, so a sustained rebound is unlikely. - A more defensive positioning is warranted in fixed income, focusing on higher quality

Rising recession risk will put modest downward pressure on U.S. Treasury yields and spur further spread widening, thereby taking the shine off short-duration, low-quality assets. Investors may want to re-focus on core bonds. - Challenged equity and fixed income markets create a positive backdrop for real assets

The diversification offered by real assets is particularly valuable in this environment, as are their defensive characteristics. The stubbornly high inflation backdrop should likely extend the outperformance in commodities and infrastructure.

The stars align for the perfect market storm

The global economy and financial markets have suffered a dreadful first half of the year, ravaged by a severe commodity shock, strict COVID-19 lockdowns in the world’s second-largest economy, and one of the most aggressive Fed tightening cycles in recent history. The second half looks equally tough.

Consumers, already struggling with higher food and energy prices, are now being confronted by rapidly rising mortgage borrowing costs. Corporations, which have been able to pass on elevated input costs in recent months, are now facing an increasingly price-sensitive consumer, with negative implications for profit margins and earnings.

And now, in its bid to put inflation back in its cage, the Fed is no longer avoiding economic weakness, rather, it is targeting additional economic weakness. A U.S. recession in 2023 is now our baseline expectation.

Playing defense: Quality and stability

Global monetary easing has become global monetary tightening. Global growth is transitioning to global recession. Earnings beats will likely soon be earnings disappointments. With the familiar playbook of easy financial conditions supporting risk assets turned upside down, investors need to revisit portfolios and positioning with fresh eyes.

It will be crucial for investors to refocus on high quality, seeking out assets that can potentially still deliver stable earnings even as the growth landscape becomes dry and barren. Most importantly, and now maybe more than ever, the importance of diversification cannot be exaggerated.

Investing in real time

Traditional equity and fixed-income classes will be challenged in this low-growth, high-inflationary environment. By contrast, real assets are typically less sensitive to inflation (or even thrive in inflationary environments), offer more predictable cash flows, and therefore can potentially flourish in this investment landscape, providing important diversification benefits and inflation mitigation.

Investors may be concerned that, like so many post-Global Financial Crisis and post-COVID winners, real asset gains are starting to run dry. However, structural shortages should continue to support commodity returns, while infrastructure provides opportunities to access attractive long-term investment themes, such as decarbonization, which will likely outlast Fed tightening and recession concerns.

Consider the potential risks

Sizeable energy disruption: An escalation in the geopolitical conflict that results in a sustained cut-off in Russian energy supply would not only push global energy prices and inflation even higher, but it would also generate an acute stagflationary economic shock to the global economy, prolonging and deepening a recession.

Fed policy mistake: Although the market may be concerned that the Fed will hike too far, there is a risk it instead capitulates to market fears and stops tightening too early.

While markets may initially respond positively, inflation and inflation expectations would likely resume a sharp upward path, enhancing the Fed’s task. In that event, the Fed would need to hike even more than in the current trajectory.

Global economic defenses are being tested

The global economy has been exceptionally resilient in the face of considerable turbulence and multiple headwinds. However, the defences are beginning to crumble.

The COVID pandemic has reduced its stranglehold on much of the global economy, yet China’s strict adherence to its zero-COVID policy has meant that their latest surge in infections has severely hampered mobility and discouraged consumer spending. Although China’s economic activity is likely to be more robust in the second half of 2022 as infection rates drop and mobility picks up, it likely won’t be sufficiently strong to meaningfully lift global growth.

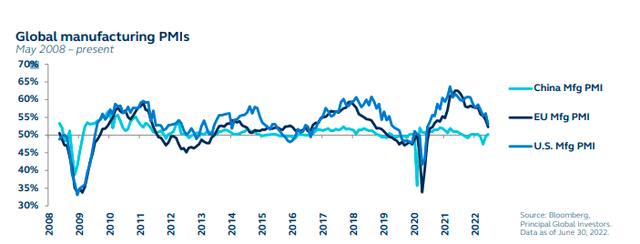

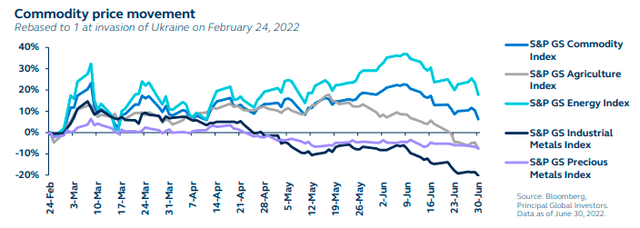

The Ukraine crisis has inflicted an additional blow to the global economy. Russia and Ukraine are key commodity exporters, so not only has broad sentiment plunged in response to the conflict, but energy and food prices have soared. In the face of such significant price pressures, global economic growth is starting to slow, with PMI activity indicators moving sharply lower. The downside pressures are greatest for Europe and parts of emerging markets (EM), but the U.S. economy also faces considerable challenges.

The global economy has been hit with several shocks since 2020. The most recent resulting in sharply higher commodity prices, driving a severely deteriorating outlook.

Global Manufacturing PMIs Commodity Price Movement

U.S. economy: A brittle outlook

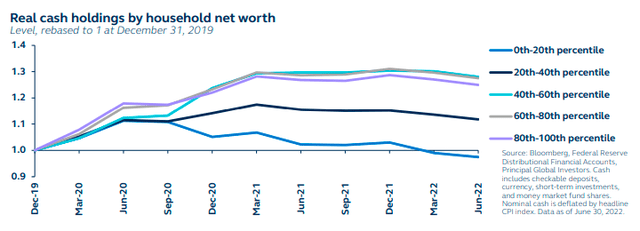

Supported by tight labor markets and consumers who themselves are still sustained by excess savings, the U.S. economy is unlikely to enter recession this year. However, cracks are rapidly growing.

- Time and inflation have eroded real cash holdings for the poorest cohort of U.S. households back to pre-COVID levels. The next quintile of poorest households will likely face the same fate within the next few quarters, exacerbated by high food and energy prices. As a result, household spending will become increasingly strained.

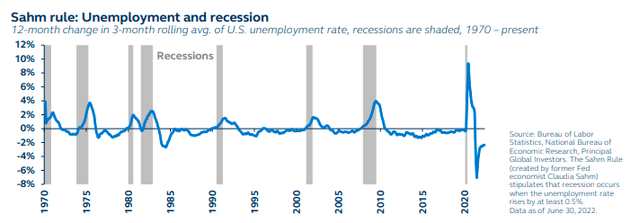

- In downturns, firms typically first cut worker hours and temporary help, or remove job postings. Worker hours have been falling throughout 2022 and growth in temporary employment is slowing – a precursor to a slowdown in payrolls. The Fed’s own forecast sees unemployment rising from 3.6% to 4.1%. Historically, there has never been a 0.5% increase in the U.S. unemployment rate without it resulting in recession.

- Companies are struggling to pass higher input costs to newly price-sensitive consumers, pressuring profit margins.

There is already noticeable deterioration in the U.S. economy as households and companies struggle under the weight of inflation. Fed hikes will only exacerbate economic weakness.

Sahm Rule: Unemployment And Recession Real Cash Holdings By Household Net Worth

Relentless inflation, a monetary quandary

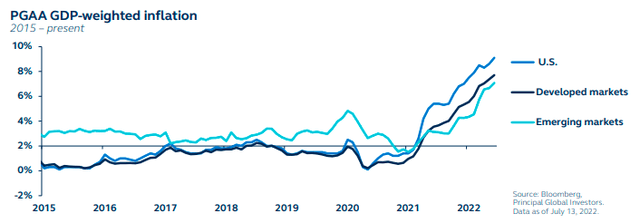

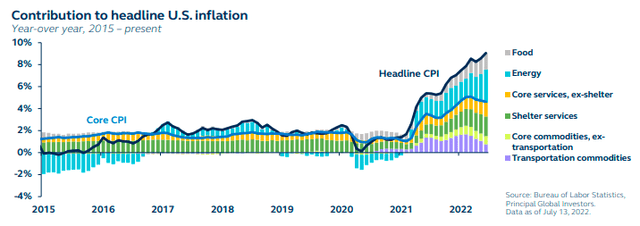

Global price pressures have continued to intensify, weighing heavily on households and companies. Europe’s dependence on Russian gas means that it is facing very significant energy price increases, and peak inflation is still several months away. Emerging market inflation pressures have also continued to build, while U.S. annual headline inflation has hit 9.1% – a fresh 40-year high.

U.S. inflation is likely close to peaking. Whereas last year the prices for core commodities, such as cars and durable goods, benefitted from strong excess demand, this year consumer patterns are reversing. Consumers are shifting from goods to services, whilst overall demand is also slowing, so core goods price pressures are becoming more deflationary. However, because inflation pressures have spread to the stickier parts of the market, such as shelter which responds to a fall in house prices with an 18-month lag, the decline in inflation will likely be frustratingly slow.

Even then, energy and food prices are the wild cards that could drive inflation (and inflation expectations) higher, even as softer demand exerts downward pressure. This commodity component of inflation is severely complicating monetary policy decisions.

U.S. inflation is likely near its peak but will remain uncomfortably high. Headline CPI will only fall to around 6.5% by end-2022, before slowing more rapidly in 2023.

PGAA GDP-Weighted Inflation Contribution To US Headline Inflation

Central banks adopt tunnel vision

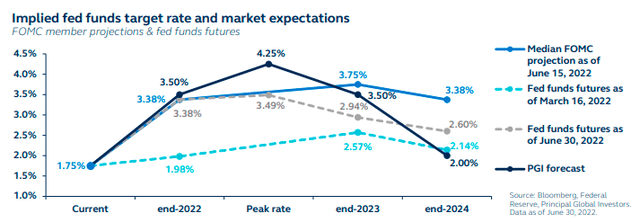

The U.S. Federal Reserve has raised policy rates by 75 bps for the first time since 1994. Further sharp tightening is still to come, with the Fed compelled to respond forcefully to stubbornly high headline inflation and climbing inflation expectations if energy prices rise further. Expect policy rates to rise to 3.5% this year and then to 4.25% next year.

In the last 11 tightening cycles, the Fed has only skirted recession three times (1965, 1984 and 1994). In each of those cycles, inflation was lower and the Fed funds rate was meaningfully higher at the point of liftoff, so Fed tightening didn’t need to be as dramatic as it does today. A soft landing feels like a long shot from here.

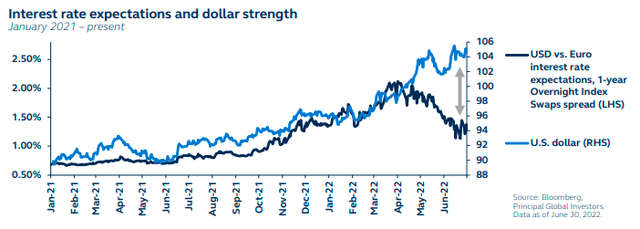

The European Central Bank (ECB) is also facing record high inflation and will soon start raising policy rates – yet, the weakness of the euro area economy suggests they will not tighten anywhere close to the Fed. By contrast, the Bank of Japan continues to hold on to their yield curve control policy, while the People’s Bank of China is stepping up its policy stimulus actions. The Fed’s relatively hawkish policy is putting upward pressure on the U.S. dollar, pushing emerging markets central banks to hike further even if their economies are not strong enough, thereby adding to economic weakness around the world.

The Fed has asserted that price stability is their number one priority. Bringing inflation down toward target via sharp rate hikes will likely result in recession in the first half of 2023.

Implied Fed Funds Target Rate And Market Expectations Interest Rate Expectations And US Dollar Strength – January 2021 To Present

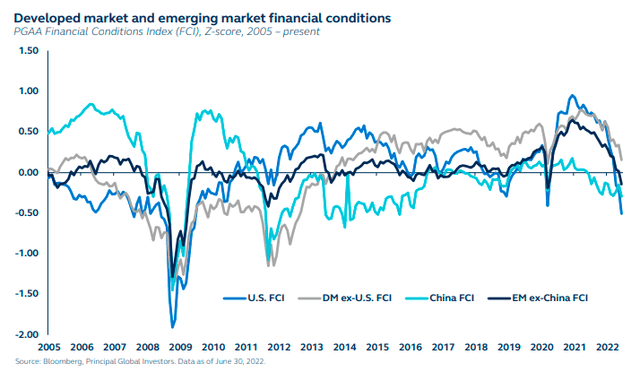

Tightening financial conditions: Gauging the pain

Global central banks have, for the most part, clearly asserted that price stability sits above economic growth in their priority list, triggering major market upheaval. Global equities have suffered significant losses, with the U.S. S&P 500 index recording its worst first half in 60 years, while low-quality credit is too feeling severe strains. This has led to a significant tightening of financial conditions, but not enough to convince the Fed to take its foot off the brake.

Financial conditions likely need to tighten meaningfully below historic averages – perhaps driven by further equity market declines or additional severe credit market stress – before the Fed backs off. Above anything else though, it is a convincing decline in inflation and inflation expectations that the Fed needs to see before it changes course.

With global central banks raising rates, the tightening in financial conditions is a global phenomenon and will weigh sharply on global growth. China is the one exception.

Although China’s equity market sell-off and weak loan demand due to COVID have both led to tightening financial conditions, stimulative monetary policy over coming quarters should at least partially reverse the tightening.

Financial conditions have tightened but still have further to go before central bank hiking cycles peak. As a result, equity and credit markets likely face considerable further strains.

Developed Market And Emerging Market Financial Conditions

Equities

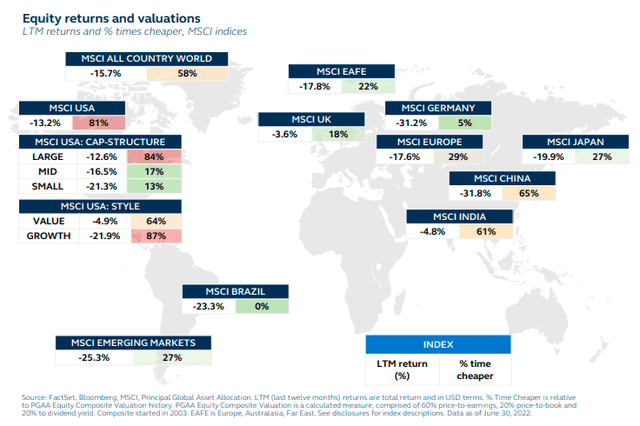

A more appetizing global valuation picture

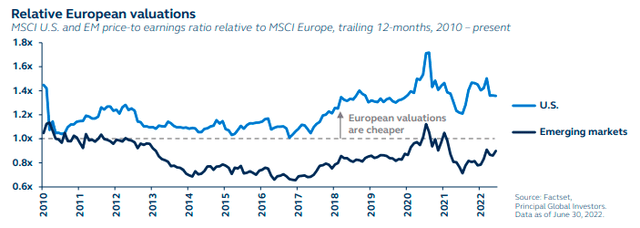

Global equity markets have faced a particularly difficult six months, falling sharply in the face of historically elevated inflation, expectations for aggressive monetary tightening and growing recession concerns. In turn, valuations have become more attractive across nearly all markets.

At the start of 2022, the U.S. had rarely been more expensive. Now, after falling into bear market territory, it is certainly more attractive – but in historical terms, only slightly. Indeed, the U.S. has still been cheaper almost 80% of the time. By contrast, parts of Europe, where equity losses have also been significant, are flashing green. Relative to the U.S., Europe has rarely been less expensive. Furthermore, valuations in pockets of emerging markets suggest that EM offers great buying opportunities.

Yet, just as over the past decade expensive valuations did not present any obstacles on the way up, inexpensive valuations do not necessarily present any obstacles on the way down. With global recession looming and earnings growth the next shoe to drop, most markets may continue to see losses.

Global valuations have become more attractive. Yet, cheap valuations do not necessarily present any obstacles on the way down. Most markets will likely face additional losses.

Global Equity Returns And Valuations

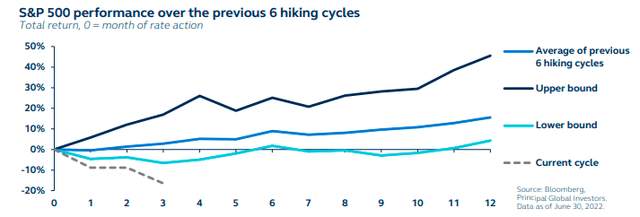

Equity drawdown primarily a rates-driven story… so far

The S&P 500 index had its worst start to the year since 1962, falling 21% by the end of Q2. Since the Fed started hiking in March, U.S. equities have tumbled almost 15%. This stands in stark contrast to the previous six Fed hiking cycles where equities have, on average, delivered a 15.6% return during the initial 12 months after the first hike.

One key difference between this hiking cycle and previous ones is the steepness of the Fed’s tightening path. Not only is this hiking path steeper than any of the last six cycles, but by the end of July, in the space of just four months, the Fed’s tightening will likely have matched the entire three-year hiking cycle of 2015-18.

The market is anticipating a further 175 bps of tightening this year alone. The closest resemblances to the current Fed policy trajectory are the hiking cycles in 1988-89 and 1994-95, and in those two episodes, equities valuations contracted sharply. Similarly, this year has seen an extremely sharp valuation contraction. Indeed, with earnings growth still holding up, this equity market decline has been very much a rates-driven story.

Aggressive Fed tightening has led to a sharp contraction in equity valuations. As a result, equity markets have declined significantly – all before earnings have even fallen.

S&P 500 Performance Over The Previous 6 Hiking Cycles Market Performance And Earnings Expectations – 1990 To Present

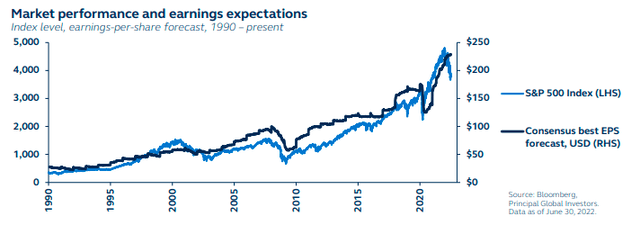

Earnings watch: The bear is still lurking

Although U.S. valuations have contracted significantly, they have still been cheaper around 80% of the time, so multiple expansion from here is unlikely. As a result, equity prices will likely follow the earnings path lower.

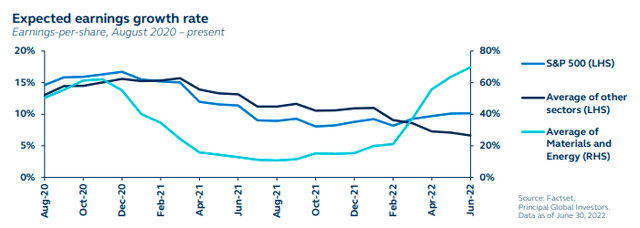

To date, overall earnings growth has been steady and is tracking 10% for 2022 as a whole. If sustained, earnings growth could provide a decent buffer to U.S. equities despite valuation headwinds.

However, sector-level earnings growth shows that the energy and materials sectors have essentially carried the overall earnings growth story. Most of the other sectors’ earnings have been on a downward trend, signalling weakness ahead. The deteriorating economic outlook will inevitably pressure earnings growth, in turn weighing on equity prices.

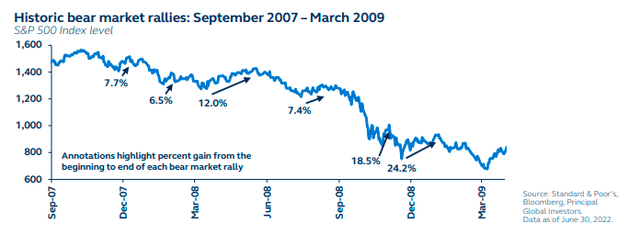

In the meantime, with technicals already signalling very negative investor sentiment and positioning data showing an increase in cash allocations, a modest bear market rally is possible. In fact, previous equity market drawdowns have typically been characterised by several bear market rallies, each peaking a little lower than the previous one.

A near-term bear market rally is possible as Fed rate expectations settle and inflation peaks. However, with earnings concerns growing, a sustained rebound is unlikely.

Expected Earnings Growth Rate – August 2020 to Present Historic Bear Market Rallies – September 2007 To March 2009

Cap-sizing the usual large- and mid-cap narrative

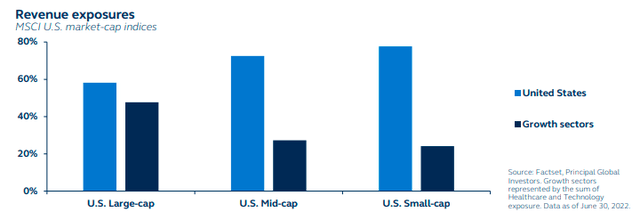

From a fundamental perspective, large-caps will be challenged by their global exposure. Although the U.S. economy is slowing rapidly, the outlook is worse for Europe and large parts of EM. By contrast, mid-caps tend to be more domestically focused, whilst they also have less sector concentration.

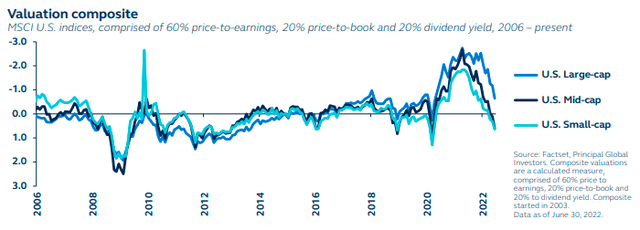

From a valuation perspective, although large-cap stocks are still expensive, mid-cap valuations have only been cheaper 17% of the time.

Small-caps remain the most challenged by the economic outlook. Not only will they struggle to pass on higher costs, so will suffer greater margin pressures than either mid- or large-caps, but they will face the greatest debt servicing challenges as growth declines.

With regard to styles, with the recent equity downturn very much a rates-led story, value has outperformed growth. Historically, however, during recessions, growth earnings have tended to be more resilient than value earnings. As a result, as recession comes closer into view, growth may strengthen. Therefore, for now, a balanced allocation to growth and value is warranted.

Although large-caps typically outperform in a downturn, more attractive valuations, greater domestic revenue exposure and a more balanced sector exposure suggest mid-caps can potentially outperform in the current environment.

Revenue Exposures Valuation Composite

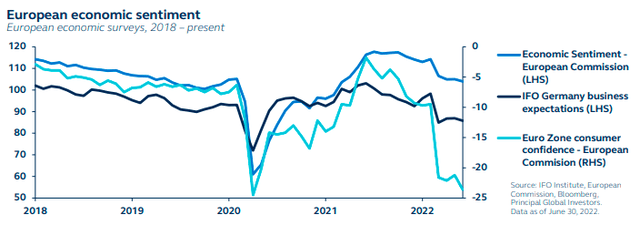

Valuations already capture Europe’s dire outlook

The European economy is likely to fall into recession before year-end, with households already struggling deeply in the face of elevated living costs. Growing risk of a Russian gas embargo threatens to drive European wholesale natural gas prices sharply higher from already extremely elevated levels, driving a plunge in consumer confidence. What’s more, if Russian gas supply is stopped, industrial users in Europe will likely be forced to ration gas later this year, weighing sharply on an already challenged economic outlook.

European equities already price in a mild recession and are trading at a P/E below long-term average levels. Yet, with the risk of a more severe European recession rising, equities will likely remain under downward pressure until either earnings growth estimates are sufficiently negative or the threat of a Russian gas embargo fades.

Importantly, though, European valuations have cheapened significantly relative to the U.S. since mid-2021 and, in fact, have rarely been more attractive. Relative to EM, however, the opportunity is not as compelling.

Europe will likely enter recession ahead of the U.S., putting downward pressure on European equities in the near term. But this more negative fundamental outlook is somewhat balanced out by its more attractive valuations relative to the U.S.

European Economic Sentiment Relative European Valuations

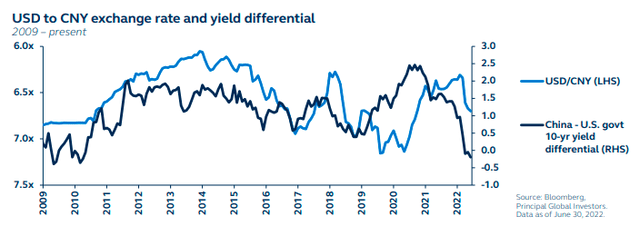

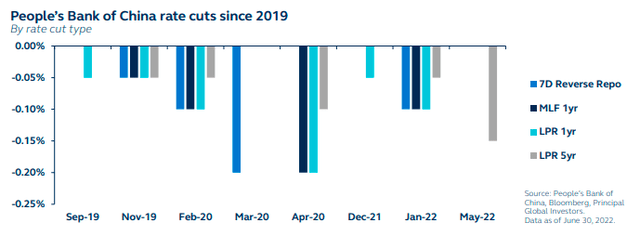

China outlook: Perhaps sunny, but with some cloud cover

China’s monetary policy response to the COVID lockdown-driven economic downturn has been hampered by global financial conditions. High inflation and expedited Fed hikes have driven up yields globally, eradicating the yield advantage of China’s government bonds over U.S. Treasurys, in turn fuelling capital outflows and sharp renminbi depreciation. Further policy action to reduce borrowing costs and stimulate the economy would reduce the attractiveness of the renminbi and encourage further outflows, thereby limiting policy stimulus options.

More recently, however, China’s government has signalled a more proactive policy is warranted, endorsing more targeted stimulus actions. Rather than cutting multiple lending rates simultaneously, the People’s Bank of China (PBoC) has cut the five-year LPR (the benchmark for mortgage rates and long-term infrastructure loans), thereby directly targeting a stabilization in the property market and supporting infrastructure investment. These actions, however, need to be followed up with additional stimulative policy in order to spur a rebound in economic growth, creating uncertainty around the long-term outlook.

Although China’s policymakers appear to have recognized the urgency for policy stimulus, they have only a narrow window to introduce important policy measures to rekindle economic growth.

USD To CNY Exchange Rate And Yield Differential – 2009 To Present People’s Bank Of China Rate Cuts Since 2019

Fixed income

U.S. Treasurys suffer worst first half since 1788

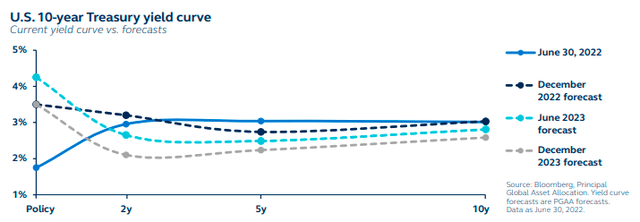

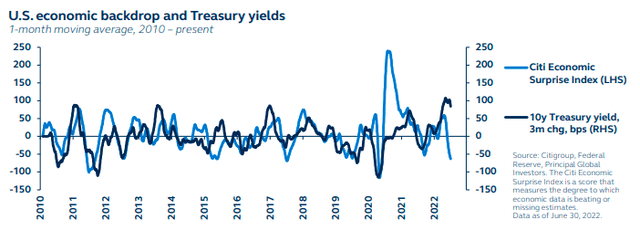

Spooked by elevated inflation and expectations for an aggressive, front-loaded Fed hiking path, U.S. 10-year Treasurys have suffered their worst first half of any year since 1788, rising sharply from around 1.50% at the start of 2022 to 3.48% by early June, before dipping back towards 3% by the end of the second quarter.

Looking forward, the deteriorating economic backdrop has set the stage for a further decline in 10-year Treasury yields over the coming quarters. Indeed, rising recession risk, coupled with expectations for eventual Fed policy rate cuts once the economy is contracting and inflation pressures have weakened sufficiently, limit upside potential for the long end of the yield curve. Expect to see 10-year Treasury yields sitting at around 2.6% by end-2023.

The front-loaded Fed tightening path, which will likely see the Fed funds rate above 3% within just a few meetings, will initially support the front-end of the Treasury curve, causing the 3m10yr yield curve – an important recession indicator – to invert. However, by end-2023, with the Fed embarking on rate cuts to support the economy through recession, the front-end should dip back.

While Fed hikes will keep the front-end of the Treasury yield curve supported, rising recession fears will weigh on the long-end, pushing 10-year U.S. Treasury yields below 3%.

US 10-Year Treasury Yield Curve – Current Yield Curve Vs. Forecasts US Economic Backdrop And Treasury Yields – 1-Month Moving Average, 2010 To Present

IG outlook improving, remains challenged

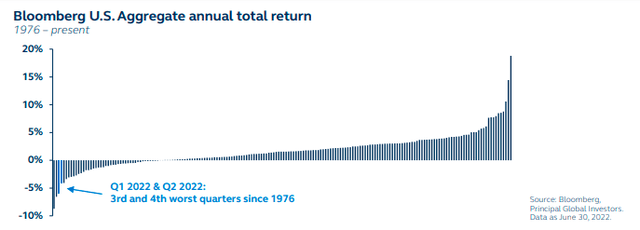

Q1 and Q2 of 2022 delivered the third and fourth worst quarterly core bond performances since 1976. The Bloomberg U.S. Aggregate Bond index has now erased all its gains since March 2019.

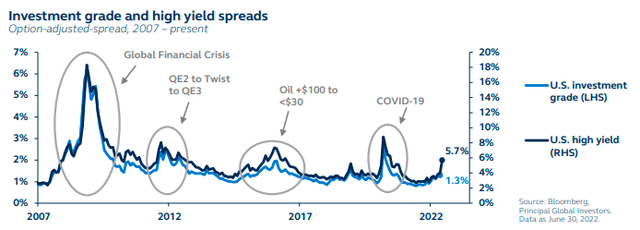

Investment grade (IG) spreads widened more than high yield (HY) spreads earlier in the year, with HY supported by still-abundant liquidity, robust economic activity, as well as its shorter-duration characteristics. However, the relative outlook for IG credit has improved.

- Valuations have become considerably more attractive. Now, with U.S. IG yields at 12-year highs, demand from yield-based buyers should accelerate. In addition, a repeat of the recent bond market rout is unlikely.

- Whereas short-duration positioning was important in recent months, with recession risks rising, the long-end Treasury yields will be under downward pressure.

- Recession risks are mounting. The higher quality of IG credit, alongside U.S. Treasurys, can add an element of defensive positioning in portfolios, providing downside mitigation.

IG valuations have become more attractive, and higher-quality exposure will be increasingly important as recession approaches. Even so, further IG spread widening is still likely.

Bloomberg US Aggregate Annual Total Return – 1976 To Present Investment Grade And High Yield Spreads – Option-Adjusted Spread, 2007 To Present

Long duration + high quality does not equal high yield

During an initial inflation scare, credit investors typically hide out in high yield (HY) due to its lower duration.

However, once economic and liquidity deterioration takes hold and duration becomes more attractive, a gradual shift toward higher-quality credit ensues.

- Quantitative tightening, together with higher Fed Funds rates, will effectively withdraw liquidity from capital markets and raise the cost of capital. This threatens to restrain risk-taking across markets, manifesting in wider credit spreads.

- Ratings momentum has been robust for U.S. HY, with more upgrades than downgrades since 2000. However, the slowing economy has now resulted in a growing number of downgrades, and this trend is likely to persist, drawing investors towards higher-quality assets.

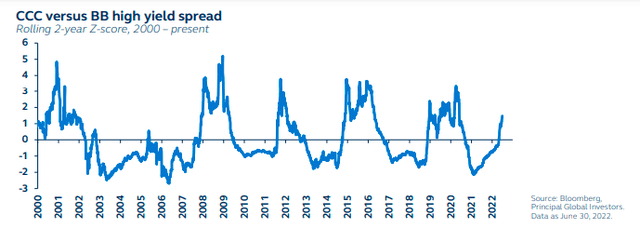

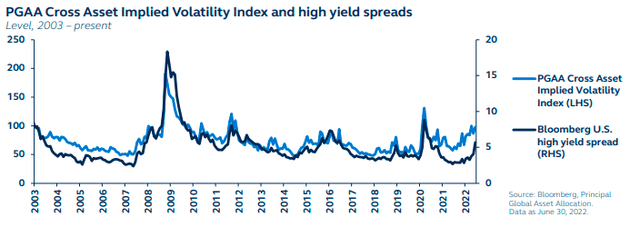

These concerns are already starting to kick in, as evidenced by the rapidly widening CCC-BB spread. What’s more, the historically tight relationship between market volatility and high yield spread suggests that additional market stress as recession approaches and the Fed takes policy rates meaningfully higher will drive HY spreads wider.

High yield has been relatively resilient so far. However, rising liquidity and economic stress will likely drive HY spreads wider, implying a need to underweight the asset class.

CCC Vs. BB High Yield Spread – Rolling 2-Year Z-score, 2000 To Present PGAA Cross Asset Implied Volatility Index And High Yield Spreads, 2003 To Present

Emerging markets unappreciative of the risks

Emerging economies face the greatest headwinds this year. Inflation dynamics mirror those in developed markets (DM), but as food and energy have a higher weighting in EM inflation baskets, EM price pressures are likely to fade at a considerably slower pace than in DM.

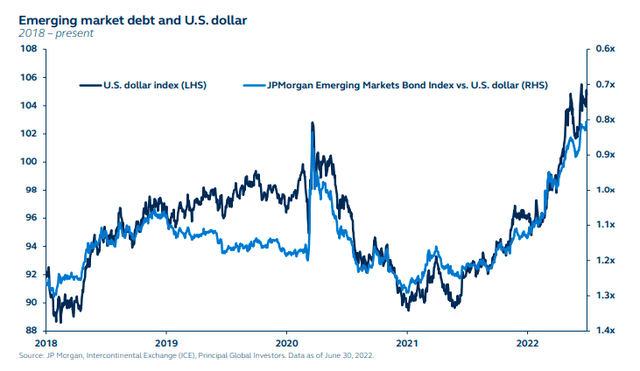

In EM Asia, rate hiking cycles are still in relatively early days and so have much further to go, while their economies are additionally pressured by the strong U.S. dollar. By contrast, oil-exporting economies in Latin America have seen significant currency appreciation. However, as inflation momentum still hasn’t faded, ongoing monetary policy normalization continues to depress economic activity. In addition, U.S. quantitative tightening poses an additional risk to emerging markets, threatening significant capital outflows as liquidity drops.

Despite the additional risks, local currency emerging market debt yields have not risen as much for U.S. credit, suggesting there could be considerable further stress to come for this asset class. Similarly, EM credit spreads underappreciate the risks and are likely to widen further.

Emerging market debt will be challenged by several headwinds, including food and energy price inflation, Fed tightening, and the strong U.S. dollar.

Emerging Market Debt And USD, 2018 To Present

A favorable position for preferred securities

Just as in low-yield environments, when investors need to think outside the traditional fixed-income box, they must also do so during challenging economic environments.

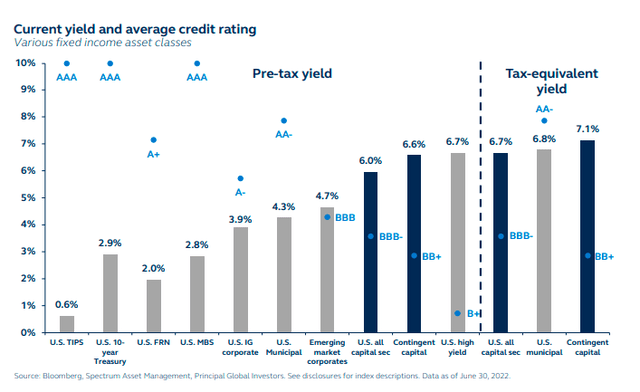

Preferred securities, just like other fixed-income securities, have had a challenging two quarters. However, the relative outlook is brightening, with preferred securities currently in a favorable spot of price, yield, quality, and structure.

Price: Preferred securities are trading below par and are now offering attractive valuations.

Yield: They demonstrate relatively competitive yields, even compared to lower quality fixed-income assets.

Quality: Typically investment grade preferred securities, so default rates are lower than high yield.

Structure: Offer “fixed to floating,” “fixed to variable” rate structures, which may help a long-term investor as rates rise.

What’s more, although financials would certainly be impacted during a downturn, U.S. banks and consumer focused lenders are in strong health and should remain resilient over the coming challenging months.

Within fixed income, preferred securities are favored. Not only are yields relatively attractive, but the structure can potentially be beneficial in the current environment.

Current Yield And Average Credit Rating

Alternatives

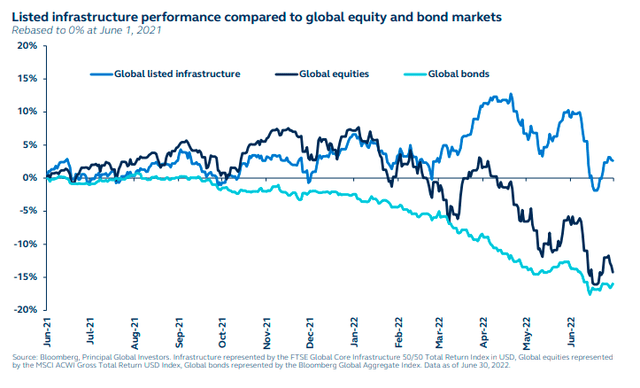

Infrastructure typically shines during high inflation

In this macro environment, the diversification benefits of alternative investments, in addition to the fundamental strengths and defensive characteristics, are likely to be on full display. In particular, infrastructure investments are one of the few asset classes that can potentially outperform in the current slowing-growth, high-inflation environment.

Since demand for critical services is less sensitive to inflation, owners of certain infrastructure assets can sustain and increase prices without significantly impacting demand, offering potentially resilient returns through periods of higher inflation. Listed infrastructure has historically delivered higher returns than global equities during periods of higher inflation.

Furthermore, infrastructure investments typically have more predictable cash flows associated with the long-lived assets, with historically attractive yield.

They also offer exposure to the global theme of decarbonization, which presents a multi-decade tailwind for utilities and renewable infrastructure companies.

Challenged equity and fixed-income markets, coupled with stubbornly high inflation, have created a positive backdrop for alternatives and, in particular, listed infrastructure.

Listed Infrastructure Performance Compared To Global Equity And Bond Markets

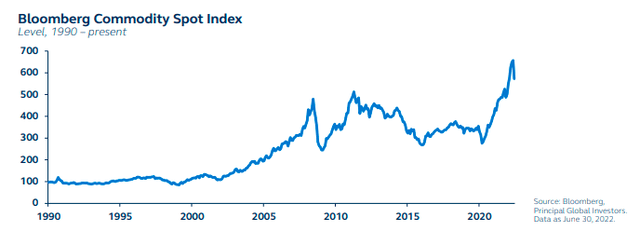

Commodity prices: Short-term relief, long-term pain

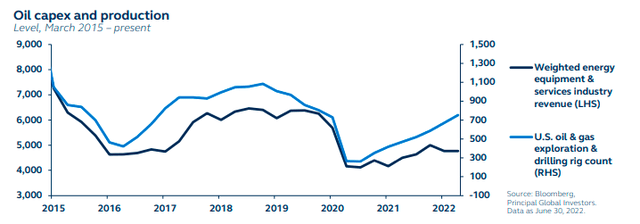

Commodity prices have risen sharply higher in recent months, partially due to the Russia/Ukraine conflict, but more fundamentally due to structural supply shortages. Indeed, a large number of commodities are in backwardation – a pricing structure that signals scarcity.

Supply shortages stem from several factors, including post-COVID logistical disruptions and supply chain constraints, as well as significant underinvestment. Oil capex, for example, has been slow to recover since the COVID crisis, and as oil capex typically leads oil production by roughly 18 months, indicates a persistent supply shortage is likely in the medium term.

In the near term, oil and other commodity prices may be subject to some downward pressure as fears of global recession continue to mount. However, China’s potential growth upturn will likely re-intensify upward price pressures, while supply shortages will likely gradually support prices higher.

Indeed, a commodity price slowdown is simply a short-term abatement of the symptom (inflation) and not a cure for the problem – underinvestment.

Commodity prices may come under downward pressure in the near term as recession fears mount. However, structural supply shortages will likely prevent prices from falling too far and will drive them higher in the medium term.

Bloomberg Commodity Spot Index, 1990 To Present Oil Capex And Production, March 2015 To Present

Investment implications

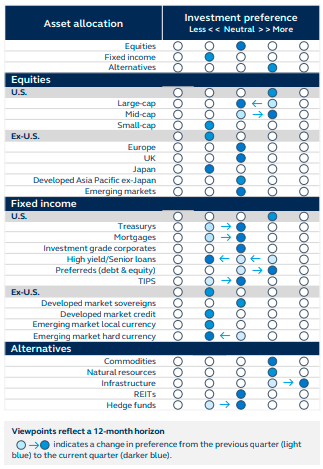

Cross asset allocation is unchanged: Neutral equities, underweight fixed income; real assets the top pick.

Equities

Within our neutral equities position, we retain a preference for the U.S. over other developed market (DM) and emerging market (EM) regions given relative U.S. economic strength and slightly lower vulnerability to rising energy prices. Within the U.S, we move large-cap from overweight to neutral, concerned by still-expensive valuations and significant global exposure. By contrast, mid-caps are more domestically focused, and valuations are below historical averages. Although Europe is set to enter recession by year-end, this is broadly priced in and valuations look attractive. Greater optimism around China supports our neutral EM position.

Fixed income

We shift to a more defensive and higher-quality path within fixed income. With U.S. recession approaching, we increase our exposure to U.S. Treasurys, while moving securitized debt from an underweight to neutral, and TIPS to neutral given their tight correlation to U.S. Treasurys. More attractive valuations and a requirement for high quality keeps our investment grade position at neutral, but by contrast, we shift from overweight high yield to underweight given recession and liquidity fears. Preferred securities move from neutral to overweight, encouraged by its favorable yields, low default rates, and exposure to high-quality companies. In EM credit, we reduce our exposure to hard currency debt, concerned by the stronger USD and Federal Reserve tightening.

Alternatives

Our continued constructive view on alternatives conveys not only their diversification benefits in this macro environment but also their fundamental strengths and defensive characteristics. Specifically, given structural supply shortages, we maintain our overweight preference to commodities despite short-term demand concerns. We increase our overweight to infrastructure, encouraged by its inflation protection characteristics, stability of cash flows, and exposure to the structural decarbonization trend. In this more challenging macro environment where selectivity is key, hedge funds are favorable, and we move our position from underweight to neutral.

Source: Principal Global Asset Allocation, Data As Of June 30, 2022

Alternatives asset class include commodities, natural resources, infrastructure, REITs, and hedge funds. Allocations across the investment outlook can be proportionately adjusted so magnitudes across categories do not have to net to neutral. Data as of June 30, 2022.

|

Equities Reduce risk appetite and focus on U.S. high quality factors |

Position towards certainty and stability

|

How to implement

|

|

Fixed Income Time for defense |

Core fixed income and preferred securities

|

How to implement

|

|

Alternatives Pursue less correlated real asset exposures. |

Real assets

|

How to implement

|

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment