NicoElNino

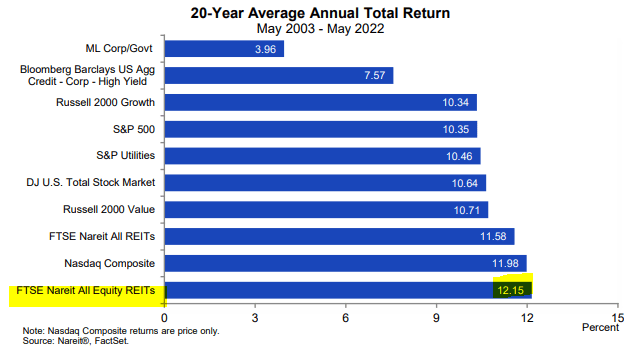

Over the long run, REITs have been some of the most rewarding investments, beating not just Tech stocks (QQQ) and the S&P 500 (SPY) but also value stocks (IWN), gold (GLD), bonds, and most other asset classes:

NAREIT

Interestingly, REITs achieved these superior returns despite being safer and paying higher income than most other investments.

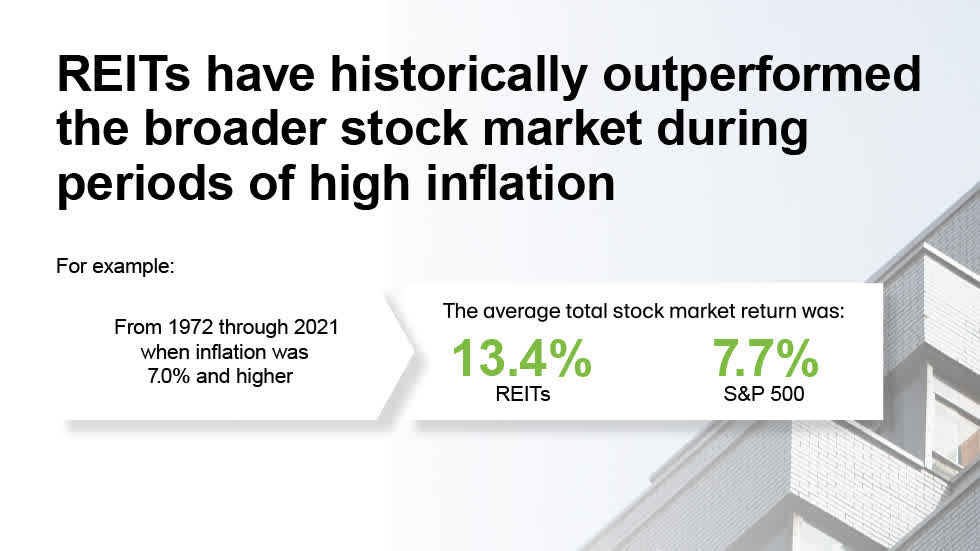

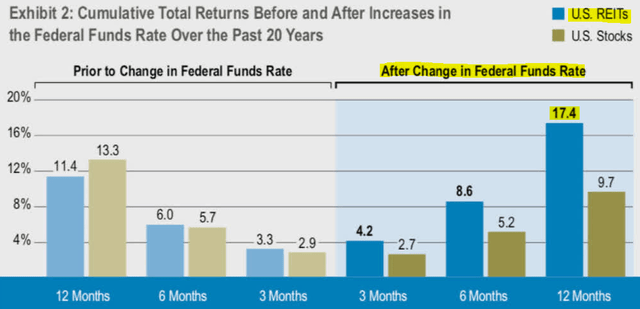

Today, REITs are especially attractive because they are priced at the lowest valuations in years, and they offer inflation protection and valuable diversification benefits in an uncertain world. Historically, REITs have generated even higher returns when inflation was high and interest rates were rising because the positive impact of inflation far outweighs the negative impact of rising rates:

NAREIT

Therefore, most investors will probably agree that they need to have a REIT allocation in their portfolio. But the more challenging question is how should they get this exposure?

Here you are faced with 2 main options:

- Buying a REIT ETF

- Buying individual REITs

There are pros and cons to both approaches.

If you are a passive investor, have little knowledge about REITs, and have no interest to learn about them, then the best option is likely to invest in an ETF and hold it for the long run.

It will allow you to get broad exposure to the sector with a relatively low management fee. Vanguard Real Estate (VNQ) is probably the best choice.

I think that ETFs make a lot of sense for a lot of people and I myself would use them for some sectors of the market. However, when it comes to REITs, I prefer to build my own portfolio by investing in individual REITs.

Here are 5 reasons why:

Reason 1: mispricings are frequent

Today, the stock market is so efficient that it is almost impossible for active investors to outperform benchmarks according to many studies.

This is especially true for popular sectors like large-cap tech stocks which are scrutinized and covered by thousands of analysts worldwide.

But REITs are an exception.

It is still a niche sector and inefficiencies/mispricings are much more frequent. Real estate investors typically don’t trust REITs or the stock market, and stock investors generally have little knowledge about real estate.

Being a hybrid of both has put REITs in a weird category of stocks that often lack a well-informed following and not surprisingly, market inefficiencies and mispricings are then more frequent.

This is also proven by studies that have shown that active REIT investors outperform benchmarks quite handily, and this has also been our experience at High Yield Landlord. We have managed to earn materially higher returns than REIT ETFs by being more selective.

Reason 2: ETFs Invest in Poorly Managed REITs

ETFs aim to give you broad exposure to a sector. That’s great if you are looking for instant and wide diversification, but it comes at a cost.

Some companies are exceptionally well managed. Others are just average. And then some management teams are clearly conflicted and should be avoided at all costs.

Here it is important to know that REITs can be managed internally or externally.

The preferred management structure is internal because it results in lower management costs and better alignment of interest with shareholders.

However, to this day, there are still a lot of externally managed REITs and they have historically earned much lower returns due to higher management costs and conflicts of interest.

ETFs also invest in externally managed REITs, causing your investment performance to suffer.

Reason 3: ETFs Are Mainly Invested in Large-Caps

Most REITs are fairly small in size. Out of ~150 REITs, only about a third are large-caps.

But because most ETFs are market-cap weighted, they will put most of their capital in large-cap REITs. If you look at the top holdings of VNQ as an example, you will note that they are all massive REITs like Digital Realty (DLR), Public Storage (PSA), and Prologis (PLD).

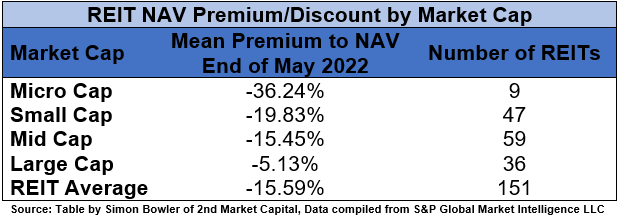

This is a problem because large-caps typically trade at much higher valuations as you can see from the chart below:

Simon Bowler

We often find the best opportunities in smaller and lesser known REITs that are overlooked by most investors.

A good example would be BSR REIT (OTCPK:BSRTF), a Texas-focus apartment REIT that grew its FFO per share by 75% in 2021, and yet, it is currently priced at a 35% discount to NAV. It is growing faster than its larger peers like Mid-America (MAA) and yet, it is a lot cheaper.

By investing in smaller REITs, we are able to earn higher cash flow for each dollar invested, earn higher dividends, and often, enjoy faster growth and greater upside.

Smaller REITs are of course riskier as their investments are more concentrated but you can take care of the diversification yourself by holding a portfolio of ~20-25 individual REITs.

Reason 4: ETFs Invest Heavily in Questionable Sectors

Today, there are REITs for literally everything. Just to give you an idea, there are REITs that invest in billboards, farmland, and casinos.

Yet, ETFs continue to invest heavily in REITs that specialize in office buildings, retail properties, and hotels, because historically, these have been some of the largest REIT sectors.

Offices suffer from the growth of remote work, which is made possible by increasingly efficient technologies like Zoom (ZM) and DocuSign (DOCU).

Retail suffers from the growth of Amazon (AMZN).

And hotels suffer from the growing competition from Airbnb (ABNB).

This does not mean that you cannot invest in these sectors, but you may want to limit your exposure and be more selective.

At High Yield Landlord, we don’t invest in any office or hotel REITs at this time, and while we find great value in some retail REITs, we are very selective.

Reason 5: ETFs Offer Too Little Income And Charge Fees

Today, most REIT ETFs pay more or less a 3% dividend yield.

That’s not enough for a real estate investment in my opinion.

I think that real estate should boost the yield of your portfolio and provide high income during times of market volatility.

The yield of ETFs is so low because they mainly invest in large-cap REITs and they also charge fees. The fees are low, but they still add up over time.

I aim to earn closer to a 6% dividend yield by being selective. It allows me to stay patient while I wait for long-term appreciation.

The “Landlord” Approach to REIT Investing

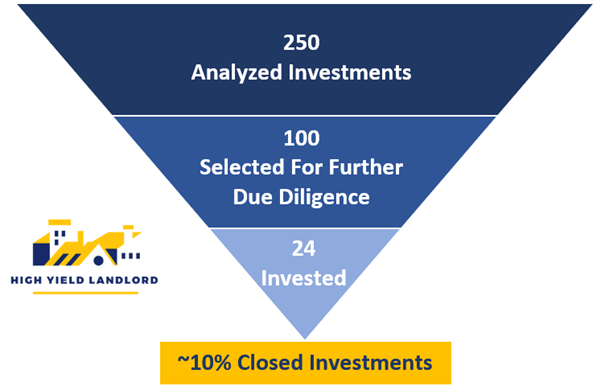

At High Yield Landlord, we aim to outperform the broader REIT market by being very selective. We call it the “landlord” approach because we are buying REITs as if we were buying rental properties.

We are very selective because the money is made at the time of the purchase. On average, we only invest in one REIT out of ten because:

- We skip all externally managed REITs that are conflicted

- We stay away from office and hotel REITs for the most part

- We aim to buy good REITs at large discounts to net asset value

- We mainly focus on sectors with strong fundamentals like farmland

- We target a 5-8% yield so that we are not just reliant on appreciation

As a result, we typically end up investing in smaller and lesser known REITs that fly under the radar:

High Yield Landlord

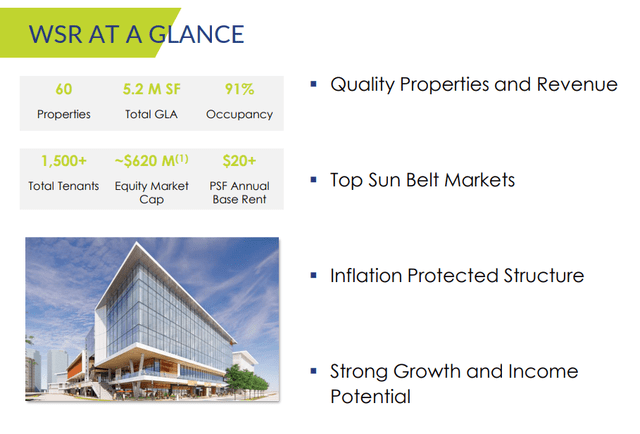

A good example would be Whitestone REIT (WSR), a small-cap retail REIT that owns service-oriented strip centers in rapidly growing sunbelt markets.

It is priced at a 10% FFO yield and an estimated 35% discount to NAV.

It is so cheap because the market sees it as just another retail REIT, but what it appears to overlook is that its assets are located primarily in Phoenix, Arizona, and Austin, Texas, which are two of the strongest markets in the entire nation. Moreover, these service and grocery-oriented properties are fairly resilient to Amazon (AMZN) and even recessions.

Whitestone REIT

The company has guided for ~15% FFO per share growth in 2022 and its occupancy rates have a lot more upside potential in the coming years.

We think that a company of this quality should trade closer to its NAV, meaning that it has ~40% immediate upside potential. While we wait, the company generates a 10% cash flow yield, out of which, it pays us 5% in dividends, and reinvests the other half in future growth, which will result in more appreciation.

Bottom Line

Both ETFs and individual REITs have pros and cons.

But if you are willing to learn about REITs and put some time into researching them, you may earn significantly higher returns by investing in undervalued individual REITs.

Be the first to comment