Morsa Images/DigitalVision via Getty Images

Introduction

In late March 2022, I recommended Zoom (NASDAQ:ZM) as a “Strong Buy” citing the disconnect between its business fundamentals and valuation. Since then, Zoom’s stock has lost another 7% (despite being up +22% post Q1 FY-2023 earnings release on 23rd May 2022). In my view, this growing disconnect between price and intrinsic value is an incredible buying opportunity, and Zoom’s latest quarterly result was another conviction booster for me. My detailed investment thesis and Q4 FY-2022 earnings analysis are linked below:

- Zoom Is A New Weekly Top Idea [original investment thesis]

- Inverse Bubbles Part-1: Zoom [Q4 FY-2022 earnings review]

Zoom: Q1 FY-2023 Earnings Review

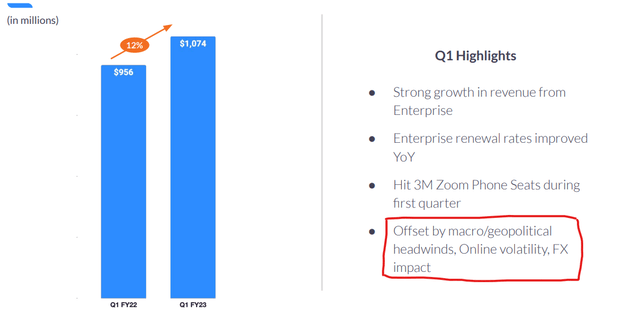

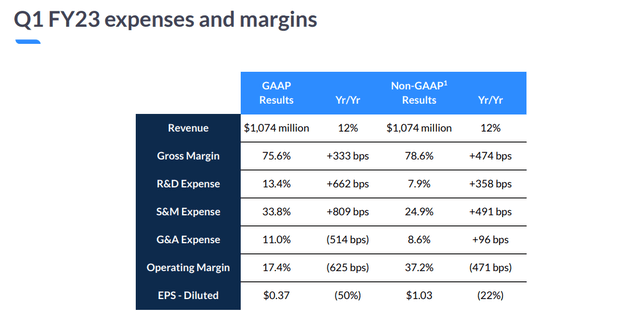

In Q1, Zoom’s revenues came in at $1.074B (up 12% y/y), beating consensus analyst expectations of ~$1.07B by a razor-thin margin. While the future of work is likely to be hybrid, macroeconomic and geopolitical factors combined with weakness in Zoom’s online (SMB-heavy) segment are driving continued slow down at Zoom.

Zoom Q1 FY-2023 Investor Presentation

During the quarter, Zoom Phone surpassed the 3M seat milestone, and Eric Yuan (Zoom’s CEO) also announced some early wins in the contact center. Zoom’s ever-expanding UCaaS platform and new business workflows are attracting greater spending from new and existing customers.

Zoom Q1 FY-2023 Investor Presentation

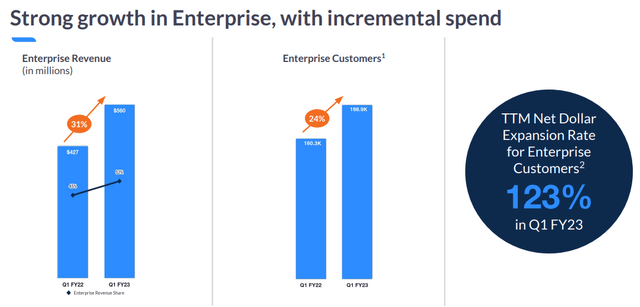

In my view, Zoom’s enterprise revenue growth of 31% y/y serves as evidence that the company’s sales and marketing investments are paying off handsomely. While Zoom’s NDER (among enterprise customers) declined from 130% in Q4 to 123% in Q1, customer retention rates remain healthy and showcase the substantial value offered by Zoom’s best-of-breed unified communications platform.

Zoom Q1 FY-2023 Investor Presentation

The central bear thesis for Zoom is competition from deep-pocketed tech giants like Microsoft (MSFT) [Teams], Salesforce (CRM) [Slack], and Alphabet (GOOG) [Google Meet]. In Dec-2021, Microsoft announced the general availability of Teams Essentials (as a standalone offering) with pricing set at $4 per month per user, which is ~1/4th of Zoom’s pricing. Clearly, Microsoft is gunning for market share among small-medium-sized businesses (encroaching Zoom’s territory).

As a result of increased competition and macroeconomic headwinds in EMEA, Zoom’s online (SMB-heavy) segment is facing heightened volatility and flattening growth. Many critics argue that Microsoft will eat Zoom’s market share; however, Q1 results prove that Zoom is able to hold its revenues (among SMBs) despite a lopsided price war and simultaneously expand among enterprise customers (Microsoft’s territory). I understand that this is a bold claim (since we do not have exact numbers on Teams), but I sincerely believe that Zoom is eating Microsoft’s lunch (enterprise software market) and will continue to do so in the future. This is precisely why I am bullish on Zoom amidst all the noise around competition.

In his unique way, Eric outlined Zoom’s competitive advantage during the earnings call while replying to Ittai Kidron (Oppenheimer analyst) –

Let’s say you target some other cloud-based service providers. You talk to their customers and talk with our customers. And as you know, we make a customer happy.

When I heard this statement from Eric, I couldn’t stop smiling for minutes, and at that moment I realized that the customer-centricity of its UCaaS platform is enabling Zoom (a relative minnow) to outcompete mega-cap tech companies like Microsoft and Google. And that’s the bull case in a nutshell.

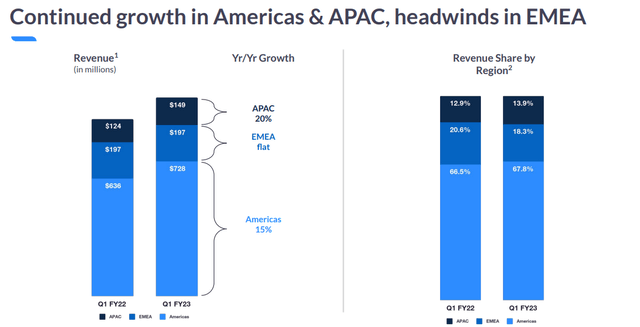

Geographically, Zoom is showing healthy growth in the Americas (~15%) and Asia Pacific (~20%) but struggling in the EMEA region (mostly due to the war in eastern Europe and consequent forex changes).

Zoom Q1 FY-2023 Investor Presentation

The slowdown in revenue growth at Zoom is being partially offset by rising gross margins. According to the management, deployment of private cloud servers and optimized use of public clouds are driving this margin expansion. We know that Zoom is already a free cash flow machine (~$2B annualized FCF); and while 2021 was a year of consolidation for Zoom (after explosive growth in 2020), revenue growth is likely to re-accelerate in the second half of this year as new products and services gain traction.

Zoom Q1 FY-2023 Investor Presentation

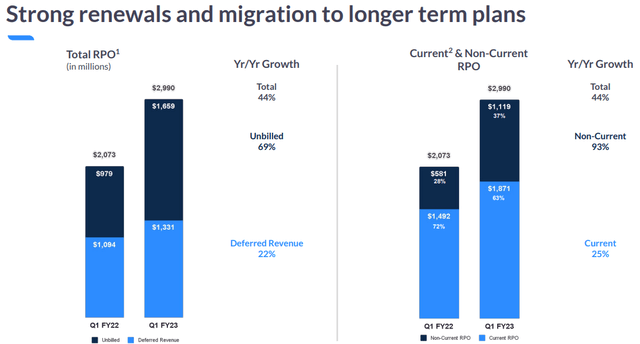

Even in the post-pandemic world, Zoom’s business is showing strong renewals from customers, as indicated by the 44% y/y growth in Remaining Performance Obligations from $2.07B to $2.99B. Additionally, Zoom’s customers are opting for longer-duration contracts, which is a sign of confidence in Zoom’s offerings and hybrid work environments.

Zoom Q1 FY-2023 Investor Presentation

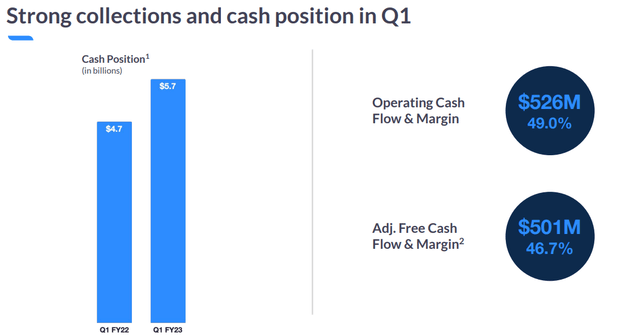

As a direct consequence of higher margins, strong renewals, and longer duration contracts, Zoom’s operating cash flows and adj. free cash flows came in at record highs of $526M (49% of total revenues) and $501M (46.5% of total revenues). While Q1 (typically) tends to be the strongest quarter for Zoom in terms of cash flow generation (due to the nature of its billing cycles), I expect Zoom to achieve $1.8-2B in free cash flow over the coming twelve months. Even with a buyback program of $1B, Zoom’s humongous cash balance (of $5.7B) will continue to grow over coming quarters (unless Zoom’s management adopts a more aggressive M&A policy).

Zoom Q1 FY-2023 Investor Presentation

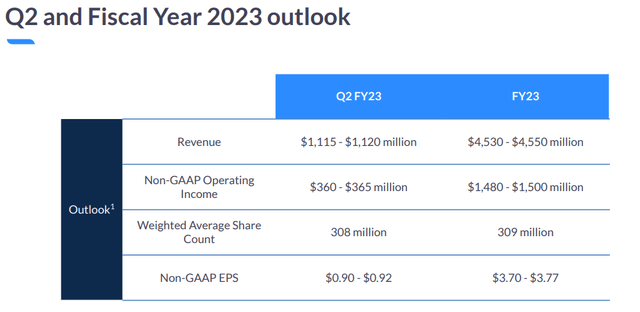

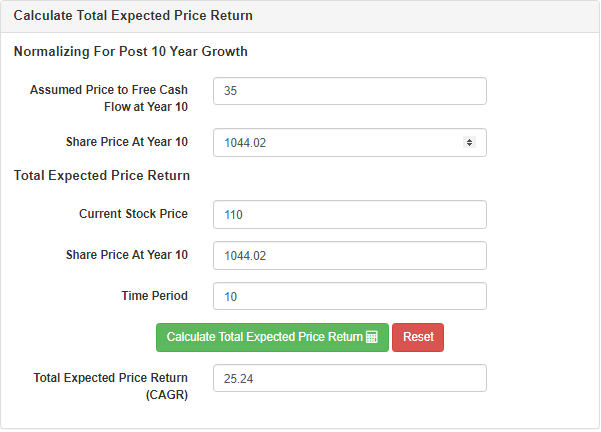

For Q2 2023, Zoom’s management guided for $1.11-1.12B in revenue, with a non-GAAP operating income of $360-365M. While Zoom’s buyback program is not going to make a big impact on the share count in 2022 due to additional share-based compensation expenses, I can see Zoom buying back ~$15-20B (roughly 25%) of its outstanding shares over the next decade. Even if Zoom fails to grow beyond this point, Zoom’s management could easily deliver robust shareholder returns from this point via capital return programs (and this is possible due to terminal valuation multiples bestowed upon Zoom by the market right now).

Zoom Q1 FY-2023 Investor Presentation

Despite a temporary slowdown, Zoom has a lot of headroom for future growth, with a rapidly-expanding TAM of $84B+. With a revenue re-acceleration penned in for the second half of this year, I think this weakness in Zoom’s stock is a great buying opportunity. Let us now determine Zoom’s fair value and expected returns to make an informed investment decision.

Zoom’s Fair Value And Expected Returns

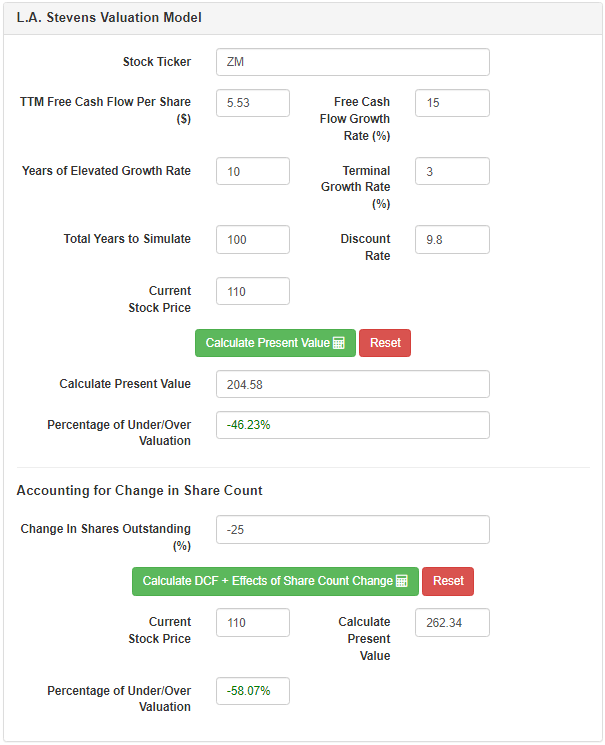

Zoom’s enterprise wins make me confident about the future; however, the weakness (flattening growth) in the online segment [due to multiple reasons including a return to the office, business disruptions due to macroeconomic factors, and increasing competitive pressures] could lead to near-term revenue volatility. As a result, I am cutting my revenue forecast and future growth rates to be ultra-conservative with our projections. To be sure, Zoom may grow much faster via acquisitions, and this market environment could create lucrative M&A opportunities for a well-capitalized business like Zoom.

Assumptions:

|

Forward 12-month expected revenue [A] |

$4.9 billion |

|

Potential Free Cash Flow Margin [B] |

35% |

|

Average diluted shares outstanding [C] |

~310 million |

|

Free cash flow per share [ D = (A * B) / C ] |

$5.53 |

|

Free cash flow per share growth rate |

15% |

|

Terminal growth rate |

3% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

Results:

L.A. Stevens Valuation Model L.A. Stevens Valuation Model

At $32.5B in market capitalization (~16-17x P/FCF), Zoom is trading at multiples typically ascribed to companies that have reached terminal growth rates (which is not the reality). In my view, Zoom’s growth story has many more chapters to follow as the video communications giant expands to adjacent markets. Even if you choose to take a very conservative stance on Zoom’s future, as I did in today’s valuation exercise, Zoom is a fantastic buy at current levels.

Key Takeaway: I rate Zoom a strong buy at $110.

Thanks for reading. Please feel free to share any thoughts, questions, and/or concerns in the comments section below.

Be the first to comment