jaturonoofer/iStock via Getty Images

Introduction

I’ve been searching for a company belonging to the sector of ‘financials’ and being a dividend growth investor, I’ve utilised the recent market pullback to initiate a position in T. Rowe Price Group (NASDAQ:TROW). Not the flashiest of companies as it doesn’t carry the same brand awareness as major banks or financial infrastructure companies such as Visa (V), or JPMorgan Chase (JPM). However, looking under the hood of this car, and the financial machinery is well maintained with today’s stock price representing a discount as I see it.

So why have I decided to go long T. Rowe Price?

- I’m a dividend growth investor and TROW is a dividend aristocrat with a 36-year track record of consecutive dividend hikes, meaning the company has stood the test of time through multiple recessions and economic macro events.

- With a forward yield of 3.8% at the current price, you can lock in a yield well above the ten-year and five-year average, in fact, in the last decade there was only one other moment where TROW could be picked up at a similar yield, the Covid-19 crash.

- Over the past decade, TROW has managed to grow revenue, net income and free cash flow, which are all paramount for a growing business and a secure dividend.

- TROW is in possession of a rock-solid balance sheet with $2 billion in cash and only $320 million in debt.

- With a payout ratio at 35% when measured on free cash flow, and enough cash on the balance sheet to cover it for almost two years, the dividend is very secure.

T. Rowe Price Group

TROW is an American investment management company offering funds, retirement plans and account management as well as advisory services. By the end of 2021 assets under management stood at $1.7 trillion, while coming in at $1.55 trillion by end of the recent quarter due to flow of funds turning negative in uncertain times. The two largest areas of operation as measured on AUM, is US mutual funds with $871 billion and sub advised and separately managed accounts with $471 billion, both numbers as per end of 2021.

The company is still a growing business exemplified by having recently completed its acquisition of Oak Hill Advisors who brought $56 billion of capital under management into the TROW family. The timing perhaps wasn’t optimal, but the pendulum of time sometimes swings in one’s favour, and other times, it doesn’t. End of the day, TROW paid $4.2 billion for OHA comprised of 74% in cash with the rest in stock. Besides that, the match seems to be one of value, as OHA can leverage TROW’s global reach for its products, which are different to those of TROW, as OHA is considered an alternative credit manager.

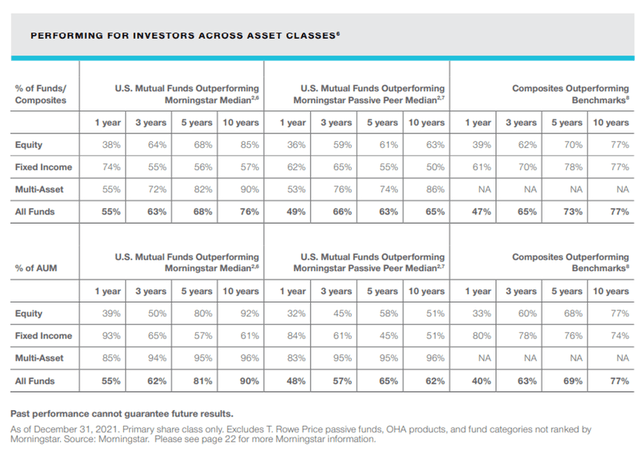

TROW has a history of delivering strong returns for its clients, with clients’ success being the chief motivation for the company. As a result, TROW has secured themselves a number of accolades from for instance Morningstar, such as its “Gold analyst rating”. Holding ‘outstanding performance’ rankings with Morningstar is a meaningful indicator for future clients in going with TROW, though as the illustration above also states, “past performance cannot guarantee future results”. TROW is a recognised and respected player in its industry.

T. Rowe Price Group 2021 Annual Report

As can be seen above, a satisfied cohort of clients have resulted in a growing business for TROW. As a consequence, shareholders have received a growing dividend throughout the period, including an extraordinary one of $3 per share, which was paid in 2021. With a forward yield of $4.8 per share, it corresponds to a payout ratio of 37% when measured against the FY2021 adjusted diluted earnings.

Despite being a growing business with a strong financial profile, TROW highlights a number of risks in its 10-K, such as the rise of passive investing, downwards moving fee structures, increased regulatory requirements and so forth.

With the investment community currently trying to understand if an economic drawback is in front of us, such a scenario will inevitably impact total AUM negatively as we are already seeing flow of funds turn negative. It’s important to note, that negative flow of funds is an industry wide phenomenon, not something tied to TROW in particular. However, this is not the first economic drawback experienced by TROW, who has been in existence for 85 years, and if history is to teach us anything, it is that TROW will also be here after the next recession. With a strong balance sheet and ample liquidity to uphold its promise of a growing dividend, today’s depressed stock price could present a timely opportunity to go long TROW. In fact, since its IPO, TROW has been paying shareholders a growing dividend come rain or sunshine.

So Why Are We Down YTD?

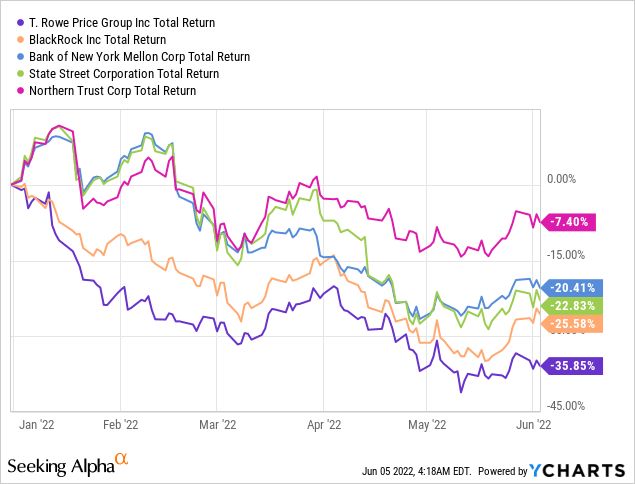

So here I am, praising this company, and if this company is so great, why are we down YTD by almost 36%?

As I mentioned, the entire asset management sector is under water as fund outflows pick up pace in uncertain times, asserting gravity on financials for all related companies. Not just TROW, but also its peers such as The Bank Of New York Mellon (BK), BlackRock (BLK), State Street Corporation (STT), Northern Trust Corporation (NTRS) and others.

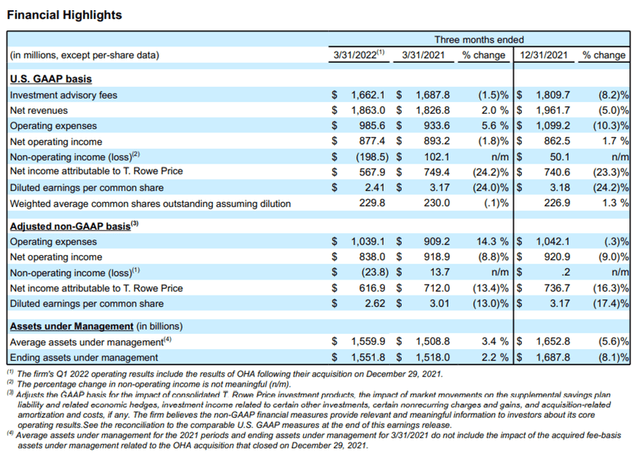

If we take a look at the financial highlights for TROW during its Q1-2022, we see the impact. QoQ revenue took a 5% beating, resulting in a negative 23% impact on a net income basis. YoY, the negative revenue impact comes in at 1.5% but still with a negative 24% impact on net income. However, at end of day, GAAP EPS is a positive $2.4. The situation may worsen before it gets better, but even if a recession strikes, there will still be a global and growing need for asset management on the other side. TROW missed Q1-2022 consensus expectations by $0.14, with forward expectations for the remaining three quarters of the year showing an average 21% drop YoY compared to 2021. Understandably, there is uncertainty tied to the immediate performance in the coming quarters, but I’m not here to invest for a quarter or two, I’m here to invest for the long haul. To grow my dividend and experience an appreciating asset.

The Dividend

I’ve already touched upon it, but I just want to highlight that it’s rare we are observing a dividend aristocrat who already has 36 hikes notched in its belt, while showcasing a payout ratio of only 35% when measured on a free cash flow basis. The payout ratio will of course worsen if we go into a recession, but that’s the name of the game, as periods of economic expansion drive strong free cash flows, while recessions lead to the opposite as flows of funds turn negative. However, with $2 billion of cash on the balance sheet, TROW could theoretically pay almost two years’ worth of dividends with that amount alone, which is expected to require $1.07 billion this year, based on the forward dividend of $4.8 per share. That is without considering that TROW is cash flow positive, and would add to that cash amount during that period.

Coming back to the point about having completed 36 hikes and still maintaining a low payout profile. That is rare, as companies holding such a track record typically would be approaching the territory of meagre dividend hikes due to the payout profile slowly, but surely, having climbed towards, or above 70%. To the point where it maims the individual companies’ financial profile, as a growing dividend becomes more of a negative, than a positive, in the sense that it strains the financial flexibility of the individual company. However, not in the case of TROW.

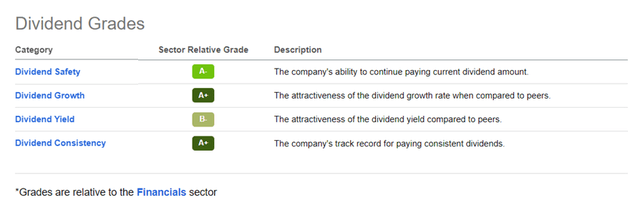

Unsurprisingly, TROW receives a very strong dividend grade from Seeking Alpha, both in terms of safety, growth, yield and consistency.

The only hair in the soup, is that we are seeing inflation above 8%, meaning a 3.8% yield might not impress everybody, as the nominal 3.8% direct return, is reduced to a negative 4.2% in real terms. Here I would argue that long-term inflationary expectations remain at the central bank target rate of 2%, and that a 3.8% starting yield, grows over time in conjunction with the annual hike. If you are an income focused investor, that is just the name of the game right now, as inflation is outpacing dividends for most companies, at least the ones that also provide a safe dividend.

Seen from my vantage point, this is a very appetizing yield, as its starting point of 3.8%, well above my personal requirement of 2.5%, is also extremely safe due to TROW’s ample financial muscle.

TROW Valuation

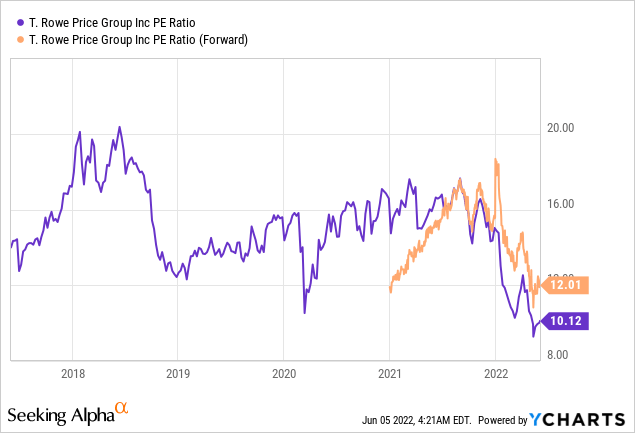

Being down 36% YTD or 44% off its recent high is in no way a guarantee that we can’t see another substantial slide downwards. As I already mentioned, the forward expectations on an EPS level indicate a weaker performance than a year ago, but for long-term investors, I find the current price offers an interesting opportunity.

With a five-year average yield just below 3%, TROW would have to trade at $159.5 per share to come back to a forward yield of 3%, and a $189.5 per share if the price should reflect a forward yield of 2.5%. This heuristic is what’s referred to as “dividend yield theory”, the idea that blue-chip stocks paying a growing dividend, reverse to its dividend mean over time, as stocks in this category sometimes trade below or above the historical average, due to periods characterised by market euphoria or depression. It’s simple and intuitive but should of course not stand alone. However, in the situation of a company like TROW, with such a well-covered dividend and a stable business outlook, I believe it has some merit as to gauge where we might be going.

This might be a stretch as we are in an environment where we don’t yet know how much further TROW’s earnings will have to go, before we get to a more favourable environment, but comparing today’s yield with the historical average, keeping in mind that TROW is a quality business, I expect upside to the stock once uncertainty is past us. As a long-term investor, I’m willing to stay patient.

For now, the market will remain focused on the coming quarters, suppressing TROW’s stock price for a while; as we heard in the already famous words articulated earlier this week by JPMorgan Chase CEO Jamie Dimon, we don’t know if the current economic environment turns out to be a storm or a superstorm. Naturally, a superstorm will wreak havoc on any company’s financials, but a lower price would just make TROW even more interesting in my eyes – again, remember the stellar balance sheet.

Normally, I would consider the free cash flow yield, but as we don’t know how compressed TROW’s earnings will turn out, it’s a bit void, even though it currently stands at 11% on last year’s free cash flow, which in all fairness, was also an all-time strong, subtracting from the value of that perspective.

With a forward P/E of 12, the stock is currently priced at a low point compared to how the market usually treats the stock, another indicator that initiating a position at the current price, probably isn’t the worst idea around. Again, the “E” in P/E that makes up earnings, can of course compress even further, which would elevate the forward P/E. However, with coming quarters already expected to deliver a 20% decreased EPS YoY, I wouldn’t expect substantial downside to the “E”, unless of course, we are affected by Dimon’s superstorm, but then there will be no shelter in the market, and we will all have to ride out the storm.

Conclusion

TROW’s business is suffering from the current economic outlook, its earnings per share being down 24% YoY with forward expectations for the remaining three quarters of the year indicating a 21% YoY drawback. TROW has grown its revenue, net income and free cash flow seen over the past decade, while showing an exceptional balance sheet with $320 million in debt and $2 billion in cash, easily covering its forward dividend of $1.07 billion for the coming year, not considering the fact that TROW remains highly profitable despite the unfavourable market conditions today. A dividend aristocrat, TROW has stood the test of time and made it through an array of recessions and economic crisis, while increasing its dividend year on year, with a current payout on a free cash flow basis of 35%. We shouldn’t forget that free cash flow will be weaker this year, but remaining profitable and with a strong balance sheet, TROW will continue to expand its dividend, while growing its business, as most recently exemplified by the completed acquisition of OHA by end of 2021. Having on average offered a starting yield of just below 3%, TROW should start trending upwards again to meet that average, once we move past the economic uncertainty. However, don’t forget that recessions can lead to suppressed stock prices for a very extended period.

Personally, I’m a long-term investor with a focus on dividend growth, and TROW is offering exactly that, while currently at a stock price where I expect favourable total returns.

Be the first to comment