Olemedia

Investment Thesis

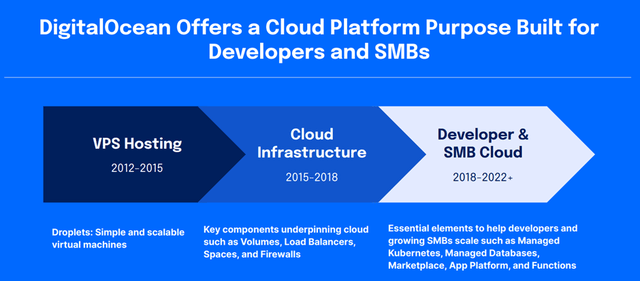

DigitalOcean (NYSE:DOCN) is a cloud computing platform specialising in infrastructure and platform tools, with a focus on serving small and medium-sized businesses (aka SMBs). This SMB segment has been largely ignored by the cloud behemoths of Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL), who offer enterprise-focused solutions that are overly complex and too opaque for smaller companies.

This is where DigitalOcean differentiates itself, by offering cloud infrastructure and platform technologies that can be implemented quickly, intuitively, and independently – with extremely affordable and transparent prices.

DigitalOcean Q2’22 Investor Presentation

Unfortunately, the focus on smaller businesses has made DigitalOcean far more susceptible to the macroeconomic headwinds faced by the economy right now. Enterprise-sized businesses have a whole host of costs that can be cut when times are tough, yet they are so dependent on their cloud providers that this cost will not be touched.

When it comes to smaller companies, there are substantially fewer costs to cut – and in a recession, the aim is simply to survive. As a result, DigitalOcean may well experience more churn than its larger counterparts; in part caused by SMBs cutting off spend with DigitalOcean, but more so due to these smaller companies going out of business.

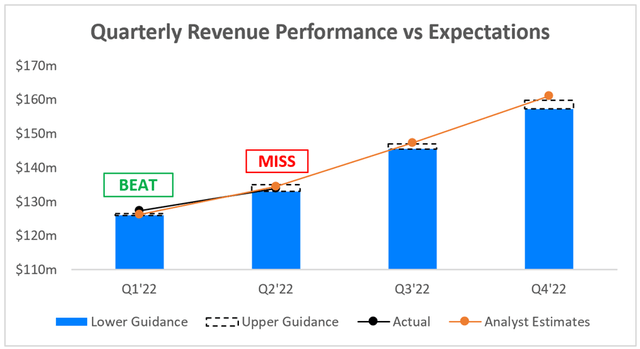

Whilst I see a bright future for this company (as outlined in a previous article), it’s undeniably facing more headwinds than most businesses in the same industry. This goes some way to explaining why it missed analysts estimates for revenue in Q2.

But investing is a forward-looking game, and I believe that a lot of these headwinds have been incorporated into DigitalOcean’s current share price, meaning that a successful Q3 earnings report could greatly reward shareholders. So, what should investors be looking for from DigitalOcean’s Q3 results?

Latest Expectations

DigitalOcean is set to report its Q3’22 earnings on Thursday, 3rd November, and there are several key items that investors should keep their eyes on.

Starting with headline numbers, and analysts are expecting Q3 revenue of ~$147m, representing ~32% YoY growth. This figure is at the top end of management’s $146-147m guidance, so it would appear that analysts are feeling slightly more optimistic now than management were back in August.

Investing.com / DigitalOcean / Excel

Looking ahead to Q4, and I’ve taken the implied management guidance (FY23 guide minus Q3 guide minus Q1 and Q2 actuals) of $157-160m. Analysts are once again expecting slightly more, at $161m, which would represent Q4 YoY growth of ~35%.

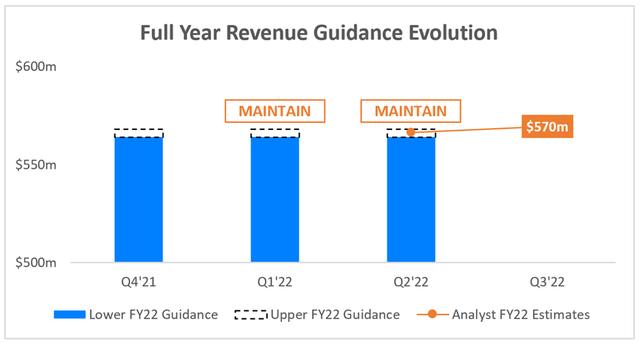

If we move onto full-year revenue guidance, analysts’ latest estimates are for $570m. This has increased from their expectations of $566m in Q2, when DigitalOcean’s management team maintained its full-year guidance of $564-568m.

Investing.com / DigitalOcean / Excel

Judging from these figures, it would appear that analysts are feeling positive about DigitalOcean’s ability to beat its latest guidance in terms of revenue, and still achieve in excess of 30% YoY growth. This is a positive sign – analysts get more time than you or I to truly dive into industries, so the raising of expectations could mean that analysts are finding DigitalOcean to be more resilient than expected in Q3; yet there is another potential reason for this optimism that I’ll touch on later.

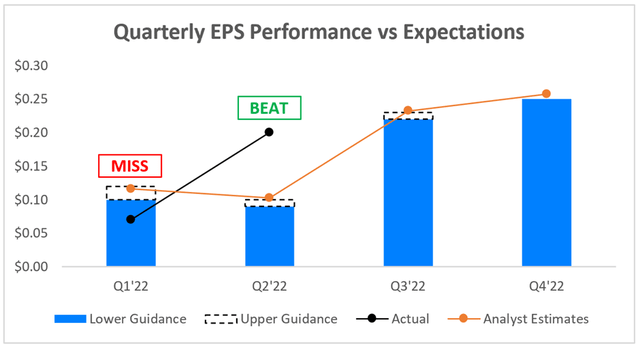

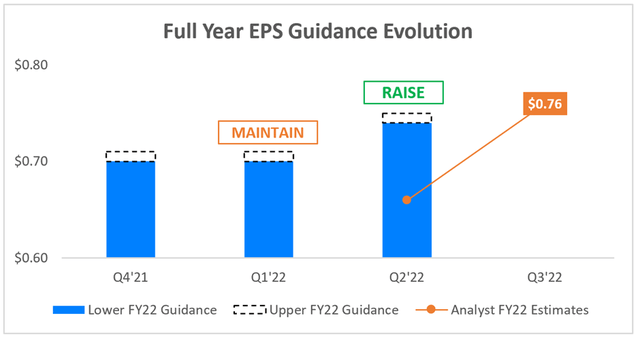

If we move down to earnings, this is where DigitalOcean saw success in Q2. The company’s EPS came in at $0.20, substantially beating analysts’ estimates of $0.10, with a strong guide for the rest of the year.

Investing.com / DigitalOcean / Excel

Prior to Q2 results being released, analysts were expecting full year EPS of $0.66; following the release of Q2 results, and management’s updated FY22 EPS guidance of $0.74-0.75, analysts have bumped their expectations up to $0.76.

Investing.com / DigitalOcean / Excel

Whilst DigitalOcean is certainly more of a growth story than an earnings story, it was a real bright spot in its Q2 earnings to see a substantial EPS improvement. This was due in part to an improvement in margins, but also due to $550m worth of share repurchases at an average price of $43.83.

Whilst Q2 results appeared solid, I’m intrigued to see whether or not analysts’ apparent optimist for Q3 is merited. There was one other piece of news over the quarter that I’ll be looking for more information about.

Cloudways Acquisition

DigitalOcean announced in August that it would acquire Cloudways, a leading managed cloud hosting and SaaS provider for SMBs. It would do so by paying $350m in cash, with a substantial amount to be paid over a 30-month period following the closing of this acquisition (which was finalised on 8th September).

Cloudways

I think this goes some way to explaining analysts’ apparent optimism about DigitalOcean’s revenue figures; management expects this transaction to contribute between $13-15m of revenue in FY22 – so ironically, I think analysts may currently be underestimating DigitalOcean’s full year revenue figures.

The difficulty here is knowing whether or not the figures on Investing.com take into account the impact of this acquisition or not; for example, Seeking Alpha sees the consensus estimate for FY22 revenue at ~$581m compared to Investing.com’s ~$570m – so something for investors to consider when analysing Q3 earnings & comparing results and guidance to analysts’ estimates.

Back to Cloudways, and I personally hate large acquisitions or “mergers”, however I’m a big fan of smaller bolt-on acquisitions such as this. It’s made even better by the fact that DigitalOcean and Cloudways have worked together for 8 years, as stated in the acquisition press release:

DigitalOcean and Cloudways have been close partners since 2014 — Cloudways currently relies on DigitalOcean infrastructure to power approximately 50% of its customers. Cloudways serves an international and growing customer base with an industry-leading NPS score of 71. Together, DigitalOcean and Cloudways will serve over 124,000 customers paying over $50 per month, representing approximately 84% of the pro forma company’s total revenue.

It’s also worth noting that Cloudways should help boost DigitalOcean’s revenue growth rate regardless, as it’s expected to generate more than $52m in FY22 revenue, which represents a CAGR in excess of 50%. It also isn’t going to negatively impact margins, which is great to see.

In truth, this feels like a smart and shrewd acquisition; just be wary that, when looking at Q3 earnings, some of the figures will be skewed by Cloudways – and there’s no telling exactly how much management will break out between organic and inorganic growth.

An Attractive Valuation

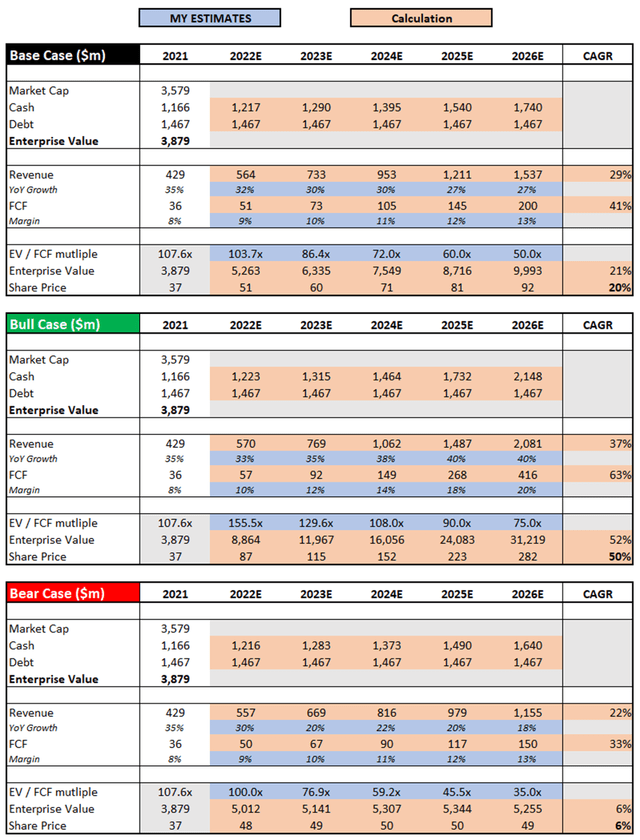

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether DigitalOcean is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

DigitalOcean / Excel

I have kept all assumptions the same as in my previous article, only updating any items that have changed, such as market capitalisation. I am not including the impact of the Cloudways acquisitions for now; however, I expect it to be accretive to DigitalOcean in the long run.

Put all that together, and I can see DigitalOcean shares achieving a CAGR through to 2026 of 6%, 20%, and 50% in my respective bear, base, and bull case scenarios.

Bottom Line

This is a business that has continued to perform well despite a whole host of headwinds, and I think it will come out of these difficult macroeconomic times even stronger than before. Q3 earnings will give investors a chance to see exactly how much pressure DigitalOcean is being put under, and I’m sure management will also speak to the integration of Cloudways.

In my view, DigitalOcean remains a compelling long-term investment with multiple secular tailwinds. Once it rides out this storm, I believe the opportunity to be enormous, with a current valuation that offers a tempting risk / reward scenario.

Given all this, I will be reiterating my previous ‘Strong Buy’ rating on DigitalOcean.

Be the first to comment